Dates: 2/3/2026 Speculative Momentum...

Retail

Baozun BZUN Stock Price is tanking, but I found something! Look at this

Baozun BZUN stock price is down 12% in the last 5 days & volume is up 290%, but is it over for this breakout stock?

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for BZUN is, a 🔥1 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I established the coveted HOT Stock Reporting system.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Baozun Company Information

Company Name: Baozun Inc

Ticker: BZUN

Exchange: NASDAQ

Website: https://www.baozun.com/

Baozun Company Summary:

Baozun, Inc. operates as an holding company, which through its subsidiaries provides brand electronic commerce (e-commerce) services and solutions. Its services include apparel and accessories; appliances; electronics; home and furnishings; food and health products; beauty and cosmetics; fast moving consumer goods, and mother and baby products; and insurance and automobiles. The company was founded by Wen Bin Qiu, Jun Hua Wu, and Qing Yu Zhang in August 2007 and is headquartered in Shanghai, China.

Baozun stock price is due to News?

May 12, 2022 (GLOBE NEWSWIRE via COMTEX) — SHANGHAI, China, May 12, 2022 (GLOBE NEWSWIRE) — Baozun Inc. (Nasdaq: BZUN and HKEX: 9991) (“Baozun” or the “Company”), the leading brand e-commerce service partner that helps brands execute their e-commerce strategies in China, today announced that it will release its unaudited financial results for the first quarter ended March 31, 2022, on Thursday, May 26, 2022, before the open of U.S. markets. HERE

Compare Baozun BZUN stock Price vs Competitors

CDK Global CDK HERE

Cinedigm Corp. CIDM HERE

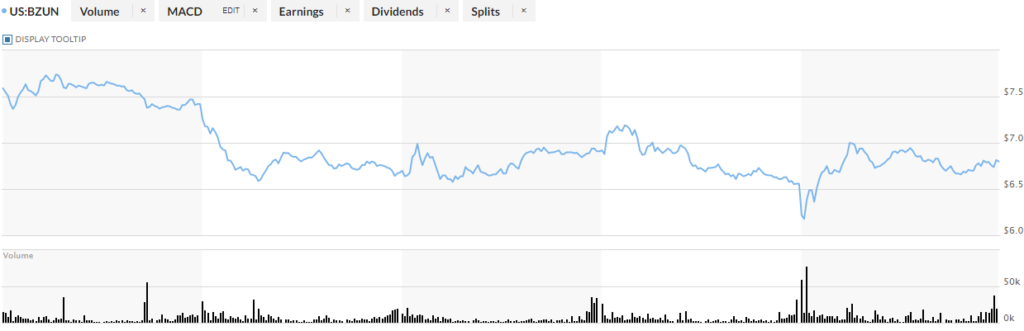

Trending Stock BZUN 5 Day Chart

BZUN Stock Price HOT Stock Grade:

BZUN is, a 🔥1 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4.

BZUN Trading Volume

The volume, the normal trading volume is established by the previous 30 days of trading and this stock is trading at an increase of 290% over the average. Normally, this indicates a higher demand in the stock or a sell off (selling pressure).

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

BZUN Technicals

The technical analysis “chart reading”, this stock is down12% on the 5 day chart and the overall trend for the long term chart, the 1 month, is down 14%. BAD BAD BAD

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

BZUN News Cycle

The news, there is no significant news.

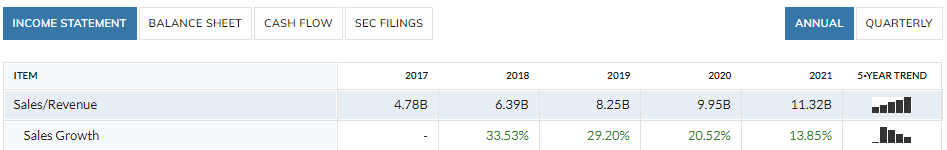

BZUN Fundamentals

The fundamentals, how a company is doing financially can be a serious KPI and there is no exciting financial filings associated with this stock. Great growth

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

BZUN Awareness

Marketing efforts “Awareness Campaigns” Just like advertising a product is important, advertising a publicly traded company during a news cycle is critical for the stock price of a company.

