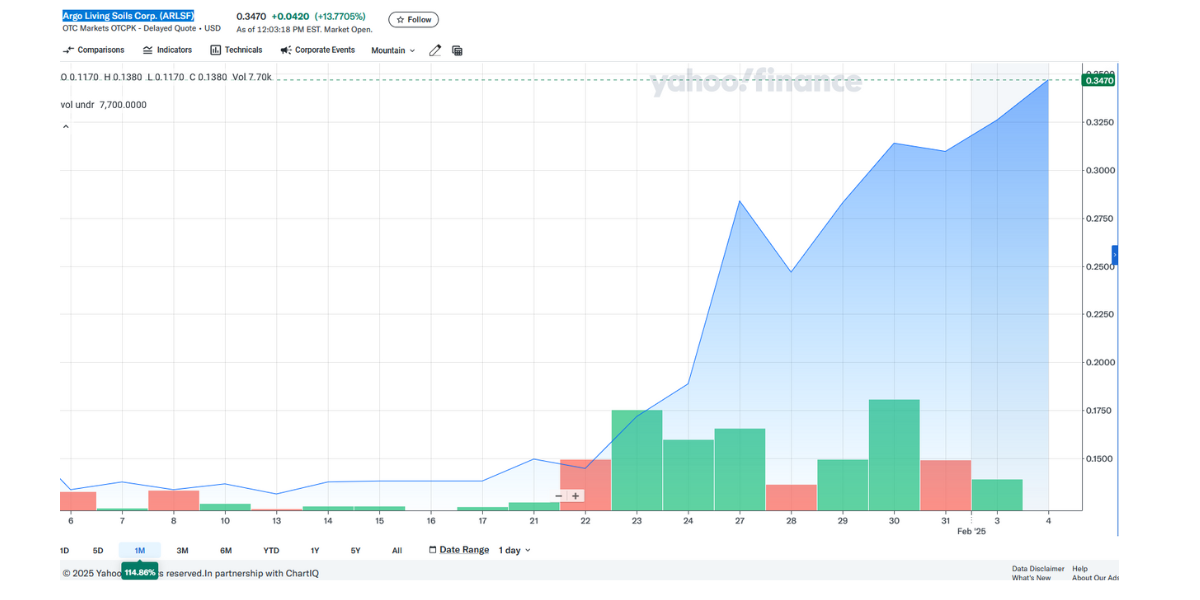

UPDATE: 2/4/25

Argo Living Soils Corp. (ARLSF) Sees 50% Price Surge in Just One Week – A Great Call for Investors

Argo Living Soils Corp. (ARLSF) has seen an impressive 50% surge in its stock price in the past week, following our alert last Tuesday. This sharp rise in share value is a clear reflection of the market’s growing recognition of Argo’s potential in the sustainable agriculture sector.

The company’s innovative approach to soil health and environmental sustainability has caught the attention of both investors and industry experts, contributing to the significant boost in its market value. As we predicted, Argo’s focus on cutting-edge solutions in living soil technology has positioned them as a leader in the green tech space, and investors are taking notice.

With the stock appreciating nearly 50% in just one week, it’s hard not to feel confident about the call we made. This strong performance showcases the potential that Argo Living Soils Corp. has to continue gaining momentum in the market. If you’ve been following our alerts, you’re likely enjoying this positive move and the fruits of our timely recommendations.

This price surge further validates Argo’s growth potential and reinforces our belief that this is just the beginning for the company. Stay tuned as we continue to monitor the progress and opportunities in the sustainable investing space.

ORIGINAL POST 1/28/25

Argo Living Soils Corp. (OTCMKTS: ARLSF): Key Catalysts Poised to Drive Massive Growth in 2025

Argo Living Soils Corp. (OTC: ARLSF) has become a compelling opportunity for investors, and as we head into 2025, several significant catalysts could trigger major price moves. Let’s break down each of these key catalysts and how they could create explosive growth for the company.

1. Strategic Partnerships and Market Expansion

Catalyst Overview: Argo Living Soils’ recent strategic partnerships and international market expansion are key drivers of the company’s growth story. The company has secured collaborations with innovative organizations that can rapidly scale Argo’s presence in the global market, which includes one of the most promising sectors in agribusiness: sustainable farming.

