Here’s How And Why BREAKING DATA CORP COM NPV (OTCMKTS:BKDCF) Is Dominating The Online Media Space

If a group of people was asked to name the publishing outlet that commands the biggest Facebook page (as defined by the largest number of individual members), chances are companies like BBC or Mashable would be top of the list. Narrow it down to sports media outlets and ESPN would be a top contender. Very few people, if anyone, would return an answer of GiveMeSport. With more than 24 million followers, however, and more than 26 million likes (as of late July 2017) the publisher outperforms all of the above-mentioned household names. For reference, ESPN has the next largest single sports publisher Facebook page with 17 million members.

Why is this important?

Facebook is quickly becoming one of the largest and most prominent news aggregators in the world. The social media platform is an integral part of any content publisher’s arsenal and its dominance in the content serving and sharing space is only expected to grow over the coming decade.

Companies are rushing to figure out how to take advantage of this trend and are having varying degrees of success to this aim. The above mentioned Mashable has created its own technology, called Velocity, that helps it to predict which stories are likely to go viral and when and, in doing so, allows it to capitalize on this early stage information.

Other companies haven’t had as much luck.

The ever changing algorithms that underpin Facebook’s content delivery platform make it difficult to find a sweet spot and even more difficult to maintain it.

So how has GiveMeSport managed to amass such a large following?

The answer is rooted in the company that’s behind the outlet – BREAKING DATA CORP COM NPV (OTCMKTS:BKDCF) (BKD.V) (CVE:BKD). Breaking Data acquired GiveMeSport back in December 2016 and has spent the last six months incorporating its proprietary artificial intelligence (AI) technology into the media outlet’s day to day activity. With this acquisition, not only has Breaking Data given GiveMeSport a considerable technological advantage over its peers, it’s also served to offer public markets an exposure to the outlet’s success (which is what drew the attention of our analysts).

Breaking Data acquired GiveMeSport back in December 2016 and has spent the last six months incorporating its proprietary artificial intelligence (AI) technology into the media outlet’s day to day activity. With this acquisition, not only has Breaking Data given GiveMeSport a considerable technological advantage over its peers, it’s also served to offer public markets an exposure to the outlet’s success (which is what drew the attention of our analysts).

By way of a quick introduction to GiveMeSport and for those not familiar with the platform, it’s a news and entertainment outlet that – as implied by its name – focuses on serving sports related content to its users. The platform is fronted by a website, www.givemesport.com, and traffic is directed to the site through various social channels, including the above mentioned Facebook page.

While this is a website at core, the key thing to recognize here is that Facebook is the real growth driver for the outlet. Its founders are ex-Facebook strategists for various sports stars in the sports and entertainment space and the experience drawn from this side of the operation is what feeds into the company’s success i its Facebook endeavors today.

The way it works is as follows: Breaking Data and GiveMeSport have developed an AI technology that is able to track changes in Facebook’s content algorithm (not directly, but through the impact of the changes on the way the platform’s users interact with GiveMeSport’s content). When it detects changes, it automatically suggests strategic alterations that not only limit the impact of changes on the company’s content’s reach, but also seek to capitalize on it.

This AI approach is what sets GiveMeSport and Breaking Data aside from other publishers in this space. Whereas another publisher may take a 30% hit to its traffic on the back of a Facebook algorithm change and not be able to recover from the hit, GiveMeSport’s AI technology detects the change, mitigates its impact and alters the company’s strategy to try and take advantage of what is ultimately hurting its competitors.

All this is great but it means nothing to an investor in Breaking Data if it doesn’t translate to revenue – so how does Breaking Data generate sales on the traffic it’s attracting through its GiveMeSport platform?

Just as is the case with the vast majority of internet publishers, the answer is through online advertising.

With 32 million monthly visitors (this is a six month old metric but it’s the best we have available, chances are the figure is higher now) GiveMeSport has a very large audience to which it can serve advertisements of all shapes and sizes. Additionally, with a sporting focus, this audience is not only very large, it’s also very diverse. NFL, NHL and NBA fans comprise a large portion of the site’s users and each of these offers a different demographic and user type to the advertisers that want to gain exposure to a potential sales base through the platform.

