We’re heading into what could be a second golden age of technology, as the quantum becomes reality. Whereas the semiconductor behemoths ruled the 80s and 90s, a number of funds are looking for a bit of diversification in the space. Kemet offers said diversification. Here’s a look at the company’s latest institutional buyer, and what it means for the company

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Kemet Corp (NYSE:KEM) reported that Marda Rama S. has picked up 335 of common stock as of 2017-01-20.

The acquisition brings the aggregate amount owned by Marda Rama S. to a total of 335 representing a 7.26% stake in the company.

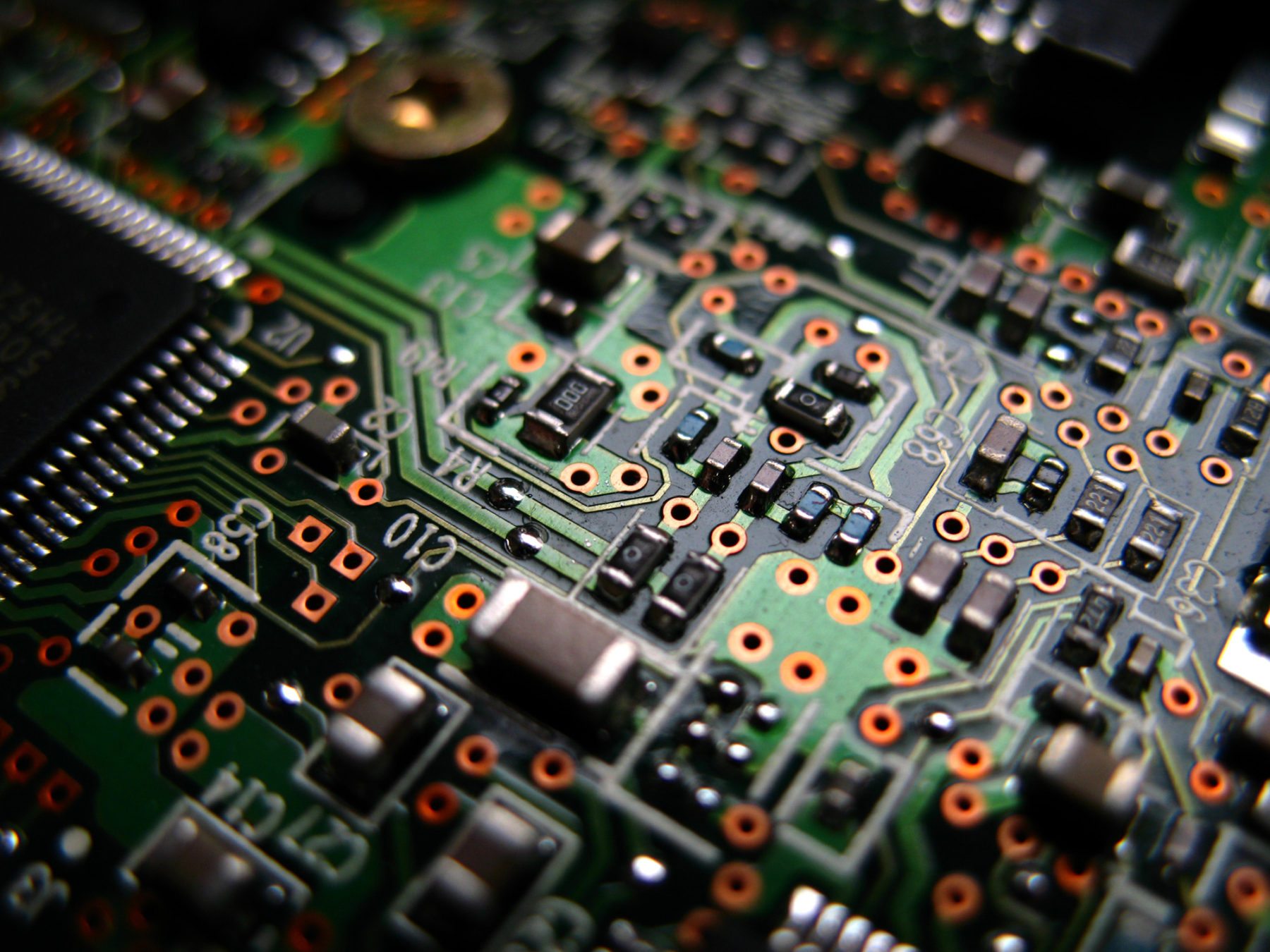

For those not familiar with the company, KEMET Corporation (KEMET) is a manufacturer of passive electronic components. The Company operates in two segments: Solid Capacitors, and Film and Electrolytic. The Solid Capacitors segment primarily produces tantalum, aluminum, polymer and ceramic capacitors. Solid Capacitors also produces tantalum powder used in the production of tantalum capacitors. The Film and Electrolytic Business Group produces film, paper and wet aluminum electrolytic capacitors. It also designs and produces EMI Filters. The Company’s product offerings include surface mount, which are attached directly to the circuit board; leaded capacitors, which are attached to the circuit board using lead wires, and chassis-mount and other pin-through-hole board-mount capacitors, which utilize attachment methods, such as screw terminal and snap-in.

A glance at Kemet Corp. (NYSE:KEM)’s key stats reveals a current market capitalization of 325.84 million based on 46.28 million shares outstanding and a price at last close of $7.07 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-02-01, Lowe picked up 10,000 at a purchase price of $1.51. This brings their total holding to 525,264 as of the date of the filing.

On the sell side, the most recent transaction saw Mcadams unload 1,446 shares at a sale price of $8.82. This brings their total holding to 24,957.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Kemet Corp. (NYSE:KEM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.