In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Htg Molecular Diagnostics Inc (NASDAQ:HTGM) reported that Novo A/s has picked up 1,280,185 of common stock as of 2017-03-31.

The acquisition brings the aggregate amount owned by Novo A/s to a total of 1,280,185 representing a 15.9% stake in the company.

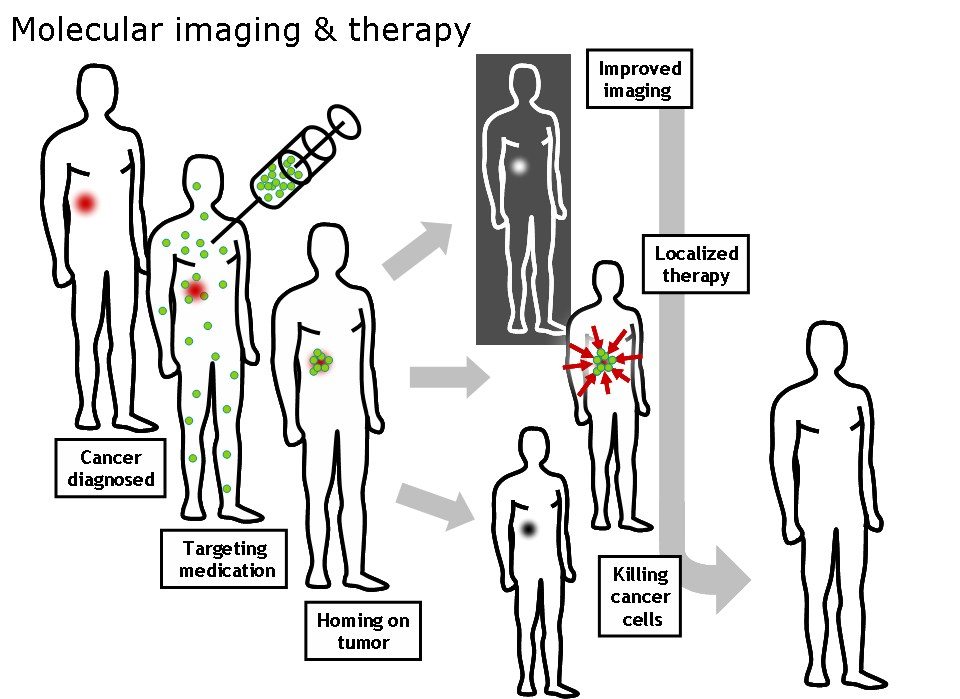

For those not familiar with the company, HTG Molecular Diagnostics, Inc. is a commercial-stage company that develops and markets a technology platform to facilitate the routine use of complex molecular profiling. The Company’s HTG Edge and HTG EdgeSeq platforms, consisting of instrumentation, consumables and software analytics, are used in sample profiling applications, including tumor profiling, molecular diagnostic testing and biomarker development. The Company’s HTG Edge and HTG EdgeSeq platforms automate the molecular profiling of genes and gene activity using its nuclease protection chemistry on a range of biological samples. The Company’s HTG EdgeSeq chemistry, together with its HTG Edge or HTG EdgeSeq instrumentation and software, automates and adapts its nuclease protection chemistry to enable analysis using next generation sequencing (NGS) instrumentation. The HTG EdgeSeq system utilizes substantially the same sample preparation reagents as its original chemistry, but allows for read out on an NGS instrument.

A glance at Htg Molecular Diagnostics Inc (NASDAQ:HTGM)’s key stats reveals a current market capitalization of 62.19 Million based on 8.05 Million shares outstanding and a price at last close of $6.92 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-08-24, Johnson picked up 1,000 at a purchase price of $5.34. This brings their total holding to 11,718 as of the date of the filing.

On the sell side, the most recent transaction saw Glaxosmithkline unload 300,000 shares at a sale price of $10.15. This brings their total holding to 792,781.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Htg Molecular Diagnostics Inc (NASDAQ:HTGM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.