DFLI dropped huge news last week and needs to be on radar immediately.

Surging green early, DFLI is up approx. 18% and could just be getting started.Why? Here’s why:Dragonfly Energy to be Granted U.S. Patent in Continued Momentum Toward Domestic Non-Flammable Lithium Battery Production

News

Why Northern Superior Could Be one of the Best Gold Plays Of 2023!

Gold investors have been waiting a long time for a shot at another Malartic and we believe we just struck gold with Northern Superior Resources (OTCQX: NSUPF)!

Is (NASDAQ:LSDI) Lucy Scientific Discovery Announces Massive Announcement.

LSDI has gained attention of late from traders looking for a possible low risk high gain investment. Just last month LSDI presented almost 70%…

Remember Malartic? Why Northern Superior Could Be one of the Best Gold Plays Of 2023!

Gold investors have been waiting a long time for a shot at another Malartic and we believe we just struck gold with Northern Superior Resources (TSX-V: SUP) (OTCQX: NSUPF)!

Malartic was a big gold discovery in the province of Quebec which became a mine and the company owning it ended up being acquired for total considerations of C$3.9 billion! Of course, not all mining developers are as rewarding, but when a company is successful in that sector, the reward for investors can be astonishing.

For those investors who missed out on the 1000%++ returns that we have seen repeatedly in that industry, sit back and keep reading because we believe (TSX-V:SUP) (OTCQX: NSUPF) could be just as interesting and its value is currently only C$60M.

What do you get when you combine one of the largest consolidated gold discoveries in Quebec’s rich history and a rapidly rising gold price driven by global economy in a tailspin, possibly, even stronger gains?

Before we get into the 3 catalysts that could make Northern Superior Resources one of the best gold plays of 2023, let’s go over the basics…

This company owns several deposits near each other and has been making headlines with its impressive drill results from the Philibert gold property in Quebec, where it has delineated of gold near surface over a 3-kilometre strike length.

Those deposits, including Philibert, are located in the rapidly emerging Chibougamau gold camp, which hosts the world-class Nelligan deposit. Nelligan was the “Discovery of the year[1]” in 2019. Many believe that the area, The Chibougamau Gold Camp, has the potential to be the next Malartic, as ounces grow and reach a level similar to one of the largest operating gold mines in Canada.

But that’s not all. Northern Superior also has a stellar executive team that has decades of experience in discovering and developing gold projects in Canada and abroad. The team includes Mr. Victor Cantore, Executive Chairman, a seasoned executive whose most recent win has been to take Amex Exploration from C$0.07 to more than C$3.50 per share in less than 2 years. This team is seriously invested. All in all, the insiders own more than 30% of the company and recently took down almost 20% of the $5M equity financing.

And if that’s not enough to convince you to take a look at Northern Superior, consider this: Northern Superior is well-positioned to benefit from the rising gold prices driven by stagflation. Stagflation is a scenario where inflation rises while economic growth slows down, creating a perfect storm for gold demand. As more investors seek a safe haven from currency devaluation and market volatility, central banks around the world keep buying and gold prices are already soaring to new heights.

BREAKING NEWS

TORONTO, ON / ACCESSWIRE / June 6, 2023 / Northern Superior Resources Inc. (“Northern Superior” or the “Company”) (TSXV:SUP) (OTCQX:NSUPF) is pleased to report the final assay results for nine holes completed on the Falcon Gold Zone (“FGZ“) on its large (20km x 15km) 100% owned Lac Surprise property, located within the Chibougamau gold camp, Québec.

Let’s do a quick summary on Northern Superior Resources (TSXV: SUP) :

Company Name: Northern Superior Resources

Ticker: (TSXV: SUP)

Exchange: TSX

Website: https://nsuperior.com

Northern Superior Resources Company Summary:

Northern Superior is a gold exploration company focused on the Chibougamau Gold Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau Est. Northern Superior also owns significant exploration assets in Northern Ontario highlighted by the district scale TPK Project. The Company has indicated its intention to spin off the TPK Project, which could provide immediate benefit for shareholders.

Without further ado, the 3 catalysts that could make Northern Superior Resources the gold play of 2023:

- #1 The next Canadian Malartic

- #2 The Executive Team

- #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to consider Northern Superior While it is on the ground floor of one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

#1 The next Canadian Malartic

Attention, investors! This is your chance to consider getting involved on the ground floor of a once-in-a-lifetime opportunity where central banks keep buying gold, combined with an oppertunity to getting a do-over on Malartic. Why is that significant? The company that owned Malartic was sold for C3.9 billion! Northern Superior Resources Inc. is a junior exploration company that is poised to possibly become the next Canadian Malartic. How will they do that? It is simple, they have consolidated the area and continue to rapidly increase the size of those deposits. By owning all of those nearby deposits, Northern Superior is rapidly reaching a critical geological level where the camp could become a single large mining operation. This matters as viable ounces are worth significantly more than unviable ounces, hence the consolidation strategy.

If you’re looking for a golden opportunity to invest in one of Canada’s largest and most exciting gold companies, look no further than Northern Superior Resources Inc. Northern Superior is consolidating the Chibougamau Gold Camp in Quebec, a region that has produced over 6 million ounces of gold historically. The company has discovered or acquired several impressive gold projects, including the Lac Surprise project, which is adjacent to IAMGOLD’s Nelligan project, which was the “Discovery of the Year” in 2019, and hosts a total of 5.5 million ounces[2] of gold.

