AWSI Stock Price is up 135%, can it go higher? URGENT Report

Aria Wireless Systems AWSI stock price is up 135% in the last 5 days, but is the run over for this breakout stock? There is an old adage, “two heads are better than one”, so let’s put both our heads together and compare notes on AWSI.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for AWSI, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for AWSI is, a 🔥🔥 2 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Aria Wireless Systems Company Information

Company Name: Aria Wireless Systems Inc.

Ticker: AWSI

Exchange: OTC

Website: https://finance.yahoo.com/quote/awsi/?fr=sycsrp_catchall

AWSI stock price is due to News?

I don’t see anything which is strange so I presume there is a campaign going on. Tread carefully!

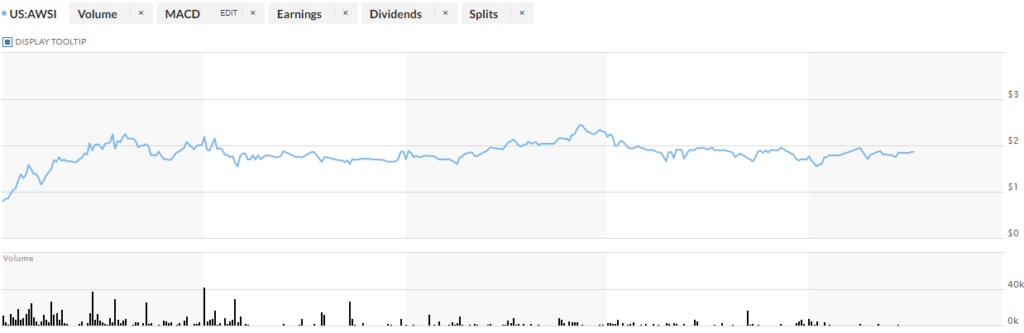

Trending Stock AWSI 5 Day Chart

AWSI Stock Price HOT Stock Grade:

The official heat level for AWSI is, a 🔥🔥 2 out of 4 . Here are my takeaways on it and why it is just a 2 out of 4. Do you agree?

AWSI Trading Volume

The volume, is trading at an increase of 67% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

CA:XBC Technicals

The technical analysis “chart reading”, it is consolidating after a great run! It was up over 100% after a great run. It looks very stable right now on limited volume.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

AWSI News Cycle

The news, there is no significant news

AWSI Fundamentals

The fundamentals, there is no financial filings associated with this stock on Marketwatch.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

AWSI Awareness

Marketing efforts “Awareness Campaigns”, I have found marketing efforts around the investor awareness of this company. Hence the 2 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]