BDMS Bounce Play or Stay Away (OTCMKTS:BDMS) Birner Dental Management Services, Inc.

OTCQX:BDMS (Birner Dental Management Services, Inc.) is looking rather bearish lately and we’ll try to figure out why and what an investor might expect in the near and not-so-near future. BDMS is a dental business service organization, which engages in servicing geographically dense dental practice networks in Colorado, New Mexico and Arizona.

Just last November it looked like BDMS was about to go big time. Stock was up to $18.61 and volume had picked up quite noticeably. Right now it sits at its yearly (and 5-year) low at $7.00.

Be careful when you Google BDMS – you might get a suggestion/question about whether you really meant to  search for BDSM and I’ll leave it to the reader to do your own research on that topic. The BDMS we’re talking about here is based in Denver, CO and has approximately 490 full time employees according to information made public by the company. As their URL www.perfectteeth.com might have led you to believe, they’re a dental services company (franchise) network in Colorado, New Mexico and Arizona focusing on cosmetic dentistry, but also maintaining the standard slate of orthodontics, oral surgery, endodontics, periodontics, dental implants and pediatric dentistry. They offer many of these services through their own dental plan the PERFECT TEETH™ Dental Plan (not sure why it’s in ALL CAPS, but it is). The firm was founded in 1995 and claims to be the largest provider of comprehensive dental care in Colorado and New Mexico, with increasing penetration in Arizona. At its most basic level, BDMS essentially serves as an outsourced business office for practicing dentists, orthodontists and oral surgeons, removing the burden of paperwork and bureaucracy and “letting dentists be dentists.” According to their website, on two separate occasions they have been included on Fortune Small Business Magazine’s list of America’s Top 100 Fastest growing Small Public Companies. As of December 31, 2016, the company managed 69 offices, including 48 in Colorado, 11 in New Mexico, and 10 in Arizona under the PERFECT TEETH name.

search for BDSM and I’ll leave it to the reader to do your own research on that topic. The BDMS we’re talking about here is based in Denver, CO and has approximately 490 full time employees according to information made public by the company. As their URL www.perfectteeth.com might have led you to believe, they’re a dental services company (franchise) network in Colorado, New Mexico and Arizona focusing on cosmetic dentistry, but also maintaining the standard slate of orthodontics, oral surgery, endodontics, periodontics, dental implants and pediatric dentistry. They offer many of these services through their own dental plan the PERFECT TEETH™ Dental Plan (not sure why it’s in ALL CAPS, but it is). The firm was founded in 1995 and claims to be the largest provider of comprehensive dental care in Colorado and New Mexico, with increasing penetration in Arizona. At its most basic level, BDMS essentially serves as an outsourced business office for practicing dentists, orthodontists and oral surgeons, removing the burden of paperwork and bureaucracy and “letting dentists be dentists.” According to their website, on two separate occasions they have been included on Fortune Small Business Magazine’s list of America’s Top 100 Fastest growing Small Public Companies. As of December 31, 2016, the company managed 69 offices, including 48 in Colorado, 11 in New Mexico, and 10 in Arizona under the PERFECT TEETH name.

Way back in March of 2012, BDMS stock value peaked at $23.03, but hasn’t reached any higher than $18.61 in the past 1-year period (52-week range is $6.01 to $19.89). Currently it sits at $7.00, on the bottom of what looks like a trough, and volume is actually up about 14-fold over average to 15,370 (average was 1040). Market Cap is 13.11M and EPS is -$0.81.

Way back in March of 2012, BDMS stock value peaked at $23.03, but hasn’t reached any higher than $18.61 in the past 1-year period (52-week range is $6.01 to $19.89). Currently it sits at $7.00, on the bottom of what looks like a trough, and volume is actually up about 14-fold over average to 15,370 (average was 1040). Market Cap is 13.11M and EPS is -$0.81.

The company incurred a loss of $900,000 during the Q2 of 2017 and For what it’s worth, BDMS believes much of the decline in revenue and Adjusted EBITDA is due to a decrease in the number of dentists in their network. The count on March 31, 2016 was 112 and had dropped to 98 at December 31, 2016. The last announced count was back up to 105 as of July 31, 2017. The Company currently manages 69 dental offices, of which 36 were acquired and 33 were developed internally (“de novo offices”). With average revenues of roughly $220K at each location, and looking at their quarterly earnings, this appears to be a sound theory. If so, it might be a good idea to keep up with how many locations they have at the time you make your investment. The count looks like a leading indicator of next-quarter performance.