Northern Superior Resources Inc. also has district scale exploration potential in Ontario, where it owns 100% of the TPK project, the largest till anomaly in North America, something that is sure to get the attention of any geologist. The TPK project has shown exceptional gold and diamond results, with drill intercepts of up to 25.9 grams of Gold per tonne over 13.5 meters and a boulder carrying 727 grams of Gold per tonne. The company recently obtained its drilling permit for this asset and has indicated its intention of spinning out this asset into a new company to accelerate its development. If TPK were to repeat historical exploration success, directly or indirectly, the shareholders of Northern Superior would greatly benefit.

Northern Superior Resources Inc. is led by a seasoned management team with decades of experience in the mining industry. Let’s take a closer look at their team.

Executive Team

Victor Cantore is the Executive Chairman of Northern Superior Resources with over 25 years of experience in the mining industry, having worked as an investment advisor, head of institutional trading and a corporate finance specialist. He has been instrumental in raising funds and negotiating deals for several mining companies, including Amex Exploration, where he serves as the President and CEO. It is worth mentioning again that he took Amex Exploration from C$0.07 to more than $3.50 in less than 2 years!

Cantore is passionate about creating value for shareholders and stakeholders, while adhering to the highest standards of environmental and social responsibility. He believes that Northern Superior Resources has the potential to become one of Canada’s premier gold producers. He is committed to advancing the projects to the next level.

Simon Marcotte is one of the most accomplished and visionary leaders in the Canadian mining industry. He has a proven track record of creating value for shareholders through his involvement in several successful exploration and development projects across various commodities. Marcotte has over 25 years of experience in the mining sector, starting his career as a Chartered Financial Analyst with CIBC World Markets, Sprott and Cormark Securities.

In 2018, Marcotte was instrumental in launching Arena Minerals Inc., a lithium exploration company with assets in Argentina. He facilitated strategic investments from Ganfeng, the world’s largest lithium producers, and also from Lithium Americas Corp. Most important to investors, he was instrumental in the price appreciation from $.05 – $.75! Arena was finally acquired by Lithium Americas Corp. in 2023.

In 2020, Marcotte founded Royal Fox Gold Inc., where he served as President and CEO until November 2022, when he orchestrated a merger with Northern Superior Resources and was appointed President and CEO of Northern Superior Resources thereafter.

Marcotte is also the founder of Black Swan Graphene Inc., a graphene manufacturing company based on a proprietary technology developed by Thomas Swan & Co. Ltd., a leading chemical company based in England. The shares of Black Swan Graphene just recently went up by 400%.

Michael Gentile is one of the most successful investors in the mining sector in Canada. He has built a fortune by identifying undervalued and overlooked opportunities in the natural resources industry; after his latest capital injection in the company, he now owns 16% of Northern Superior.

Michael, a former fund manager, has developed a reputation as a savvy and visionary investor who could spot opportunities that others missed. He invested in companies that had strong fundamentals, low valuation, high-quality assets, and growth potential. He also looked for companies that were undervalued by the market or had catalysts for appreciation.

Some of his most notable investments include:

- K92: One of the most successful mining companies in recent years; Michael acquired a major stake in the company in 2017 between C$0.45 and C$1.00. K92 now trades around C$6.00 but reached more than C$10.00 last year!

- Arizona Metals: Michael first invested in Arizona Metals around C$0.18. A little more than a year later, the stock traded at more than C$6.00 per share.

Stagflation’s Effect on Gold Prices

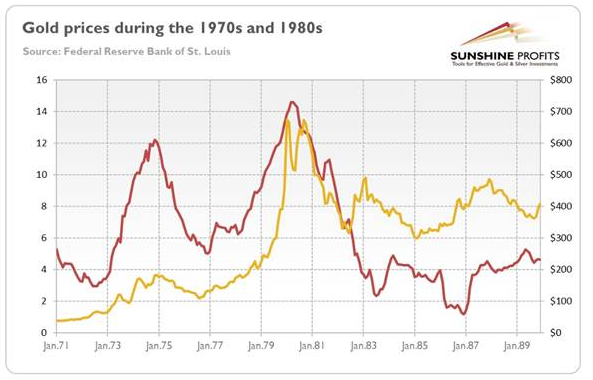

Gold investors have been waiting for this moment for almost 30 years, stagflation is upon us. The world is facing a serious economic dynamic. Stagflation, a situation where inflation is high and growth is slow, is absolute catnip for gold prices. Stagflation was once thought to be impossible by economists, but it happened in the 1970s, when an oil shock triggered a recession and soaring prices. This time, a step back in globalization, triggered by tension with China, and military activities in eastern Europe, are taking us down the same path.

What does this mean for investors? It means that they need to protect their wealth from the eroding effects of inflation. There is simply no better way to do that than by investing in gold, and this is why gold is already making new highs.

Gold has a long history of being a safe haven asset in times of turmoil. Gold preserves its purchasing power over time, unlike paper money that loses value as central banks print more of it. Gold also has a negative correlation with stocks and bonds, meaning that it tends to rise when they fall. Gold is therefore an ideal hedge against stagflation and market volatility.

But not all gold investments are created equal. Some are more risky and costly than others. That’s why we recommend taking a look at Northern Superior Resources, a company backed by a team with a proven track record of success.

Northern Superior Resources has a portfolio of high-quality projects in Canada, one of the most stable and mining-friendly jurisdictions in the world. The company has a strong management team with decades of experience in the industry. The company also has a low-cost structure and a healthy balance sheet, with no debt and ample cash.

