On Monday September 12th Ilustrato Pictures ILUS Stock Price went Up BIG and in this article I am going to explain why!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Ilustrato Pictures Company Information

Company Name: Ilustrato Pictures International INc.

Ticker: ILUS

Exchange: OTC

Website: https://ilus-group.com/

Ilustrato Pictures Company Summary:

Ilustrato Pictures International, Inc. is an investment company, which focuses on acquiring businesses in the technology, engineering & manufacturing sector. The company was founded on April 27, 2010 and is headquartered in New York, NY.

ILUS stock price is due to News?

Sept. 15, 2022

With signed Letters of Intent to acquire two wildfire equipment manufacturers, and in line with upcoming subsidiary up list plans, the company is gearing up extensive manufacturing facilities for wildland firefighting equipment and specialist vehicles in Serbia.

In 2022, extreme wildfires have swept across huge swathes of land all over the world, destroying homes and threatening livelihoods. The frequency and severity of wildfires has increased and with globally increasing temperatures and an increased onslaught of droughts; the momentum is showing no signs of slowing. Some reports show that annually, wildfires cause as many as 400,000 global deaths, millions of injuries and billions in property and business costs. It is estimated that the cost of damage from wildfires is as much as 1-2% of GDP in some high-income countries.

ILUS’ emergency response subsidiary, Emergency Response Technologies (ERT), is rolling out acquisition and manufacturing plans which will soon make it the leading global wildland firefighting technology manufacturer and solution provider. As part of several acquisitions which are underway for the subsidiary, the company is in the process of completing the acquisition of two companies which specialize in the manufacture of wildland firefighting equipment. Both companies are already prominent wildfire equipment manufacturers and together, they hold the most extensive global distribution network.

Sept. 09, 2022

Given the substantial progress that has been made by the company in the third quarter, it recently confirmed that it will be making important announcements on the following milestones during the month of September 2022:

- Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”)

- Investment Bank which the company is working with to complete its first planned subsidiary up list to a major stock exchange

- Announcement regarding planned Share lock-up and Share buy-back

- First site which the company is acquiring in Serbia and details on the Investment Project and its incentives

- $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND)

- Further acquisitions which are in their final stages

In order to become fully reporting, change its name, and up list to the OTCQB, ILUS underwent the audit of its 2020 and 2021 financials, the completion of which was announced on the 30th of August 2022. ILUS is now in the final stages of preparing its Form 10-12G Registration Statement, which it expects to file during September 2022.

ILUS has been in talks with a major investment bank regarding the planned up-list of a subsidiary to a major stock exchange. During this month, the company will make an announcement confirming the investment bank and its associated plans. Linked to the investment bank confirmation, ILUS will make an announcement regarding its planned Share lock-up and Share buy-back.

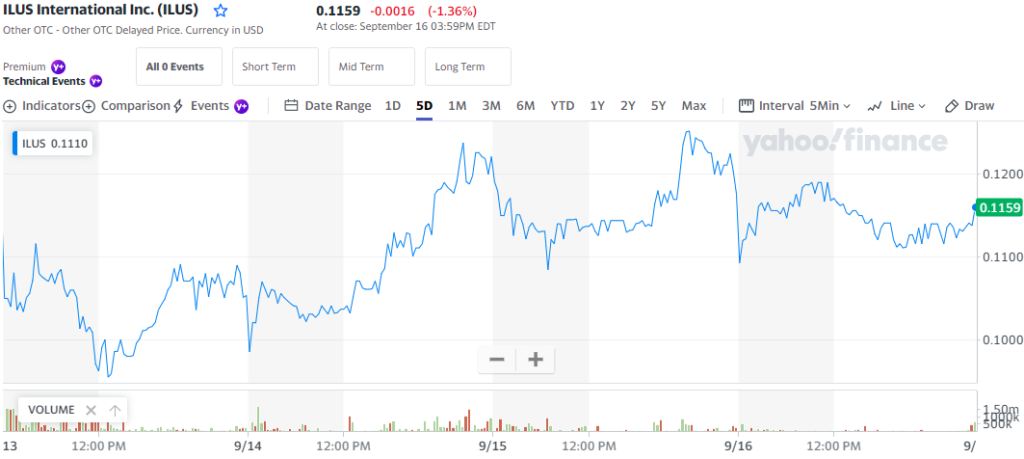

ILUS 5 Day Chart

6 Reasons Why ILUS Stock Price skyrocketed Monday, here is why!

- The Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”) is a huge announcement and a key contributor to Mondays explosion and subsequent rally.

2. The up list to a major stock exchange is exciting and noteworthy.

3. Announcement regarding planned Share lock-up and Share buy-back is another planned objective which historically reaps PPS increases.

4. First site which the company is acquiring in Serbia and details on the Investment Project and its incentives is driving demand for the stock.

5. $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND) never hurts!

6. Moreover, ILUS has further acquisitions which are in their final stages

[thrive_leads id=’14274′]