Argo Living Soils Corp (ARLSF) Is Poised To Save The World?

Yes, we titled the name of this research report, “Argo Living Soils Is Poised To Save The World?” because… they might just do that! Our children’s future depends on our food supply and one of the major environmental challenges facing the world today is the degradation of our top soil. That is the upper layer […]

CYBIN (CYBN) ISSUED A BUY RATING WITH A 1,539% UPSIDE!

Good Morning Traders, Cybin CYBN issued blockbuster news this morning that the FDA has cleared their proprietary molecule for the phase 2a study. Take a look at the news below and get ready for a big day. Cybin Inc. (NYSE American: CYBN) today announced that the U.S. Food and Drug Administration (“FDA”) has cleared its […]

Coeptis Therapeutics Could Revolutionize The Treatment of Cancer

Small Cap Exclusive is proud to present our research report on Coeptis Therapeutics a NASDAQ biopharmaceutical company trading under the ticker (COEP) that is developing innovative treatments in the field of cancer. Take a look at this chart below! There is very little resistance in L2 with market makers and the slightest bit of volume […]

CRYO American CryoStem Corp Continues, but is it time to SELL?

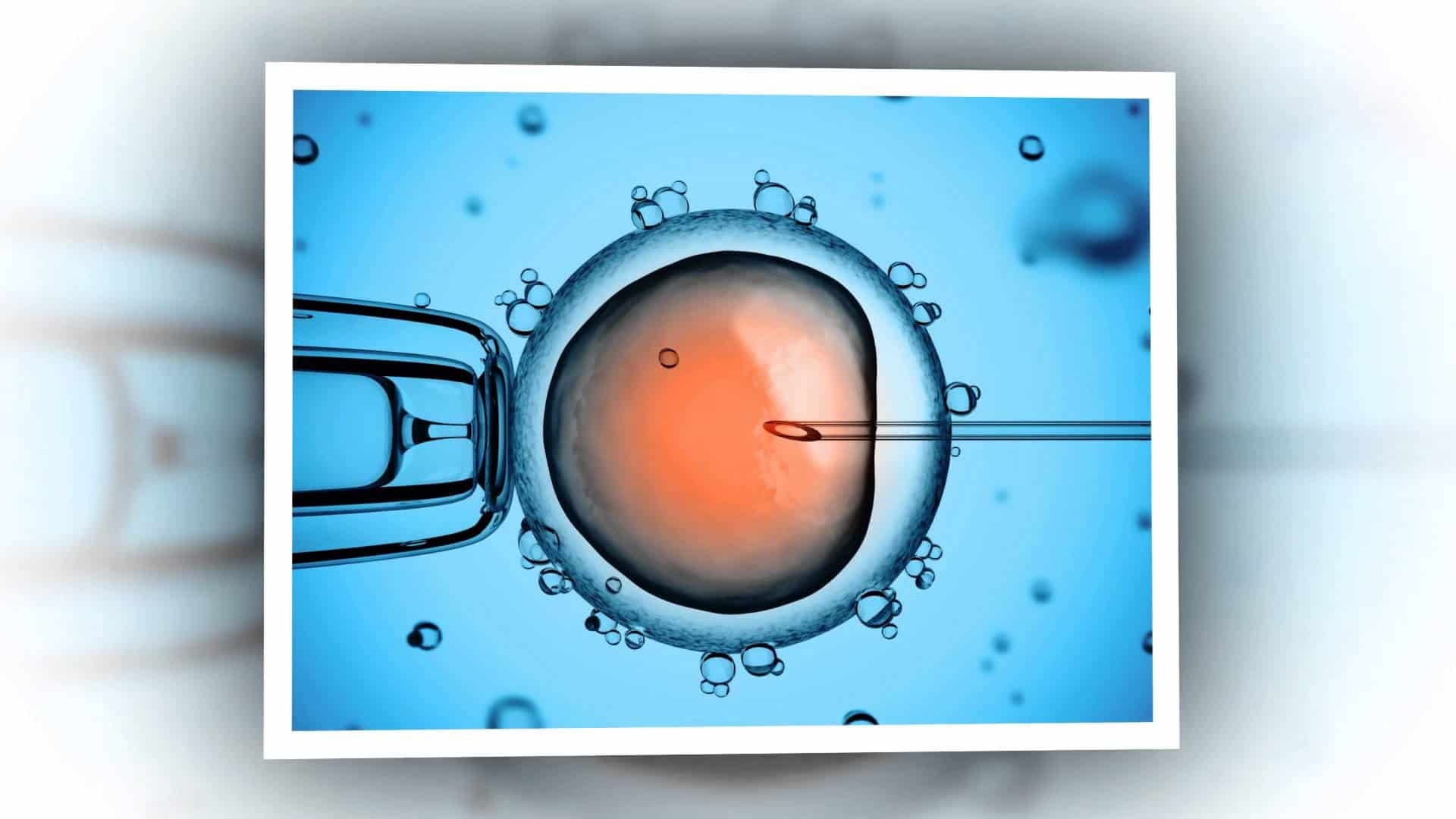

OTC:CRYO (American CryoStem Corporation), based in Eatontown, NJ, with partner laboratories in the U.S., Japan and China, is a firm engaged in developing, bringing to market, standardizing and licensing technologies, materials and services geared at adipose tissue (aka body fat) regenerative and personalized medicine. In this capacity, CRYO is focused on research, analysis, transfer, storage, sterilization, viability and other services in the over-arching adipose tissues field. They also claim to have a strategic portfolio of intellectual property (IP) which they say will support their pipeline of stem cell and applications and biologic products. CRYO was founded in 2008.