Further, if one looks a little deeper at the numbers in their last several quarterly reports, it becomes evident that BDMS may be facing management and operations difficulties. Low gross and net margins could mean that they aren’t significantly differentiating themselves from their peers. Also compared to their peers nationally, BDMS revenues and earnings have moved much more slowly, which could be a tell on their operational inefficiencies (including poor cost control) and lack of management focus. All of that said, the firm appears to be engaged in trying to get their operating costs under control and that may bode well for investors, especially given the current low stock price.

The dental business isn’t going anywhere and BDMS is operating and ramping up in areas of the country where they don’t have many, if any, peers on their level. On GlassDoor.com, most of their reviews from employees reflect a positive future outlook. However other current and former employees cite a number of low-volume locations that could have been chosen more carefully. This was a summary and I encourage you to do your own detailed research, but I think this is a bounce opportunity and that the stock is undervalued by the market right now. If they’re indeed busy making adjustments to widen the operating margins and increase earnings, now would be a good time to jump in if you’ve got a tolerance for a small amount of risk or understand the regional marketplace conditions in CO, NM and AZ.

FRMO Corp has OVER 40% Gains in Just 3 Days, BUT WHY?

FRMO (OTCMKTS:FRMO) FRMO Corp has solid gains on massive Volume in just 3 days, but why?

We are going to attempt to explain why share prices have gone from $4.30 on 8/30/17 to over $6.49 on Friday 9/1/17

Recent History

FRMO has traded between $ and $4.50 for the last few months with moderate volume and no spikes or drops. On August 28 volume hit a 3 month high but FRMO closed red. On the 29th of August FRMO Corp released its Fiscal Results for 2017

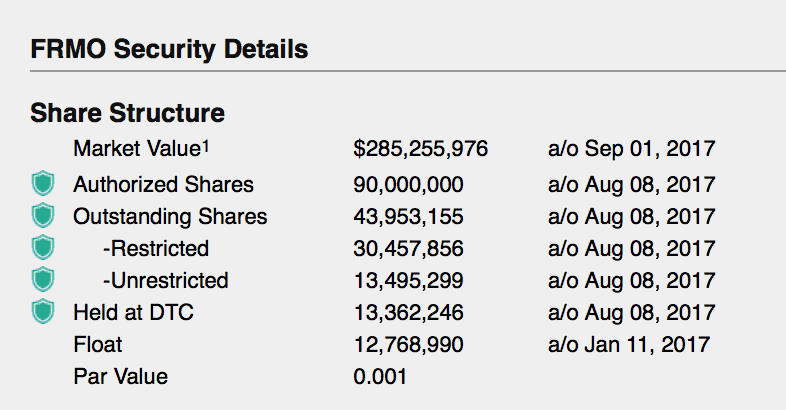

FRMO’s 2017 book value as of May 31, 2017 was $114.2 million ($2.60 per share on a fully diluted basis), including $10.9 million of non-controlling interests. The figure from the prior fiscal year-end as of May 31, 2016 was $102.0 million ($2.33 per share) including $3.7 million of non-controlling interests. Current assets, comprised primarily of cash and equivalents and investments available for sale, amounted to $71.3 million as of May 31, 2017, and $62.8 million as of May 31, 2016. Total liabilities were $13.1 million as of May 31, 2017, compared to $12.9 million as of May 31, 2016, the majority of each being deferred taxes.

FRMO’s 2017 net income (loss) for the fiscal year ended May 31, 2017 was $3,493,948 ($0.08 per share basic and diluted), compared to a loss of $(780,011) ($(0.02) per share basic and diluted) for the 2016 fiscal year. Income from operations for the 2017 fiscal year ended May 31, 2017 was $6,915,986, compared to $993,913 for the prior year. Comprehensive income (loss) attributable to the Company for the same periods was $4,335,956 up from a loss of $(7,020,898). The latter figure included unrealized investment losses.

