Date: 2/13/2026 NTRP Breakout Alert...

Date: 2/13/2026 NTRP Breakout Alert...

Perpetuals.com Ltd. (NASDAQ: PDC) is...

Dates: 2/10/2026 Early Momentum...

Dates: 2/9/2026 Eva Live, Inc is...

Dates: 2/9/2026 RenX Enterprises Corp....

Dates: 2/3/2026 Thin Liquidity Keeps...

After combing the NASDAQ exchange for weeks, we think we found a true juggernaut in the Communication Equipment Industry. The kicker… As of April 20, 2023, it’s trading at around the low low price $3.20 per share. The Company is Amplitech Group Inc. (NASDAQ: AMPG) and we think you NEED to know about this one BEFORE it becomes a household name.

Alright, without further adieu, let’s get started.

AmpliTech designs, develops, and manufactures custom and standard state‐of‐the‐art RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover the frequency range from 50 kHz to 40 GHz Eventually, offering designs up to 100 GHz. AmpliTech also provides consulting services to help with any microwave components or systems design problems.Our growth has come about because we can provide complex, custom solutions. Therefore, AmpliTech is committed to providing immediate responses to any custom requirements that are presented to us. AmpliTech, Inc. has developed and supplied LNAs to Fortune 500 companies, the Military and Government Agencies such as:

Think this sounds like any one of the other hundreds of small-cap companies trying to make a name for themselves without any financial backing, eh?… Well, think again because AMPG has a market cap of $30.72 million. The enterprise value is $21.76 million. In fact, in the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses. Meaning, Their FY 2022 results BEAT Revenue Guidance and Reports Record 267% YoY!

BUT THAT’S NOT ALL!

Continue reading to get our FULL BREAKDOWN of AMPG’s Highlights.

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

So, if a currently has a current ratio of 2, then it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. Well, Financial Position: AMPG has a current ratio of 12.08. Meaning, it can easily settle each dollar on loan or accounts payable 12 times over.

That said, a very high current ratio may indicate that a company has excess cash in hand. Well, after looking into it, AMPG does have cash in hand… A lot of cash in hand… $13.54 MILLION to be exact.

Saving the best for last, In the last 12 months, AMPG had revenue of $19.39 MILLION. Let’s take a closer look at how great a year it’s been for this company.

In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

March 31, 2023:

2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

Full Earnings Report: https://finance.yahoo.com/news/amplitech-reports-fy-2022-results-130000549.html

