Fifth Third Bancorp FITB stock price is down -3% in the last 5 days & volume is up 81%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for FITB is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Fifth Third Bancorp Company Information

Company Name: Fifth Third Bancorp

Ticker: FITB

Exchange: NASDAQ

Website: https://www.53.com/content/fifth-third/en.html

Fifth Third Bancorp Company Summary:

Fifth Third Bancorp engages in the provision of banking & financial services, retail & commercial banking, consumer lending services, and investment advisory services through its subsidiary Fifth Third Bank. It operates through the following segments: Commercial Banking, Branch Banking, Consumer Lending and Wealth & Asset Management.

The Commercial Banking segment offers credit intermediation, cash management, and financial services to large and middle-market businesses. The Branch Banking segment provides deposit, loan, and lease products to individuals and small businesses.

The Consumer Lending segment includes residential mortgage, home equity, automobile, and indirect lending activities. The Wealth & Asset Management segment provides investment alternatives for individuals, companies, and not-for-profit organizations. The company was founded in 1975 and is headquartered in Cincinnati, OH.

Fifth Third Bancorp FITB stock price is due to News?

May 11, 2022 /3BL Media/ – Fifth Third Bancorp (NASDAQ: FITB) today announced it has closed on the acquisition of Dividend Finance, a leading fintech point-of-sale (POS) lender, providing financing solutions for residential renewable energy and sustainability-focused home improvement.

“The addition of Dividend Finance enhances the scale of our digital service capabilities through its tech-forward platform, provides customers and contractors with a best-in-class experience, and accelerates customer adoption of solar and sustainable home improvements, which are even more compelling given rising energy prices,” said Tim Spence, president of Fifth Third Bancorp. “We expect to grow the Dividend platform significantly and further our ESG leadership position.”

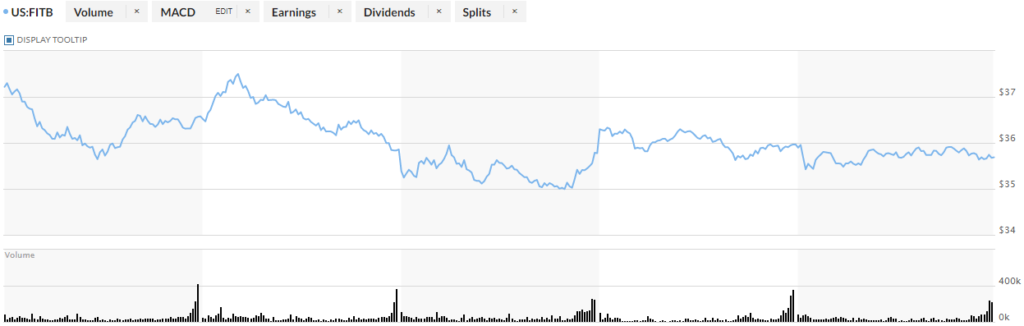

Trending Stock FITB 5 Day Chart

FITB Stock Price HOT Stock Grade:

FITB is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

FITB Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 946% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

FITB Technicals

The technical analysis “chart reading”, this stock is up 0% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down 10%. Not a lot of volatility with this stock. Overall it has just had a significant bearish move and I believe it will bounce soon.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

FITB News Cycle

The acquisition of Dividend Finance, should bode very well for FITB..

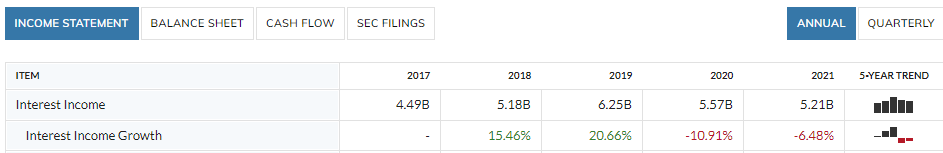

FITB Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there no exciting financial filings associated with this stock in fact there has been two years of nominally down revenue years.

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

FITB Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a prroduct is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]