Curaleaf Holdings CURLF bounce?

Curaleaf Holdings CURLF is looking poised for a great run, put it on your watchlist today! Let’s take a closer look at CURLF.

Company Name: Curaleaf Holdings

Ticker: CURLF

Exchange: OTC

Website: https://ir.curaleaf.com

Curaleaf Holdings CURLF Company Summary:

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf”) is a leading international provider of consumer products in cannabis with a mission to improve lives by providing clarity around cannabis and confidence around consumption.

As a high-growth cannabis company known for quality, expertise and reliability, the Company and its brands, including Curaleaf and Select, provide industry-leading service, product selection and accessibility across the medical and adult-use markets.

In the United States, Curaleaf currently operates in 23 states with 117 dispensaries, 25 cultivation sites, and employs over 5,200 team members. Curaleaf International is the largest vertically integrated cannabis company in Europe with a unique supply and distribution network throughout the European market, bringing together pioneering science and research with cutting-edge cultivation, extraction and production.

Why do I like CURLF?

Dec. 28, 2021 Curaleaf Holdings, Inc. announced that it has entered into a definitive agreement to acquire Bloom Dispensaries (“Bloom”), a vertically integrated, single state cannabis operator in Arizona in an all cash transaction valued at approximately US$211 million. The Transaction is expected to close in January 2022, subject to customary approvals and conditions.

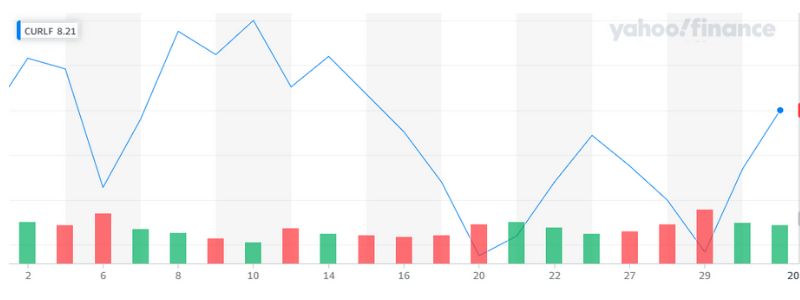

Consequently, Now that I covered the news, let’s look at CURLF 1 Month Chart

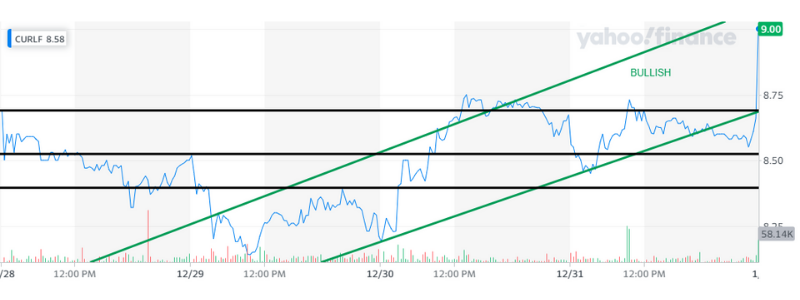

CURLF 5 Day Chart

Curaleaf Holdings CURLF Technical Analysis

Curaleaf Holdings has reversed it’s bearish trend with plenty of confirmation. The acquisition of Bloom Dispensaries by Curaleaf Holdings, Inc. is a big deal. The market is reacting to it in a positive way.

Beyond the Bloom Dispensaries deal, the 1 Month chart shows a clear reversal and the 5 day confirms it as well. Put it on your watchlist today, I like this stock! If you trade this stock, place stop losses at $8.75 to protect your investment!

Aurora Cannabis Inc. (OTCMKTS:ACBFF) ACBFF leading the way for Cannabis companies?

Today (OTCMKTS:ACBFF) Aurora Cannabis had gains of more than 7% on news that they will be making investments in Hempco HEMP.V

Both of these companies are leading the way in the cannabis industry. With growing interest from consumers and manufactures alike, hemp products are trending and investors are begging to be part of this movement.