I have found marketing efforts around the investor awareness of this company. So, I have awarded this stock a 1 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

Aterian ATER Stock Price is so consistent, can it go higher? Exclusive!

Aterian ATER stock price is up 43% in the last 5 days & volume is up 773%, but is it over for this breakout stock?

There is an old adage, “two heads are better than one”, so let’s collaborate on ATER and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for ATER, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for ATER is, a 🔥🔥🔥 3 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Aterian Company Information

Company Name: Aterian Inc

Ticker: ATER

Exchange: NASDAQ

Website: https://www.aterian.io/

Aterian Company Summary:

Aterian, Inc. is a technology enabled consumer products company. The company’s brands include hOme, Vremi, Xtava and RIF6. Its product categories include home and kitchen appliances, kitchenware, environmental appliances, beauty related products and consumer electronics. The company was founded by Yaniv Sarig Zion in 2014 and is headquartered in New York, NY.

Trending Stock ATER 5 Day Chart

ATER Stock Price HOT Stock Grade:

The official heat level for ATER is, a 🔥🔥🔥 3 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

ATER Trading Volume

The volume, is trading at an increase of 775% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

ATER Technicals

The technical analysis “chart reading”, it is bullish and has been that way since the early part of this month with a steady ascending channel. It is up 43% in the last 5 days and over 100% in the last month.

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

ATER News Cycle

The news, there is no significant news.

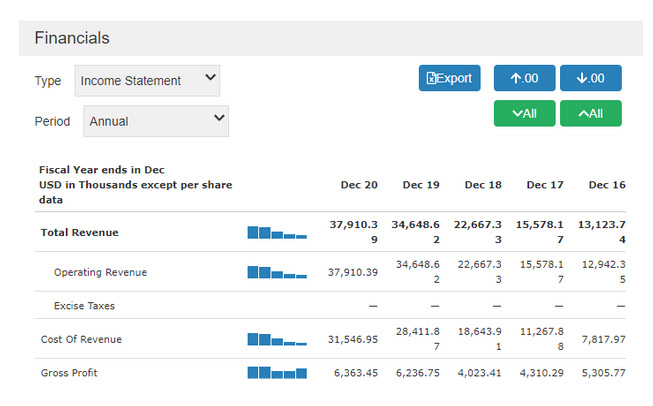

ATER Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, “265% growth”!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

ATER Awareness

Marketing efforts “Awareness Campaigns”, I have not found marketing efforts around the investor awareness of this company. Hence the 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

UPDATE: Kodak NYSE: KODK Looking Strong!

Kodak NYSE: KODK is a stallworth in American business but the last few years they have been struggling mightily. Lately they are up 50%, could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

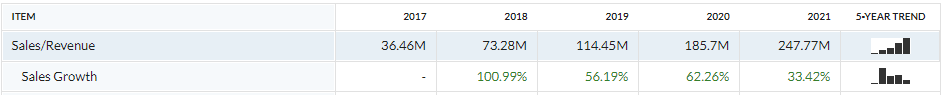

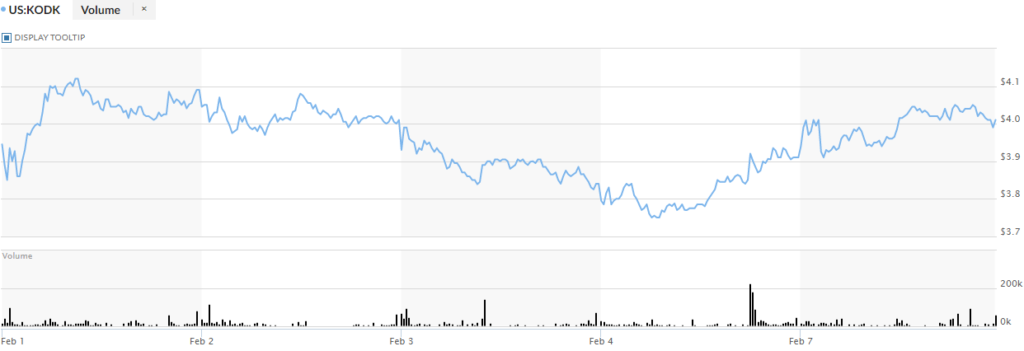

EKodak NYSE: KODK: KODK 6 month Chart

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can Kodak NYSE: KODK stay above $7.20? If so, that would be a decent signal. I have been covering this stock for months and I have been nailing the predictions! I love it if it can beat $7.20

Kodak NYSE: KODK UPDATE: KODK outlook

Kodak NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

EKodak NYSE: KODK: KODK 6 month Chart

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can Kodak NYSE: KODK stay above $4.00, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $3.70 and $3.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $4.15 PPS. That would be a buy signal in my opinion.