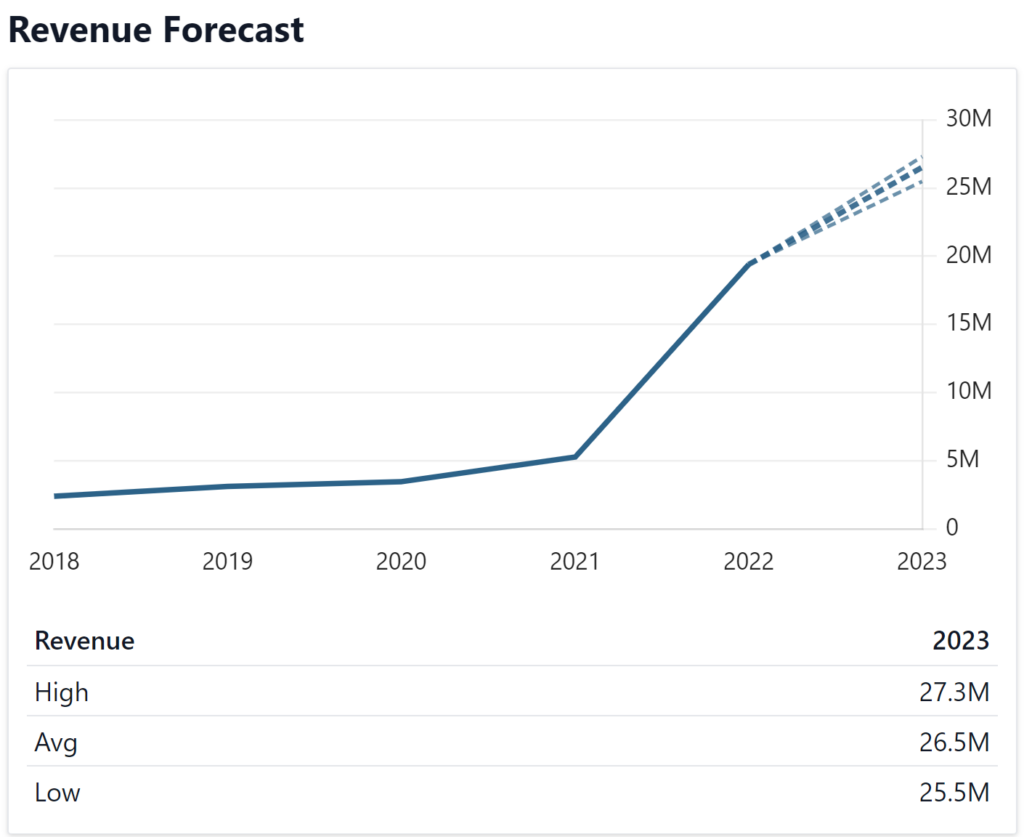

Now, I know what you’re thinking. The past is the past. What is AMPG going to do for me in the future?… Well, let’s see what the analyst’s forecast for the future of AMPG.

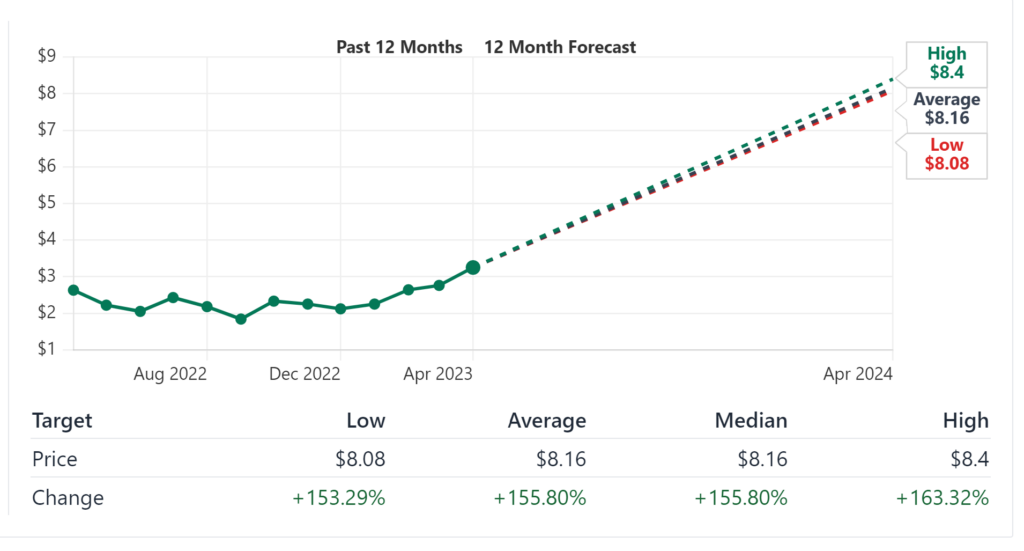

As if that’s not a good enough projection, according to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%. The lowest target is $8.08 and the highest is $8.4. On average, analysts rate AMPG stock as a buy. In fact, a couple of firms have already initiated coverage of AMPG with more expected to do so as this one continues to move higher.

