In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Metlife Inc. (NYSE:MET) reported that Board Of Directors Of Metlife Inc. has picked up 162,077,300 of common stock as of 2017-03-01.

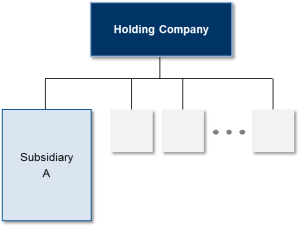

The acquisition brings the aggregate amount owned by Board Of Directors Of Metlife Inc to a total of 162,077,300 representing a 14.9% stake in the company.

For those not familiar with the company, MetLife, Inc. (MetLife) is a provider of life insurance, annuities, employee benefits and asset management. The Company’s segments include Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit Funding; Latin America (collectively, the Americas); Asia, and Europe, the Middle East and Africa (EMEA). Its Retail segment is organized into two businesses: Life & Other, and Annuities. Its Group, Voluntary & Worksite Benefits insurance products and services include life, dental, group short- and long-term disability, property and casualty, long-term care, accidental death and dismemberment, critical illness, vision, and accident and health coverages, as well as prepaid legal plans. Its Corporate Benefit Funding segment provides funding and financing solutions that help institutional customers manage liabilities primarily associated with their qualified, nonqualified and welfare employee benefit programs using a spectrum of life and annuity-based insurance and investment products.

A glance at Metlife Inc. (NYSE:MET)’s key stats reveals a current market capitalization of 57.83 billion based on 1.10 Billion shares outstanding and a price at last close of $52.44 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-06-12, Sicchitano picked up 18 at a purchase price of $54.65. This brings their total holding to 36,430 as of the date of the filing.

On the sell side, the most recent transaction saw Morris unload 2,200 shares at a sale price of $54.51. This brings their total holding to 107,872.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Metlife Inc. (NYSE:MET) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.