OTC:CRYO (American CryoStem Corporation), based in Eatontown, NJ, with partner laboratories in the U.S., Japan and China, is a firm engaged in developing, bringing to market, standardizing and licensing technologies, materials and services geared at adipose tissue (aka body fat) regenerative and personalized medicine. In this capacity, CRYO is focused on research, analysis, transfer, storage, sterilization, viability and other services in the over-arching adipose tissues field. They also claim to have a strategic portfolio of intellectual property (IP) which they say will support their pipeline of stem cell and applications and biologic products. CRYO was founded in 2008.

There’s been a spike in recent activity on CRYO and we’ll look at the short- and long-term implications as well as try to figure out what’s actually behind the sudden upward trendline.

In 2016 CRYO appointed a Nobel Prize nominee and stem cell expert Vincent C. Giampapa, M.D. to its medical and scientific advisory board. Mr. Giampapa was nominated for the prize for his stem cell work in epigenetics, or the study of human cell function with the goal of aging better. More recently CRYO filed for patent protection for its premier growth medium, ACSelerate MAX™, in Europe, China, Hong Kong, Japan, Mexico, Thailand, Israel, Russia, India, Australia/New Zealand, Brazil, Canada, and Saudi Arabia. This product is a growth medium for stem cells. They also announced the plan to continue to expand the licensing model that the developed for ACSelerateMAX™ and apply it to their entire family of 14 growth and differentiation mediums as well as its transportation and cryopreservation mediums many of which are patented and others in the patent process internationally.

So long story short, this company is in the business of stem cell treatments and therapies. What does that mean and how does it compare to their peers? Well, they just released their 2017 Q3 earnings report and from what we can see, most indicators fare pretty well for the future. In summary, revenues are up slightly, YOY revenue growth is about 173%, earnings are positive for the first time in several cycles as is net margin.

So long story short, this company is in the business of stem cell treatments and therapies. What does that mean and how does it compare to their peers? Well, they just released their 2017 Q3 earnings report and from what we can see, most indicators fare pretty well for the future. In summary, revenues are up slightly, YOY revenue growth is about 173%, earnings are positive for the first time in several cycles as is net margin.