Falling below $3.75 is a clear sign that KODK is continuing a bearish trend.

Eastman Kodak Company NYSE: KODK outlook

Eastman Kodak Company NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

6 month Chart

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can KODK stay above $4.80, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $4.70 and $4.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $5.00 PPS. That would be a buy signal in my opinion.

Falling below $4.55 is a clear sign that KODK is continuing a bearish trend.

UPDATE:4 Reasons LGIQ Continues To Run Higher, Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

Here are 4 exciting reasons to stop what you are doing and read this short research article on Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

- Logiq’s News is explosive!

- They have an experienced leadership team

- The stock is Highly Undervalued

- The stock is ready for another possible big move!

Before we get into the those 4 exciting reasons to put LGIQ on your watchlist, let’s do a quick update on the news!

Jan. 27, 2022

Announced it has completed the transfer of its AppLogiq assets into Lovarra (OTC: LOVA), a fully reporting U.S. public company.

The transfer completes the previously announced separation of Logiq’s DataLogiq and AppLogiq businesses into two publicly traded companies. The AppLogiq assets include CreateApp™, an award-winning software-as-a-service (SaaS) platform that enables small and medium-sized businesses worldwide to easily create and deploy a native mobile app for their business. AppLogiq also includes platforms for mobile payments and delivery services designed for emerging markets, as well as licenses of its technologies to industry partners.

Jan 13, 2022

Preannounced Q4 revenues of $12.3 million, coming in well above our November estimate of $8.8 million. Although company did not give the breakdown between AppLogiq and DataLogiq, we believe both businesses had a strong quarter. For one, we know that DataLogiq had great results in providing Medicare sales leads and is even working to expand the sales leads business, investigating adding call center capabilities. In addition, the company announced it had achieved gross margins in excess of 34% for the quarter. These results show year over year revenue growth of 87% and a doubling of gross margin dollars.

For the year Logiq will report revenues of approximately $36.5 million a decline of 3.7% and a double of its gross margin to approximately 30.6% versus 16.8% in 2020. As a result we are raising 2021 numbers as well as 2022. For 2022 we are increasing to $44 million in sales while keeping the loss the same. We will revisit estimates when the financials for the spin out are released.

Nov. 08, 2021

Has been invited to present at the ROTH 10th Annual Technology Event being held virtually on November 17-18.

Logiq president, Brent Suen, scheduled to present and participate in one-on-one meetings with institutional analysts and investors at the conference.

Management will discuss the company’s recently announced plan to separate AppLogiq™ and DataLogiq™ into two publicly traded companies to capitalize on their respective growth opportunities in the rapidly evolving global e-commerce and fintech landscape.

Preannounced Q4 revenues of $12.3 million, Now, That Is Incredible News!

Company Name: Logiq

Ticker: {NEO: LGIQ} (OTCQX: LGIQ)

Company Summary: Let’s start with the fancy jargon, “Logiq is a global provider of marketing solutions for Ecommerce, m-commerce (mobile commerce), and fintech solutions.”

Now let us break down in layman terms what all of that mumbo jumbo really means.

Logiq is BIG, really big, in fact they are reaching into the WORLD market. They are in ASIA, In North America and everywhere in between.

They offer solutions to small and medium sized companies who are trying to sell you something online. For example, all those advertisements following you around Facebook, Instagram and even news articles, that is Logiq and their competitors.

M-commerce (mobile commerce) is a fancy term for an app (application) on your phone (mobile) that gives the user the ability to make a small business website on their phone! Yes you can make a full website on your phone in the waiting room of your doctor’s office. Pretty cool!