To date, some of the biggest names in the world have advertised through the GiveMeSport platform, including Mercedes Benz, Bayerische Motoren Werke AG (ETR:BMW), American Express Company (NYSE:AXP) and Electronic Arts Inc. (NASDAQ:EA). These are billion dollar companies achieving quantifiable results through a relationship with GiveMeSport and, by proxy, Breaking Data.

So what’s next?

As per the latest available numbers, Breaking Data generated $1.08 million revenues for the twelve months to January 31, 2017. At that time, however, the GiveMeSport acquisition was less than one month old and the outlet’s advertising revenues were not included in the statement. As such, the next major catalyst for this stock is the reporting of financials (presumably, first quarter, but management hasn’t confirmed when it will start to include GiveMeSport in its audited numbers) that offer insight into just how much of a difference the acquisition makes to Breaking Data’s top and bottom lines.

Beyond that, the outcome of a recently announced marketing strategy that sees the company team up with NFL UK to develop an original content series themed around attempts at Guinness World Records is very much on the catalyst radar.

If this collaboration materializes as expected, it could expand the company’s reach to a television audience and – in turn – could dramatically increase its potential to command premium rates from advertisers looking to gain exposure to its userbase.

Here’s What To Look For From The Upcoming VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV) Phase III Study

VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV) just announced the details of its long awaited phase III program in hepatitis B. The program, if successful, will underpin registration applications for VBI’s lead hepatitis B asset in the US, Europe and Canada and – as such – its initiation is a major step towards the company dramatically increasing its target population.

Markets are yet to respond to the news, meaning there exists an opportunity right now to get into the stock ahead of VBI revaluing to reflect the operational advance.

With this in mind, here’s a look at the details of the trial, what’s important about how the trial is set up and what to look for going forward as indicative of successful execution and – in turn – a long term bull thesis on the company.

So, as mentioned, it’s a hepatitis B program and it revolves around an asset called Sci-B-Vac. For those new to this company, VBI has developed a platform through which it is able to create next generation vaccines that are designed to build on the immunogenicity and seroprotection offered to patients as part of the current standard of care vaccines. In this instance, the target is hepatitis B and the current standard of care vaccine in this space is Engerix-B.

Engerix-B is effective across a decent portion of the global population but it has its limitations. First, it commands a drawn out dosing regimen, which can lead to non-adherence and – by proxy – a failure of the drug to induce immunization. Second, it’s not particularly effective in certain subgroups of the population; namely, immunosuppressed patients. People with diabetes often fail to achieve seroprotection, even after completing a stringent dosing regimen of Engerix-B. The same is true with elderly patients and patients with chronic kidney disease.

Sci-B-Vac is designed to incorporate three different hepatitis B related antigens, which can help to increase the immunogenicity of the vaccine by increasing the variety of antibodies that are created in response to the vaccine being presented to the immune system. It also doesn’t require the adjuvant that’s generally attached to the standard of care treatment (in the case of Engerix-B, it’s aluminum).

VBI has conducted numerous early and mid stage trials that have demonstrated the safety and efficacy of Sci-B-Vac across a range of population types – regular, immunosuppressed, etc. The drug is also already approved in a number of countries globally and is one of two standard of care hepatitis B vaccines for newborns (it shares this title with the above discussed Engerix-B) in Israel. This means that, in addition to the data collected formally by the company as part of clinical trials, there also exists a huge data set derived from everyday administrations – all of which prove that this is a safe and effective alternative to the standard of care therapy.

On its own, however, this data isn’t enough to justify approval in the above three noted major markets – the US, Europe and Canada. The regulatory authorities in these regions – the FDA, the EMA and Health Canada respectively – require an investigator sponsored phase III trial to form the basis of an application for approval and it is this trial for which the company just served up the details.

Before getting into the trial specifics, it’s worth noting that, over the last six months, VBI has put together three pieces of the approval puzzle for this particular asset. Specifically, these pieces are confirmation from the FDA, the EMA and Health Canada that a single, global phase III program would be enough to underpin an application in each region. In other words, confirmation that the company won’t have to conduct three separate programs, one for each region. This confirmation from Europe and Canada came back in February. Markets had to wait a little longer for US confirmation but it eventually came in June.

