Avalon GloboCare’s (Nasdaq: ALBT) Fusion Gene Map Technology Could Be The Greatest Investment?

Literally, this could be the best investment of the year.

Why, think about this!

Avalon is establishing a leading role in the fields of cellular immunotherapy, exosome technology (ACTEX™), and regenerative therapeutics.

Why is that a big deal?

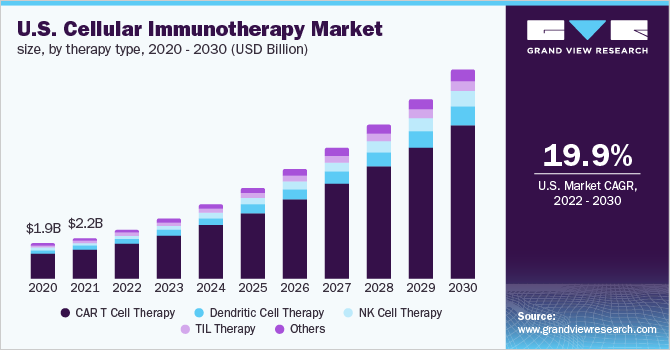

The global cellular immunotherapy size is expected to reach USD 37.97 billion by 2030!

It is estimated to register a CAGR of 22.41% during the forecast period.

This amazing growth is driven by the growing government support for innovative therapies research, rising prevalence of cancer & development of advanced cell-based immunotherapies.

Now before we get into the top 4 reasons we like ALBT, let’s do a quick summary on the company.

Avalon GloboCare Company Summary

Company Name: Avalon GloboCare Corp.

Ticker: ALBT

Exchange: NASDAQ

Website: www.avalon-globocare.com

Avalon GloboCare Company Summary:

Avalon GloboCare Corp. (NASDAQ: ALBT) is a clinical-stage biotechnology company dedicated to developing and delivering innovative, transformative cellular therapeutics, precision diagnostics, and clinical laboratory services.

Avalon also provides strategic advisory and outsourcing services to facilitate and enhance its clients’ growth and development, as well as competitiveness in healthcare and CellTech industry markets.

Through its subsidiary structure with unique integration of verticals from innovative R&D to automated bioproduction and accelerated clinical development, Avalon is establishing a leading role in the fields of cellular immunotherapy (including CAR-T/NK), exosome technology (ACTEX™), and regenerative therapeutics.

💥 RECESSION PROOF 💥

Historically, what is a great market segment to invest in during a recession, Medical!

In my opinion, The hottest vertical within The Medical market is biotech stocks.

They are safe and recession-proof.

After all, we can’t stop people from aging or from seeking treatments for a myriad of issues.

Plus, there’s growing demand for innovation in gene therapies, immune-oncology, precision medicine, machine-learning drug discovery, and treatments for unmet medical needs.

According to Grand View Research, the global biotech industry could be worth up to $2.44 trillion by 2028.

The global cellular immunotherapy market size is expected to reach

USD 37.97 billion by 2030!

It is estimated to register a CAGR of 22.41% during the forecast period.

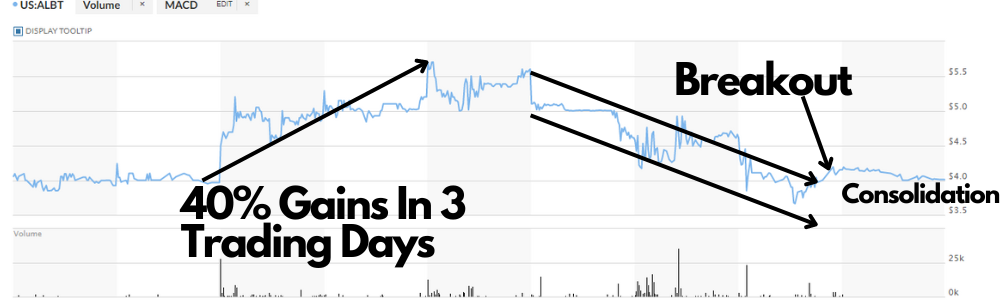

In THREE trading days this stock went up 40%!

Also, it created a base at $4 before it ran 40%!

GUESS WHAT?! It is at $4 again and appears to be ready to run!

Take a look at the buy ratings in #4 Section from Investing.com, Stock.ta and American Bulls!

3 TRUSTED sources saying, “BUY”

Now, let’s look mat what is driving these ratings and explosive gains, the amazing press released by ALBT below.

Jan. 03, 2023

Announced that it has deployed a breakthrough fusion gene map technology to be used for the goal of developing companion diagnostic kits and devices to enhance personalized clinical management of leukemia patients.

In collaboration with the Lu Daopei Institute of Hematology, a fusion gene map database from over 1,000 patients with leukemia was established and the results were previously published in the Blood Cancer Journal. Fusion genes are important genetic abnormalities in leukemia. Using advanced gene sequencing technology, called “Whole Transcriptome Sequencing” (WTS), multiple previously unknown fusion genes were identified which may potentially establish novel diagnostic and therapeutic targets.

Dec. 14, 2022

Announced that the Company completed a private placement of shares of its Series A preferred stock with the Company’s Chairman, Daniel Lu. The gross proceeds of the offering were $4.0 million, which is in addition to the previously announced private placement of $5 million of Series A preferred stock, all of which will be used to pay a portion of the purchase price for the announced acquisition of Laboratory Services MSO, LLC.

As previously announced, the Company’s Series A preferred stock is convertible into shares of the Company’s common stock at price per share equal to the greater of $1.00 or 90% of the closing price of the Company’s common stock on the Nasdaq Stock Market on the day prior to conversion. All holders of the Series A preferred stock will be restricted from selling the shares of common stock issuable upon conversion of the Series A preferred stock for a period of 9 months and will be limited to selling no more than 10% of their shares of common stock in any calendar month.

Sept. 29, 2022

The Company received a Notice of Allowance from the United States Patent and Trademark Office (USPTO) related to its QTY fusion water-soluble receptor protein platform. The patent was jointly filed with Dr. Shuguang Zhang of the Massachusetts Institute of Technology (MIT) and covers seven claims related to the technology.

ALBT has a 52-week high of $9.40, which is MORE THAN DOUBLE compared to current levels. In fact, it would be upside of 126% if the stock climbs back there.

ALBT even has a STRONG BUY Rating From Highly Respected Investing.com!

ALBT also has a BULLISH sentiment from StockTa.com right now which can be seen HERE.

Additionally, the stock has a STAY LONG rating at AmericanBulls.com which can be seen below:

Currently ALBT boasts a relatively small trading float for a NASDAQ stock at a little over $13M.

Wall Street is still uncovering this hidden gem and with a small number of shares available for trading, a sudden demand could create a major sudden upswing in price.

Now let’s review the 4 reasons we encourage you to turn your attention to ALBT.

As a quick reminder of the 4 REASONS why you should pull up ALBT right now:

- BioTech Market Is Recession Proof

- The Chart Looks Like an “Ideal Setup”

- The Press Releases are Simply Incredible

- Buy Rating Issued from Investing.com

Source 1: https://www.grandviewresearch.com/press-release/global-cellular-immunotherapy-market

Source 2: https://www.grandviewresearch.com/industry-analysis/cellular-immunotherapy-market-