SIGA Technologies SIGA stock price is up 53% in the last 3 months & volume is up 4%, but is it over for this breakout stock?

There is an old adage, “two heads are better than one”, so let’s collaborate on ECTM and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for SIGA, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for SIGA is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

SIGA Technologies Company Information

Company Name: SIGA Technologies Inc.

Ticker: SIGA

Exchange: NASDAQ

Website: https://www.siga.com/

SIGA Technologies Company Summary:

SIGA Technologies, Inc. is a commercial-stage pharmaceutical company, which engages in the development and commercialization of solutions for serious unmet medical needs and biothreats. The firm develops therapeutic solutions for lethal pathogens including smallpox, Ebola, dengue, Lassa fever, and other dangerous viruses. It offers an orally administered antiviral drug that targets orthopoxviruses under the TPOXX brand. The company was founded by Steven Oliveira on December 28, 1995 and is headquartered in New York, NY.

SIGA stock price is due to News?

June 23

announced approximately $13 million of procurement orders for oral TPOXX (tecovirimat), including $11 million for initial procurement from two new international jurisdictions and an approximate $2 million order from a country in the Asia Pacific region that has an established contract for oral TPOXX (tecovirimat).

May 25, 2022 (AB Digital via COMTEX) — The global biotechnology market is expected to grow at a compound annual growth rate of 15.83% from 2021 to 2028 to reach USD$2.4 trillion by 2028 according to Grand View Research. The industry is on the upswing and several stocks in the sector require your immediate attention.

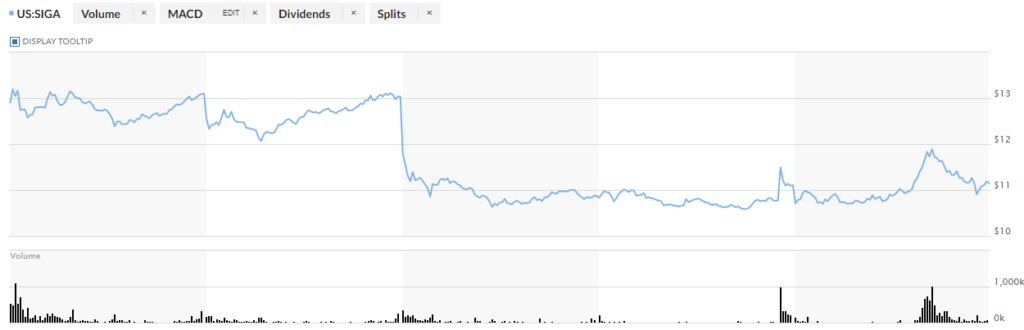

Trending Stock SIGA 5 Day Chart

SIGA Stock Price HOT Stock Grade:

The official heat level for SIGA is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

SIGA Trading Volume

The volume, is trading at an increase of 230% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

SIGA Technicals

The technical analysis “chart reading”, it is bullish and has been that way since the early part of this month with a steady ascending channel until it went up over 53% and pulled back.

Is this a breakout from the pullback pattern? It appears so, but I would wait till the rush is over this morning before considering a position.

More than likely it will pullback after this pre-market rush.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

SIGA News Cycle

The news, there is significant news: “$13 million of procurement orders for oral TPOXX”

SIGA Fundamentals

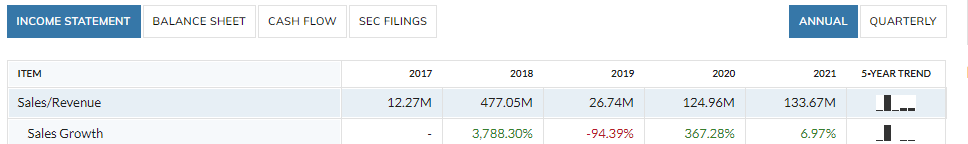

The fundamentals, there is exciting financial filings associated with this stock, “374% growth combined over last two years”!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

SIGA Awareness

Marketing efforts “Awareness Campaigns”, I have not found marketing efforts around the investor awareness of this company. Hence the 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]