Fintech Solutions, the “Fin” in Fintech stands for financial. The “tech” in Fintech stands for technology. So, they offer solutions in the financial sector via technology.

Logiq has all the right building blocks for an explosive play! TAKE A LOOK NOW!

There are 4 Key Units Driving Logiq’s Impressive Financial Numbers!

Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ), operates four key units:

1. DataLogiq – Here comes the Jargon, “is designed for ad generation and Ecommerce marketing solution” Ok, ad generation is found below, it is found on sports illustrated and is an ad

This ad is following me around because my dog is a jack A$# that doesnt listen and I’ve been searching for services and products so I don’t murder him. So the advertisement found above, understands that I have a jerk for a dog and will continue to show me things to buy.

E-commerce, means any attempt to buy and sell goods or services (commerce) online (e). Any platform that is found online, including websites (native) & Facebook (social media) that has an advertisement on it, is considered an e-commerce platform.

DataLogiq is a technology that allows small to medium size businesses to gain access to data (statistics) to help decide what platform (facebook) to run advertisements on to capture conversions (a purchase).

2. AppLogiq – which is a platform-as-a-service (PaaS) solution for SMBs to deploy native mobile apps for their businesses that come complete with mobile payments.

Wowzers, that is a lot of fancy words! PaaS platform as a service is fancy talk for an app (platform) as a service, self explanatory, the app offers a service.

Example, if you know a millennial, they have photo editing applications on their phone, so they can look completely different on instagram, LOL. The app (platform), offers a service (photo editing).

The service that AppLogiq offers is the ability to build a website on your phone with the AppLogiq app. It comes complete with the ability to accept payment right from your very own small business website built with your smartphone.

3. Fixel – delivers AI-driven engagement segmentation by analyzing user interactions on a company’s website, fixel learns consumer behavior and then delivers the data the company needs to create valuable audiences.

Let me break that down for you, when a person goes to a website they use a tracking pixel, similar to a jealous husband that puts a GPS tracker in his wife’s car.

The company, like the jealous husband, can follow your patterns of buying things. This information is then run through artificial intelligence to create audiences (larger groups) based on the data.

Best example, the more you use Netflix, the more the (AI) can predict what you will WANT to watch next. Yes it can sound creepy but it is also very convenient.

So they can market to more people just like that user. Hence, more data, more efficiency and more buyers.

4. Pay&GoLogiq – this unit handles credit and payment points, payments using QR codes, and powers the company’s AtoZ Go food delivery service.

This one is written in almost common language. Here is a little more clarification, all ecommerce stores need to process payments via credit card on their website, Logiq offers that solution.

FOUR Exciting reasons to stop what you are doing and read this short research article on Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ)

The News is explosive!

Oct. 12, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include Semcasting’s advanced consumer and B2B title targeting capabilities.

Commonly referred to as data onboarding, Semcasting’s solution will allow LDM clients to easily take their offline customer data, including in-store receipts or home addresses, and translate it into targetable data for online marketing.

Sept. 23, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include geofencing-based targeting.

Unlike traditional geotargeting that restricts digital ads to audiences in a particular zip code, city, state, or country, geofencing is a custom-defined area that can outline the boundaries around a particular store, mall, or other physical venues. The technology enables geofencing by using the latitude and longitude coordinates of a consumer digital device, such as a connected TV, smartphone, tablet or PC, to determine their location.

Sept. 13, 2021 Logiq creates a partnership that creates an avenue to bring digital wallet and payment services to 50 million Indonesians. Mobiquity Pay, one of the world’s largest digital wallets from Comviva, will now power Logiq’s (NEO-LGIQ) (OTCQX-LGIQ) PayLogic digital wallet in the country.

On June 21 2021, Logiq (NEO-LGIQ) (OTCQX-LGIQ) announced the closing of its IPO offering of 1,976,434 units of securities in Canada at C$3.00 for gross proceeds of C$5.9 million and began trading in Canada on the NEO exchange to expand its reach up north.

The Asia-Pacific region is one of the fastest growing in the world and Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is focusing efforts there as a result of the huge opportunities it presents for the company. On July 21, 2021, the company expanded its Logiq (NEO-LGIQ) (OTCQX-LGIQ) digital marketing platform to include direct-media buying across the APAC region.