Their peers include Brainstorm Cell Therapeutics, Inc. (BCLI), Verastem, Inc. (VSTM), Arrowhead Pharmaceuticals, Inc. (ARWR), Fate Therapeutics, Inc. (FATE) and Caladrius Biosciences, Inc. (CLBS) and all have reported for the same Q3 period. All told, CRYO appears to be in good shape compared to its peers (all information is available to the public) and is holding onto its market share. It doesn’t look like CRYO has sacrificed working capital for gross margins, which also improved, and indicates balance sheet solidity and good decision making by corporate governance.

So, where does it stand and where is it going? For much of the last year it has hovered between a low of $0.20 and $0.54 in June of 2017. At that point it began a takeoff and in August fluctuated between $0.53 and $0.75 before spiking to $1.10 twice in the past 2-week period through a 75% increase in trading volume. As of now, it rests at $1.00. We truly think that anything is possible with this one and most indicators are positive for the short and mid-term value of this stock. It appears to be slightly undervalued and the market has noticed. A year ago they retained an investor relations partner and that may be paying off in more than one ways.

Keep an eye on this one. Even though it’s near its all-time high, we think that bodes even better for the future.

(OTCMKTS:BTCS) BTCS Inc. & Blockchain

Introduction

BTCS Inc. ( BTCS ) is an early adopting online e-commerce marketplace where merchandise is available for direct retail purchase using digital cryptocurrencies, such as bitcoin, litecoin, and dogecoin. The company name is an acronym of sorts for Blockchain Technology Consumer Solutions. It originally incorporated in Nevada in 2008 as Hotel Management Systems, Inc. and entered into an Exchange Agreement with BitcoinShop.us, LLC in 2014 formally changing its name to BTCS Inc. in July 2015.

Various summaries of the company found online indicate that the company’s business includes:

- A cost-effective bitcoin mining services business, focuses on transaction verification

- A beta e-commerce marketplace for the aforementioned cryptocurrencies

- A bitcoin wallet based on a relatively well known technology and two-factor authentication for secure storage of bitcoin keys

According to various digital currency news sites and press releases dating back to 2014, BTCS claims to have invested in several technologies and firms including the GoCoin payment platform (which appears to be a solid player in the field), GEM (a Bitcoin API developer which is positioning itself as the go-to blockchain company in the healthcare and supply chain fields providing “bank grade” security) and what looks to have been an aborted attempt to merge with Spondoolies-Tech, Ltd. (a cryptocurrency mining equipment vendor) in 2015. Spondoolies shuttered operations in 2016 due to internal problems including inability to meet payroll.

For more info use link below :

https://www.otcmarkets.com/stock/BTCS/quote

Recent News and Trading:

Other recent occurrences include a default on a lease with CSC Leasing Company of numerous servers and power supplies resulting in the forfeiture of a $25,000 security deposit and, of course, the return of all of the equipment to CSC. At this point it is not clear whether this represents a drawback in BTCS’ ability to process e-commerce transactions or whether the capacity lost with the defaulted lease was made up for in other ways.

A visit to the website (shop.btcs.com) reveals a relatively random catalog of consumer items ostensibly available for purchase, but it appears that the bulk of products represented are merely placeholders, perhaps served up by external scrapers or scripts. In limited research, we were unable to find any items actually “in-stock” or “available” for purchase.

All time high was $1.37 per share in early February, 2014 with quite a fall off very shortly thereafter and a settling in at zero from June 1, 2016 to January of 2017, with a recent high of $0.18 in March, 2017. We’re seeing a lot of fluctuation within the $0.07 and $0.08 range over the past few days and since January of this year, daily volume has fluctuated from 120,000 all the way up to 30,000,000 and back down again, with volume for today at 3,389,582 at a closing price of $0.07. There was a 1/60 stock split in February of 2017.

| Market Cap | 3.06M |

| Beta | 2.88 |

| PE Ratio (TTM) | -0.01 |

| EPS (TTM) | -5.22 |

* Financial statements are incomplete and/or not up-to-date. We could not run down Income Statement, Balance Sheet or Cash Flows for 2017.