Details: One of the most impactful recent announcements was Argo’s partnership with PT. APLIKASI GRAFENA INDUSTRI & CONSULTING (AGIC). This collaboration focuses on developing biomass-to-graphene technology, a new frontier that combines sustainable farming with cutting-edge technology. Graphene is a highly sought-after material with applications across industries, and entering this market could revolutionize Argo’s growth trajectory.

In addition, Argo has been actively expanding its global footprint with a joint venture under discussion with Hampshire Eco Farms in Malaysia. This international move sets the company up for broad-scale penetration into Asia, where demand for sustainable farming practices is growing rapidly.

Why It Matters: These partnerships position Argo as a leader not only in organic agriculture but also in the rapidly expanding markets of sustainable tech and global agribusiness. Such alliances bring both credibility and financial backing to fuel Argo’s ambitious growth plans.

2. Technological Innovation and R&D Advancements

Catalyst Overview: Argo’s commitment to innovation, particularly in research and development (R&D), is a powerful catalyst that could propel the company forward. Technological advancements and new product offerings will help the company stay ahead of competitors and capture a larger market share.

Details: Argo has been pushing boundaries in its R&D efforts, with the company recently securing collaborations with renowned institutions, such as the University Putra Malaysia. These efforts are aimed at improving Argo’s core products—living soils and bio-fertilizers—as well as innovating entirely new solutions to meet the needs of the modern farming industry.

Argo is also introducing a new generation of bio-fertilizers designed to improve crop yields while minimizing environmental impact. These new products, coupled with the existing product lineup, provide Argo with a strong competitive edge in a rapidly expanding organic agriculture market.

Why It Matters: The company’s R&D is not just about improving existing products—it’s about creating entirely new solutions that address pressing agricultural challenges like soil degradation and excessive chemical use. This focus on innovation ensures Argo remains relevant in an ever-evolving industry and positions the company for long-term success.

3. Financial Strength and Capital Raise

Catalyst Overview: Argo’s ability to raise capital through private placement offerings strengthens its financial position and supports its aggressive expansion strategy. This capital infusion is crucial as the company looks to scale operations and accelerate growth.

Details: In January 2025, Argo successfully closed its first tranche of a non-brokered private placement offering, raising the necessary capital to support its rapid growth initiatives. The funding will be used for various purposes, including the development of new products, expansion into international markets, and strengthening its balance sheet.

Additionally, Argo’s growing financial backing is set to enable further strategic partnerships, acquisitions, and research endeavors. As the company secures more capital, it can reinvest into its operations, driving continued growth and shareholder value.

Why It Matters: Having ample capital gives Argo the flexibility to pursue its business strategy without delay. This financial strength positions the company to take advantage of strategic opportunities that may arise in the near future, whether in the form of acquisitions, product developments, or expansion into new markets.

4. Rising Demand for Sustainable and Organic Farming Solutions

Catalyst Overview: The agribusiness industry is rapidly shifting toward sustainable farming practices, driven by increasing demand for organic and environmentally friendly products. Argo Living Soils is well-positioned to capitalize on this trend, making it an attractive player in a fast-growing sector.

Details: The demand for organic farming solutions is growing as consumers and businesses alike become more conscious of environmental issues and the impact of traditional farming practices. Argo’s products, which include living soils and bio-fertilizers, are in direct alignment with this demand, providing farmers with sustainable alternatives that improve crop yields while preserving the environment.

As more farmers turn to organic solutions to meet the demand for eco-friendly products, Argo’s product offerings are increasingly sought after. The company’s commitment to innovation, sustainability, and quality ensures it will continue to meet the evolving needs of this market.

Why It Matters: The shift toward organic and sustainable agriculture is not a passing trend—it’s a fundamental change in the industry. Argo’s products are positioned at the intersection of this shift, making the company a key player in the future of agriculture. The increasing consumer preference for sustainable food sources further boosts the market opportunity for Argo.