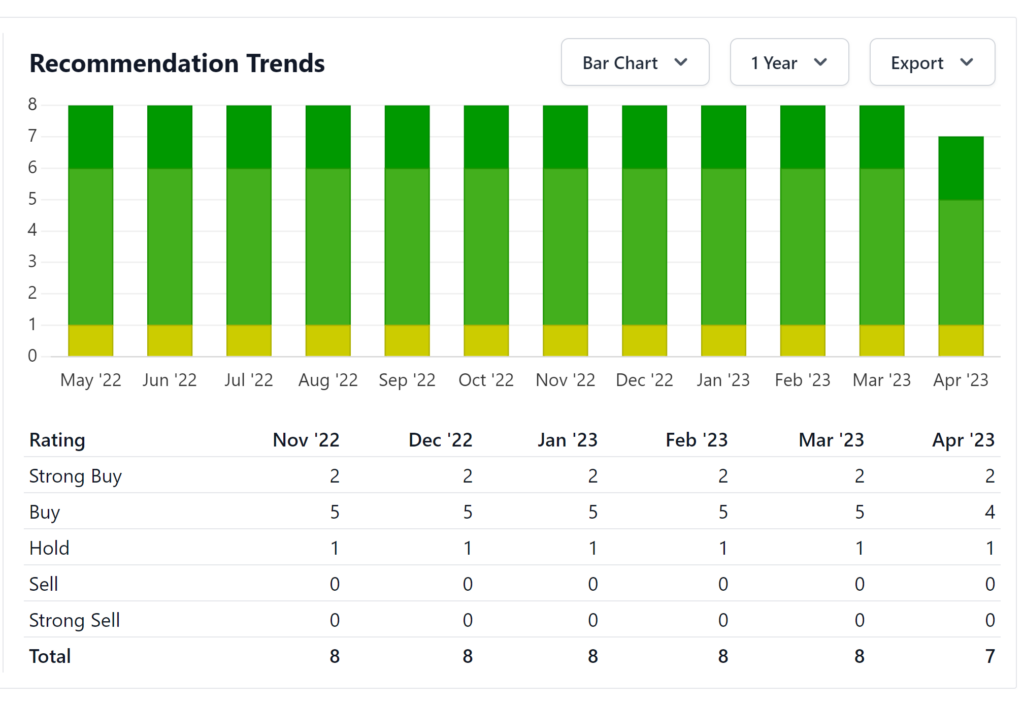

The consensus rating for AMPG from stock analysts is “Buy.” This means that analysts believe this stock is likely to outperform the market over the next twelve months.

The average analyst rating for AMPG stock from 7 stock analysts is “Buy”. This means that analysts believe this stock is likely to outperform the market over the next twelve months.

February 2, 2022

Analyst Firm: Small Cap Consumer Research

Rating: Buy

Target: $5.00

July 7, 2021

Analyst Firm: Maxim Group

Rating: Buy

Target: $10

If the forecasters think AMPG is worth adding to their watchlist then we should too, right? But, what about actually buying the stock for themselves? Let’s take a look…