VANCOUVER and BURNABY, BC , June 8, 2017 /CNW/ – Aurora Cannabis Inc. (the “Company” or “Aurora”) (ACB.V) (ACBFF) ( Frankfurt : 21P; WKN: A1C4WM) and Hempco Food and Fiber Inc. (“Hempco”) (HEMP.V) are pleased to announce that Aurora will be making a strategic investment in Hempco for an ownership stake of up to 19.9% on a fully diluted basis, subject to Regulatory and Board approvals, as well as satisfactory completion of due diligence. Additionally, subject to customary conditions, Aurora will obtain an option to acquire shares from the majority owners of Hempco that, upon exercise of the option, will bring Aurora’s total ownership interest in Hempco to 50.1% on a fully diluted basis.

This news brought hungry investors into both ACBFF and HEMP.V with gains in ACBFF of more than 7% and HEMP.V showing double digit gains around 14%.

Hempco is one of the world’s largest industrial producers of hemp and hemp products, and currently offers three primary product lines: (1) bulk and packaged food products (e.g. hemp protein powder, hemp seeds or hearts, hemp oil etc.); (2) hemp fibre; and (3) nutraceuticals. Hempco’s line of packaged foods are sold under the brand “Planet Hemp” and are distributed globally in seven countries.

The target market for these products includes, but is not limited to, health conscious consumers, including vegetarians seeking to supplement protein and reduce or eliminate animal product intake, as well as an increasing number of consumers focused on managing and preventing a variety of health issues through a healthy diet, known as “LOHAS”, Lifestyles of Health and Sustainability, and “millenials” looking for clean and “green” products.

In August of 2016 ACBFF was sitting around $0.35 a share but just a few months later it hit a high around $2.70 in the middle of November. Over the next 6 months ACBFF bounced between $1.70 and $2.65 with average volume over the last 30 days around 490,000 shares. Just in the last week some heavy than normal selling brought the PPC to a low of $1.50

We will continue to watch ACBFF over the short term and keep you updated on any changes that deserve your attention.

March Review Released for INVICTUS MD Strategies Corp (OTCMKTS:IVITF)

INVICTUS MD Strategies Corp (OTCMKTS:IVITF) shares ticked 9.75% higher to $1.27 on Wednesday and were flat in after-hours trading. Share prices have been trading in a 52-week range of $0.18 to $1.61. The company has a market cap of $43.50 million at 37.50 million shares outstanding.

INVICTUS MD Strategies Corp is a company that is focused on three main verticals within the burgeoning Canadian cannabis sector: Licensed Producers under the ACMPR including an investment in a fully licensed facility, AB Laboratories Inc. as well as the option to now acquire 100% of Acreage Pharms Ltd.; Fertilizer and Nutrients through Future Harvest Development Ltd.; and Cannabis Data and Delivery, with its wholly owned subsidiary Poda Technologies Ltd.

In a press release, INVICTUS MD Strategies Corp Chairman Dan Kriznic provided a month in review, highlighting the transformational time for the company as it worked to expand and solidify its cultivation portfolio with expansion plan forecasts of 50,000 kilograms of high quality cannabis production by 2020.

He started off by sharing that CBC News learned that marijuana could be legal in Canada by July 1, 2018 and that the legislation will be announced during the week of April 10. Analysts estimate that this industry could reach $22.6 billion over the coming years, according to Deloitte, with a retail market worth up to $8.7 billion. So far, there are only 41 producers licensed by Health Canada so there’s still significant potential for INVICTUS MD Strategies Corp to capitalize on this growth over time.

At the beginning of March, INVICTUS MD Strategies Corp announced that it had closed its previously announced bought deal private placement with Canaccord Genuity Corp. and Eventus Capital Corp., including a portion of the over-allotment option, for aggregate gross proceeds of $16,218,065. Soon after, the company completed its final commitment with a cash transaction of CAD$2,000,000 to acquire 33.33% of AB Laboratories Inc. This is a Licensed Producer under the Access to Cannabis for Medical Purposes Regulations in Ontario.

Towards the end of the month, the company closed the definitive option agreement to acquire 100% interest in OptionCo which had received its license to cultivate under the Access to Cannabis for Medical Purposes Regulations as Acreage Pharms Ltd. It has constructed a 6,800 square foot production facility with an expansion plan floor plate of 30,000 square feet, and the option to add a 20,000 square foot mezzanine on 150 acres of land in Alberta.

