Boingo Wireless Inc (NASDAQ:WIFI) Attracts Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Boingo Wireless Inc (NASDAQ:WIFI) reported that Park West Asset Management has picked up 1,971,559 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Park West Asset Management to a total of 1,971,559 representing a 5.1% stake in the company.

For those not familiar with the company, Boingo Wireless, Inc. is a provider of commercial mobile wireless fidelity (Wi-Fi) Internet solutions and indoor direct-attached storage (DAS) services for carriers. The Company operates as a service provider of wireless connectivity solutions across its managed and operated network and aggregated network for mobile devices such as laptops, smartphones, tablets and other wireless-enabled consumer devices segment. The Company has established wireless networks that provide high-speed, high-bandwidth wireless connectivity to smartphones, tablets, laptops, wearables, the Internet of Things (IoT) and other wireless-enabled devices. Its wireless networks include DAS, femto-cell, and Wi-Fi networks that it manages and operates, which it refers to as managed and operated locations, as well as Wi-Fi networks managed and operated by third-parties with whom it contract for access (roaming networks). Its services include DAS or Femto-Cell, Wholesale-Wi-Fi, Retail, Military and Advertising.

A glance at Boingo Wireless Inc (NASDAQ:WIFI)’s key stats reveals a current market capitalization of 504.80 Million based on 38.65 Million shares outstanding and a price at last close of $12.99 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-01, Dunlevie picked up 5,131 at a purchase price of $11.51. This brings their total holding to 110,542 as of the date of the filing.

On the sell side, the most recent transaction saw Tracey unload 3,750 shares at a sale price of $12.14. This brings their total holding to 47,658.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Boingo Wireless Inc (NASDAQ:WIFI) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Spirit Bear Ltd. Picked Cool Technologies Inc. (OTCMKTS:WARM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Cool Technologies Inc. (OTCMKTS:WARM) reported that Spirit Bear Ltd. has picked up 11,374,854 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Spirit Bear Ltd. to a total of 11,374,854 representing a 9.62% stake in the company.