This latest release, then, confirming trial design, is a fourth piece of the puzzle and the final one necessary before initiation.

So, let’s look at the trial.

As mentioned, it’s a single global program that’s set up to underpin registration applications in the US, Europe, and Canada and, according to the study design, it’s going to consist of two phase III studies. The first will be a safety and immunogenicity study called PROTECT and the second will be what’s called a lot-to-lot consistency study called CONSTANT. All told, both studies will enroll approximately 4,800 subjects and will be conducted at approximately 40 sites across the U.S., Europe, and Canada.

It’s worth noting here that a count of 4,800 patients is relatively low for a pivotal trial in a common indication like hepatitis B. The reason that the company is able to keep this number so low is that, as described above, there already exists a large set of data supportive of safety and efficacy. According to the company’s latest release, this set includes data from more than 2,000 patients.

Anyway, let’s look at the two phase III trials.

The PROTECT study will be a double-blind, two-arm, randomized, controlled study, enrolling approximately 1,600 adult subjects all of which are age 18 years and older. Subsequent opt enrollment, the patients will be randomized in a 1:1 ratio to receive either a three-dose course of Sci-B-Vac (at a 10μg dose) or a three-dose course of the control vaccine, which is the above discussed Engerix-B (at a 20μg dose).

There are two primary endpoints associated with the study.

The first is the demonstration of non-inferiority of the seroprotection rate induced by the active drug versus the control drug, four weeks after the third vaccination. This one relates specifically to patients aged 18 and older.

The second is the same, but superiority (as opposed to non-inferiority) in patients aged 45 and older. This one is an attempt to prove that the drug can be more effective in the immunocompromised population, as discussed above.

The CONSTANT study is a double-blind, four-arm, randomized, controlled study that will enroll approximately 3,200 adult subjects, age 18-45 years. In this one, the patients will be randomized in a 1:1:1:1 ratio to receive one of four three-dose courses – Lot A of Sci-B-Vac 10μg, Lot B of Sci-B-Vac 10μg, Lot C of Sci-B-Vac 10μg, or the control vaccine Engerix-B 20μg.

For those not familiar with these lot-type studies, the point is to show that the effect that the drug has on the patients is the same across a variety of different lots (just think of these as batches) of the drug in question. In this instance, VBI is trying to show to the regulatory agencies that Sci-B-Vac is consistently manufactured and – by proxy – has a consistent impact (in terms of seroprotection induced) across a range of different batches. The consistency in this instance is measured using what’s called geometric mean concentration (GMC) of antibodies.

The best way to think of this second study is as it being a study geared towards demonstrating a consistency of quality of the product, as opposed to specifically addressing efficacy. Of course, safety and efficacy will be measured (in fact, they comprise the secondary endpoint of this particular part of the program), as these metrics will also be used to measure quality across batches.

So, what are we looking for from the trials as indicative of success?

From the first study, we want to see two things.

First, that the drug is as effective in inducing seroprotection in adults aged 18 plus as is Engerix-B. That’s sort of the core primary endpoint. The second primary endpoint, however, the one looking at patients aged 45 plus in this author’s opinion, is more interesting. Not necessarily more important, as the primary needs to be hit, but more interesting.

Why?

Because there’s a very large market available to VBI if it can show that its asset is superior to Engerix-B in immunosuppressed patients. This second primary endpoint is geared towards proving just that.

From the second phase III, we just want to see safety and consistency between lots. It would be nice to see superiority in efficacy as compared to the individual lots and Engerix-B but it’s not essential.

As far as timelines are concerned, VBI hasn’t served up any specific dates for enrollment initiation but the company expects to kick off both studies during the second half of this year. With a 15-month time to completion, this means we should see topline hit press during the first half of 2018.

Disclosure: The author has no shares in any of the stocks mentioned in this article.