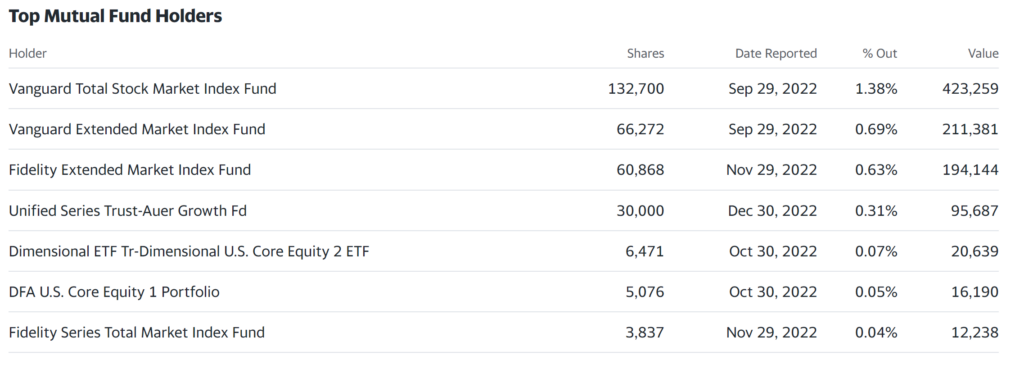

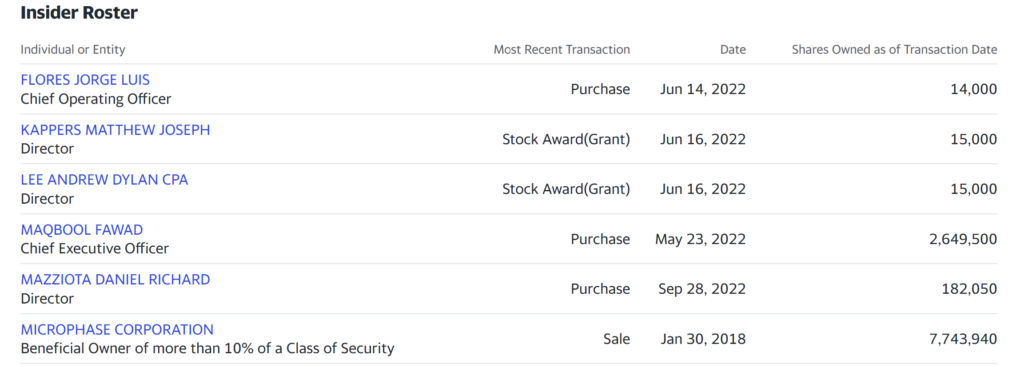

AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares with a meager short interest of less than 1% sold short. Of their shares, 32.99% are held by insiders, 8.68% is held by 16 different institutional investors, totalling to a little under 13% of the float.

AmpliTech Group’s Division, Spectrum Semiconductor Materials, Inks Distribution Deal with NGK Electronic Devices, a Leading Global Semiconductor Manufacturer

AmpliTech to Become NGK’s First US Distributor of Their RF Microwave Package Products

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG) a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, and a worldwide distributor of packages and lids for integrated circuit assembly, as well as a designer of complete 5G/6G systems, is proud to announce its partnership with NGK Electronic Devices, a powerhouse in the semiconductor packaging industry, to become their US distributor for NGK’s state-of-the-art RF Microwave products. This partnership marks NGK’s first distribution agreement with a US partner, presenting a significant opportunity for both parties.

Full Article: https://finance.yahoo.com/news/amplitech-group-division-spectrum-semiconductor-133000902.html

AmpliTech Records a New Benchmark at Satellite 2023 Show in Washington, D.C.

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, as well as a worldwide distributor of packages and lids for integrated circuit assembly, is excited to announce an unprecedented achievement at the Satellite 2023 show held in Washington, D.C. The company recorded more than 100 meetings with executives in the satellite communications (Satcom) space – a new record for the prestigious event. Among the attendees were multiple Fortune 100 companies, top-tier research institutions, and exciting startups driving the next generation of connectivity.

Full News Article: https://finance.yahoo.com/news/amplitech-records-benchmark-satellite-2023-130000747.html

AmpliTech Group, Inc. Discusses Significance of Its State-of-the-Art Radio Frequency Components with The Stock Day Podcast

AmpliTech Group, Inc. (NASDAQ: AMPG),a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor of packages and lids for integrated circuit assembly, is pleased to announce its participation in three upcoming shows, where it will exhibit its latest technological advancements at the Satellite Show in Washington DC, at Booth #2092. AmpliTech Group is also attending the Mobile World Congress (MWC) Show in Barcelona, and the American Physical Society (APS) show in Las Vegas, to participate with key players in the 5G and Quantum Computing industries.