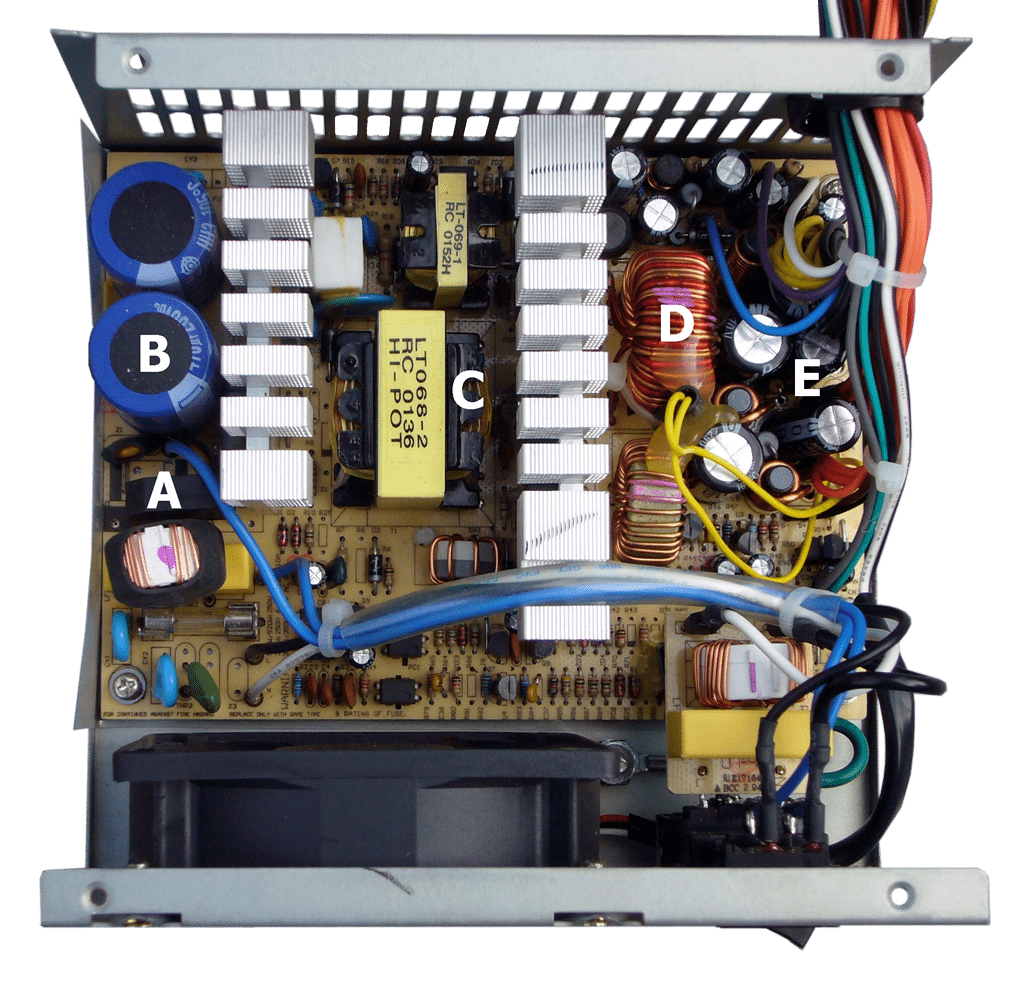

For those not familiar with the company, Cool Technologies, Inc., formerly HPEV, Inc., is engaged in developing and commercializing dispersion technologies in various product platforms. The Company is also engaged in developing and commercializing an electric load assist technology around which it has designed a vehicle retrofit system. Its application process is Totally Enclosed Heat Pipe Cooled technology (TEHPC). The markets for products utilizing its technology include consumer, industrial and military markets, both in the United States and across the world. Its initial target markets include those involved in moving materials and moving people, such as motors/generators, mobile auxiliary power, compressors, turbines, bearings, electric vehicles, brakes/rotors/calipers, pumps/fans, passenger vehicles, commercial vehicles, military and marine. The Company’s technologies are divided into categories, which include heat dispersion technology, mobile electric power and electric load assist. It has not generated any revenues.

A glance at Cool Technologies Inc. (OTCMKTS:WARM)’s key stats reveals a current market capitalization of 11.21 Million based on 113.2 Million shares outstanding and a price at last close of $0.100 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-10, Bibb picked up 100 at a purchase price of $0.10. This brings their total holding to 1,121,100 as of the date of the filing.

On the sell side, the most recent transaction saw Spirit unload 110,200 shares at a sale price of $0.09. This brings their total holding to 214,654.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Cool Technologies Inc. (OTCMKTS:WARM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Hc2 Holdings Inc. (NYSEMKT:HCHC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Hc2 Holdings Inc. (NYSEMKT:HCHC) reported that Falcone Philip has picked up 6,508,288 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Falcone Philip to a total of 6,508,288 representing a 13.8% stake in the company.

For those not familiar with the company, HC2 Holdings, Inc. is a holding company. The Company operates through seven segments: Manufacturing (Schuff), Marine Services (GMSL), Insurance, Telecommunications (PTGi-ICS), Utilities, Life Sciences and Other. Schuff fabricates and erects structural steel for commercial and industrial construction projects, such as high- and low-rise buildings and office complexes, hospitals, dams, bridges, mines and power plants. GMSL is an offshore engineering company focused on specialist subsea services across the market sectors, such as telecommunications, oil and gas, and offshore power. The Insurance segment, CIG, provides long-term care, life and annuity coverage to approximately 99,000 individuals through its Insurance Companies. The PTGi-ICS business unit provides customers with Internet-based protocol and time-division multiplexing (TDM) access and transport of long distance voice minutes. The Life Sciences segment focuses on the development of technologies and products in healthcare.

A glance at Hc2 Holdings Inc. (NYSEMKT:HCHC)’s key stats reveals a current market capitalization of 248.28 Million based on 41.94 Million shares outstanding and a price at last close of $5.93 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-14, Falcone picked up 21,000 at a purchase price of $4.53. This brings their total holding to 805,827 as of the date of the filing.

On the sell side, the most recent transaction saw Gerber unload 522,000 shares at a sale price of $7.50. This brings their total holding to 254,372.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Hc2 Holdings Inc. (NYSEMKT:HCHC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Taiwan Fund Inc (NYSE:TWN) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Taiwan Fund Inc (NYSE:TWN) reported that Lazard Asset Management Llc. has picked up 1,729,646 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Lazard Asset Management Llc. to a total of 1,729,646 representing a 21.03% stake in the company.

