TAL Education Group bounces from here? Let’s take a close look.

Company Name: TAL Education Group TAL

Ticker: TAL

Exchange: NYSE

Website: https://en.100tal.com/

Company Summary:

Tomorrow Advancing Life (NYSE: TAL) is an educational technology company dedicated to supporting public and private education across the world and exploring new education models for the future with smart education tools and open platforms featuring well-rounded development and extracurricular learning.

Tal News

Bloomberg states, “Chinese companies listed in the U.S. rebounded Thursday after a five-day slump as investors piled back into stocks hurt by Beijing’s crackdown this year.

The Nasdaq Golden Dragon China Index jumped as much as 10%, its biggest intraday gain since at least 2012, putting the gauge on pace for its largest climb since 2008. Alibaba Group Holding, Tal Education Group and Vipshop Holdings Ltd. were among some of the best performers Thursday with each rallying at least 9.7%. The article can be found HERE

Also, Investors Observer released news two days ago in regards to “TAL Education Group (TAL) is around the top of the Education & Training Services industry according to InvestorsObserver. TAL received an overall rating of 42, which means that it scores higher than 42 percent of all stocks.

TAL Education Group also achieved a score of 73 in the Education & Training Services industry, putting it above 73 percent of Education & Training Services stocks. Education & Training Services is ranked 125 out of the 148 industries.” The article can be found HERE

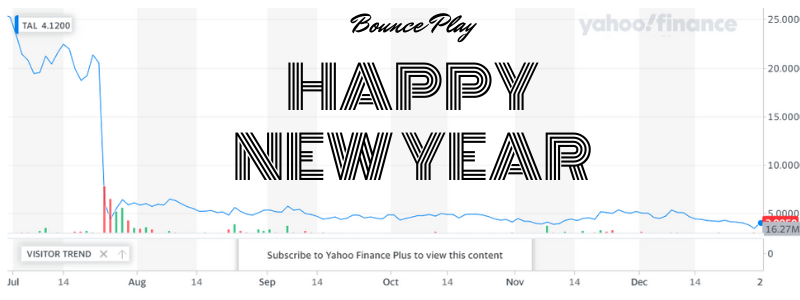

TAL 6 month chart

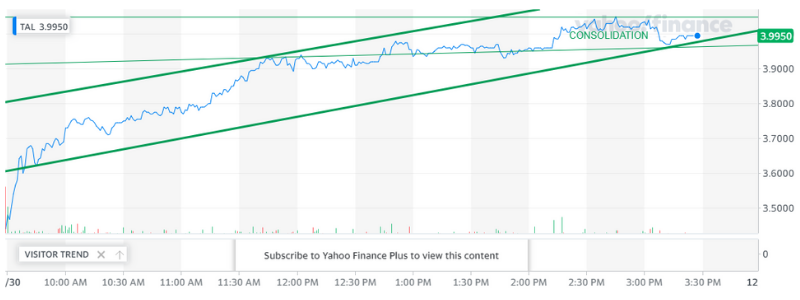

TAL Education Group TAL 5 day chart

Tomorrow Advancing Life (NYSE: TAL) 1 day chart

Tomorrow Advancing Life (NYSE: TAL) Technical Analysis:

TAL is a very interesting play. If you look at the overall Chinese sector it is a very good time to invest in Chinese stocks. The government announced tax incentives that should bolster the strength of the publicly traded companies.

A technical analysis in the 6 month chart shows that this is most definitely a bottom play.

The 5 day chart reveals that the trend has reversed but is showing difficulty with a double confirmation at the $4.00 PPS. The 1 day chart shows a strong bullish move and then consolidation with an end of the day slight bearish move to be watched.

Overall, I like the stock! My only concern in the short term is a bearish break from the consolidation pattern. If I was to invest in this company, I would once it breaks $4.00 with ease.