In Closing – Northern Superior Resources Inc. has a diversified portfolio of gold in Ontario and Québec. The company’s value driver is its recent consolidation effort to put all of those deposits under one roof, opening the door to a single mining operation, and therefore increasing the value of those deposits. The flagship project, at least for the time being, is the Philibert Project, which has already seen more than 77,000 metres of drilling, a large part paid for by the Quebec Government, and is now about to publish a resource calculation. On its website, the Company is clear that it expects this resource publication to establish Philibert as a pillar in the Chibougamau camp. Philibert is only 9km away from Nelligan, so everyone will be quick to combine the size of those 2 deposits together and see the real value of this camp. The company also owns the Ti-pa-haa-kaa-ning (TPK) gold property, which has shown significant mineralization in several drill holes and the company indicated its intention to proceed to a spin out, which could also be an important catalyst for investors.

Northern Superior Resources Inc. is committed to creating value for its shareholders by advancing its projects to the next stage of development. The company has a strong financial position, having recently raised $5M with strong participation from insiders. The company also has a loyal shareholder base including several large institutional investors.

Don’t miss this opportunity to invest in one of the best gold exploration stories in the market. Northern Superior Resources offers you a chance to profit from the coming gold boom while protecting your wealth from stagflation.

Remember, just on of these catalysts could make SUP explode but there are three catalysts: #1 The Next Canadian Malartic #2 The Executive Team #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to take a look at one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

Act now before it’s too late.

Disclaimer

This Article contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Should one or more of these risks and uncertainties occur or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. This article is not intended to be a solicitation to buy or sell securities and readers are cautioned to consult their own financial advisors before doing so.

Small Cap Exclusive owned by King Tide Media has been hired by Northern Superior Resources Inc. for a period beginning on March 20th, 2023 to publicly disseminate information about (SUP) via website and email. We have been compensated up to $50,000 USD to profile SUP. Full Disclaimer

Trending Now: (SWAN.V) Black Swan Graphene’s Explosive Month of April

Small Cap Exclusive is always on the lookout for under the radar companies that have established a positive trend, backed by breaking news, technical analysis, fundamentals, & / or insider & institutional backing. And, we believe that Black Swan (TSXV: SWAN.V) may just be one such company that’s trending higher backed by some excellent news. Here’s what we’ve found.

Previous Trend

Starting with their previous trend, was essentially stagnant, trading at around $0.10-$0.15, for the past 6 months. However, as of March 27, 2023 a new trend started to take shape…

Trending Now: Black Swan Graphene

As of April 19, 2023: Currently trading at $0.25, shares are up over 92.30% since March 27, 2023, hitting 52 week highs 9 different times during that time.

But, is this just a coincidence or has a new trend been established for Black Swan?

Trend Catalyst

March 27, 2023: Black Swan was trading at $0.13, around where it’s been trading for the past 6 months.

- 9:07am – The Investment Industry Regulatory Organization of Canada (IIROC) put a halt on all shares of Black Swan (TSX.V: SWAN.V) for the reason of… Pending News.

- 11:45am – IIROC announced the resumption of trading for all shares of Black Swan as the news was released.

The March 27 News Release

Black Swan Graphene and Nationwide Engineering Announce Strategic Partnership, Part of an Integrated Supply Chain, to Accelerate the Adoption of Graphene-enhanced Concrete Globally.

Black Swan Graphene Inc. and Nationwide Engineering Research and Development Ltd. (“NERD”) announced that their strategic partnership was being embedded in a fully integrated supply chain which will include Arup Group Limited (“Arup”), a multinational engineering consultancy headquartered in London, United Kingdom, with 18,000 experts working across 140 countries.

News Update #1:

April 6, 2023: Black Swan stock price was trading at $0.15, up 15% since their March 27 announcement.

- News Release: Black Swan Graphene Announces Closing of Equity Swap with Nationwide Engineering Creating a Strategic Partnership, Part of an Integrated Supply Chain, to Accelerate the Adoption of Graphene-enhanced Concrete Globally

News Update #2

April 10, 2023: Black Swan was trading at $0.165, up 26% since their March 27 announcement.

- News Release: Black Swan Graphene CEO discusses concrete supply chain partnership with Nationwide Engineering

News Update #3

April 13, 2023: Black Swan was trading at $0.20, up 53.84% since their March 27 announcement.

- News Release: Black Swan Graphene Bolsters Technical and Product Development Capabilities with Appointment of Dr. Chris Herron, A Seasoned Graphene Professional, as Vice-President Research and Product Development

Positive Trend Established

April 19, 2023: Black Swan is trending higher, hitting a new 52 week high 9 times and is currently trading at $0.25, up 92.30%, since March 27, 2023.

About Black Swan Graphene Inc

Headquartered in Toronto Canada, Black Swan Graphene Inc. (“Black Swan”) (or the “Company”) (TSXV: SWAN) (OTCQB: BSWGF) (TSX.V: SWAN.V) (Frankfurt: R96) engages in the production and commercialization of patented graphene products for concrete, polymers, Li-ion batteries, and other sectors.

Mainz Biomed MYNZ Receives a $25 Price Target (Possible Gains Of 272% From Current Prices)

H.C. Wainwright Price Target Here

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential. Our research reports have uncovered some of the largest breakout stock alerts year after year.

We stand by our alerts, our 2023 alert tracker providing transparency. Click Here

Small Cap Exclusive’s much anticipated research report on Mainz Biomed is found below.