For those not familiar with the company, The Taiwan Fund, Inc. is a diversified, closed-end management investment company. The Fund’s investment objective is to seek long-term capital appreciation through investment primarily in equity securities listed on the Taiwan Stock Exchange (TSE) in the Republic of China (ROC). The Fund invests in various sectors, including biotechnology and medical care; building material and construction; cement; chemical; communications and Internet; computer and peripheral equipment; electric and machinery; electronic parts and components; financial and insurance; foods; oil, gas and electricity; optoelectronic; plastics; semiconductor; shipping and transportation; textiles, and trading and consumers’ goods. The Fund’s investment advisor is JF International Management Inc.

A glance at Taiwan Fund Inc (NYSE:TWN)’s key stats reveals a current market capitalization of 320.5 Million based on 8.22 Million shares outstanding and a price at last close of $17.78 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2010-09-29, Skinner picked up 4,900 at a purchase price of $16.50. This brings their total holding to 4,900 as of the date of the filing.

On the sell side, the most recent transaction saw Skinner unload 4,900 shares at a sale price of $17.09. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Taiwan Fund Inc (NYSE:TWN) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Picked Enphase Energy Inc. (NASDAQ:ENPH) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Enphase Energy Inc. (NASDAQ:ENPH) reported that Third Point has picked up 6,248,987 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Third Point to a total of 6,248,987 representing a 7.6% stake in the company.

For those not familiar with the company, Enphase Energy, Inc. is a provider of energy management solutions. The Company is engaged in designing, developing, manufacturing and selling microinverter systems for the solar photovoltaic industry. Its semiconductor-based microinverter system converts direct current (DC) electricity to alternating current (AC) electricity. Its microinverter system consists of three components: Enphase microinverters, an Envoy gateway and Enlighten cloud-based software. Its Enphase microinverters provide power conversion at the individual solar module level by a digital architecture that incorporates custom application specific integrated circuits (ASIC), specialized power electronics devices, and an embedded software subsystem. Envoy bi-directional communications gateway provides collecting and sending data to Enlighten software. Enlighten cloud-based software provides the capabilities to remotely monitor, manage, and maintain an individual system or a fleet of systems.

A glance at Enphase Energy Inc. (NASDAQ:ENPH)’s key stats reveals a current market capitalization of 113.01 Million based on 82.53 Million shares outstanding and a price at last close of $1.34 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-09-23, Kortlang picked up 600,000 at a purchase price of $1.20. This brings their total holding to 852,614 as of the date of the filing.

On the sell side, the most recent transaction saw Nahi unload 1,234 shares at a sale price of $1.05. This brings their total holding to 523,007.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Enphase Energy Inc. (NASDAQ:ENPH) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Jamba Inc. (NASDAQ:JMBA) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Jamba Inc. (NASDAQ:JMBA) reported that Engaged Capital has picked up 2,466,047 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Engaged Capital to a total of 2,466,047 representing a 16.1% stake in the company.

For those not familiar with the company, Jamba, Inc. is a restaurant retailer of specialty food and beverage offerings. The Company operates through retail segment. The Company’s offerings include whole fruit smoothies, squeezed juices and juice blends, Energy Bowls, and a range of food items including, hot oatmeal, breakfast wraps, sandwiches, Artisan Flatbreads, baked goods and snacks. The Company, through its subsidiary, Jamba Juice Company, operates a lifestyle brand. The Company has a global business driven by a portfolio of franchised and company-owned Jamba Juice stores, and licensed JambaGO and Jamba Juice Express formats. The Company has approximately 890 Jamba Juice stores globally, consisting of over 70 company-owned and operated stores, all located in the United States (Company Stores), approximately 740 franchisee-owned and operated stores (Franchise Stores) in the United States, and over 70 Franchise Stores in international locations (International Stores), collectively the (Jamba System).

A glance at Jamba Inc. (NASDAQ:JMBA)’s key stats reveals a current market capitalization of 146.42 Million based on 15.33 Million shares outstanding and a price at last close of $9.59 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-16, Welling picked up 7,600 at a purchase price of $9.85. This brings their total holding to 2,466,047 as of the date of the filing.

On the sell side, the most recent transaction saw Joliff unload 1,031 shares at a sale price of $9.90. This brings their total holding to 19,238.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Jamba Inc. (NASDAQ:JMBA) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Arrowstreet Capital is Buying Abercrombie & Fitch Co (NYSE:ANF) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Abercrombie & Fitch Co (NYSE:ANF) reported that Arrowstreet Capital has picked up 2,491,145 of common stock as of 2017-03-20.

