Mullen Automotive MULN Stock Price exploded but is the run over? Exclusive Report

MULN Stock Price is up over 50% with a volume increase of 27%. There has been some early signs of a possible retrace so let’s look at it a little closer.

Wondering why this stock is having such a hard time and if it can break the overall trend? Keep reading to find out more!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! MULN Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Mullen Automotive Inc. Company Information

Company Name: Mullen Automotive Inc.

Ticker: MULN

Exchange: NASDAQ

Website: https://www.mullenusa.com/

Netlist Inc. Company Summary:

Mullen Automotive Inc. operates as an electric car company. It develops electric vehicles and energy solutions. The company was founded by David Michery in 2014 and is headquartered in Brea, California.

MULN stock price is due to News?

May 31st

- Mullen Automotive Inc (NASDAQ: MULN) has put forth the results of its solid-state polymer battery testing with the Battery Innovation Center (BIC) in Indiana.

- “The battery has performed exceptionally well, and I’m pleased with the results from BIC in Indiana,” said David Michery, CEO and chairman.

- Testing results from BIC show the solid-state polymer cell, rated at 300 Ah and 3.7 volts, tested at 343.28 Ah at 4.2 volts, exceeding expectation and is in line with test tolerance from previous EV Grid test results.

Feb. 28, 2022 (GLOBE NEWSWIRE) — via InvestorWire — Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an emerging electric vehicle (“EV”) manufacturer, announces an update on Mullen’s next-generation solid-state polymer battery technology, which is a significant advancement over today’s current lithium-Ion batteries.

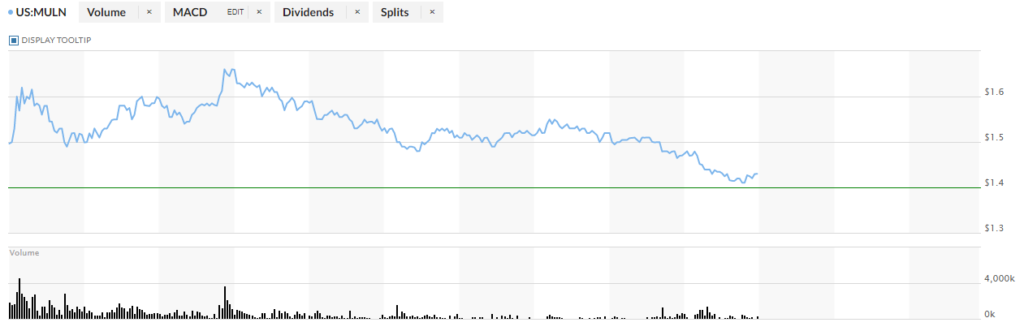

MULN 5 Day Chart

MULN Stock Price Technical Analysis:

I like the stock only if it can beat resistance at $1.55 and if you are truly conservative the $1.66 PPS is important too. The 1 day is showing the bearish move so just be aware of the movement.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Clean Vision CLNV Stock Price is up BIG! Time Sensitive UPDATE Inside

Clean Vision Corp. CLNV Stock Price has been trying to recover since it’s April high of almost $.17 Wondering why this stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! CLNV Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Clean Vision Corp. Company Information

Company Name: Clean Vision Corp.

Ticker: CLNV

Exchange: OTC

Website: https://www.cleanvisioncorp.com/

Clean Vision Corp. Company Summary:

Clean Vision Corp. operates as a Investment company enacting mergers and acquisitions in the tech space. It focuses on re-positioning in to the broader technology sector to monetize acquired companies by connecting them with blue chip and larger organizations with specific tech challenges. The company was founded on February 24, 2003 and is headquartered in Manhattan Beach, CA.

CLNV stock price is due to News?

Feb 23, 2022

Announced its Clean-Seas subsidiary reports its pilot pyrolysis plant has arrived in Mumbai, India, on schedule and in excellent condition.

