HYMC Stock Price has been trying to recover since it’s March 21 high of almost $8. Wondering why this NASDAQ stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! HYMC Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Hycroft Mining Holding Corp. Company Information

Company Name: Hycroft Mining Holding Corp.

Ticker: HYMC

Exchange: NASDAQ

Website: http://www.hycroftmining.com/

Hycroft Mining Holding Corp. Company Summary:

Hycroft Mining Holding Corp. engages in the exploration, mining, and development of gold and silver properties. The company was founded on August 28, 2017 and is headquartered in Winnemucca, NV.

HYMC stock price is due to News?

Feb. 22, 2022

Provided preliminary operating results for 2021 and results of an Initial Assessment for the Hycroft project. Please see an updated presentation on the homepage of our website at www.hycroftmining.com.

2021 Highlights

- Safety: Hycroft’s safety performance was significantly improved with a 0.64 Total Recordable Injury Frequency Rate (TRIFR) at the end of 2021, which was an 80% reduction from 3.24 at the end of 2020. At month end January 2022, the TRIFR improved to a new low of 0.31.

- Production: Gold production for the year ended December 31, 2021, of 55,668 ounces exceeded the high end of the guidance range as the process team continued to improve equipment, process control and costs. Silver production of 355,967 ounces was approximately 20% below guidance due to slower than planned leach kinetics. Processing of ore on leach pads is currently planned to proceed through the second quarter of 2022.

Cash Position: The Company ended 2021 with $12.3 million of cash on hand and was in compliance with debt covenants.

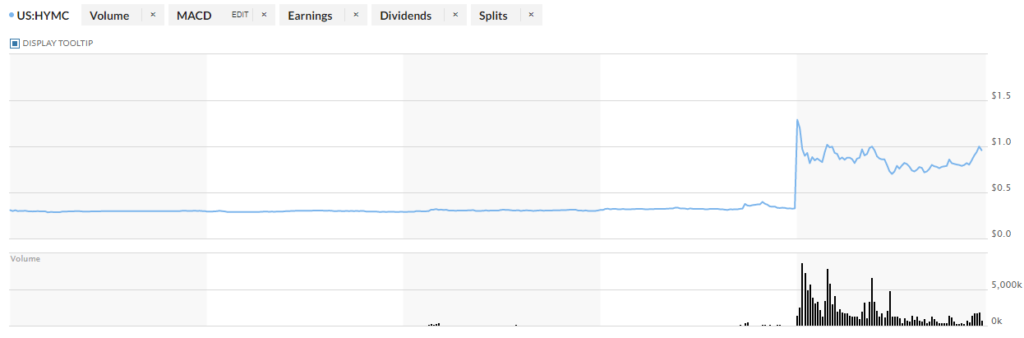

HYMC 5 Day Chart

HYMC Stock Price Technical Analysis:

It’s very simple, If this NASDAQ stock can beat $1.00 -$1.10 if you’re conservative the I like it.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]