GWPH Long Term Major Player in Medical Cannabis (NASDAQ:GWPH)

Intro & History:

GWPH, GW Pharmaceuticals (NASDAQ: GWPH) is a British biopharmaceutical company known for its multiple sclerosis treatment product Sativex, and Epidiolex (cannabidiol) which is their lead development drug nearing market introduction to treat a rare form of childhood-onset epilepsy which currently has few, if any, real treatment options. Sativex was the first natural cannabis plant derivative to gain market approval in any country. Founded in 1998 and based in Salisbury, UK GWPH is headed by Geoffrey W. Guy and Brian Whittle. GWPH calls themselves the “global leader in developing cannabinoid-based medicines.” We think that the epilepsy market is a sweet spot for cannabinoids because of relaxing medical marijuana regulations and the increasing prevalence of various types of epilepsy, all over the world.

Recent News & Developments:

On May 24th of this year, GWPH through its subsidiary Greenwich Biosciences published a “groundbreaking” study of Epidiolex in the prestigious New England Journal of Medicine. This corresponded with a slight surge in stock price, but came nowhere near historical highs. In any case, the current Phase III study has received ample positive attention not only in the NEJoM but from physicians specializing in conditions it is designed to treat at the American Academy of Neurology annual meeting on April 25 of this year.

This is starting to sound repetitive, but we have to say again that with relaxation of regulations at the state level, the federal government will eventually have to follow suit. So far that has remained elusive, especially with notorious drug warrior Jeff Sessions, the current U.S. Attorney General pressing Congress for the repeal of the Rohrabacher-Farr Amendment which prevents the federal government from prosecuting (or persecuting) marijuana based businesses that are in compliance with their state and local laws.

In some good news to counter the bad, Cory Booker, a liberal Democrat from New Jersey; Kirsten Gillibrand, a more moderate Democrat from New York; and Rand Paul, a libertarian leaning Republican from Kentucky introduced the CARERS Act which directly benefits firms like GW Pharmaceuticals by officially codifying Obama era policies whereby the feds largely ignored medical marijuana based businesses, and expanding opportunities for medical and scientific research into therapeutic uses for cannabinoids through a combination of banking, veterans access, and perhaps most importantly rescheduling marijuana away from the Schedule I designation which it shares with Heroin and LSD, making it very cumbersome to perform research. Finally, this act would completely remove cannabidiol (CBD), GWPH’s bread and butter so to speak, from federal drug schedules.

GWPH’s pipeline includes CBDV (GWP42006) for epilepsy and autism spectrum disorders and a host of other similarly cannabis-derived compounds for conditions including a form of neonatal encephalopathy, glioma, schizophrenia and complications stemming from multiple sclerosis. There are numerous clinical trial actions underway, viewable at the Clinicaltrials.gov website here.

Market Data & Performance:

Currently at $103.49 with a Market Cap of $2.61B. This is down from their all-time high of $132.73 in September of 2016 that coincided with the end of that fiscal quarter, the impending filing for FDA approval of Epidiolex (which still has yet to occur), and a resulting sharp spike of $50 in share price from August 1 to September 1, 2016. Since that time performance has been mostly negative, but could be looking up for Q3 2017.

Various positive indicators came out of the Q2 2017 call in early May. These included improving assets to liabilities and assets to inventory ratios. They’ve budgeted a significant $130M-$150M to spend for the next 12 month period, largely on operations, research and market penetration. They also discussed high profile Phase III research and development news regarding Epidiolex – which may finally be nearing FDA approval, several management changes including the hire of Scott Giacobello as their new CFO and plans to become a U.S. domestic NASDAQ registrant reporting under U.S. GAAP (and in U.S. dollars) in the near future, among other items.

Conclusion & Looking Ahead:

Based on current and historical performance, as well as positioning of current and future drug releases, GWPH is probably a bit undervalued. Sales of legal cannabis and marijuana in both the recreational and medical sectors are expected to rise by ~30% in 2017, ~45% in 2018, and reach $17 billion (or more) in 2021, per the “Marijuana Business Factbook 2017”. Numerous cannabis related stocks have already surpassed 2X or 3X on their value at introduction/IPO and GW is sitting at a pretty low point right now.

We think you are capable of doing the math here. While I cannot make any specific recommendations on this stock, you will be well served to short list a group of marijuana based stocks and follow them closely in the coming months and years. This should be one of them – keep an eye on upcoming clinical trials because the FDA and EMA processes to bring new drugs to market is long and fraught with peril and the floor can drop out at any time as a result. You should also be wary of a “green rush” bubble propping up marijuana based stocks but also understand that the inherent safety of cannabinoid products and derivatives, along with the aforementioned relaxed federal medical cannabis regulatory environment, do provide some insulation from sudden stock crashes resulting from suits or government “imminent public safety” action.