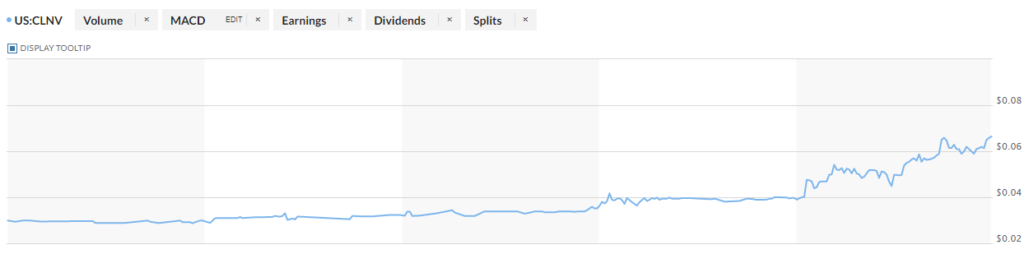

CLNV 5 Day Chart

CLNV Stock Price Technical Analysis:

I love it! The chart is very pretty on the 5 day and 1 day!

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

TUI AG ADR TUIFY Stock Price is consolidated and ready for a run? Alex has the answer!

TUIFY Stock Price has been trying to recover since it’s 12 month high of almost $3. Wondering why this stock is having such a hard time and if it can break the overall trend? Keep reading while Alex gives his opinion.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! TUIFY Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

TUI AG ADR Company Information

Company Name: TUI AG ADR

Ticker: TUIFY

Exchange: OTC

Press: https://www.marketwatch.com/investing/stock/tuify

TUIFY Stock Price will be impacted by the technicals on the chart, look below!

TUIFY 5 Day Chart

TUIFY Stock Price Technical Analysis:

I am not a big fan of this stock. The chart is bearish on the 1 year. The chart is bearish on the 5 day too. This stock is a stinker unless of course it can beat $1.50 but I still wouldn’t trust it.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Nel ASA NLLSF Stock Price is ready for another run? Shocking Analysis

NLLSF Stock Price has been trying to recover since it’s Nov high of almost $10. Wondering why this stock is having such a hard time and if it can break the overall trend? Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! NLLSF Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Nel ASA Company Information

Company Name: Nel ASA

Ticker: NLLSF

Exchange: OTC

Website: https://nelhydrogen.com/

Nel ASA Company Summary:

NEL ASA operates as a hydrogen company, which provides solutions to produce, store and distribute hydrogen from renewable energy. Its hydrogen solutions cover the value chain from hydrogen production technologies to manufacturing of hydrogen fueling stations. The firm operates through the following segments: Nel Hydrogen Fueling and Nel Hydrogen Electrolyser. The Nel Hydrogen Fueling segment engages in manufacturing of hydrogen fueling stations providing fuel cell electric vehicles with the same fast fueling and long range as conventional fossil fuel vehicles. The Nel Hydrogen Electrolyser segment operates as a global supplier of hydrogen production equipment and plants based on both alkaline and PEM water electrolyser technology. The company was founded by Erik Anders Lönneborg and Praveen Sharma in 1927 and is headquartered in Oslo, Norway.

NLLSF stock price is due to News?

16 February 2022) Nel ASA (Nel) reported all time high revenues of NOK 248.1 million in the fourth quarter of 2021, up from NOK 229.1 million in the same quarter of 2020 and an EBITDA of negative NOK -167.7 million (Q4 2020: -96.2) following the global scale-up strategy to maintain the leadership position in a market set to grow rapidly. The company had an order intake of NOK 418 million in the period ending the quarter with a record order backlog. The addressable project pipeline doubled during the fourth quarter of 2021, providing a strong long-term outlook.

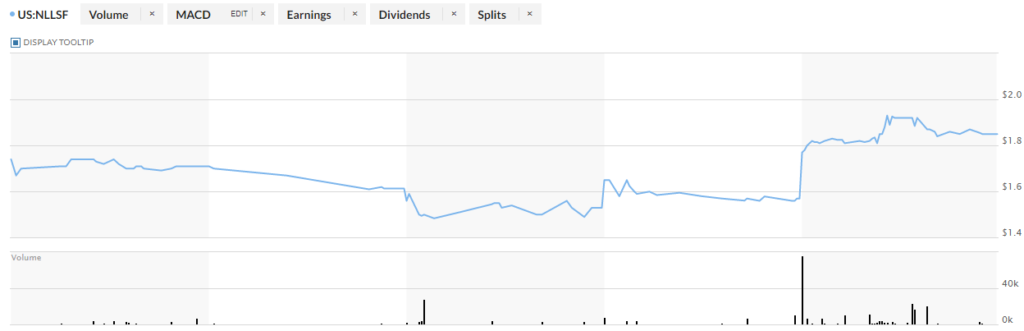

NLLSF 5 Day Chart

NLLSF Stock Price Technical Analysis:

NLLSF is trending stock for good reason, I like it. I would place a stop loss at $1.80.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Hycroft HYMC Stock Price is consolidated and ready for a run? URGENT Update

HYMC Stock Price has been trying to recover since it’s March 21 high of almost $8. Wondering why this NASDAQ stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! HYMC Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Hycroft Mining Holding Corp. Company Information

Company Name: Hycroft Mining Holding Corp.

Ticker: HYMC

Exchange: NASDAQ

Website: http://www.hycroftmining.com/

Hycroft Mining Holding Corp. Company Summary:

Hycroft Mining Holding Corp. engages in the exploration, mining, and development of gold and silver properties. The company was founded on August 28, 2017 and is headquartered in Winnemucca, NV.

HYMC stock price is due to News?

Feb. 22, 2022

Provided preliminary operating results for 2021 and results of an Initial Assessment for the Hycroft project. Please see an updated presentation on the homepage of our website at www.hycroftmining.com.

2021 Highlights

- Safety: Hycroft’s safety performance was significantly improved with a 0.64 Total Recordable Injury Frequency Rate (TRIFR) at the end of 2021, which was an 80% reduction from 3.24 at the end of 2020. At month end January 2022, the TRIFR improved to a new low of 0.31.

- Production: Gold production for the year ended December 31, 2021, of 55,668 ounces exceeded the high end of the guidance range as the process team continued to improve equipment, process control and costs. Silver production of 355,967 ounces was approximately 20% below guidance due to slower than planned leach kinetics. Processing of ore on leach pads is currently planned to proceed through the second quarter of 2022.

Cash Position: The Company ended 2021 with $12.3 million of cash on hand and was in compliance with debt covenants.

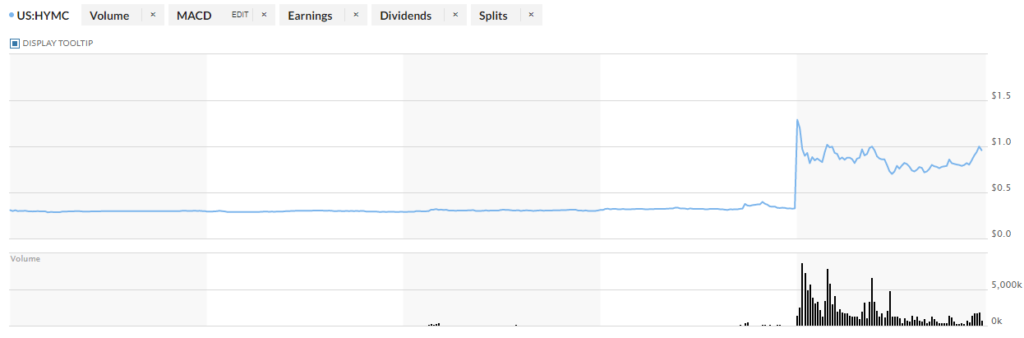

HYMC 5 Day Chart

HYMC Stock Price Technical Analysis:

It’s very simple, If this NASDAQ stock can beat $1.00 -$1.10 if you’re conservative the I like it.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Sunworks Inc. SUNW Stock Price could be a steal? Urgent UPDATE

SUNW Stock Price is up almost 100% in one month, but is the stock to pricey to buy? Is this breakout stock going to continue to run? Keep reading to find out.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! SUNW Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Sunworks Inc. Company Information

Sunworks, Inc. engages in the provision of photovoltaic based power systems for the residential, commercial, and agricultural markets. Its services include design, system engineering, procurement, project installation, construction, grid connection, warranty, system monitoring, and maintenance. The company was founded by Roland F. Bryan, Mark P. Harris, and Christopher T. Kleveland in 1983 and is headquartered in Roseville, CA.