As one of the few cannabis producing companies in North America listed on a major exchange such as the TSXV, that move will enable us to engage a wider investor audience,” said Dan Kriznic, Chairman & CEO, Invictus MD. “We are strongly focused on building our shareholder value. With 250 acres of cultivation space that stretches from Alberta to Ontario, allowing for purpose built production facilities rather than retrofitting existing buildings, we now have the largest land package in Canada for building cultivation facilities as demand increases and we will continue the disciplined but agile execution of our business strategy,” added Kriznic.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

22nd Century Group Inc (NYSEMKT:XXII) Shares Up 12.5%

22nd Century Group Inc (NYSEMKT:XXII) shares rose 12.5% on Thursday to $1.20 and were unchanged in after-hours trading. Share prices have been trading in a 52-week trading range of $0.73 to $1.71. The company has a market cap of $107.83 million at 90.70 million shares outstanding.

22nd Century Group Inc is a plant biotechnology company that is focused on technology that allows increasing or decreasing the level of nicotine and other nicotinic alkaloids in tobacco plants, and levels of cannabinoids in cannabis plants through genetic engineering and plant breeding.

It is engaged in various activities, including research and development of less harmful or modified risk tobacco products and tobacco plant varieties; development of X-22, a smoking cessation aid consisting of very low nicotine (VLN) cigarettes; manufacture, marketing and distribution of its RED SUN and MAGIC cigarettes; production of SPECTRUM research cigarettes for the National Institute on Drug Abuse (NIDA); contract manufacturing of third-party branded tobacco products, and research and development of plant varieties of hemp/cannabis, such as plants with low to no amounts of delta-9-tetrahydrocannabinol (THC), plants with high levels of cannabidiol (CBD), and other non-THC cannabinoids.

In a press release, 22nd Century Group Inc announced that representatives of the company’s wholly-owned subsidiary, Botanical Genetics, have been invited to serve as featured speakers and presenters at the annual Colorado Hemp Expo. This will be held at the Ranch Events Complex, 5260 Arena Circle, Loveland, Colorado on Friday, March 31, 2017, and Saturday, April 1, 2017.

We are developing several exciting new strains of medical marijuana as well as industrial hemp varieties with substantially altered levels of cannabinoids – all of which will be below the legal limit of 0.3% THC,” explained Dr. Paul Rushton, Vice President of Plant Biotechnology. “Following our recently announced success with Zero-THC hemp plants and our major collaboration with the University of Virginia, Botanical Genetics is now aggressively expanding our activities in an effort to make our Company a major source of proprietary plants for both the legal medical marijuana and industrial hemp markets. We look forward to exploring exciting business opportunities with like-minded companies in Colorado.”

Along with Thomas James Esq., Vice President & General Counsel, they will provide conference attendees with business and scientific updates and highlights of 22nd Century Group Inc advances in the rapidly evolving legal medical marijuana and industrial hemp markets. This includes Dr. Rushton’s featured speech on Friday evening regarding the 22nd Century Group Inc proprietary cannabis initiatives like their recently announced development of THC-free industrial hemp plants and the propagation of medical marijuana strains that are selected for increased levels of medically-important cannabinoids.

Dr. Rushton will also speak in a panel discussion on Seeds, Clones, Pesticides and Pollen while James will speak on three panel discussions: Investments in Hemp, Global Hemp Activities, and The Future of Hemp. They will also be available for one-on-one discussions.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Marijuana Company Of America Inc (OTCMKTS:MCOA) Completes Financial Statement Audit

Marijuana Company Of America Inc (OTCMKTS:MCOA) shares dipped 0.08% on Tuesday to $0.0485 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.20. The company has a market cap of $74.51 million at 1.58 billion shares outstanding.

Marijuana Company of America Inc is a development-stage company. It is a cannabis marketing and distribution company that distributes medical cannabis products, providing product sourcing, branding, payment, distribution and knowledge through an architecture structure to maintain customer loyalty and capture market share.

It is also developing a knowledge base complete with information from subject matter experts, medical articles and opinions, current articles, YouTube and other videos, blogs, and industry news and papers. The company provides information on strains, and other processed products that will be available through its club. It will track industry and consumer information and post to its social media and online knowledge base. It offers collectives and dispensaries in legal medical marijuana states marketing and managed services designed to improve membership and transactions.

In a press release, Marijuana Company of America announced that PCAOB auditors have completed a two year audit of the company’s financial statements for the years ended December 31, 2015 and 2016. From here, their legal counsel will finalize a Form 10 registration statement for filing with the Securities and Exchange Commission.

