RADA stock price, is it time to sell or rebuy? Exclusive analysis! URGENT

Rada Electronic Industries RADA stock price and chart looks great, is it time to sell or rebuy? Famed stock picker, Alexander Goldman has his analysis, take a look below.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! RADA Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below. Now, let’s go over some of the basic information on this stock before we get in the technical analysis.

Rada Electronic Industries Company Information

Company Name: Rada Electronic Industries Ltd.

Ticker: RADA

Exchange: NASDAQ

Website: https://www.rada.com/

Rada Electronic Industries Company Summary:

Rada Electronic Industries Ltd. Operates as a defense technology company. It develops, manufactures and sells defense electronics, including avionics solutions (including avionics for unmanned aerial vehicles and airborne inertial navigation systems), airborne data/video recording and management systems and tactical land-based radars for defense forces and for border protection systems. The company was founded on December 8, 1970 and is headquartered in Netanya, Israel.

RADA stock price is due to News?

Jul 06, 2022 (GLOBE NEWSWIRE via COMTEX) — RADA expects revenue of approximately $22.5 million for the second quarter of 2022;

In light of the Company’s pending merger with Leonardo DRS, RADA is withdrawing its full year 2022 revenue guidance

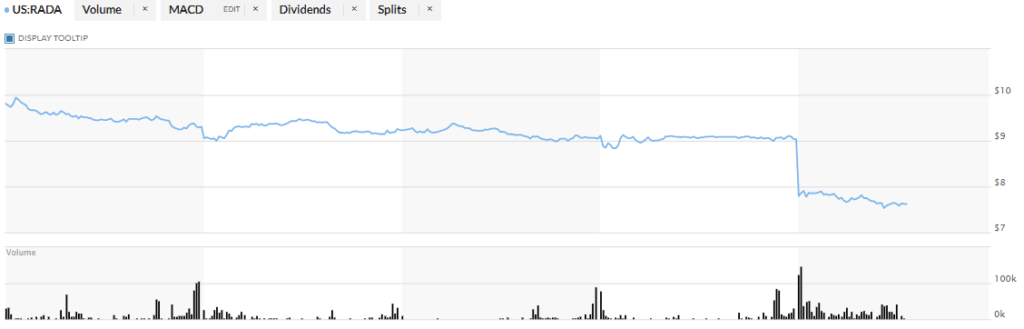

RADA 5 Day Chart

RADA Stock Price Technical Analysis:

The chart looks incredibly bad. I do not like the stock it is bearish and the 5 day chart looks like hot garbage.

Once again my name is Alex and I’m so glad you took the time to read this far. I would love to have you be apart of our growing family of traders.

I always like giving tid bits of knowledge that I have learned from my mentors, so here goes. As a reminder to all of the traders out there to leave your emotions at the door and never, ever, try to catch a falling safe. Simply let it crash to the ground and then, walk over and pick up the money. That is a reference to bounce plays LOL.

I strive to find breakout stock alerts and deliver them before the market finds out. I’m the original OG trend setter of trending stocks! If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below 👇

[thrive_leads id=’14274′]