Finally, the status quo in Washington D.C. could be good for firms with existing research capabilities and market penetration like GW. Namely, recreational use is facing a steep climb toward federal legality, but numerous pieces of legislation currently making their way through Congress with the aim of easing restrictions on all aspects of the medical marijuana business.

ABBV AbbVie Inc Continues To Impress (NYSE:ABBV)

Intro & History on ABBV (NYSE:ABBV) :

In the biotech and medical marijuana arena, we think that ABBV AbbVie Inc. (NYSE ABBV) is an interesting and well known stock to keep an eye on. ABBV is a pharmaceutical development, discovery, manufacturing and sales firm based in Illinois near Chicago, and traded on NYSE and they are, according to Wikipedia, the world’s eighth-largest independent biotech company by market cap. AbbVie falls squarely into the “Big Pharma” category. From their own company literature they are:

“…a global, research-driven biopharmaceutical company committed to developing innovative advanced therapies for some of the world’s most complex and critical conditions. The company’s mission is to use its expertise, dedicated people and unique approach to innovation to markedly improve treatments across four primary therapeutic areas: immunology, oncology, virology and neuroscience. In more than 75 countries, AbbVie employees are working every day to advance health solutions for people around the world.”

AbbVie originated in 2013 when Abbott Laboratories decided to separate into two separately traded companies. Abbott is now focused only on medical devices, equipment and nutrition products whereas AbbVie is strictly in the pharmaceutical research and manufacturing business.

They manufacture several products, which in this day and age of ubiquitous pharma adverts, can arguably be called household names. The two most prominent of which – for our purposes anyway – are Humira and Marinol. Humira – This immunosuppressive drug accounts for over 60% of AbbVie’s revenue and is used to treat Crohn’s disease and happens to be the highest grossing drug *in the world*, with over 15% growth in the past year alone. There are so-called “patent cliff” concerns looming, but I’ll address those momentarily. Marinol – This marijuana derivative, also known as Dronabinol, is marketed to chemotherapy, AIDS and other patients dealing with nausea, vomiting and suppressed appetite resulting from a pathology or treatment regimen. It is currently regulated as a Schedule III substance under the Controlled Substance Act, differing markedly from marijuana which sits at Schedule I and carries unreasonably harsh criminal penalties in many places in the United States and abroad. Medicinal cannabis/marijuana is currently approved in over half of the United States.

Recent News & Developments:

ABBV currently has an alphabet soup of promising experimental drugs in the hopper. The one drawing the most publicity is Upadictinib (formerly research chemical ABT-494) which recently significantly outperformed a placebo in clinical trials for rheumatoid arthritis. The FDA recently rejected Baricitinib (developed and submitted by Eli Lilly and Incyte) thereby seriously limiting competition for Upadictinib. Now all AbbVie has got to do is find a catchier name for Ubpadictnib it and send out the sales force. I kid, of course; if history is any indication, it could be named “Thistuffakillyatinib” and it wouldn’t make a bit of difference – so long as it continues to work without any previously unforeseen large scale side effects and the accompanying class actions cropping up.

The one big question mark at this point; and one which doesn’t have too many informed investors and biotech experts worried given the timeframe, is the expiration of Humira’s patent in 2022 and the introduction of competing drugs. Since ABBV derives so much of their current income from this product, it is of course incumbent on them to develop replacement revenue drivers between now and then. Again, most analysts with whom I am familiar are bullish on the likelihood that this will indeed happen.

