Man Group Plc. is Buying Tangoe Inc. (OTCMKTS:TNGO) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Tangoe Inc. (OTCMKTS:TNGO) reported that Man Group Plc has picked up 1,993,543 of common stock as of 2017-04-25.

The acquisition brings the aggregate amount owned by Man Group Plc to a total of 1,993,543 representing less than 5.06% stake in the company.

For those not familiar with the company, Tangoe, Inc. is a provider of information technology (IT) and Telecom Expense Management (TEM) software and related services. The Company offers its services to a range of global enterprises and service providers. Its products and solutions include mobility, telecom, cloud, IT expense, strategic consulting and mobility as a service (MaaS). Its mobility solution includes expense management; procurement, logistics and activation; usage management; enterprise mobility; mobile support, and financial management. Its IT expense solution includes expense management, inventory and asset management, usage management and financial management. Its enterprise mobility and IT consulting services include strategic sourcing; strategy assessment, planning, and policy development, and implementation and transition support. The Company offers contract sourcing, strategy and policy consulting, service maturity assessment, global services benchmarking and lifecycle advisory, among others.

A glance at Tangoe Inc. (OTCMKTS:TNGO)’s key stats reveals a current market capitalization of 214.90 Million based on 39.43 Million shares outstanding and a price at last close of $5.45 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-04-13, Clearlake picked up 1,202,666 at a purchase price of $7.25. This brings their total holding to 7,492,797 as of the date of the filing.

On the sell side, the most recent transaction saw Clearlake unload 1,590,000 shares at a sale price of $8.00. This brings their total holding to 5,902,797.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Tangoe Inc. (OTCMKTS:TNGO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Periam Ltd. Picked Up Enernoc Inc. (NASDAQ:ENOC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Enernoc Inc. (NASDAQ:ENOC) reported that Periam Ltd. has picked up 1,525,120 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Periam Ltd. to a total of 1,525,120 representing a 5.0% stake in the company.

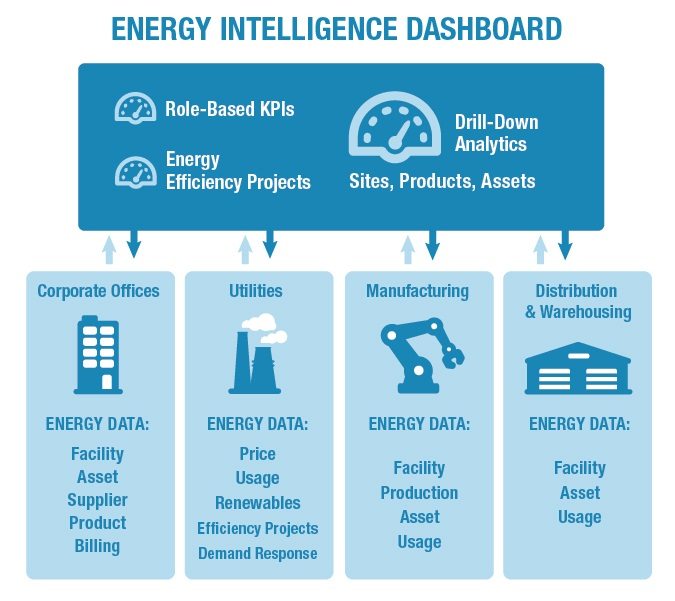

For those not familiar with the company, EnerNOC, Inc. is a provider of energy intelligence software (EIS) and demand response solutions. The Company’s EIS provides enterprise solutions, utility solutions and energy procurement solutions. The Company’s EIS offers enterprise customers with a Software-as-a-Service (SaaS) solutions with various areas of functionalities, including energy cost visualization, budgets, forecasts and accruals; project tracking, and demand management. Its EIS provides its utility customers with a SaaS-based customer engagement platform, which collects and processes data and enables its utility customers to provide personalized communication and recommendations to their customers. Its EIS includes an energy procurement platform that helps its enterprise and utility customers. Its procurement platform offers its enterprise and utility customers with features, such as energy contracts management. Its technology includes over two components: its EIS platform and Network Operations Center (NOC).

A glance at Enernoc Inc. (NASDAQ:ENOC)’s key stats reveals a current market capitalization of 160.04 Million based on 30.43 Million shares outstanding and a price at last close of $5.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-17, Healy picked up 8,170 at a purchase price of $7.36. This brings their total holding to 1,353,907 as of the date of the filing.

On the sell side, the most recent transaction saw Dixon unload 10,000 shares at a sale price of $12.51. This brings their total holding to 231,696.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Enernoc Inc. (NASDAQ:ENOC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Qumu Corp (NASDAQ:QUMU) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Qumu Corp (NASDAQ:QUMU) reported that Harbert Discovery Fund, Lp. has picked up 871,853 of common stock as of 2017-04-13.