Experienced Leadership

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

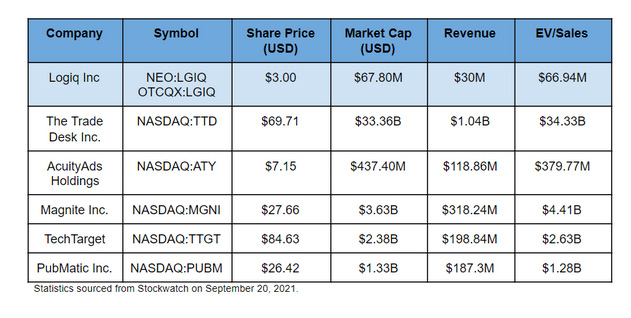

The stock is Highly Undervalued!

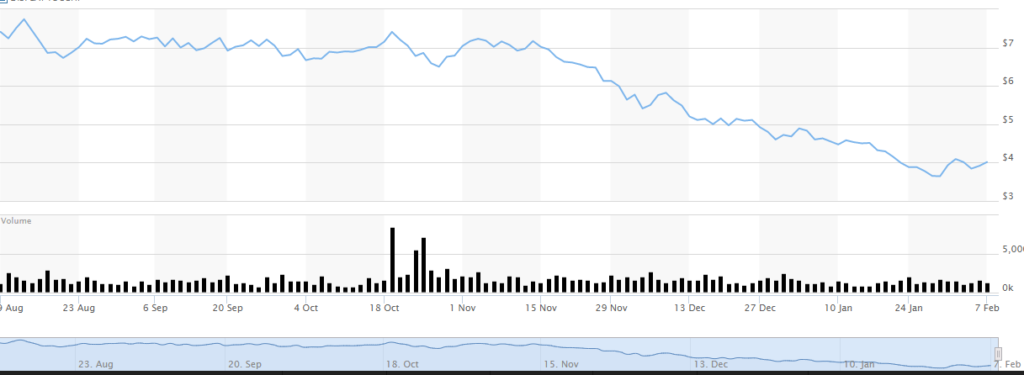

You get a better idea of how impressive the consistent, continued growth is by looking at the growth in the chart below over the last 5 years!

Growing at a CAGR (Compound Annual Growth Rate) of 31% from 2016 to 2020, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is growing fast. Company leaders are now expecting 31% gross margins and revenues between $34-38 million by the end of 2021.

As you can see from the prices above, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) has a lot of room to grow when it comes to price – and with word now starting to get out about this previously under-the-radar company that growth could come quickly.

The stock is ready for another possible BIG MOVE!

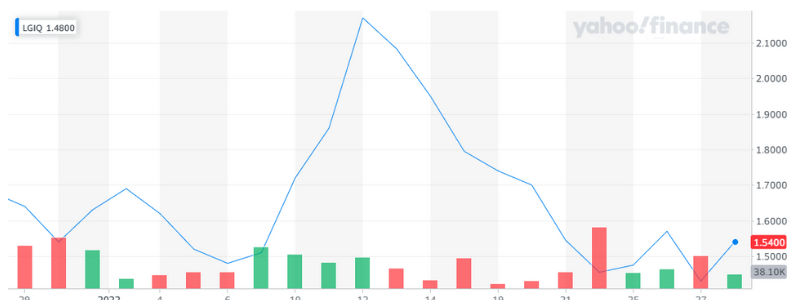

As you can see below this stock has the ability to make some serious moves. In less than four trading days this stock went from $1.45 to over $2.17 yielding 50% gains. More importantly, the stock created a very stable and methodical climb to a whopping 50% GAINS in FOUR trading days! If you had $10,000 invested in about 4 days you could have made $5,000!!!

As one can see from the 1 month chart below, the stock has consolidated and is ready for a possible large run AGAIN.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Logiq should be on your watchlist because of the massive opportunity it has in a very accessible market because:

- The News is explosive

2. Experienced Leadership

3. The stock is Highly Undervalued

4. The stock is possibly ready for another big move!

Happy Trading and remember, never try to catch a falling knife!

