Update: iSpecimen ISPC Bottom or Fake out?

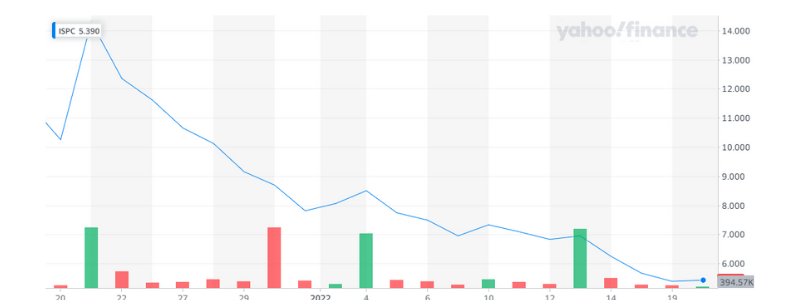

iSpecimen ISPC ran over 200% after our alert on November 22nd but as expected after an epic run like that, it will pull back. Since that 200% gain, ISPC has retraced to $5.39 just $.50 higher than what is was trading before the November explosion. It is official iSpecimen has fully retraced and could be ready for it’s next move up.

However, before you read this insightful information, sign up below, let’s stay in contact.

iSpecimen ISPC announced last week, “the expansion of its supplier capabilities with the addition of a reference lab in New York to support commercial and government customers focused on COVID-19 research, including analyzing the Omicron and Delta variants.” However, before we get started, let’s review some basic information on this company.

iSpecimen Company Summary

Company Name: iSpecimen

Ticker: ISPC

Exchange: NASDAQ

Website: https://www.ispecimen.com/

ISPC Company Summary

iSpecimen offers an online marketplace for human biospecimens, connecting life scientists in commercial and non-profit organizations with healthcare providers that have access to patients and specimens needed for medical discovery. Proprietary, cloud-based technology enables scientists to intuitively search for specimens and patients across a federated partner network of hospitals, labs, biobanks, blood centers, and other healthcare organizations.

LVGI News

Jan. 13, 2022

Announced the expansion of its supplier capabilities with the addition of a reference lab in New York to support commercial and government customers focused on COVID-19 research, including analyzing the Omicron and Delta variants.

The reference lab, a recent addition to the iSpecimen supplier network, has the capacity to sequence hundreds of COVID-19 positive swabs per week, providing data that is crucial in the fight against the virus. This lab is sequencing the most recent swabs to identify new variants of COVID-19 as the virus continues to progress globally.

ISPC 1 Month Chart

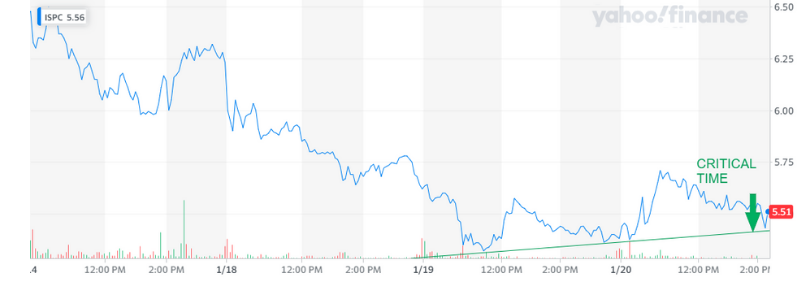

iSpecimen 5 Day Chart

ISPC Technical Analysis

ISPC needs to stay above $5.43 and new highs to be a bounce. If it doesn’t, it will be a head fake! It has consolidated and appears to be slightly bullish. This could be what we have been waiting for!

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Dais Corp DLYT up over 2,000%

Company Name: Dais Corporation

Ticker: (DLYT)

Exchange: OTC

Website: https://daisanalytic.com/

Company Summary:

Dais Corporation is a nanotechnology business producing a versatile platform of nanotechnology membrane materials (called Aqualyte™) addressing evolutionary and disruptive air, energy, and water applications. These proven products are characterized by offering Climate Change emission and energy reductions, longer lifetimes, and competitive pricing in the HVAC, Water, and Energy industries. Current commercial revenues come from selling:

- Advanced Aqualyte™ nanomaterials to a wide range of OEMs wishing to create new or highly differentiated products which embrace the moisture management features of the product.

- ConsERV™, a commercially available HVAC engineered energy recovery ventilation system that uses energy in exhaust air to precondition the temperature and moisture content of incoming fresh air. ConsERV™ typically saves energy, reduces CO2 emissions, and allows the overall HVAC system to be safely downsized. ConsERV™ introduces fresh ventilation air, resulting in higher productivity and sharper decision-making skills of building occupants, lowers triggers for allergies and asthma, and offers strong protection against key pathogens, including COVID-19 and most aggressive forms of bacteria.

Why is Dais on a rocket ship?

Nov. 29, 2021 Dais Corporation announced the Company has removed $2.12M of convertible, variable debt from its balance sheet.

3 Month Chart

5 Day Chart

Technical Analysis:

It is Bullish overall but this stock finished bearish and is up over 2,000%++. Be VERY careful and I wouldn’t look at this till it beats $6.20 or it will fall or best case consolidate.