The acquisition brings the aggregate amount owned by Harbert Discovery Fund, Lp. to a total of 871,853 representing a 9.4% stake in the company.

For those not familiar with the company, Qumu Corporation (Qumu) is an enterprise video content management software company. The Company is engaged in providing tools businesses need to create, manage, secure, deliver and measure their videos. The Company operates through the enterprise video content management software business segment. Its video content management software solutions allow organizations to create, capture, organize and deliver content across the extended enterprise to a range of end points, including mobile devices and thick or thin clients. Qumu’s video platform supports both live and on-demand streaming. The Qumu platform is a video content management software solution that can be deployed as a perpetual software license, a term software license or a cloud-hosted software as a service (SaaS). Qumu Capture Studio is a portable software-enabled device that records, edits and publishes video and presentation content.

A glance at Qumu Corp (NASDAQ:QUMU)’s key stats reveals a current market capitalization of 24.71 Million based on 9.28 Million shares outstanding and a price at last close of $2.71 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-17, Madison picked up 3,250 at a purchase price of $2.95. This brings their total holding to 14,625 as of the date of the filing.

On the sell side, the most recent transaction saw Hotchkiss unload 1,875 shares at a sale price of $14.50. This brings their total holding to 4,625.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Qumu Corp (NASDAQ:QUMU) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Empery Asset Management Picked Up Pareteum Corp (NYSEMKT:TEUM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Pareteum Corp (NYSEMKT:TEUM) reported that Empery Asset Management, Lp. has picked up 1,000,000 of common stock as of 2017-04-05.

The acquisition brings the aggregate amount owned by Empery Asset Management, Lp. to a total of 1,000,000 representing a 8.98% stake in the company.

For those not familiar with the company, Pareteum Corporation, formerly Elephant Talk Communications Corp., is an international provider of mobile networking software and services. The Company and its subsidiaries provide a mobility cloud platform, utilizing messaging and security solutions for the global mobile, mobile virtual network operator (MVNO), enterprise and Internet of things (IoT) markets. It is engaged in providing communications technology. ET Software DNA 2.0 is the Company’s intelligent mobile service platform. Its platform hosts integrated information technology (IT) or Back Office and Core Network functionality for mobile network operators (MNOs), MVNOs, and mobile virtual network enablers (MVNEs) and mobile virtual network aggregators (MVNAs) on an outsourced software as a service (SaaS), platform as a service (PaaS) and infrastructure as a service (IaaS) basis. Its virtual mobile platform solutions for MNOs and MVNOs feature Software Defined Networking and Network Functions Virtualization technologies.

A glance at Pareteum Corp (NYSEMKT:TEUM)’s key stats reveals a current market capitalization of 9.83 Million based on 12.77 Million shares outstanding and a price at last close of $0.770 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-31, Bozzo picked up 8,000 at a purchase price of $0.94. This brings their total holding to 19,036 as of the date of the filing.

On the sell side, the most recent transaction saw Carroll unload 76,241 shares at a sale price of $0.37. This brings their total holding to 642,941.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Pareteum Corp (NYSEMKT:TEUM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

U S Venture Partners Ix L P is Buying Box Inc. (NYSE:BOX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Box Inc. (NYSE:BOX) reported that U S Venture Partners Ix L P has picked up 11,713,775 of common stock as of 2017-04-04.

The acquisition brings the aggregate amount owned by U S Venture Partners Ix L P to a total of 11,713,775 representing a 15.7% stake in the company.

For those not familiar with the company, Box, Inc. provides an enterprise content management platform that enables organizations of all sizes to manage enterprise content while allowing access and sharing of this content from anywhere, on any device. With the Company’s Software-as-a-Service (SaaS) cloud-based platform, users can collaborate on content both internally and with external parties, automate content-driven business processes, develop custom applications, and implement data protection, security and compliance features to comply with internal policies and industry regulations. Its platform enables people to view, share and collaborate on content, across various file formats and media types. The software integrates with enterprise business applications, and is compatible with various application environments, operating systems and devices, ensuring that workers have access to their business content. It offers individuals a free basic version of the Box platform that allows them to experience its solution.

A glance at Box Inc. (NYSE:BOX)’s key stats reveals a current market capitalization of 2.23 Billion based on 69.81 Million shares outstanding and a price at last close of $16.81 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-10-09, Stein picked up 5,000 at a purchase price of $12.14. This brings their total holding to 45,000 as of the date of the filing.

On the sell side, the most recent transaction saw O’driscoll unload 319,228 shares at a sale price of $16.58. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Box Inc. (NYSE:BOX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

AlarmCom Hldg Inc. (NASDAQ:ALRM) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), AlarmCom Hldg Inc. (NASDAQ:ALRM) reported that Abs Capital Partners V Trust has picked up 5,337,646 of common stock as of 2017-03-23.