4 Catalysts That Could Send Mainz Biomed B.V. (NASDAQ: MYNZ) Soaring Past Wainwright’s $25 Price Target

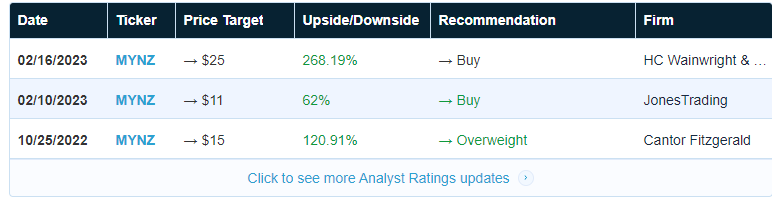

#1 H.C. Wainwright Announces MYNZ is Undervalued with a Price Target of $25

#2 Technicals Reveal a Major Bounce Play Opportunity

#3 Mainz Biomed Is Generating Revenue

#4 Philanthropic Investing feels good

Before we go over the top 4 reasons, let’s get acquainted with Mainz Biomed.

Company Name: Mainz BioMed

Ticker: MYNZ

Exchange: NASDAQ

Website: https://mainzbiomed.com/investors/

Mainz Biomed Company Summary

Mainz Biomed develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product is ColoAlert, an accurate, non-invasive, and easy-to-use early detection diagnostic test for colorectal cancer.

ColoAlert is currently marketed across Europe with an FDA clinical study and submission process intended to be launched in the first half of 2022 for U.S. regulatory approval.

Urgent: Pattern Detected

Small Cap Exclusive’s research department has uncovered a pattern with their news cycle.

Most investors react to a press release, however our largest breakout stock alerts have an over arching story hidden in the news cycle.

However, if you read between the lines, the press releases act as a road map to the future.

Found below is the important press releases signaling to savvy investors a future where Mainz Biomed could soar past $25.

Seeking Alpha’s research report echoes this sentiment with the quote below:

“The current data suggest that the approvals should occur. As such, I expect the share price to jump significantly.”

Our research department has provided the condensed press releases below that are pointing to the “big announcement” where massive price increases could take place in hours yielding a fortune for early investors.

We have highlighted the “road map” below where we found hidden in the press releases a foreshadowing of “the big announcement”.

We start with the announcement of March 2022 with the pivotal clinical trial design for ColoAlert concluding with the press release below, where they will begin commercialization throughout Europe. All press releases are located here.

Key Press Releases, When Will Be The “Big Announcement?”

Savvy investors have known for decades that corporations are sending messages to the trading public via press releases, can you detect the underlying message with their news cycle?

February 21, 2023

Transaction entails executing option agreements to purchase IP portfolio associated with current ColoAlert product and the novel gene expression (mRNA) biomarkers being evaluated in ColoFuture/eAARLY DETECT Studies

Announced today the execution of its option from Uni Targeting Research AS to acquire all of the previously licensed scientific intellectual property (“IP”) for its flagship product ColoAlert, a highly efficacious, and easy-to-use detection test for colorectal cancer (“CRC”) being commercialized across Europe.

Simultaneously, the Company also exercised its exclusive option with SOCPRA Sciences Sante et Humaines S.E.C. (“SOCPRA”), to outright purchase IP, including a pending patent, associated with a portfolio of novel gene expression (mRNA) biomarkers that have demonstrated ability to detect CRC lesions, including advanced adenomas (“AA”), a type of pre-cancerous polyp often attributed to this deadly disease.

Key Takeaway: Commercialized across Europe.

Mainz Biomed’s

Announced another deal to expand the marketing reach of its flagship ColoAlert diagnostic. This one is with Germany-based Labor Staber, a leading diagnostics services lab with over 800 employees, including almost 100 medical specialists, biologists, chemists, and other academics from various disciplines. Under the terms of the deal, ColoAlert, a highly efficacious and easy-to-use at-home screening test for colorectal cancer (CRC), will be marketed through Labor Staber’s extensive network of physicians and laboratories.

3/14/23

MYNZ share price weakness presents an opportunity to trade ahead of potential near-term catalysts. Shares dropped on Monday, possibly in sympathy with the Silicon Valley Bank fiasco. However, while MYNZ does list a Berkeley, California connection on its byline, this company is primarily based in Germany. Thus, financial exposure, if any, is more of a distraction than an MYNZ-specific event. Moreover, its significance is outweighed by the planned data releases expected over the next 90 days.

Remember, all deposits have been guaranteed by the U.S. Government and made available Monday morning. Hence, investors shouldn’t expect disruption to cash flow, which is the lifeblood of biotech. In other words, everything at MYNZ has stayed the same. And with contagion the likely cause of its share price decline, paying attention to MYNZ’s fundamentals and potential catalysts in the crosshairs exposes an opportunity worth seizing.

February 15, 2023

Continued roll-out in Europe with onboarding of new lab partners

Announced today the establishment of commercial partnerships for ColoAlert with Marylebone Laboratory (Marylebone Lab LTD) and Instituto de Microecologia, two leading independent laboratories covering England and Spain.

ColoAlert, Mainz Biomed’s flagship product, a highly efficacious and easy-to-use, at-home detection test for colorectal cancer (CRC), is currently being commercialized across Europe and in select international markets via a differentiated business model of partnering with third-party laboratories for test kit processing versus the traditional methodology of operating a single facility.

Key Takeaway: Covering England & Spain.

January 18, 2023

Patient Access Initiative Addresses €1 Billion Annual Market in Germany

Announced today the launch of a corporate health program in Germany for ColoAlert, its highly efficacious and easy-to-use screening test for colorectal cancer (CRC) being commercialized across Europe and in select international territories. As a start, ColoAlert has been integrated into BGM (“betriebliches Gesundheitsmanagement”), a corporate health network providing services to employees at forty-eight of the fifty largest companies in Germany[1].

