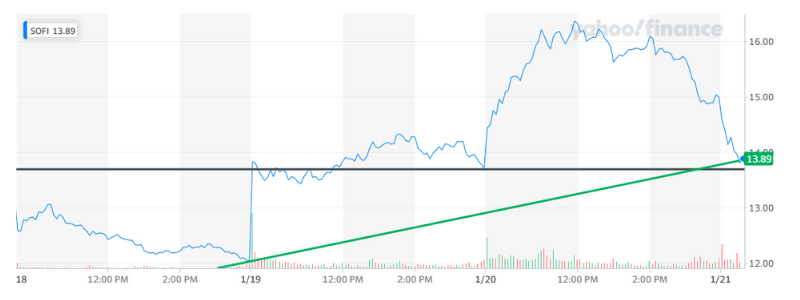

Sofi Technologies SOFI is up 41% after due to a massive amount of volume being injected into this little well known stock that has been crashing for the last 6 months. I have written a full report on SOFI that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Sofi Technologies SOFI Company Summary

Company Name: Sofi Technologies, Inc.

Ticker: SOFI

Exchange: NASDAQ

Website: https://www.sofi.com/

Sofi Technologies, Inc. Product Summary

SoFi helps people achieve financial independence to realize their ambitions. Our products for borrowing, saving, spending, investing and protecting give our nearly three million members fast access to tools to get their money right.

SoFi membership comes with the key essentials for getting ahead, including career advisors and connection to a thriving community of like-minded, ambitious people. SoFi is also the naming rights partner of SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles Rams.

SOFI News

December 15, 2021

Announced the completion of the redemption of the outstanding warrants (the “Public Warrants”) to purchase shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), that were issued under the Warrant Agreement, dated October 8, 2020, by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent, (the “Warrant Agreement”), as part of the units sold in the Company’s initial public offering (the “IPO”) and that remained outstanding at 5:00 p.m. New York City time on December 6, 2021 (the “Redemption Date”) for a redemption price of $0.10 per Public Warrant.

In addition, the Company announced the completion of the redemption of the outstanding warrants to purchase Common Stock that were issued under the Warrant Agreement in a private placement simultaneously with the IPO (the “Private Warrants” and, together with the Public Warrants, the “Warrants”) on the same terms as the outstanding Public Warrants.

Sofi Technologies 5 Day Chart

SOFI Technical Analysis

As we speak this stock is in a critical place, if it falls below $13.70 I would expect it to retrace and test the 1/18/22 low of $12.04. It’s pretty simple, if it can consolidate here it has a chance to run and more importantly retain it’s much needed gains from the last few days.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!