The acquisition brings the aggregate amount owned by Abs Capital Partners V Trust to a total of 5,337,646 representing a 11.55% stake in the company.

For those not familiar with the company, Alarm.com Holdings, Inc. is a platform solution for the connected home. The Company, through its cloud-based services, makes connected home technology accessible to millions of home and business owners. The Company operates through two segments: Alarm.com and Other. The Company’s Alarm.com segment represents its cloud-based platform for the connected home and related connected home solutions. Its Alarm.com segment also includes the results of Horizon Analog, which is a research company that focuses on collection and analysis of data relating energy usage and consumer behavior and energy disaggregation; Secure-i, which is a commercial video as a service provider, and SecurityTrax, which provides software-as-a-service (SaaS)-based customer relationship management software tailored for security system dealers. Its Other segment is focused on researching and developing home and commercial automation and energy management products and services in adjacent markets.

A glance at AlarmCom Hldg Inc. (NASDAQ:ALRM)’s key stats reveals a current market capitalization of 1.40 Billion based on 46.23 Million shares outstanding and a price at last close of $31.39 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-07-01, Hoag picked up 5,576 at a purchase price of $13.02. This brings their total holding to 105,863 as of the date of the filing.

On the sell side, the most recent transaction saw Hutz unload 3,500 shares at a sale price of $33.09. This brings their total holding to 145,522.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on AlarmCom Hldg Inc. (NASDAQ:ALRM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Lone Star Value Management Picked Up Ciber Inc (NYSE:CBR) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Ciber Inc (NYSE:CBR) reported that Lone Star Value Management has picked up 694,669 of common stock as of 2017-03-13.

The acquisition brings the aggregate amount owned by Lone Star Value Management to a total of 694,669 representing less than 1% stake in the company.

For those not familiar with the company, Ciber, Inc. (Ciber) is a global information technology (IT) services company. The Company operates in two segments: North America and International. Its Ciber International segment primarily consists of countries in Western Europe and the Nordic region. Its North America segment is organized into service offerings, which include Independent Software Vendor Relationships (ISV)/Channel Partner Platforms, Managed Services, Business Consulting, Application Development and Management (ADM)/Staffing, and Software-as-a-Service (SaaS). It provides project management, application and technical consulting, and database administration for both implementation projects and managed-services engagements. It also provides a solution, Ciber Compliance Suite, which helps SAP customers monitor the usage of their SAP systems. Its business consulting offering helps clients manage their business by offering expertise in IT strategy, enterprise architecture and vertical business processes.

A glance at Ciber Inc (NYSE:CBR)’s key stats reveals a current market capitalization of 48.23 Million based on 81.65 Million shares outstanding and a price at last close of $0.580 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-02-07, Legion picked up 82,855 at a purchase price of $0.33. This brings their total holding to 741,656 as of the date of the filing.

On the sell side, the most recent transaction saw Stine unload 3,725 shares at a sale price of $3.19. This brings their total holding to 3,779.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Ciber Inc (NYSE:CBR) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Esw Capital, Llc. Picked Up Marin Software Inc. (NYSE:MRIN) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Marin Software Inc. (NYSE:MRIN) reported that Esw Capital, Llc. has picked up 3,000,700 of common stock as of 2017-03-13.

The acquisition brings the aggregate amount owned by Esw Capital, Llc. to a total of 3,000,700 representing a 7.6% stake in the company.

For those not familiar with the company, Marin Software Incorporated provides a cross-channel, cross-device, enterprise marketing software platform for search, display and social advertising channels. The Company’s enterprise marketing software platform is offered as an integrated software-as-a-service (SaaS) solution for advertisers and agencies. The Company’s platform enables digital marketers to manage performance of their online advertising campaigns. Its software solution is designed to help its customers measure the effectiveness of their advertising campaigns through its reporting and analytics capabilities; manage and execute campaigns through its user interface and underlying technology that streamlines and automates functions, such as advertisement creation and bidding, across multiple publishers and channels, and optimize campaigns across multiple publishers and channels based on market and business data using its predictive bid management technology.

A glance at Marin Software Inc. (NYSE:MRIN)’s key stats reveals a current market capitalization of 69.89 Million based on 39.25 Million shares outstanding and a price at last close of $1.73 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-02-25, Dunlevie picked up 67,921 at a purchase price of $3.07. This brings their total holding to 159,286 as of the date of the filing.

On the sell side, the most recent transaction saw Kato unload 1,250 shares at a sale price of $9.62. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Marin Software Inc. (NYSE:MRIN) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.