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, LGIQ. Small Cap Exclusive has been hired by Civit Digital for a period beginning on October 29, 2021 and by Emerging Markets Consulting for a period beginning October 29, 2021 to publicly disseminate information about (LGIQ) via website and email. We have been compensated $35,000 USD by Civit Digital and $27,500 USD by Emerging Markets Consulting. We will update any changes to our compensation.

Read full disclaimer here.

White Label Liquid Inc. (OTCMKTS:WLAB) Stock Gains Momentum, What To Do?

White Label Liquid, Inc. (OTCMKTS:WLAB) stock is going well this year with a gain of over 75% since the beginning of this year. Let’s analyze the recent developments about the company.

Florida based hemp-based CBD oil company White Label Liquid has established itself as one of the leading suppliers of customer mad CBD oil products to a range of big-ticket companies over the past few years.

White Label Liquid has considerable production capabilities and can churn out as many as 50,000 units per day. In addition to the largest cannabis companies, it also supplies to dealers, distributors, and stores all across the world.

[thrive_leads id=’8276′]

Financial Results

On 11 April this year, the company announced its financial results for 2018 and the numbers were highly encouraging. The company generated revenues of $7,006,110 and it topped its 2017 revenues of $5 million by a significant margin. The rise reflected a year on year rise of 250% and demonstrated the fact that the company has continued to grow at a fast clip.

However, in this regard, it is also necessary to keep in mind that White Label has continued to raise its range of offerings and back on 25 March this year, the company announced that it is going further expand its range of CBD oils. The move is particularly important since CBD oils are the fastest growing niche in the hemp market and White Label is determined to be one of the biggest players in that segment.

New products will include CBD infused olive oils, honey tinctures and much more. The CBD oils market is expected to be worth $22 billion at some point and White Label wants to capture a major chunk of it.

Varied Line Of CBD Products

Earlier on in March, on the 19th to price, it came to light that White Label provides the most varied line of CBD products to its clients. At this point in time, the CBD market has grown into a behemoth with a customer base of 10 million. White Label continues to be the main supplier for most resellers, who take White Label’s products and then sell it under their own label.

MedMen Enterprises (OTCQX – MMNFF): MedMen Stock Tumbles 65% From Peak. Time To Buy?

MedMen stock has underperformed the broader cannabis sector over the past one year. The stock has tumbled over 65% from its October peak price of $7.57.

MedMen Enterprises (CSE:MMEN) (OTCQX:MMNFF) has announced the opening of its second location in Sorrento Valley, San Diego California and its third-quarter results.

Sorrento Valley store

The location will be the 11th operational store the company is opening in California.

The Sorento Valley facility is strategically located in San Diego which is a major tourist destination. The opening of the store shows the company’s expansion strategy is in California which is estimated to have a cannabis market potential of $11 billion annually. Recently MedMen reported an estimated $100 million in annual sales in California and a 7% market share2.

[thrive_leads id=’8276′]

Q3 operating results

In the third quarter, MedMen reported systemwide revenue of $36.6 million that includes its retail operations and it also represents a 22% increase from the second quarter. The revenue recorded also includes the pending acquisition of PharmaCann as well as other smaller buyouts. In the third quarter, pro forma sales grew 11% to around $54.9 million compared to the third quarter last year. PharmaCann posted strong sales growth in the quarterly revenue growing to 15.5 million up from $9.8 million in the second quarter.

MedMen ended the quarter with around 82 licenses and 32 stores which includes pending acquisitions. In October 2018 when MedMen agreed to acquire PharmaCann for $682 million they had on 66 retail licenses. Although the expansion sounds to be a strong sign of progress the full quarterly results might reflect something different.

One thing that should raise eyebrows is how the company generated its Q3 results. Besides sales growth in Nevada and Arizona of 34% and 513% respectively most of its organic sales in 10 southern California locations declined. The 10 locations contributed a combined $24.9 million which was a partly 5% growth from Q2 which is alarming growth for a state that leads in recreational cannabis sales.

Gross margin also dropped from 53% in Q2 to 51% in Q3 despite the company reporting a $19.5 million gross profit. The company expects an operating loss of over $50 million following the trend in subsequent quarters.