Conclusion:

Cryptocurrencies, including Bitcoin, are almost certainly here to stay. Even as the central banks may be attempting to subvert these alternative currencies, the technology behind the blockchain is solid and there is a wide community of developers and entrepreneurs pushing the boundaries and penetrating new sectors of the traditional online economy. There will likely continue to be hacks and breaches such as the $460M disaster that struck Mt. Gox in 2014, partially leading to a temporary decline in Bitcoin’s value, but the technology is simply too firmly entrenched and it stands to reason that security will improve. BTCS was a relative “mover and shaker” in the bitcoin/cryptocurrency world just three short years ago, but with a dearth of recent information to go on, the fact that their flagship website does not appear to be functioning yet (granted, it bears the “beta” designator) and the fact that filings are not up to date or complete may indicate this is one to view with careful scrutiny.

Why CytRx Corporation (NASDAQ:CYTR) Stock Could Keep Dropping

CytRx Corporation (NASDAQ:CYTR) shares were down 15.02% on Thursday to $0.685 and an additional 7.65% in after-hours trading to $0.632. The company has a market cap of $75.70 million at 117.32 million shares outstanding. Share prices have been trading in a 52-week range of $0.36 to $3.46.

CytRx Corporation is a biopharmaceutical research and development company specializing in oncology. It is focused on the clinical development of aldoxorubicin, its modified version of the chemotherapeutic agent, doxorubicin. It is engaged in Phase III trials for aldoxorubicin as a therapy for patients with soft tissue sarcoma (STS) whose tumors have progressed after treatment with chemotherapy.

The company is also involved in evaluating aldoxorubicin in a Phase IIb clinical trial in small cell lung cancer; a Phase II clinical trial in human immunodeficiency virus-related Kaposi’s sarcoma; a Phase II clinical trial in patients with late-stage glioblastoma (brain cancer); a Phase Ib trial in combination with ifosfamide in patients with STS, and a Phase Ib trial in combination with gemcitabine in subjects with metastatic solid tumors. It is engaged in the pre-clinical development for DK049, an anti-cancer drug conjugate that utilizes its Linker Activated Drug Release (LADR) technology.

Earlier this month, CytRx Corporation announced that an abstract describing results from its global Phase 3 clinical trial evaluating aldoxorubicin versus investigators’ choice in patients with relapsed and refractory soft tissue sarcomashas been selected for an oral presentation at the 2017 American Society of Clinical Oncology in June.

We look forward to presenting the more detailed and updated global Phase 3 results to the medical community at ASCO this year,” said Daniel Levitt, M.D., Ph.D., Chief Operating Officer and Chief Medical Officer of CytRx Corporation. “The Phase 3 trial and the combination trial of aldoxorubicin with ifosfamide continue to build on our prior studies showing the utility of aldoxorubicin as a treatment for patients with STS. These trials, together with our other clinical and pre-clinical studies of aldoxorubicin, will support our planned New Drug Application submission.”

However, the gains were quickly faded when CytRx Corporation recently announced a proposed public offering of its common stock that is subject to market conditions. The company plans to use the proceeds for working capital and general corporate purposes, including clinical and regulatory activities, new drug discovery activities, and possible future strategic transactions.

Also, there an be no assurance as to whether or when the offering may be consummated, or as to the actual size or terms of the offering. H.C. Wainwright & Co. is acting as exclusive placement agent for the offering.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Why NanoViricides Inc (NYSEMKT:NNVC) Shares Could Recover Soon

NanoViricides Inc (NYSEMKT:NNVC) shares dipped 2.61% on Wednesday to $1.12 and were unchanged in after-hours trading. Share prices have been trading in a 52-week range of $1.03 to $2.18. The company has a market cap of $72.89 million at 62.82 million shares outstanding.