Market Data & Performance:

During the last one-year period this Large Cap stock has fluctuated between $55.06 (low) and $73.67 (high) with an average volume of 5,560,234, a current volume of over 9,000,000 and higher than average yield. The characteristic zigzag graph indicates rallies and reactions over the past five years, but the stock has trended generally upward in every year for which data is available since 2012. To further belabor the point, almost every new peak or trough has been higher than the preceding peak or trough through time, and the line-of-best-fit has a definitively positive slope. ABBV has used about 58% of free cash flow to cover their past four quarterly payments which isn’t ideal, but far from abnormal. Price closed at $73.18 on June 22, 2017 and is currently trending down, but only by about 1% on June 23. Other mostly current stats are as follows:

- Market Cap: 469B

- PE Ratio: 18.97

- EPS: 3.86

- 6% yield

The company released its first quarter 2017 financial results and outlook at the end of April and it contained the following statement:

AbbVie is confirming its GAAP diluted EPS guidance for the full-year 2017 of $4.55 to $4.65. AbbVie expects to deliver adjusted diluted EPS for the full-year 2017 of $5.44 to $5.54, representing growth of 13.9 percent at the mid-point. The company’s 2017 adjusted diluted EPS guidance excludes $0.89 per share of intangible asset amortization expense and other specified items.

Paying down of the relatively high debt load has not, and looks to continue to not be a priority, which could mean that the C-suite is confident in the likelihood of continued future growth.

Looking Ahead:

To those of you with a particular interest in the cannabis market sector, AbbVie has had Marinol since 1985 and has over 30 years of research into cannabinoid compounds. Several experts have speculated that one path away from ABBV disproportionately heavy reliance on Humira and the dangers associated with the impending collapse of its veritable monopoly, would be in medical marijuana derivatives – the market for which is in the process of moving from $5 Billion in 2015, to over $20 Billion by 2020.

Conclusion:

Humira is facing existential competition, but not anytime soon. Toward weaning themselves from Humira, ABBV acquired rights to ½ of sales of Imbruvica, a cancer drug, in 2015 and it is joined in their oncology drug portfolio by Venclexta another novel cancer treatment drug. There are, again, many more products in the research phase.

Even if there is an overall market correction in biotech, it would affect all such stocks equally and probably hit the smaller companies harder – and given the increasingly positive reception to relaxed medical (and recreational) marijuana laws and the tax revenues that decriminalization and legalization would bestow at the state and national levels, it would behoove AbbVie to seriously consider this market vertical for continued research, development, and acquisitions. They have the benefit of their extensive previous research and the notion that the DEA simply has to be trending toward totally re-scheduling marijuana (and its derivatives); and we feel like they can afford to be; actually – they NEED to be very aggressive in pursuing innovations in this market.

Further, given Humira’s continuing status as the #1 revenue grossing drug on the planet, the next 3 or so years look promising as a mid-term investment – depending on how proactive AbbVie can be in staking out aforementioned (or currently unannounced) new market footprint(s). Overall, in our opinion, the lower AbbVie trends toward the $60-65 threshold, the better the mid-to-long term bargain for investors and the more closely it should be followed.

Cara Therapeutics Continues to Climb (NASDAQ:CARA)

We think Cara Therapeutics (NASDAQ: CARA), a boutique “clinical stage” biotech/biopharma firm which develops novel compounds (including cannabis derived chemicals) for neuropathic pain is worthy of a close look. Cannabis regulation has been relaxing both globally and in the United States and this influences our stance on CARA stock. But there has also been positive recent product news. Furthermore, current trend analysis indicates that CARA could be on the cusp of becoming a real steady performer on the market.

Good news: The U.S. Food and Drug Administration (FDA) just granted “breakthrough therapy status” to Cara’s CR845, a unique therapeutic compound which has provided significant clinical benefits to some patients with chronic kidney disease and osteoarthritis (more on that in a bit) and trading has picked up significantly in recent days likely as a result.

Cara is based in Stamford, CT and was founded by Derek T. Chalmers, Michael E. Lewis, and Frédérique Menzaghi in 2004 (initial IPO on January 30 of that year) with the following mission:

… to fundamentally change the way acute pain, chronic pain and pruritus are managed. We aim to achieve this by developing new products that selectively target the body’s peripheral kappa opioid receptors. Cara is developing a novel and proprietary class of product candidates that target the body’s peripheral nervous system and have demonstrated initial efficacy in patients with moderate-to-severe pain and pruritus (itch) without inducing many of the undesirable side effects typically associated with currently available pain and itch therapeutics.