Once this registration statement becomes effective and the company’s common stock registered with the commission, Marijuana Company of America will apply to uplist its trading tier with OTC Markets to the OTCQB exchange. These steps are being taken to enhance long-term shareholder value, and attract a broader and more diverse shareholder base, including more institutional investors.

Our goal is to meet the requirements to be a fully reporting company. This is in-line with our business plan to move to a higher level stock exchange. As we continue to grow within our industry, achieving the highest level of transparency for our current and future shareholders is of paramount importance to us. With the audit completed, we are well on our way to becoming fully reporting and offering more transparency to investors and shareholders,” said Marijuana Company of America CEO and President Donald Steinberg.

As mentioned previously, being listed on a higher stock exchange can allow the company to attract not just more number of shareholders but better liquidity. The company is now turning its attention to the auditing process and has reportedly engaged the services of a CPA firm to complete a two-year audit of its financial statements as part of the process of preparing to become a fully reporting public company with the intent of uplisting to a higher reporting exchange.

Earlier this year, the company shared that it has recently commenced generating revenue and started to ship orders for its hempSMART Brain product after its launch in November.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

ProText Mobility Inc (OTCMKTS:TXTM) Shares Drop on Latest Acquisition

ProText Mobility Inc (OTCMKTS:TXTM) shares fell 20.83% on Monday to $0.00190 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.01. The company has a market cap of $5.92 million at 1.95 billion shares outstanding.

ProText Mobility Inc is a company that develops, markets and sells software solutions for the mobile communications market primarily for protecting children from dangers derived from mobile communications and mobile device use. Its offerings include solutions with downloadable applications for mobile communications devices, such as SafeText, DriveAlert and Compliant Wireless.

Its SafeText is a service for mobile devices that provides parents a tool to help manage their children’s mobile communication activities. Its DriveAlert is a virtual lock-box, designed to curb mobile device use while driving and to help mitigate the risks of driving while distracted. Its Compliant Wireless is a mobile platform designed for small to large companies. The mobile solutions for the enterprise/corporate compliance are marketed under Compliant Wireless and those with consumer solutions are marketed under FamilyMobileSafety.

In a press release, ProText Mobility Inc shared that it acquired Cannabis Biosciences Inc. from Plandaí Biotechnology Inc. In this transaction, ProText Mobility Inc acquired 100% of the capital stock of Cannabis Biosciences in exchange for 50 million shares of its common stock. According to Plandai, the shares will be distributed to Plandaí shareholders as a stock dividend and operate its two wholly owned subsidiaries as independent operating businesses.

“Where most pharma companies have chosen to focus on the non-psychoactive CBD chemical, we believe that this strategy limits the potential medical benefits. Recent third party studies have demonstrated the synergistic value of retaining the full chemical profile of cannabis. Our objective is to validate Cannabis Biosciences cannabis extracts to be not only full profile but also non-psychoactive, which will give researchers all of the benefits of cannabis without the unwanted side effects. The acquisition of Cannabis Biosciences by Protext properly aligns our pharmaceutical research under one roof, allowing us to further our cannabis studies as we strive to create a cannabis extract that can increase the well-being and potentially improve the lives of so many people,” said Roger Baylis-Duffield, CEO of ProText Mobility Inc.

Cannabis Biosciences was formed and incorporated by Plandaí Biotechnology in 2013 to legally develop non-psychoactive medicines from live cannabis plant using Plandaí’s proprietary processing and extraction technology. It intends to commence investigations in conjunction with independent researchers to develop and validate a full-profile cannabis extract, one that contains both CBD and the precursor acid form of THC found in the live cannabis plant.

In particular, the company’s investigations will be designed to show that the Cannabis Biosciences extraction process, which will use live leaf and low temperatures to extract the phyto-chemicals, should leave the acid forms of THC intact, resulting in a non-psychoactive extract with full medicinal potential.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

New IPO Stock Therapix BioSciences (NASDAQ:TRPX) Is Undervalued Compared To Peers – But Not For Long

Some of the biggest biotechnology winners of 2017 so far are cannabis stocks. GW Pharmaceuticals PLC- ADR (NASDAQ:GWPH), a $3 billion pharmaceutical cannabis company and probably the most well known company in this subsector of healthcare, is up around 7% since the start of the year. Zynerba Pharmaceuticals Inc (NASDAQ:ZYNE), a $250 million company, is up 22% year to date and close to 80% across the last twelve months.