Key Takeaway: Germany

November 15, 2022

MAINZ BIOMED ANNOUNCES U.S. EXTENSION OF COLOFUTURE STUDY TO EVALUATE INTEGRATION OF NOVEL MRNA BIOMARKERS INTO COLOALERT

Announced today the initiation of eAArly DETECT, its U.S. extension of ColoFuture, the Company’s European feasibility study evaluating the integration of a portfolio of novel gene expression (mRNA) biomarkers into ColoAlert, Mainz’s highly efficacious, and easy-to-use detection test for colorectal cancer (CRC) being commercialized across Europe and in select international territories. ColoFuture/eAArly DETECT are multi-center studies assessing the potential of these biomarkers to identify advanced adenomas, a type of pre-cancerous polyp often attributed to CRC.

Key Takeaway: USA

August 16, 2022

ColoAlert to be marketed through Dante’s extensive database and sold via its region-specific, ecommerce websites

Announced today the formal commencement of ColoAlert’s consumer commercial program in Italy and the United Arab Emirates (UAE). ColoAlert is Mainz’s flagship product, a highly efficacious and easy to use, at-home detection test for colorectal cancer (CRC) currently being commercialized across Europe and select international markets.

Key Takeaway: Consumer commercial program in Italy and the United Arab Emirates

March 31, 2022

MAINZ BIOMED COMPLETES SUCCESSFUL PRE-SUBMISSION PROCESS WITH THE U.S. FDA FOR COLOALERT’S PIVOTAL CLINICAL TRIAL

announced today that it has received supportive feedback from the U.S. Food & Drug Administration (FDA) on the Company’s pre-submission package profiling the potential pivotal clinical trial design for ColoAlert, its highly efficacious, and easy-to-use detection test for colorectal cancer (CRC). As Mainz prepares to launch ColoAlert’s pivotal clinical trial, the Company is also pleased to announce the formal commencement of its reimbursement process for ColoAlert by scheduling an initial meeting with The Centers for Medicare and Medicaid Services (CMS) in April 2022.

Key Takeaway: pivotal clinical trial design for ColoAlert

December 7, 2021

At-home Colorectal Cancer Diagnostic Test Now Available Online in Germany

Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test. German residents unable to obtain timely CRC screening via in-person physician visits, will be able to order ColoAlert directly to their home and receive highly accurate results within a maximum of nine working days.

Key Takeaway: Cancer Diagnostic Test Available Online In Germany

DECEMBER 14th, 2021

Mainz to co-brand ColoAlert with GANZIMMUN Diagnostics, one of the largest stool analysis labs in Germany with their 5,500 labs.

Mainz Biomed announced a partnership with leading diagnostics laboratory GANZIMMUN Diagnostics AG (GD), one of Europe’s leading laboratories for preventive and complementary medicine, for the commercialization in Germany of ColoAlert, Mainz’s unique, highly efficacious, and easy-to-use detection test for colorectal cancer.

Key Takeaway: 5,500 labs in Germany

Before we reveal “the big announcement” we are all waiting for MYNZ to release let’s review the methodical international network they are creating in the press releases above.

All the while Wall Street is dead asleep. That is exactly what Small Cap Exclusive has built it’s reputation on, the deep dive research delivered direct to our subscribers inbox before volume comes pouring in.

Early investing is where Warren Buffet created his wealth and we take pride in helping retail traders have the same edge as Berkshire.

Let’s review our catalysts now before we go over what we believe is “the big announcement” that will catapult MYNZ to record breaking gains.

The 4 Catalysts That Could Send Mainz Biomed B.V. (NASDAQ: MYNZ) To Wainwright’s $25 Price Target

#1 Undervalued Presenting Massive Upside Potential

#2 Technicals Reveal a Major Bounce Play Opportunity

#3 Mainz Biomed Is Generating Revenue

#4 Philanthropic Investing feels good

#1 Undervalued Presenting Massive Upside Potential

Lets start of with the upside potential, H.C. Wainwright has issued a price target of $25 HERE

From the current PPS that is a 270% gain! Savvy traders, Pay attention!

Mainz Biomed has a Market Cap of $121 Million but when you look at other companies that are in the space, you can see the value in this diamond in the rough.

We are very excited to see this kind of potential priced at such a low PPS and with a very small float at 12 Million shares outstanding.

Furthermore, Mainz plans on starting the FDA process shortly after their public listing. Recent FDA guidance recommends colorectal cancer screening for everyone over the age of 45, which translates to a market potential of over 52 million tests per year. 1

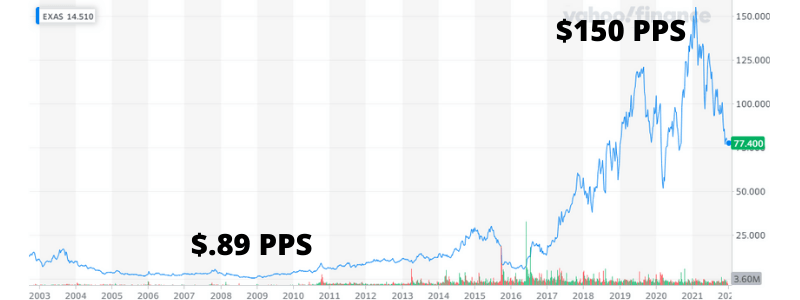

Can you imagine what will happen to the price per share of MYNZ when they get approved? Let’s look at one of their competitors to see what actually did happen!