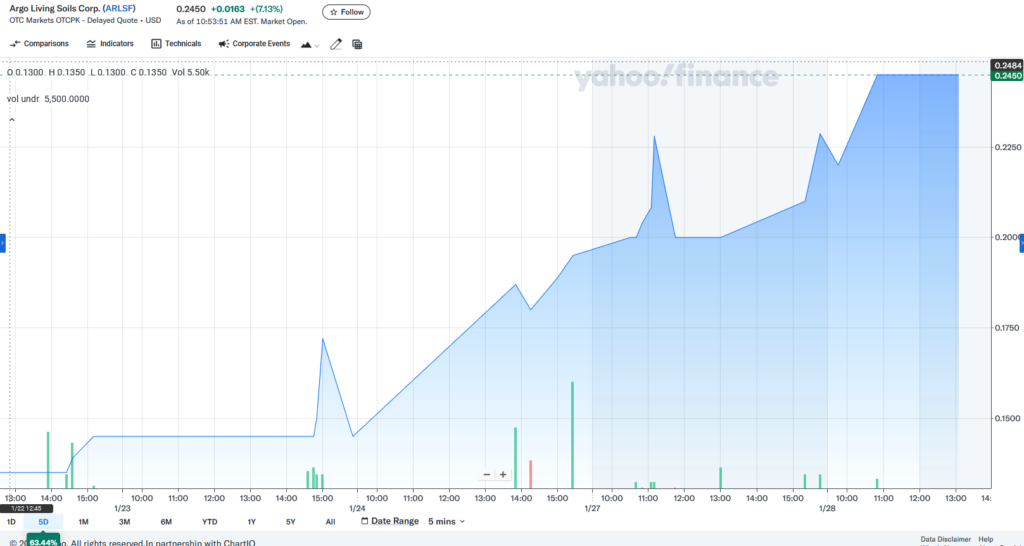

5. Undervaluation of Stock Price

Catalyst Overview: Argo’s stock is currently undervalued, providing a prime opportunity for investors looking to capitalize on future growth. As the company’s strategic initiatives begin to bear fruit, the stock is poised for significant upward movement.

Details: Argo’s stock recently surged 100% from $0.14 on January 22, 2025, to $0.28 on January 26, 2025, as investors began to recognize the potential of the company’s recent developments. Despite this surge, the stock remains undervalued when compared to other agribusiness companies with similar growth potential.

Why It Matters: The undervaluation of Argo’s stock presents a significant opportunity for investors to enter at an attractive price point before the stock price fully reflects the company’s growth potential. As Argo’s initiatives materialize, the stock is expected to experience a substantial increase, making it a lucrative investment opportunity.

Conclusion: A Perfect Storm of Catalysts

Argo Living Soils Corp. is well-positioned to capitalize on multiple growth catalysts, from strategic partnerships and technological innovation to market expansion and increasing demand for sustainable farming solutions. These catalysts, combined with an undervalued stock price, create a compelling opportunity for investors looking to profit from the future of agribusiness.

As 2025 unfolds, keep a close watch on Argo Living Soils Corp. With these catalysts in play, the company is on the verge of a major breakout that could make it one of the standout performers in the agribusiness sector.

News Section

Recent Media Mentions: Argo has been gaining increasing attention in industry publications following the announcement of its biomass-to-graphene partnership and other developments. This growing media coverage is fueling excitement about the company’s future (source: AgriTech News).

Upcoming Events: Argo’s upcoming product launches, including its next-generation bio-fertilizer, will be crucial to its continued growth. Additionally, investors should keep an eye on earnings reports, which are expected to reflect the impact of recent partnerships and new product offerings (source: Argo Investor Relations).

Industry Recognition: Argo’s commitment to innovation and sustainability has earned the company recognition in the agribusiness sector, with many citing its products as the future of environmentally friendly farming solutions (source: Sustainable Farming Digest).

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been previously compensated up to $150,000 for a campaign that ended in 2024. We have currently been compensated up to $150k for new awareness campaign beginning on Jan 20,2025 for profiling ARGO with coverage beginning 1,20,25. We own ZERO shares in ARGO.