Both of these companies have something in common – they are working to bring synthetic cannabinoids through clinical development in the US to treat conditions with a high unmet need, and in turn, a large potential market.

While we expect both to continue to appreciate throughout 2017 and beyond, as their respective pipelines mature towards commercialization, the already registered advance in each limits the upside somewhat.

There’s another company, however, with a very similar development strategy (synthetic cannabinoids) to those of GW Pharmaceuticals and Zynerba, but which has yet to benefit from the upside revaluation described above.

The company is Therapix BioSciences (NASDAQ:TRPX) and the reason it’s not yet revalued in line with its strategic peers is simple – it conducted its IPO today.

Before we get into the company, a bit of background on the space.

The medicinal benefits of cannabis are well established in a large number of different diseases and conditions. There’s evidence to suggest that sufferers of everything from neurodegenerative conditions (Alzheimer’s, dementia, etc.) to pain management to oncology and chemotherapy induced nausea can benefit from cannabis consumption in various forms, and this is the foundation of the medical marijuana industry in the United States. There are some inherent problems with using cannabis to treat these conditions, however, and the primary of these issues are side effects, consumption method and dosing. It’s incredibly difficult to ensure consistent dosing when a patient is smoking cannabis as an administration method. It’s also often undesirable (there are patients who don’t want to smoke) and creates obvious side effects, many of which are unwanted – cerebral high, respiratory issues, cancer, etc.

Synthetic cannabinoids are the focus of the above discussed companies, and many more, because they allow for the creation of cannabis based therapies, i.e. those that employ cannabinoids, or synthetic versions of cannabinoids, that don’t bring about the unwanted side effects that the natural product might, and can be administered in a controlled, measured format.

With GW Pharmacetucals, it’s a sublingual spray. With Zynerba, it’s a CBD based gel. Other companies, companies like Cannabics Pharmaceuticals Inc (OTCMKTS:CNBX), are developing topical administration, cannabis based creams.

Therapix’s answer is a sublingual tablet.

The company is developing a lead asset called THX-TS01, in a primary indication of Tourette’s syndrome. Tourette’s is a neuropsychiatric disorder that causes twitching, involuntary sounds and noises, blinking, and various other ticks, and the current standard care in the space is drug called haloperidol. It’s only really used in the most severe cases, however, as it brings with it some pretty nasty side effects, and it doesn’t really do anything about the tics side of the condition. Many Tourette’s sufferers use cannabis to ease the physical symptoms, and there’s a growing body of evidence that this is an effective method of treatment and control.

However, as mentioned above, many don’t want to smoke cannabis just to treat their symptoms. They either don’t want the high or don’t want to risk the respiratory and oncologic issues associated with smoking.

This is where THX-TS01 comes in.

The drug is a combination of synthetic THC (the active compound in cannabis) and what’s called PEA. PEA is a natural compound found in many substances (milk, fruits, etc.). It isn’t strictly a cannabinoid, but it shares many properties with cannabinoids, and – and here’s an important point – can enhance the impact of synthetic cannabinoids on the central nervous system (CNS) through what’s called the Entourage Effect, without enhancing its effect on the brain.

This Entourage Effect means Therapix has been able to take a small amount of synthetic THC (an amount not potent enough to bring about the cannabis associated high) and boost its impact on the CNS to a degree where it can improve the physical and tic-related symptoms of Tourette’s syndrome.

That’s the theory, at least, and it’s this theory that the company is out to prove subsequent to today’s IPO.

With both synthetic THC (probably more commonly known as dronabinol in the pharmaceutical space) and PEA already used in other approved drugs, there’s no need for Therapix to carry out preclinical or phase I studies for THX-TS01. Instead the company can take it through a phase II trial, and on succesfull completion of the phase II, directly into a pivotal investigation.

The first of these, the phase II (actually a phase IIa) is already underway, having initiated in December 2016. It’s enrolling at Yale University right now, and 4 out of a planned 20 patients are already on board. The trial should wrap up early third quarter 2017, and the company intends to put out topline in the same quarter. This paves the way for a pivotal trial (likely a phase IIb/III) kicking off before the end of the year.

It’s also eligible for Orphan Designation in the US, and Therapix intends to file for this designation once it has the data form the ongoing phase IIa in hand.