Take a look at Mainz Biomed’s competitor Exact Sciences Corporation NASDAQ

Today, the top non-invasive colorectal screening test technology is manufactured by Exact Sciences (NASDAQ:EXAS), which is a perfect success story that Mainz BioMed is currently seeking to recreate. EXAS is valued at $17 BILLION and trades at $60 PPS!

Could you imagine if MYNZ is trading at those PPS in the near future? That would be almost 1,000% gains, like turning $10,000 into $100,000.

We do apologize, we tend to get excited about companies that are showing massive potential in a philanthropic industry. Invest and possibly make money while saving lives, it’s the cornerstone of the capitalism that Adam Smith promoted.

Did you see the EXAS’ share price back in 08’ it fell to less than one dollar. Essentially, investors were basically saying Exact was worthless. But in June 2009, an announcement of a mutual collaboration and licensing agreement between Exact Sciences and the Mayo Clinic turned the company’s fortunes around.

Worth mentioning again, hint hint, “In June 2009, an announcement of a mutual collaboration and licensing agreement between Exact Sciences and the Mayo Clinic turned the company’s fortunes around.”

However, it was in 2014 when the FDA approved Cologuard for use as a non-invasive colorectal cancer screening test, and the test’s inclusion in multiple national guidelines that truly made the stock take off.

Hmm… Isn’t Mainz seeking FDA approval! See the correlation? I do and you should too.

For investors of EXAS who got in as recently as mid-2016 have already seen their investment grow nearly 20x in just over 5 years. Today it’s worth nearly $17 billion USD.

20x Returns, that $10,000 would be $200,000

Here is the kicker, Mainz Biomed’s ColoAlert is designed to be easier to administer than Exact Sciences ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy. This is truly cutting edge medical testing at a fraction of the PPS of Exact Science.

MYNZ other competitor is Genescopy a privately help company making some moves

The reason I mention Geneoscopy is because this story is relevant, take a look at the investment level, $100M++!

Geneoscopy Inc. is a life sciences company focused on the development of diagnostic tests for gastrointestinal health, announced November 17th the closing of a Series B financing, raising a total of $105 million through a combination of debt and equity.

The round is led by previous investors Lightchain Capital and NT Investments. Other investors in the round include Morningside Ventures, Labcorp, Cultivation Capital, BioGenerator Ventures, and Innovatus Capital Partners. HERE

That is an example of just how large this industry is and how much money is available to fund it. It’s cancer and it has affected almost everyone in one way or the other.

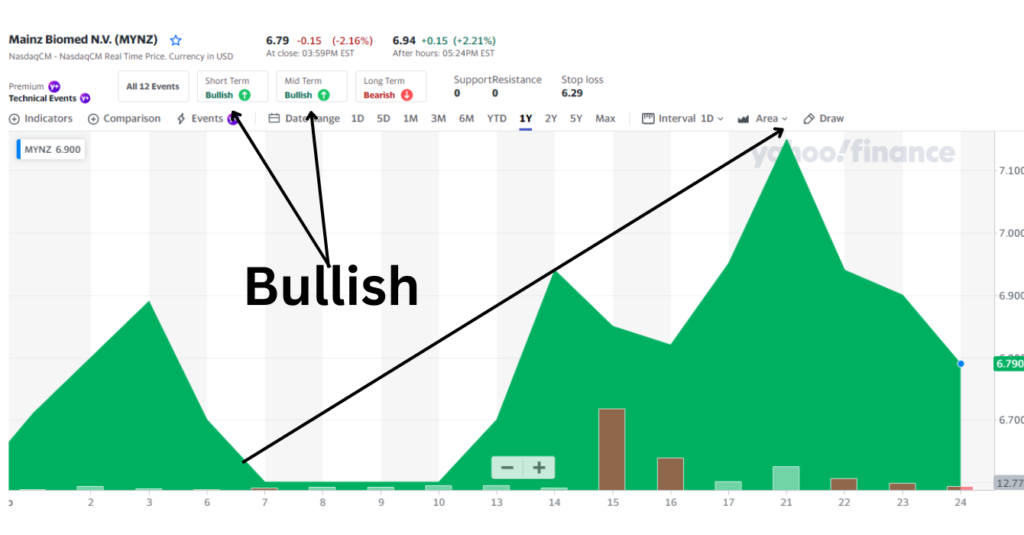

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing, for a bounce play!

Amidst the massive international stock market pull back, MYNZ PPS has been reduced by almost 50% and has created a clear consolidation pattern. See below

This is where Small Cap Exclusive shines! We issue research reports uncovering massive upside potential. There is a clear bottom in October of last year with a 30% run, then pulls back and consolidates again. We have seen this pattern over and over again and this stock should explode once the big announcement is made.

It is important to note, that MYNZ has created a stable base over the last 6 months reducing the downside risk, this is the exact point we issue research reports. Reduced risk with massive upside potential.

#3 Mainz Biomed B.V. Is Generating Revenue

ColoAlert has received CE accreditation and is approved for sale in Europe.1 European sales will provide near-term revenue potential, while they prepare for entry into the US market. Just last month, Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test.