Recent News & Developments:

The FDA granted breakthrough therapy status for CR845, a drug for treating itching (uremic pruritis), which is an intractable and common (affecting up to 50% of patients) presenting symptom with chronic kidney disease patients undergoing hemodialysis. Currently CR845 is an intravenous drug, but an oral version is in late stage development. This is significant because of the lack of available effective systemic treatments that is compounded by a dearth of new product development by other pharmaceutical companies. Available treatment regimens span the gamut from oral antihistamines to topical creams, standard analgesics (NSAIDs) to risky ultraviolet light treatments which can cause skin cancers in individuals with fair complexions. CR845 showed a 68% reduction in worse itching scores and a 100% improvement to quality of life.

A quick note on the meaning of breakthrough therapy status: According to Wikipedia, breakthrough therapy is a United States Food and Drug Administration designation that expedites drug development that was created by Congress under Section 902 of the July 9, 2012 Food and Drug Administration Safety and Innovation Act. It allows the FDA to grant priority review to drug candidates if preliminary clinical trials indicate that the therapy may offer substantial treatment advantages over existing options for patients with serious or life-threatening diseases. The FDA will work with the sponsor of the drug application to expedite the approval process. This can include rolling reviews, smaller clinical trials, and alternative trial designs. In short, it simply means that 3-9 months are potentially shaved off of the standard review and approval cycle time.

Cara’s pipeline consists of CR845, variants upon CR845 and CR701, a chronic pain treatment which operates on peripheral cannabinoid receptors, particularly in immune cells such as leukocytes and mast cells, which have been shown to be involved in pain and inflammatory responses but do not affect cannabinoid receptors of the Central Nervous System (CNS). CR701 is an advanced compound presently in preclinical development for hyperalgesia (extreme sensitivity to pain) and allodynia (perception of harmless stimuli as pain) where it has been proven significantly effective in laboratory trials involving rodents.

Looking to extend their coverage abroad,Cara has in place licensing agreements with Chong Kun Dang Pharmaceutical Corporation to develop, manufacture, and commercialize products containing CR845 in South Korea; and Maruishi Pharmaceutical Co., Ltd to develop, manufacture, and commercialize drug products containing CR845 in Japan.

Market Data & Performance:

In 2017, Cara shares have risen a phenomenal 134+%, with stocks going for about $4.50 in July of 2016 trending all the way up to where they sat at $22.87 on Friday June 23, 2017. There was a slight dip in afterhours trading ending at $22.59 – but overall performance for CARA definitely defied the general biotech sector’s slide for the past month or so. Market Cap is $736.28M. Financials appear to be up-to-date and are listed at www.sec.gov or at their investor relations webpage. An EPS of $-2.52 might usually raise red flags, but given that we’re talking about a biotech – a sector in which firms lose money for years during the development of patient-ready products – CARA’s negative earnings per share is probably not a big deal.

Conclusion & Looking Ahead:

With the recent good news from the FDA and resulting trading performance, you can probably assume that EPS and share prices will improve in the near- to mid-term, but it will be important to keep an eye on how CARA manages its revenues and expenses moving forward.

Regarding the negative EPS, in Q1 2017 CARA managed to expend $22M, but the prospect of having its first product reach the market many months ahead of schedule means they have a good shot of reversing cashflow into the black sooner rather than later – and making a serious run at $30/share in the next six months. Of course there are well documented risks for retail investors in small cap biotech so it’s not wise to make such a stock the centerpiece of your portfolio or go in too heavy before the medical sector starts buying CARA’s products in quantity. We think this is a cannabis related stock to watch closely through the end of Q2 and into Q3, 2017.

(OTCMKTS:ADRNY) ADRNY Ahold NV Goes Green

(OTCMKTS:ADRNY) Ahold NV Goes Green on Massive Volume

Shares of (OTCMKTS:ADRNY) Ahold NV traded green with massive volume brought on by possible Kroger speculation ( Amazon just purchased Whole Foods). ADRNY shares have been on a downward ride for almost a month but today that changed. With over 7,000,000 shares trading, and a close of $18.37

As traders talk of possible take over by Kroger (NYSE:KR) things look promising considering the Amazon purchase of Whole Foods. A large acquisition from Kroger could make stealthy traders very happy. Of course this is all speculation, but speculation may not be the only driving force. With share price at a one year low the bottom of ADRNY was bound to be found, Is this it?