Beyond the Tourette’s indication, Therapix is targeting a host of other conditions, with the next in line being mild cognitive impairment (MCI). This is a bigger market than Tourette’s (although it won’t qualify for Orphan Designation) and Therapix expects to initiate a phase IIa study – the equivalent of the study that’s ongoing in Tourette’s right now – during the third quarter of this year.

With just 3.1 million shares outstanding, this company has a low float and high insider ownership – circa 60% as things stand. The company has $12 million cash, which it expects will carry it through to end 2018. Based on its mid point offering price of $6, the company was expected to hit markets with a market capitalization of $18.6 million.

The company opened at $6.30, and at time of writing, morning US session, is trading at $8.60. Based on the 3.1 million expected outstanding share count, this gives the company a current market capitalization of just $26.6 million – above expected, but still low given Therapix’s underlying operations.

Not only is this a low valuation compared to some of the mid cap players with comparable programs, like the above mentioned Zynerba, but it also falls far short of other cannabis stocks with far less promising, or far less developed, programs.

The above mentioned Cannabics Pharmaceuticals, which we noted above as developing topical administration assets, is pre clinical and has a market capitalization of $330 million. OWC Pharmaceutical Research Corp (OTCMKTS:OWCP), a company working to develop cannabis based oncology therapies, is, again, preclinical, and had a market capitalization of more than $178 million at last close.

Bottom line here is that this is a company that is only valued at its current market capitalization because it’s yet to enjoy the exposure to public market capital in the US that some of its strategic and operational peers have.

Now it’s a NASDAQ company, chances are this discrepancy will quickly disappear.

Affinity Beverage Group Inc (OTCMKTS:ABVG) Announces Village Tea Partnership

Affinity Beverage Group Inc (OTCMKTS:ABVG) shares rose 33.33% on Friday to $0.00040 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.00. The company has a market cap of $668K at 1.67 billion shares outstanding.

Formerly Strategic Rare Earth Minerals Inc, Affinity Beverage Group Inc is a holding company that focuses on branded consumer product acquisition opportunities in the health and wellness sector. It targets lifestyle brands, company and/or product distribution rights focusing on traditional and non-traditional healthy beverage options. Its brands include Village Tea Company and Pura Organic Agave.

Its subsidiary Village Tea Company Distribution, Inc is an owner of the Village Tea brand of loose leaf tea and accessories. The Village Tea brand is sold in major retailers in North America, including Vitamin Shoppe, Whole Foods Markets, Winners, HomeSense, Akins/Chamberlin Natural Foods Markets, and other independent specialty and grocery store retailers. It will also seek opportunities involving young brands specializing in all natural/organic foods, bio-food, supplements and personal care products for strategic partnerships, distribution agreements and potential acquisition.

In a press release, Affinity Beverage Group Inc announced that Village Tea has agreed to a 50/50 joint venture partnership with Green Roads Wellness, LLC to develop, distribute and market a line of co-branded functional teas and potentially other organic food and beverage products that are infused with Green Roads pharmaceutical grade Hemp Oil. Green Roads Wellness is one of the world’s leading suppliers of organic cannabidiol/hemp derived CBD oil and has over 5,000 wholesale clients and over one million end users.

In this partnership, the two companies plan to leverage their collective experiences to develop a line of products that can be sold through each company’s existing channels of distribution, with an emphasis on specialty grocers/retailers, health and wellness and direct to consumer. They are working on the initial product line which will consist of a functional loose leaf tea assortment in a variety of blends targeting Focus, Sleep/Relaxation and Energy.

Prior to this, Village Tea has been invited by The Florida Panthers and On the Move, Florida’s Convenience Store to participate in a unique sales and promotions partnership opportunity. As a vendor, Village Tea will feature its’ new Single Serve POS display with variety of flavors and potentially other products at select On the Move store locations in South Florida.

“We are excited about the partnership with On the Move and the Florida Panthers and we welcome the opportunity to introduce new customers across South Florida to the Village Tea Company brand of premium loose leaf teas through our newly launched food service and hospitality platform. This is especially important as we are developing additional sales and marketing initiatives in the region and we hope to make this program an integral part of those efforts,” stated Janon Costley, CEO of Village Tea Company Distribution and Affinity Beverage Group, Inc.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.