Full News Article: https://finance.yahoo.com/news/amplitech-showcase-latest-product-wins-141500565.html

AmpliTech Recognized by Inc. Magazine as Top 10 Most Innovative Telecom Solution to Watch

AmpliTech Group, Inc. (Nasdaq: AMPG) announced that it was recognized by Inc. magazine in its list of “Top 10 Most Innovative Telecom Solution to Watch”

Founder and CEO Fawad Maqbool stated, “It was an honor to work with Inc. Magazine on this article to discuss Amplitech Group and how we currently offer a wide range of products for 5G, Telecom, quantum computing, airline Wi-Fi, and all things wireless, starting from connectorized modules, discrete transistors, MMICs, and packages, to multi-chip modules (MCMs) and systems using multiple disciplines and processes that we see a lack of in the market. All of these products directly enable technologies such as Virtual Reality (VR), Augmented reality (AR), Telemedicine, fully autonomous vehicles, Satellite-to-phone connectivity, the Internet of Things (IoT), Internet in the sky, and much more. AmpliTech is committed to connecting humans like never before in the 21st century.”

Full News Article: https://finance.yahoo.com/news/amplitech-recognized-inc-magazine-top-210000268.html

Developing the communication systems of tomorrow, today.

AmpliTech was founded to address the industry gap for high-performance, ultra-reliable, and extremely efficient radio frequency (RF) devices to power the communication ecosystem of tomorrow. We obsess over pushing boundaries of what can be done to increase connectivity in the sky, in space, and in your homes. The devices AmpliTech designs boast the lowest noise figures and power dissipation across all usage frequencies to offer customers in the military, Satcom, aviation, automotive, and computing industry unparalleled product specifications and user experience. As industry requirements for communication throughput, speed, and endurance grow exponentially, we strive to develop the technologies necessary to power the future of communication.

AmpliTech designs, develops, and manufactures custom leading-edge RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover frequencies from 50 kHz to 44 GHz. AmpliTech also has developed new products for the 5G/6G wireless ecosystem and infrastructure with unparalleled performance. In addition to this rapidly emerging market, AMPG has also developed solutions for Quantum Computing, with cutting edge technology. We continue to blaze trails in our commitment to enable and accelerate the arrival of true 5G/6G architecture and contribute to the U.S. being the leader and first to reach the coveted position of Quantum Supremacy. Our growth has come about because we provide complex, custom solutions that our competitors shy away from. We have consistently provided the industry-leading SATCOM Low Noise Amplifier Solutions for the past 18 years and our new website showcases these products below, with its advanced search engine and listing of stock items. This allows us to provide immediate response to custom requirements, unwavering technical support and timely delivery. We will be continuing our R&D efforts to always be at the forefront of emerging technologies and using our advanced techniques and IP to provide tomorrow’s technology today, and improve everyone’s quality of life. In addition, we have the best assemblers, wirers, and technicians in the industry and can provide contract assembly of customers’ own designs. AmpliTech is in the process of scaling up its proprietary technology and design its own MMICs, subsystems, and other products to address the rapidly emerging, large volume commercial applications in the communications technology space.

AmpliTech, Inc. has a rich history in the design of microwave amplifiers and components, including a wide variety of product lines, from LNA’s (Low Noise Amplifiers) and MPA’s (Medium Power Amplifiers), to broadband telecom amplifiers for the microwave and fiber optic communications firms.

As such. we are defined by our expertise in custom designed amplifiers with special requirements such as military screening and space qualification. To provide for customers dealing with extremely low noise figure applications, we have excelled in the ever-growing cryogenic market as well. In short, all our customers agree that we provide simply the best product and services available in the industry while maintaining lower prices than most of our competitors and we do so in the most emergent of technologies on the industry landscape today. Our success is marked not only by our technical achievements, but also by an extremely respectable customer base which includes giants in the industry such as Motorola, ITT, Harris, Northrop Grumman, Raytheon, L3 Communications, Aeroflex, NASA, NIST and TRW (to name a few). Due to the achievements of its talented staff, AmpliTech has also received numerous Supplier Quality awards, including a Best Technology Award from one of the industry’s leading trade magazines. AmpliTech now trades on the NASDAQ public stock exchange under the ticker symbol AMPG which will help take our products to a broader and more global customer base, bringing cutting-edge technology to the masses and improving everyday quality of life for us all. The following are some of the many advantages that set us apart from our competition:

