Freeline Therapeutics Holdings plc (FRLN) is going down down down but is the there a reversal coming soon?

Freeline Therapeutics FRLN Company Summary

Company Name: Freeline Therapeutics Holdings plc

Ticker: FRLN

Exchange: NASDAQ

Website: https://www.freeline.life/

Freeline Therapeutics FRLN Company Summary

Freeline is a clinical-stage biotechnology company developing transformative adeno-associated virus (AAV) vector-mediated systemic gene therapies. The Company is dedicated to improving patient lives through innovative, one-time treatments that provide functional cures for inherited systemic debilitating diseases.

Freeline uses its proprietary, rationally designed AAV vector, along with novel promoters and transgenes, to deliver a functional copy of a therapeutic gene into human liver cells, thereby expressing a persistent functional level of the missing or dysfunctional protein into the patient’s bloodstream.

The Company’s integrated gene therapy platform includes in-house capabilities in research, clinical development, manufacturing, and commercialization. The Company has clinical programs in hemophilia B, Fabry disease, and Gaucher disease Type 1. Freeline is headquartered in the UK and has operations in Germany and the US.

Freeline Therapeutics FRLN News

Jan. 06, 2022

Announced that the U.S. Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application for FLT201 as an investigational gene therapy for the treatment of Gaucher disease Type 1.

“The FDA clearance of this IND is an important milestone for FLT201, which is the first AAV-mediated gene therapy for patients with Gaucher disease Type 1 in the clinic,” said Michael Parini, Chief Executive Officer of Freeline. “Our FLT201 program harnesses our unique scientific platform capabilities – our highly potent, proprietary AAVS3 capsid, robust CMC and pre-clinical data across all our programs, and our advanced protein engineering capabilities – to develop a potentially transformative treatment for patients suffering from Gaucher disease. The entry of our third program into the clinic is important validation of the advantage of Freeline’s portfolio approach to development.”

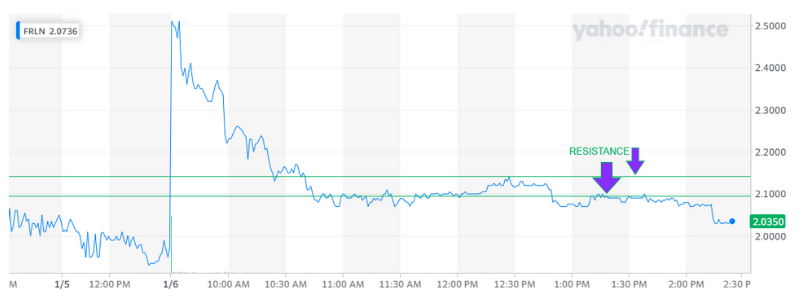

Freeline Therapeutics FRLN Stock Chart

FRLN Analysis

There is resistance at $2.10 and $2.15 and this stock will continue to go down unless it can correct and breakout of the two resistance points. The news is great, so I expect a consolidation soon and a correction. Make sure to keep this on your radar.