Hotel Casino Management is Buying Eldorado Resorts Inc. (NASDAQ:ERI) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Eldorado Resorts Inc. (NASDAQ:ERI) reported that Hotel Casino Management, Inc. has picked up 5,118,461 of common stock as of 2017-03-17.

The acquisition brings the aggregate amount owned by Hotel Casino Management, Inc. to a total of 5,118,461 representing a 10.86% stake in the company.

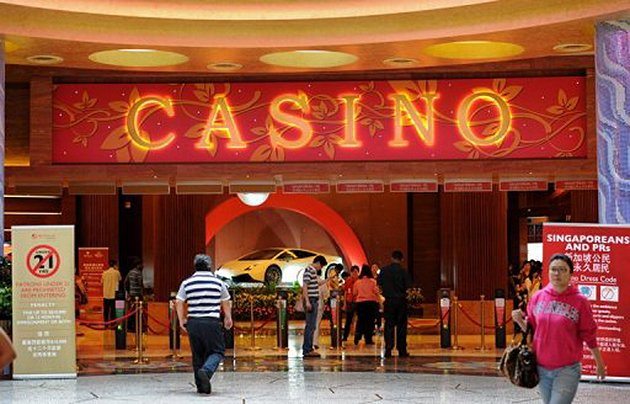

For those not familiar with the company, Eldorado Resorts, Inc. (ERI) is a gaming and hospitality company. The Company owns and operates gaming facilities located in Ohio, Louisiana, Nevada, Pennsylvania and West Virginia. The Company’s segments include Nevada, Louisiana and Eastern. The Company owns and operates various properties, such as Eldorado Resort Casino Reno, which is a 814-room hotel, casino and entertainment facility; Silver Legacy Resort Casino, which is a 1,711-room themed hotel and casino; Circus Circus Reno, which is a 1,571-room hotel-casino and entertainment complex; Eldorado Resort Casino Shreveport, which is a 403-room, all suite art deco-style hotel and tri-level riverboat dockside casino; Mountaineer Casino, Racetrack & Resort, which is a 354-room resort with a casino and live thoroughbred horse racing; Presque Isle Downs & Casino, which is a casino and live thoroughbred horse racing facility with slot machines, table games and poker located in Erie, Pennsylvania, and Eldorado Gaming Scioto Downs.

A glance at Eldorado Resorts Inc. (NASDAQ:ERI)’s key stats reveals a current market capitalization of 843.07 Million based on 47.12 Million shares outstanding and a price at last close of $19.00 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-14, Wagner picked up 1,744 at a purchase price of $18.70. This brings their total holding to 142,000 as of the date of the filing.

On the sell side, the most recent transaction saw Hotel unload 162,321 shares at a sale price of $13.49. This brings their total holding to 5,518,461.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Eldorado Resorts Inc. (NASDAQ:ERI) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Picked Up Scientific Games Corp. (NASDAQ:SGMS) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Scientific Games Corp. (NASDAQ:SGMS) reported that Sylebra Hk Co Ltd. has picked up 8,619,044 of common stock as of 2017-02-15.

The acquisition brings the aggregate amount owned by Sylebra Hk Co Ltd. to a total of 8,619,044 representing a 9.84% stake in the company.

For those not familiar with the company, Scientific Games Corporation is a developer of technology-based products and services, and associated content for the gaming, lottery and interactive gaming industries. The Company operates through three segments: Gaming, Lottery and Interactive. The Company’s portfolio includes gaming machines and game content, casino management systems, table game products and services, instant and draw-based lottery games, server-based gaming and lottery systems, sports betting technology, lottery content and services, loyalty and rewards programs, interactive gaming and social casino solutions. Its Gaming segment’s activities include supplying gaming machines, video lottery terminals (VLTs), conversion kits, automatic card shufflers. Its Lottery segment’s activities include designing, printing and selling instant lottery games. The Company’s Interactive business segment includes social (non-wagering) gaming and interactive real-money gaming (RMG).

A glance at Scientific Games Corp. (NASDAQ:SGMS)’s key stats reveals a current market capitalization of 1.76 billion based on 87.57 million shares outstanding and a price at last close of $20.15 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-11-24, Perelman picked up 10,000 at a purchase price of $8.55. This brings their total holding to 34,575,737 as of the date of the filing.

On the sell side, the most recent transaction saw Kennedy unload 113,470 shares at a sale price of $14.85. This brings their total holding to 95,004.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Scientific Games Corp. (NASDAQ:SGMS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.