Could this be the bottom of ADRNY? Could we see a share price of $22 or $23 again?

Company Profile

Ahold Delhaize is one of the world’s largest food retail groups, a leader in supermarkets and e-commerce, and a company at the forefront of sustainable retailing. Our family of 21 great local brands serves more than 50 million shoppers each week in 11 countries. Each brand shares a passion for delivering great food, value and innovations, and for creating inclusive workplaces that provide rewarding professional opportunities. Our brands have also established meaningful, lasting commitments to strengthen local communities, source responsibly and help customers make healthier choices. Ahold Delhaize was formed in July 2016 from the merger of Ahold and Delhaize Group, retail innovators for almost 150 years. Our local brands employ more than 375,000 associates in 6,500 local grocery, small format and specialty stores.

Ahold owns US brands such as Food Lion, Stop & Shop New York, Hannaford, and Martin’s Food Markets among other large retail stores.

https://www.aholddelhaize.com/en/home/

Todays volume was nothing short of crazy for ADRNY with a few trades exceding 1.9million shares. Another day like today could be what ADRNY needs to change from red to green. I will be watching this one close over the next few weeks.

We will continue to follow (OTCMKTS:ADRNY) Ahold NV with any updates.

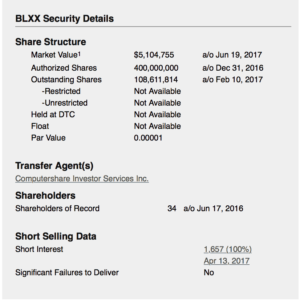

Blox Inc. BLXX (OTCMKTS:BLXX) makes easy gains off Lows

Blox Inc (OTCMKTS:BLXX) has made nice gains today on record volume. Today BLXX traded from $0.04 to highs of $0.09 and is currently sitting around $0.08 pos.

Todays total $ volume is just under $40,000.00 but even that is more than its traded in a single day for more than a year. With little selling pressure todays gains of 70% could just be the beginning of a nice move back to prices around $0.35 and needless to say its not going to take much volume to really move BLXX.

If less than $40,000 in trade value can move BLXX 70%

BLXX could really have some potential over the near future and we will continue to be watching and updating our subscribers.

Business Description

Blox Inc. (“Blox”), is a publicly traded Resource Exploration and Development Company.

Blox Inc. is focused on West Africa and at present has three Gold concessions in Ghana and one Gold concession in Guinea.

Blox Energy aims to green the mining process by implementing renewable energy into its own production processes and ultimately into those of other bulk power consumers in West Africa.

Blox’s shares trade on the OTCQB under the symbol BLXX.

Blox Inc. is based out of Vancouver B.C. Canada

http://www.otcmarkets.com/stock/BLXX/quote

Almost Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin without Owning Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin Investment Trust (OTCMKTS:GBTC) is a private, open-ended trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. The BIT’s sponsor is Grayscale Investments, a wholly-owned subsidiary of Digital Currency Group.

So for those of us that would like to invest/trade bitcoins but don’t want to have to deal with bitcoin wallets or transferring funds around you can easily use your current trading platform to purchase GBTC and trade just like any other stock.

https://www.otcmarkets.com/stock/GBTC/quote

Bitcoins Massive Run

Bitcoin has been on a massive run as of late with a value of more than $2,715 today per bitcoin and its not just the regular investors who are taking advantage of the opportunities presented with cryptocurrencies. Unless you have been hiding under a rock for the last few months you’ve heard someone or read something about Bitcoin and thats because its made a run from under $500 in 2015 to a current price of $2,715 6/20/17.

Im not going to try to explain what a bitcoin actually is because it seems that no longer matters, its the fact that the public, businesses, and even governments are beginning to recognize bitcoin is not going away.

What is a Bitcoin :

Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! There are no transaction fees and no need to give your real name. More merchants are beginning to accept them: You can buy webhosting services, pizza or even manicures.

No one knows what will become of bitcoin. It is mostly unregulated, but that could change. Governments are concerned about taxation and their lack of control over the currency.