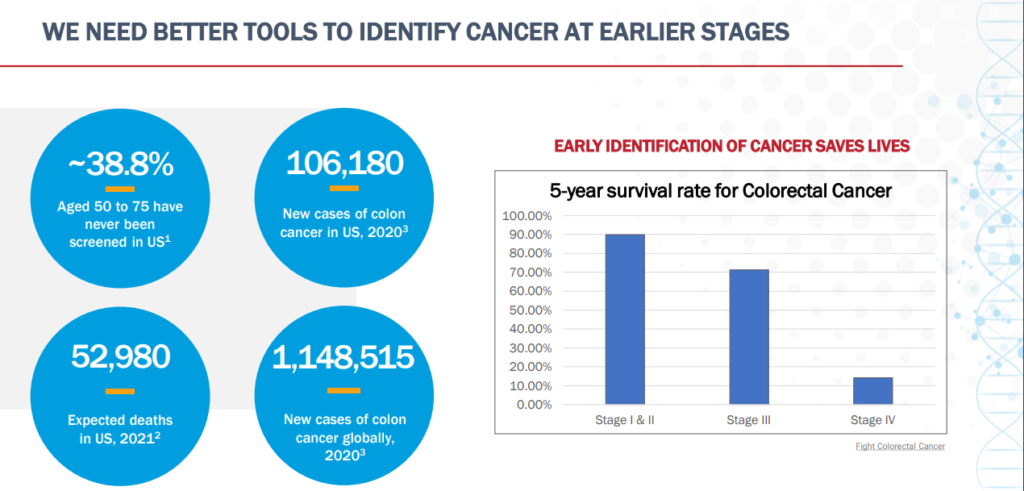

This is significant, DTC (direct to consumer) test to see if you have cancer which will allow you to catch it early and have a 90% survival rate. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

ColoAlert is designed for profitability, rapid commercial uptake, and broad consumer acceptance. The fact that Mainz Biomed is generating revenue in Europe and will be entering the US market with FDA approval is a massive sign for things to come. Make sure you keep MYNZ on your watchlist because the potential is substantial.

#4 Philanthropic Investing – possibly turn an amazing profit while helping people

It is rare for investors to be able to possibly have a home run return on an investment while helping to alleviate senseless deaths with the 2nd most deadly form of cancer.Colorectal cancer is the 2nd most lethal cancer in the US, but also highly preventable; with early detection providing 5-year survival rates above 90%. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

90% survival rate if detected early, guess what, ColoAlert detects early stage colon cancer. There is a solution and it is ready to come to market in the USA with FDA approval.

Why is Mainz Biomed your cake and icing for investors?

-

- ColoAlert Holds Potential as a Blockbuster Early Detection Test for Colorectal Cancer. Far less senseless deaths in regards to colon cancer!

- Mainz BioMed protects its intellectual property through trade secrets to control all critical reagents, processes and formulations. Protecting intellectual property is important for market capitalization!

- Mainz Biomed MYNZ is developing proprietary genetic testing methods for pancreatic cancer. Once the distribution channel is developed, offering multiple products creates more than one revenue stream!

- Non-invasive test, which can be taken at home, with rapid response of 92% specificity and 85% sensitivity. Designed to be easier to administer than Exact Science’s ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy.

We have presented the necessary research and now we are ready to unveil what our research is pointing to, “the big announcement”.

On December 6, 2022 MYNZ announced approval from an independent Institutional Review Board (IRB) for the protocol ReconAAsense, the Company’s U.S. pivotal study to evaluate the clinical performance of its highly efficacious and easy-to-use detection test for colorectal cancer (CRC).

Mainz Biomed has been conducting this study for over a year, which will form the basis of the data package to be submitted for review by the U.S. Food and Drug Administration (FDA) to achieve marketing authorization.

ReconAAsense is a prospective clinical study that will include approximately 15,000 subjects from 150 sites across the United States. The study objectives include calculating sensitivity, specificity, positive predictive value (PPV) and negative predictive value (NPV) in average-risk subjects for CRC and advanced adenomas (AA).

We believe the studies will come back positive and will be released soon. Mainz Biomed has been methodically making strategic moves that act as a harbinger of things to come.

We are already diving deeper into this for our second research report on the impact on PPS when the announcement comes. To receive this exclusive report before our publication, sign up below.

Let’s recap why Mainz Biomed MYNZ could be, THE massive breakout of 2023!

#1 MYNZ is Undervalued

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

#3 Mainz Biomed B.V. Is Generating Revenue

#4 Philanthropic Investing feels good

It is a rare opportunity in this world to have this kind of investment opportunity while also funding the act of saving lives. This is an easy fix, detect the 2nd most dangerous form of cancer early and you have a 90% survival rate. ColoAlert is the answer, we just need to stop what we are doing and place it on your watchlist, today!

Happy Trading and remember, never try to catch a falling knife!

Condensed Disclaimer

Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on February 24, 2023 to publicly disseminate information about (MYNZ) via website and email. We have been compensated $116,000 USD to profile MYNZ for one month. We will update any changes to our compensation. Full Disclaimer

LSDI Stock: Will Lucy Scientific Discovery (NASDAQ:LSDI) Come Back?

Listing of a stock on a major exchange is often seen as a positive by investors but it may not always go to plan for the companies involved and that is what happened with the Lucy Scientific Discovery (NASDAQ:LSDI) or LSDI stock on Thursday.

The company, which is involved in the contract manufacturing of compounds meant for psychotropic and psychedelic therapies, was listed on the NASDAQ on Thursday. The stock performed poorly and slid by as much as 25% on the first day of trading.

Lucy Scientific Discovery

Company Name: Lucy Scientific Discovery

Ticker: LSDI

Exchange: NASDAQ

Website: https://www.lucyscientific.com

Lucy Scientific Discovery Summary:

Lucy Scientific Discovery Inc. researches develop, manufactures, and commercializes psychedelic products. It offers biological raw materials, crude extracts, psychotropic compounds, and active pharmaceutical ingredients (APIs). Lucy Scientific Discovery Inc. was formerly known as Hollyweed North Cannabis, Inc. The company was incorporated in 2017 and is based in Victoria, Canada.