NanoViricides Inc is a nano-biopharmaceutical company with several drugs in various stages of development. The company focuses on its research and clinical programs on specific anti-viral therapeutics. It is engaged in the application of nanomedicine technologies to the issues of viral diseases.

Its nanoviricide technology enables direct attacks at multiple points on a virus particle. In addition, the nanoviricide technology also simultaneously enables attacking the intracellular reproduction of the virus by incorporating one or more active pharmaceutical ingredients within the core of the nanoviricide. The nanoviricide technology is engaged in both attacking extracellular virus thereby breaking the reinfection cycle, and simultaneously disrupting intracellular production of the virus, thereby enabling complete control of a virus infection.

In a press release, NanoViricides Inc shared that Eugene Seymour, MD, MPH, CEO, will present information about the company and its progress towards human trials at the Planet Microcap conference at the Planet Hollywood Hotel later today. This Planet MicroCap Showcase brings together the most promising companies and the top dealmakers in MicroCap Finance for three days of company presentations, one-on-one meetings, and networking.

The company has previously reported that its broad spectrum anti-herpesvirus drug candidates were highly effective in treating HSV-1 infection in a lethal animal model. It has since improved on its Herpecide technology, which ncludes development of skin cream/lotion for the treatment of herpes labialis typically caused by HSV-1, genital lesions typically caused by HSV-2, shingles caused by reactivation of the human herpesvirus-3 and eye drops or gel for the treatment of herpes keratitis of the external eye.

In particular, NanoViricides Inc believes that its drug candidate for the topical treatment of shingles would have the fastest drug development path towards human clinical trials. It has also been working on scaling up production of this drug candidate with the goal of developing 500g to 1kg per batch production capability.

Apart from this, the company has eight different drugs in development, including four indications in the HerpeCide program. It is one of a few bio-pharma companies that has all the capabilities needed from research and development to marketable drug manufacture in the small quantities needed for human clinical trials. All the biological testing and characterization of these drug candidates continues to be performed by external academic or institutional collaborators and contract research organizations.

DISCLAIMER: There is a substantial risk of loss with any speculative asset, especially small cap stocks. The opinions expressed are those of the author, and do not constitute recommendations to buy or sell a stock. Do your own research before committing capital.

Guess Who Picked Audentes Therapeutics Inc. (NASDAQ:BOLD) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Audentes Therapeutics Inc. (NASDAQ:BOLD) reported that Flynn James E has picked up 1,214,423 of common stock as of 2017-04-26.

The acquisition brings the aggregate amount owned by Flynn James E to a total of 1,214,423 representing less than 4.38% stake in the company.

For those not familiar with the company, Audentes Therapeutics, Inc. is an early-stage biotechnology company. The Company is focused on developing and commercializing gene therapy products for patients suffering from serious, life-threatening rare diseases caused by single gene defects. The Company has a portfolio of product candidates, including AT132 for the treatment of X-Linked Myotubular Myopathy (XLMTM); AT342 for the treatment of Crigler-Najjar Syndrome (Crigler-Najjar); AT982 for the treatment of Pompe disease, and AT307 for the treatment of the CASQ2 subtype of Catecholaminergic Polymorphic Ventricular Tachycardia (CASQ2-CPVT). The Company’s subsidiary is Audentes Therapeutics UK Ltd. As of September 30, 2016, the Company had not generated any revenues.

A glance at Audentes Therapeutics Inc. (NASDAQ:BOLD)’s key stats reveals a current market capitalization of 409.36 Million based on 26.93 Million shares outstanding and a price at last close of $14.98 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-07-25, Woiwode picked up 219 at a purchase price of $15.00. This brings their total holding to 11,308 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Audentes Therapeutics Inc. (NASDAQ:BOLD) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.