Business Description

Unable to find much in for a business description:

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

Company website Again not much to it….

My Opinion

There is just not much to talk about with this company but the chart looks amazing. I will continue to watch but would be very cautious about purchasing.

WNDW SolarWindow Technologies starts production of its Solar Windows (OTCMKTS:WNDW)

WNDW SolarWindow Technologies Stock Spikes After News of Production Moving Forward (OTCMKTS:WNDW)

[caption id="attachment_7890" align="alignleft" width="445"] March 14, 2014 shoot for New Energy Technologies. Scott Hammond[/caption]

March 14, 2014 shoot for New Energy Technologies. Scott Hammond[/caption]

Share of WNDW (OTCMKTS:WNDW) SolarWindows Technologies have seen 25% spike over last few trading sessions, from $3.60 to $4.80. On 8/29/17 WNDW released news that the company will go into production of its Electricity-Generating Glass with an award winning fabricator, Los Angeles-based Triview Glass Industries, LLC.

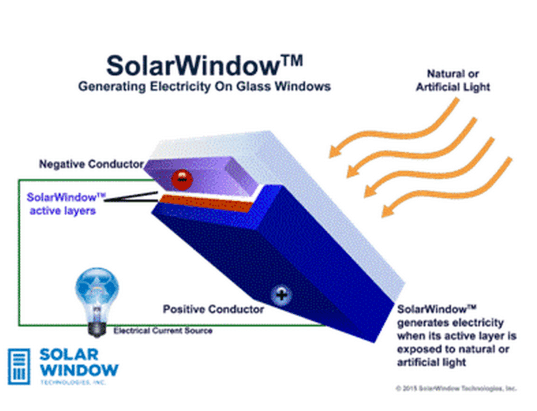

“The prospect of generating electricity on commercial buildings, which consume nearly 40% of all electricity generated in the US, is made possible when transparent SolarWindow™ electricity-generating liquid coatings are applied to glass surfaces.

As the company’s select regional fabricator in North America, Triview Glass will work to fabricate specific SolarWindow™ electricity-generating glass products at commercial scale by integrating SolarWindow™ technologies into its manufacturing processes.

Commercial buildings are ideal customers for electricity-generating windows, which could reduce electricity demand by 30%-50% and provide a one-year financial payback, according to independently-validated engineering modeling for a 50-story building. ”

Full News Released on 8/29/17 : Click Here

RECENT HISORY

ON 8/29/17 Price per share of WNDW started trading around $3.69 and with massive volume the stock hit a high of $4.04. The following day WNDW opened at $4.07 and hit a high of $4.69. On 8/31/17 the price started to consolidate and came back off the highs, hitting a low of $4.05 before hitting support and closing the day around $4.25.

Volume has slowed a bit over the last few sessions but the WNDW pps has continued to show solid support and solid moves upward.

“We’ve long awaited the opportunity to integrate SolarWindow™ technologies into commercial scale production, and I believe that our agreement with Triview puts us well on that path,” explained SolarWindow President and CEO, Mr. John A. Conklin.

Business Description

SolarWindow Technologies, Inc., publicly traded under the symbol WNDW, is focused on the research, development and eventual commercialization of the first-of-its-kind see-through SolarWindow technology, capable of generating electricity on glass windows and flexible plastics.

https://www.otcmarkets.com/stock/WNDW/profile

Technology

SolarWindow™ achieves payback within one year, according to first-ever independently validated financial modeling results.

To produce the equivalent amount of energy with conventional solar systems would require at least 5-11 years for payback and at least 10-12 acres of valuable urban land.

Unlike the many acres of expensive downtown real estate required for solar array fields, SolarWindow™ systems can be installed on the readily-available vast window glass surfaces on tall towers and skyscrapers.

SolarWindow™ can be applied to all four sides of tall towers, generating electricity using natural, shaded, and even artificial light. Conventional solar simply does not work in shaded areas or perform under artificial light.

The result? SolarWindow™ can outperform today’s solar by as much as 50-fold when installed on a 50 story building, according to independently validated power production calculations.

Find more at the company website here : www.solarwindow.com

Our Opinion

We like everything about WNDW and its electricity-generating window technology. We believe that WNDW is a safe play and the future will bring many happy investors.