(OTCQB: ARLSF / CSE: ARGO)

While the Market Watches Tesla and NVIDIA, a Little-Known Canadian Innovator Is Gaining Serious Ground in Two Booming Sectors: Regenerative Agriculture and Sustainable Construction

Most investors today are focused on the obvious: AI, EVs, and big-tech IPOs.

But smart, forward-thinking investors know the real wealth is often created in silence, while headlines chase hype.

Enter Argo Living Soils Corp. (OTCQB: ARLSF / CSE: ARGO)—a company that’s been quietly building a bridge between two unstoppable trends: sustainable agriculture and eco-friendly construction.

And if you look closer, it’s clear: this is no ordinary green stock.

This is a dual-sector disruptor with a market cap still under most radars… and major catalysts already in motion.

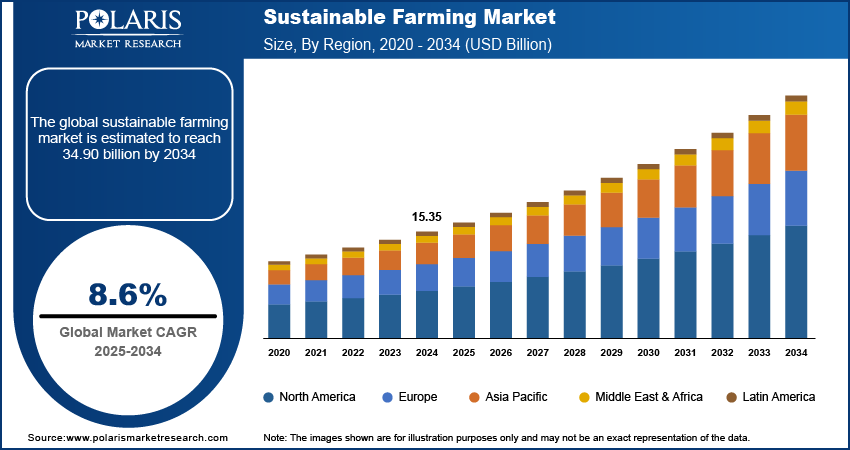

The $30 Billion+ Agriculture Revolution Is Underway—And ARLSF Is in the Middle of It

According to Market Research Future, the global sustainable agriculture market is set to skyrocket from $13.32 billion in 2022 to over $34.9 billion by 2034—an impressive CAGR of 10.17%.

That’s not a slow burn. That’s a full-blown green rush.

That’s not a slow burn. That’s a full-blown green rush.

ARLSF’s core division develops regenerative products like:

-

Organic living soils

-

Biofertilizers

-

Soil amendments based on biochar, microbes, and natural minerals

These products aren’t “eco-friendly fluff.” They address real pain points in farming—like soil degradation, reduced crop yields, and the harsh cost of synthetic chemical inputs.

What Makes This Different?

Argo isn’t just talking the ESG talk. They’re walking it with:

✅ Science-backed formulations

✅ Patents pending

✅ Commercial-ready products already in use across multiple farms in British Columbia and beyond

Strategic Partnerships That Signal Serious Scale Potential

Argo recently partnered with Connective Global, a company with reach in global ag-tech distribution, and AGIC (Advanced Graphene Industrial Concepts), to enhance their product line with graphene-based soil enhancers.

This is a game-changer.

Graphene—often hailed as a “wonder material”—offers powerful benefits in agriculture, including:

-

Enhanced microbial activation

-

Faster nutrient absorption

-

Increased crop resilience to environmental stress

The connectivity and credibility of these partners gives Argo far more than a head start—it gives them a launchpad.

But This Isn’t Just a Dirt Play. Argo Is Now Attacking One of the World’s Dirtiest Industries: Construction.

The construction industry accounts for roughly 38% of global carbon emissions.

The construction industry accounts for roughly 38% of global carbon emissions.

So what if you could make concrete stronger, cheaper, and dramatically more sustainable?

That’s the vision behind Argo’s newly formed U.S. division, Argo Green Concrete Solutions Inc., based in Nevada.

Their mission:

To develop bio-graphene concrete that reduces the carbon footprint of construction materials without sacrificing strength or durability.

Graphene-enhanced concrete isn’t just theoretical. In lab conditions, it’s been shown to be:

-

Stronger and more durable than traditional concrete

-

More water-resistant

-

Less energy-intensive to produce

Argo aims to take this from lab to jobsite.

Add ARLSF (ARGO.CN) to Your Watchlist TODAY

Follow the Money: Capital Raised, Market Upgraded, and Price Surging

In May 2024, Argo closed a $302,975 non-brokered private placement. Shortly after, they secured an additional $710,600 CAD through the exercise of warrants—a strong signal of investor confidence.

Then came the next move:

✅ ARLSF announced its application to the OTCQB Venture Market, a more transparent and investor-accessible tier of the OTC Markets Group.

This move opens the floodgates to:

-

More retail investor participation

-

Greater institutional visibility

-

Potential uplisting catalysts

And how has the market reacted?

ARLSF stock surged over 281% in the past month.

That’s not by accident. That’s because the story is finally getting out.

Two Disruptive Verticals, One Ambitious Company

While many ESG companies stretch themselves thin trying to cover dozens of niches, Argo’s focus is sharp:

-

Fix the soil

-

Fix the infrastructure

-

Do it profitably and at scale

It’s a simple thesis backed by:

-

Proprietary bioformulations

-

IP-backed graphene tech

-

Sustainable materials innovation

-

Strategic execution in high-growth markets

And here’s what’s especially exciting…

ARLSF is still early. Still small. And still severely underfollowed.

Which brings us to a key question:

Why Haven’t You Heard of ARLSF?

Because most media and analysts are focused on the obvious.

Because most media and analysts are focused on the obvious.

But that’s where you come in.

By doing your due diligence now—before the mainstream catches up—you gain the edge most miss.

You’re not chasing hype.

You’re investing in underappreciated innovation—with fundamentals and momentum lining up at the same time.

Quick Recap: Why ARLSF Is a Stock to Watch in 2025

Two massive verticals: Sustainable agriculture + green construction

Surging markets: $30B+ sustainable ag; $10T construction industry looking to decarbonize

Strategic partnerships: Connective Global & AGIC

Strong financial moves: $1M+ raised, OTCQB uplisting initiated

Price momentum: 281%+ increase in the past 30 days

Still early-stage: Undercovered, undervalued, but advancing fast

Add ARLSF to your watchlist today

Argo Living Soils (OTCQB: ARLSF / CSE: ARGO) might not be a household name—yet.

But for investors who understand timing, innovation, and under-the-radar positioning…

…it may be one of the most intriguing green opportunities of 2025.

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been previously compensated up to $150,000 for a campaign that ended in 2024. We have currently been compensated $270,000 on a previous campaign that ended April 2025, king tide media has been compensated up to $150,000 beginning on May 2025.