AmpliTech, Inc. offers:

AmpliTech, Inc. provides tangible advantages

over our competitors because:

Mr. Maqbool has been in the microwave business for 30 years. He has a B.S.E.E. in microwave engineering and a B.S.E.E in Bio-Medical Engineering from CUNY and an M.S.E.E from Polytechnic University of New York. He founded AmpliTech in 2002 to fill the need for affordable, high quality, custom, state-of-the-art amplifiers and components. For almost 14 years as Department Head, he designed and developed state of the art amplifiers and components for MITEQ Inc., a leading supplier of microwave components and communications equipment. He then founded AmpliComm (acquired by Aeroflex, Inc. (ARXX) in 2000 to develop custom cryogenic and fiber optic amplifiers and components). Mr. Maqbool’s innovative management and design experience continues to push AmpliTech’s boundaries in microwave technology both in commercial and military markets. Mr. Maqbool has received various awards for innovative design and quality from suppliers such as Motorola, and publications such as Wireless Design and Technology magazine. AmpliTech continues to surpass it’s peers in performance, value, service, and innovation, and is poised to become the leading supplier of amplifiers and related components in the coming years.

Louisa Sanfratello, a CPA (Certified Public Accountant), has been a Certified Public Accountant working in numerous organizations in various industries since 1998. Her duties throughout this time and her time as an accountant for various charities and schools consisted of preparation of official financial documents as well as day-to-day financial management. Also tapped were her skills in the area of projection of cash flow and consequent requirements. Her professional career began in 1987 with the public accounting firm of Holtz, Rubinstein & CO., where she gathered two years of invaluable experience before earning her CPA and moving on to more challenging things.

Having joined AmpliTech at the end of March in 2021, Mr. Flores brings with him over 30 years of combined Operations and Program Management experience. Prior to joining Amplitech’s executive leadership team, Mr. Flores held various leadership roles at Comtech Telecommunications, a Nasdaq listed corporation with over 2K employees and revenues of over $600M. Previous management roles included Director of Program Management Office, Business Unit Manager and Supply Line Management. Mr. Flores holds an MBA with concentration in Operations Management and Leadership from Dowling NY and, a BS in Business Administration, Major in Operations Management from NYIT.

Mr. Pastore has been in the microwave industry for 40 years. He has a B.S. in Business Management and has worked for many of the leaders in the RF/Microwave industry. Mr. Pastore is a hands-on professional whose experience spans over 20 years of progressive roles through which he has gained a rare blend of technical, manufacturing, customer service, and management skills and capabilities. His business savvy and deep understanding of the industry make him an extremely valuable asset to the company and an integral part of the AmpliTech team.

Residential real estate transaction platform operator Opendoor Technologies Inc (NASDAQ:OPEN) is one of the more innovative companies at the moment and the OPEN stock has been in the middle of a strong ride in recent weeks. The stock has continued to climb in the past week during the course of which it went up by 38%.

That took the gains made in the past month to as much as 98% as the OPEN stock ended up hitting its highest level in many months.

Opendoor Technologies Inc

Company Name: Opendoor Technologies Inc

Ticker: OPEN

Exchange: NASDAQ

Website: https://www.opendoor.com

Opendoor Technologies Inc Summary:

Opendoor Technologies Inc. operates a digital platform for residential real estate in the United States. The company’s platform enables consumers to buy and sell a home online. It also provides title insurance and escrow services. Opendoor Technologies Inc. was incorporated in 2013 and is based in Tempe, Arizona.

Now, let’s review the latest news from the company:-

#1 Q4 Earnings On Radar – All eyes on OPEN stock

All eyes are now going to be on the company’s fourth-quarter financial results and it may be a good time to keep an eye on the Opendoor stock in the lead-up to the day.

