MDM Permian MDMP is up over 300%, put it on your watchlist!

MDM Permian MDMP is in a 52 week HIGH and is looking like it really could take off. But before we do, sign up for our amazing FREE newsletter below to get the hottest picks!

[thrive_leads id=’14274′]

Company Snapshot:

Company Name: MDM Permian, Inc

Ticker: MDMP

Exchange: OTC

Website: https://www.mdmpermian.com/

Company Summary:

In today’s Permian Basin landscape of horizontal plays and unconventional setups, MDM Permian MDMP looks to differentiate itself by capturing the best of vertical development and industry leading completion technology. Using decades of conventional play knowledge and state of the art NU-Tech log analytics MDMP stands at the forefront of mid-level Permian operators poised for developmental growth in 2021-22. Through select lease targeting, strategic service provider alliances, and experience of our team we focus on building value in the ground and then capitalizing on it through select drill site development.

MDMP in the NEWS

February 08, 2022

Yesterday, MDM Permian MDMP filed a Field Work Update with OTC Markets that has gotten a lot of investor attention.

This release highlights movement on the company’s Lindley ‘A’ Lease wells. The company moved a rig onto one of the wells, and ran pressure tests for holes at shallow depths. The initial results appear to be positive. Additionally, investors like the fact that the company is moving on commercializing the reserves discovered on this property.

According to a study the company did last month, the Lindley property has two reservoirs with approximately 3.6 million barrels of recoverable oil on 640 acres. At a market price of $65 oil, the company calculates these reserves to be worth $568 million.

Additionally, the company is quick to point out that these results are only for two zones. Other proven zones are not included in these numbers.

The recent progress made to commercializing these wells has speculators believing MDM could be close to capitalizing on this property. MDM could ultimately produce the oil itself or contract production with a third party. Regardless, these reserves appear to be ready to be monetized.

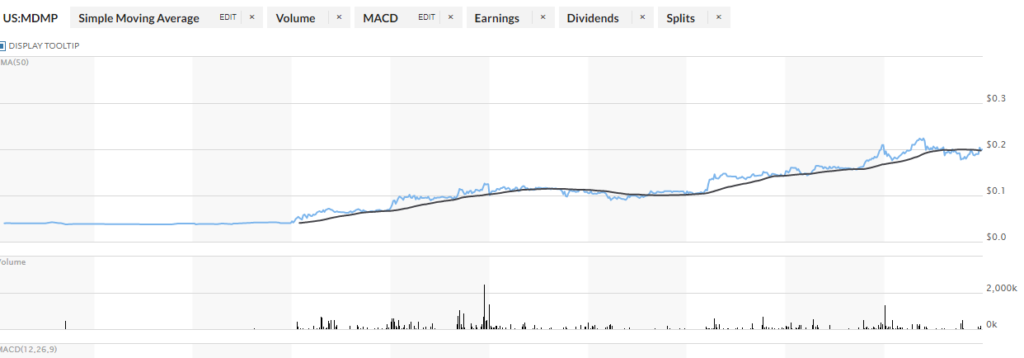

1 Year Chart

Technical Analysis:

MDMP is looking amazing with great news, but it is up a lot, so be careful. This is trending up seems to be stalled under $.24. If it has difficulty again, I would expect it to fall. Happy trading!

[thrive_leads id=’14274′]

Xalles Holdings XALL is looking pretty good, put it on your watchlist!

Xalles Holdings XALL is in a 52 week low but has just broke the trend and is looking like it really could take off. But before we dddo, sign up for our amazing FREE newsletter below to get the hottest picks!

Company Snapshot:

Company Name: Xalles Holdings, Inc

Ticker: XALL

Exchange: OTC

Website: https://xalles.com/

Company Summary:

Xalles Holdings, Inc. operates as a business development company, which is specialized in the payment industry and financial technology. It provides payment solution consulting, auditing and direct investment services. The company was founded by Thomas W. Nash on December 14, 2009 and is headquartered in Washington, DC.

XALL in the NEWS

February 09, 2022

Xalles Holdings XALL plans to expand our reach into the market of NFTs (non-fungible tokens) and cryptocurrency trading solutions.

Vigor Crypto Holdings, a wholly owned subsidiary of Xalles Capital, will analyze and test a variety of bots that are NFTs which trade on broader exchanges and futures markets like the Nasdaq, S&P 500, NYSE/Dow Jones. The goal is to evaluate, purchase and enhance our automated trading and bot portfolio, realizing that the key to success is finding the good system tool to support a good trading strategy.

Xalles Capital is also evaluating holding NFTs for long term investments which can be later sold on the secondary markets for profit. The strategy is that specific NFTs which contain trading bots and other assets and are sold in limited quantities would have a good opportunity to increase in value if the asset contained within the NFT is producing revenue or profits for its owner.

These strategies will complement what the company previously described with its joint venture company GioBot to create new trading bots to support Vigor Crypto and external clients. “NFTs and cryptocurrency trading bots and systems are an exciting part of the fintech ecosystem that Xalles is trying to optimize to drive innovation and profits,” stated Thomas Nash, Chairman and CEO of Xalles Holdings Inc.

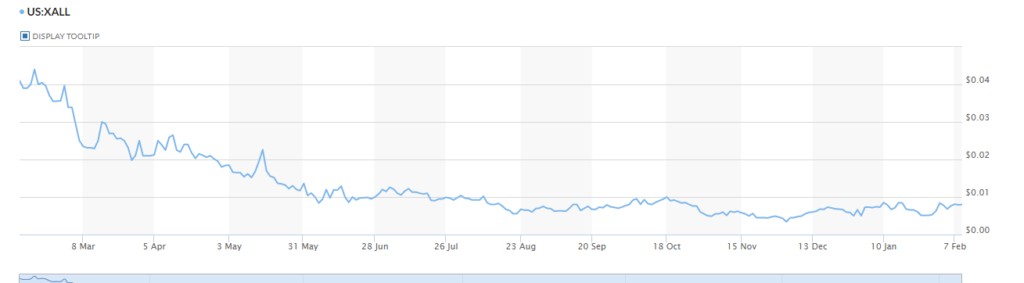

1 Year Chart

Technical Analysis:

Xalles Holdings XALL is looking like it could go either way at this point, it has created a bottom and volume is increasing so It’s possible it will take off. IF, it can break October’s high. IF, not, I expect it to continue down. Happy trading!