Angi Inc. ANGI stock quote ran for 4 days, had huge volume, never pulled back, consolidated and now what’s next? To find out, read more below because the famed stock picker Alexander Goldman has his opinion!

However, before you read this insightful information, sign up below, let’s stay in contact.

Angi announced today, “that they will be available to all customers in Walmarts in the USA.” However, before we get started, let’s review some basic information on this company.

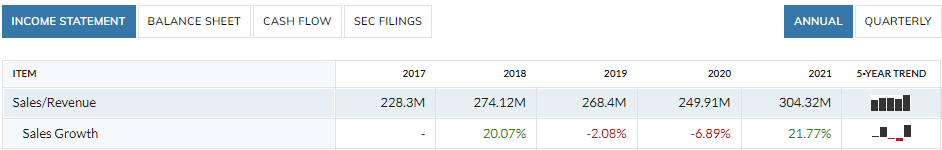

Angi Company Summary

Company Name: Angi, Inc

Ticker: ANGI

Exchange: NASDAQ

Website: www.angi.com

Angi, Inc. Company Summary

Angi (NASDAQ: ANGI) is your home for everything home—a comprehensive solution for all your home needs. From repairs and renovations to products and financing, Angi is transforming every touch point in the customer journey.

With over 25 years of experience and a network of more than 250,000 pros, we have helped more than 150 million people with their home needs. Angi is your partner for every part of your home care journey.

ANGI News

May 24, 2022 (SmarTrend(R) Spotlight via COMTEX) — SmarTrend identified a Downtrend for Angie’S List Inc (NASDAQ:ANGI) on November 5th, 2021 at $11.33. In approximately 7 months, Angie’s List Inc has returned 55.85% as of today’s recent price of $5.00.

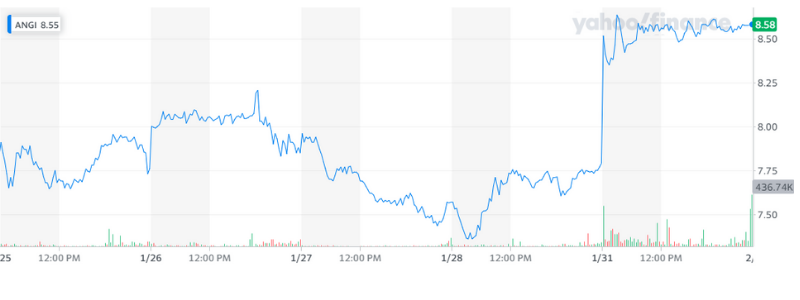

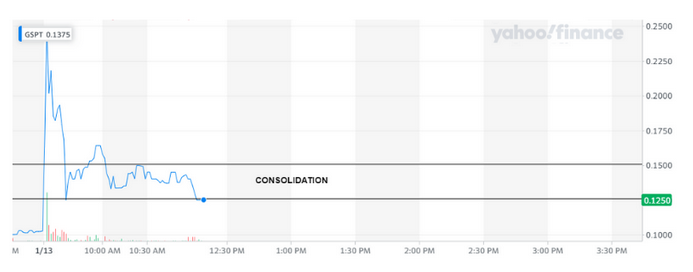

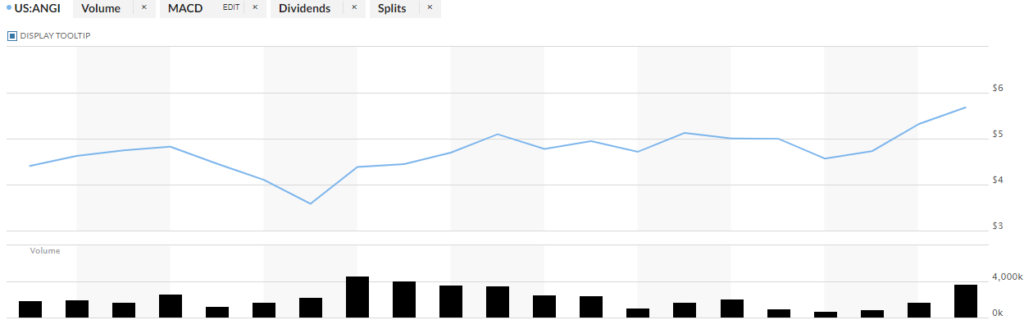

ANGI 1 Month Chart

ANGI Technical Analysis

ANGI is up almost 30% this month and volume has been solid! The chart looks solid with continued growth. I like this stock!

The real question is, what is it going to do now? Well, it gapped up, then ran some more, then ran a little more. It is pretty rare to see a sustained run, I think this one will continue heading northward!

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!