Company Name: Sunworks Inc.

Ticker: SUNW

Exchange: NASDAQ

Website: https://sunworksusa.com/

Sunworks Inc. Company Summary:

SUNW stock price is due to News?

Colliers Securities analyst Donovan Schafer CFA reiterated a Buy rating on Sunworks (SUNW – Research Report) today and set a price target of $5.50. The company’s shares closed last Friday at $2.24, close to its 52-week low of $1.70.

According to TipRanks.com, CFA is a 1-star analyst with an average return of -11.9% and a 30.8% success rate. CFA covers the Consumer Goods sector, focusing on stocks such as Electric Last Mile Solutions, Lightning eMotors, and Hyzon Motors. HERE

SUNW 5 Day Chart

SUNW Stock Price Technical Analysis:

I love this stock! I believe it has consolidated after the big run and will test $5 again soon for a handsome 25% gain.

I would place a stop loss at $3.60 and sell at $4.90 if it has difficulty beating $5

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

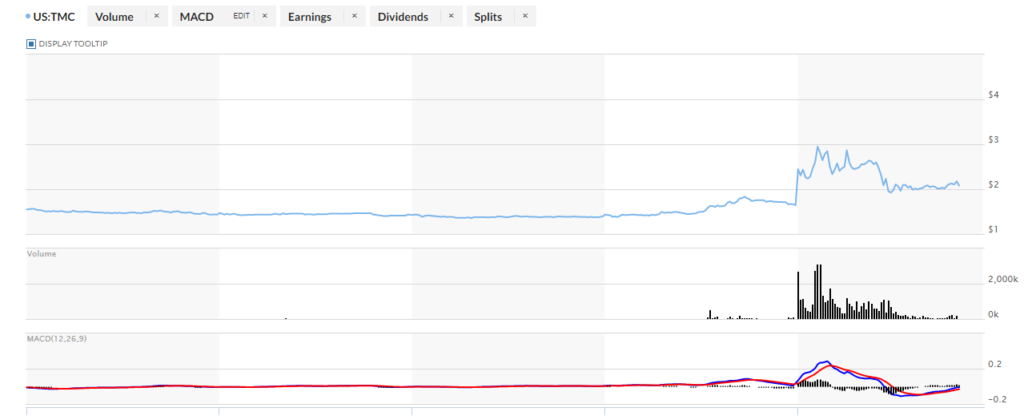

TMC Stock Price is consolidated and ready for a run? URGENT Update

TMC the metals company TMC Stock Price has been trying to recover since it’s July high of almost $11. Lately, it has been recovering, 30% gains in the last 5 days and almost 50% gains in the last month!

Wondering why this stock has had such a hard time bouncing and if it can break the overall trend? I will be looking into if this trending stock is truly recovered or if it’s just a head fake.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! TMC Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

TMC the metals company Company Information

Company Name: TMC the metals company

Ticker: TMC

Exchange: NASDAQ

Website: https://metals.co/

TMC the metals company, Company Summary:

TMC the metals co., Inc. is engaged in nodule collecting and onshore processing systems. It produces metals from polymetallic rocks to power electric vehicles. The firm’s products include nickel sulfate, cobalt sulfate, copper, and manganese. The company was founded in 2021and is headquartered in Vancouver, Canada.

TMC stock price is due to News?

Feb 28, 2022

Commended Western political and military leaders for their growing acknowledgement of the potential for seafloor polymetallic nodules to bolster domestic critical mineral supply chains for the clean energy transition.

Seventeen high-ranking U.S. military officers including former Director of National Intelligence Admiral Dennis Blair said in a letter to the U.S. Secretary of Defense, “The national security imperative of creating sufficient mineral supplies to build future EVs, energy infrastructure from turbines to transmission, and modern aerospace and defense systems must include a robust and secure supply chain within U.S. control.”

TMC 5 Day Chart

TMC Stock Price Technical Analysis:

Ok, the 5 day chart is till trending bullish! The one day is Bearish but after consolidation it appears it is creating a bullish lean.

I like the stock. If it has difficulty at $3 I would get out because of all the resistance. I would put a stop order at $2. I believe this could yield a nice 25%-40% gainer this week.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]