The acquisition brings the aggregate amount owned by Arrowstreet Capital to a total of 2,491,145 representing a 3.7% stake in the company.

For those not familiar with the company, Abercrombie & Fitch Co. (A&F) is a specialty retailer that operates stores and direct-to-consumer operations. Through these channels, the Company sells products, including casual sportswear apparel, including knit tops and woven shirts, graphic t-shirts, fleece, jeans and woven pants, shorts, sweaters and outerwear; personal care products, and accessories for men, women and kids under the Abercrombie & Fitch, abercrombie kids and Hollister brands. Its segments include Abercrombie, which includes the Company’s Abercrombie & Fitch and abercrombie kids brands, and Hollister. A&F operates approximately 750 stores in the United States and over 180 stores outside of the United States. It operates Websites for each brand, both domestically and internationally. The Websites are available in over 10 languages, accepting over 30 currencies and shipping to over 120 countries. It sources merchandise through over 150 vendors located throughout the world, primarily in Asia and Central America.

A glance at Abercrombie & Fitch Co (NYSE:ANF)’s key stats reveals a current market capitalization of 785.84 Million based on 67.67 Million shares outstanding and a price at last close of $11.67 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-09-08, Horowitz picked up 15,000 at a purchase price of $17.32. This brings their total holding to 44,701 as of the date of the filing.

On the sell side, the most recent transaction saw Chang unload 7,600 shares at a sale price of $32.05. This brings their total holding to 35,014.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Abercrombie & Fitch Co (NYSE:ANF) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Affinity Beverage Group Inc (OTCMKTS:ABVG) Announces Village Tea Partnership

Affinity Beverage Group Inc (OTCMKTS:ABVG) shares rose 33.33% on Friday to $0.00040 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $0.00 to $0.00. The company has a market cap of $668K at 1.67 billion shares outstanding.

Formerly Strategic Rare Earth Minerals Inc, Affinity Beverage Group Inc is a holding company that focuses on branded consumer product acquisition opportunities in the health and wellness sector. It targets lifestyle brands, company and/or product distribution rights focusing on traditional and non-traditional healthy beverage options. Its brands include Village Tea Company and Pura Organic Agave.

Its subsidiary Village Tea Company Distribution, Inc is an owner of the Village Tea brand of loose leaf tea and accessories. The Village Tea brand is sold in major retailers in North America, including Vitamin Shoppe, Whole Foods Markets, Winners, HomeSense, Akins/Chamberlin Natural Foods Markets, and other independent specialty and grocery store retailers. It will also seek opportunities involving young brands specializing in all natural/organic foods, bio-food, supplements and personal care products for strategic partnerships, distribution agreements and potential acquisition.

In a press release, Affinity Beverage Group Inc announced that Village Tea has agreed to a 50/50 joint venture partnership with Green Roads Wellness, LLC to develop, distribute and market a line of co-branded functional teas and potentially other organic food and beverage products that are infused with Green Roads pharmaceutical grade Hemp Oil. Green Roads Wellness is one of the world’s leading suppliers of organic cannabidiol/hemp derived CBD oil and has over 5,000 wholesale clients and over one million end users.

In this partnership, the two companies plan to leverage their collective experiences to develop a line of products that can be sold through each company’s existing channels of distribution, with an emphasis on specialty grocers/retailers, health and wellness and direct to consumer. They are working on the initial product line which will consist of a functional loose leaf tea assortment in a variety of blends targeting Focus, Sleep/Relaxation and Energy.

Prior to this, Village Tea has been invited by The Florida Panthers and On the Move, Florida’s Convenience Store to participate in a unique sales and promotions partnership opportunity. As a vendor, Village Tea will feature its’ new Single Serve POS display with variety of flavors and potentially other products at select On the Move store locations in South Florida.

“We are excited about the partnership with On the Move and the Florida Panthers and we welcome the opportunity to introduce new customers across South Florida to the Village Tea Company brand of premium loose leaf teas through our newly launched food service and hospitality platform. This is especially important as we are developing additional sales and marketing initiatives in the region and we hope to make this program an integral part of those efforts,” stated Janon Costley, CEO of Village Tea Company Distribution and Affinity Beverage Group, Inc.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.