Here are the top 3 catalysts for LSDI stock.

#1 LSDI Stock Falls In Debut Trading

The initial public offering made by the company on NASDAQ was worth as much as $7.5 million. LSDI stock opened trading at $4 a share but eventually slumped to $2.89 each before ending the day at $2.99 a share.

The company offered as many as 1.87 million shares in the initial public offering for $4 each. The underwriters for the offering had also been provided with a 45-day option for picking up, more shares in the company.

#2 Downsized IPO again

The sole book runner for the company is WestPark. In light of the poor performance on listing day, it is perhaps important for investors to keep in mind that back in December last year, the company had actually reduced the size of its IPO for LSDI stock.

Initially, the size of the IPO had been supposed to be $10 million but Lucy had decided to reduce it to $8 million.

#3 Moderate Industry Growth

While the performance on the listing day may come as a dampener for the company, its shareholders, and potential investors, it ought to be noted that Lucy is involved in an industry that is geared for growth.

As per research conducted by Future Market Insights, the psychotropic drugs market is expected to grow at a rate of 6% CAGR over the course of the period between 2022 and 2032. There is significant awareness now with regard to mental health conditions and the introduction of safe psychotropic treatments could well be the way forward in the coming years.

LSDI stock could be on your watchlist this month it is trading in the oversold zone.

Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $350,000 from Lucy Scientific Discovery Inc. for profiling LSDI. We own ZERO shares in LSDI. Full Disclaimer

Therma Bright Inc (TSXV:THRM) (OTCQB:TBRIF) Signs The Exclusive Worldwide Licensing Rights To Market And Sell Ai4lyf’s Digital Cough Technology (Dct)

The medical devices industry has grown at a decent clip over the course of the past years and one of the companies which could be worth looking into at this point is Therma Bright Inc (TSXV:THRM) (OTCQB:TBRIF). The company is currently best known for having developed the smart-enabled AcuVid COVID-19 Rapid Antigen Saliva Test but it has been working on other devices as well.

This morning the company has come into the news cycle after it announced that it had inked the exclusive global licensing rights to sell and market AI4LYF’s Digital Cough Technology (DCT). It was another major development for the company and one that is expected to bring Therma Bright onto the radars of investors.

The most important thing to point out with regard to DCT is the fact that the technology can help in detecting a range of respiratory diseases instantly and that includes COVID-19. The technology is deployed through a smartphone application and it can work anywhere at any time.

More importantly, the exclusive license is particularly important for Therma Bright. That would allow the company to work on the development of DCT solutions for detecting other diseases like bronchiolitis, asthma, and pneumonia among others.

It goes without saying that the latest development could well be a significant one for Therma Bright and investors could consider keeping an eye on the stock. Back in November 2022, it had been announced that the patent-pending DCT solutions was a revolutionary technology, powered by an artificial intelligence engine, which could change the way respiratory diseases were detected.

For instance, the app can come up with a result for the COVID-19 test within a minute and more importantly, it has managed to clock an accuracy rate of as much as 94%.

Small Cap Exclusive is owned and operated by King Tide Media, which is a US based corporation has been compensated $60,000 from Therma Bright Inc for profiling TBRIF for 30 days starting Feb 21 2023. We own ZERO shares in TBRIF.

Lordstown Motors: RIDE Stock Gains Momentum: But Why?

Electric vehicle manufacturing company Lordstown Motors Corp (NASDAQ:RIDE) is one of the companies to have come into sharp focus among investors in recent days and that can be gauged from the price action in the RIDE stock.

Over the course of the past week, the stock has managed to clock gains of 18% and that took the gains over the past month to as much as 25%. While it is currently trading above its key averages, it should not be forgotten that it is still down by 45% in the past six months.

Lordstown Motors Corp

Company Name: Lordstown Motors Corp

Ticker: RIDE

Exchange: NASDAQ

Website: https://www.lordstownmotors.com

Lordstown Motors Corp Summary:

Lordstown Motors Corp. develops, manufactures, and sells Endurance, an electric full-size pickup truck for fleet customers. The company was founded in 2019 and is based in Lordstown, Ohio.

Let’s take a look at the company’s recent news and developments of RIDE stock:-

#1 Expects Slow Rate Of Production in 1Q

The company had actually been in the news in recent times and came up with a key update back on January 4, 2023. At the time it announced that the rate of production in the first quarter was going to be slow owing to supply chain issues.

The company sent in a filing to the United States Securities and Exchange Commission in which it noted that the main supply chain problem was related to hub motor components availability. It was in the third quarter of 2022 that the company started the production of its Endurance pickup truck.

RIDE stock reacted positively after the news.

#2 Starts Shipping First Endurance Trucks To Customers

Last, in the month of January the company was in the news once again after it announced on January 11 that it had started shipping its first batch of Endurance pickup trucks to its customers.

At the time it was also announced by Lordstown Motors that the Endurance pickup truck had been named one of the three finalists in the North American Truck of the Year event for 2023.

#3 LEVs Market Projected To See a CAGR of 9.4%

While these are significant developments, it is perhaps most important for investors to keep in mind that Lordstown Motors is involved in an industry with the potential for significant growth. The light electric vehicle market is expected to have a valuation of $122.7 billion by 2027 from only $78.5 billion in 2022.

Keep an eye on RIDE stock as it is consolidating after the recent jump.