KRRGF Stock Price has been breaking it’s trend and is considered a trending stock with large volume and a 38% change in PPS in 5 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading break out stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! KRRGF Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 loswers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Karora Resources Inc. Company Information

Company Name: Karora Resources Inc.

Ticker: KRRGF

Exchange: OTC

Website: https://www.karoraresources.com/

Karora Resources Inc. Company Summary:

Karora Resources, Inc. is a mineral resource company, which engages in the acquisition, exploration, evaluation, and development of base metal and platinum group metal properties. Its gold producing operations are the Beta Hunt Mine and the Higginsville. The company was founded on December 13, 2006 and is headquartered in Toronto, Canada.

KRRGF News, KRRGF Stock Price changes are due to it?

Feb. 14, 2022

KRRGF Stock Price Announced 2022 gold production guidance of 110,000 – 135,000 ounces and all-in sustaining cost (AISC)(1) cost guidance of US$950 – US$1,050 per ounce sold. Karora is also pleased to provide its first nickel production guidance at Beta Hunt (since its 2020 re-naming), following a successful 2021 drilling campaign. Nickel production for 2022 is forecasted to range between 450 – 550 nickel tonnes. Karora has used a conservative nickel price assumption of $16,000 per tonne in its AISC(1) by-product credit forecast. Karora notes the 2022 nickel guidance does not include any nickel production from the newly discovered 50C/Gamma zone.

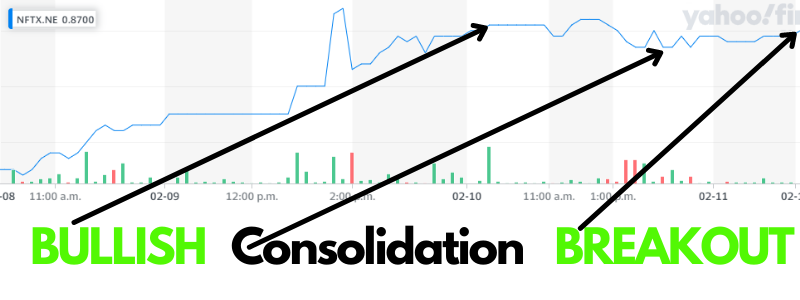

KRRGF 5 Day Chart

Karora Technical Analysis, KRRGF Stock Price:

KRRGF Stock Price is fluctuating due to the volatility in the market, it has nothing to do with the company! This stock is solid and I like it.

The 5 day chart is bullish with strong technicals.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

” /> I’m a big fan, not only is it in an incredible industry but the news and chart for Looking Glass Labs is strong.

” /> I’m a big fan, not only is it in an incredible industry but the news and chart for Looking Glass Labs is strong.