On January 26 the company announced that it was going to announce its financial results for the fourth fiscal quarter that ended on December 31, 2022, on February 23, 2023. On top of that, the management would also host a conference call to discuss the financial results and other operations. The conference call would be available on a live webcast at 2 pm PT.

It would be keenly watched, how the OPEN stock would react after earnings.

#2 Opendoor Shuffles Leadership, Appoints New CEO

The performance in the third quarter of Opendoor may have triggered a change in the management as well and back on December 2, 2022, the company made such an announcement. It announced that it had appointed a new Chief Executive Officer in the form of Carrie Wheeler.

Wheeler had previously been the Chief Financial Officer at Opendoor. The shakeup at the top echelons in the management had initially led to a selloff in the stock. Wheeler was also made a member of the board of directors of the company with immediate effect.

#3 Why The OPEN stock Fell Last Year

Last year, the stock had gone through a tough time as the weakness in demand and plunging home prices took their toll. In the third quarter, the company’s performance had been disappointing and that resulted in a 20% drop in the stock price. That took the cumulative loss in a 12-month period to 88%.

Keep an eye on OPEN stock and it would be interesting to see if the stock reverses its losses from the last year.

At this point in time, investors are hotly on the trail of A2Z Smart Technologies Corp (NASDAQ:AZ) and that becomes apparent when one looks into the price action in the stock and is the notable stock to watch. Over the course of the past week alone, AZ stock has clocked gains of 43% and that took the gains over the past month to as much as 92%.

Why Such a Big Jump?

AZ stock has been witnessing continuous buying after announcing multiple news. Firstly, the stock reached a key partnership with Lenovo Group Limited. Secondly, the company announced a launch of a new Smart Cart model.

A2Z Smart Technologies Corp

Company Name: A2Z Smart Technologies Corp

Ticker: AZ

Exchange: NASDAQ

Website: https://a2zas.com/

A2Z Smart Technologies Corp Summary:

A2Z Smart Technologies Corp. creates innovative solutions for complex challenges. A2Z’s flagship product is an advanced proven-in-use mobile self-checkout shopping cart.

With its user-friendly smart algorithm, touch screen, and computer-vision system, Cust2Mate streamlines the retail shopping experience by scanning purchased products and enabling in-cart payment so that customers can simply “pick & go”, and bypass long cashier checkout lines. This results in a more efficient shopping experience for customers, less unused shelf-space and manpower requirements, and advanced command and control capabilities for store managers.

As AZ stock has soared over the past month, let’s analyze the key catalysts:-

#1 Big Partnership With Lenovo Group

Last Friday, the company announced that its subsidiary has partnered with Lenovo Group Limited. As per the joint venture, A2Z Smart Technologies will use Lenovo solutions in its revolutionary Cust2mate Smart Cart solution and Lenovo will actively sell and promote the solution through its extensive worldwide channels.

Hila Kraus, Head of Sales stated, “The Cust2Mate platform with embedded Lenovo OEM solution is designed to serve shoppers from the moment they enter the store until they leave-without any friction, lines, or delays.”

#2 Launches Next Generation V2.8 Light Smart Cart

AZ stock hit its 4-month high recently as a key contender for the stock to watch this year. One of the major catalysts behind the latest rally in the stock came about earlier this week when the company announced that it had launched its latest Smart Card model. The product in question is expected to further enhance the current range of offerings from A2Z Smart.

The company announced that the latest version of the model had been created after consulting with some of the major retail companies in the world from the Asian and European markets.

#3 It Will Display Its Smart Cart Line of Products at the NRF 2023 Big Retail Show In NYC

Moreover, earlier on in the month on January 12, the company made another announcement that had come as a positive trigger for the A2Z Smart stock. It announced that it was going to be one of the participants in the NRF Big Retail Show. The company announced at the time that it was going to display its Smart Cart Line at the event.

Considering the recent multiple news, AZ stock should be on your radar as a stock to watch in 2023.