Northern Dynasty Minerals Ltd (NAK) Buy or Sell?

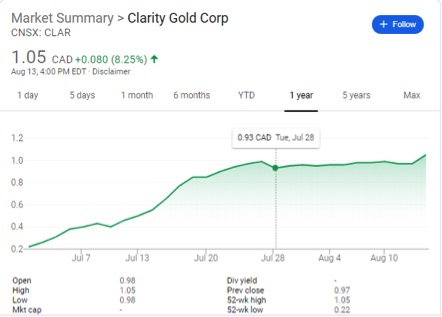

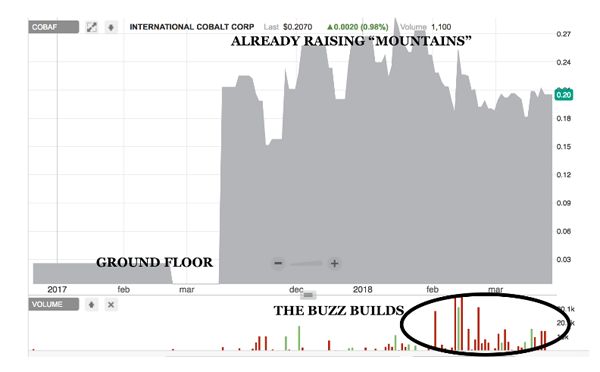

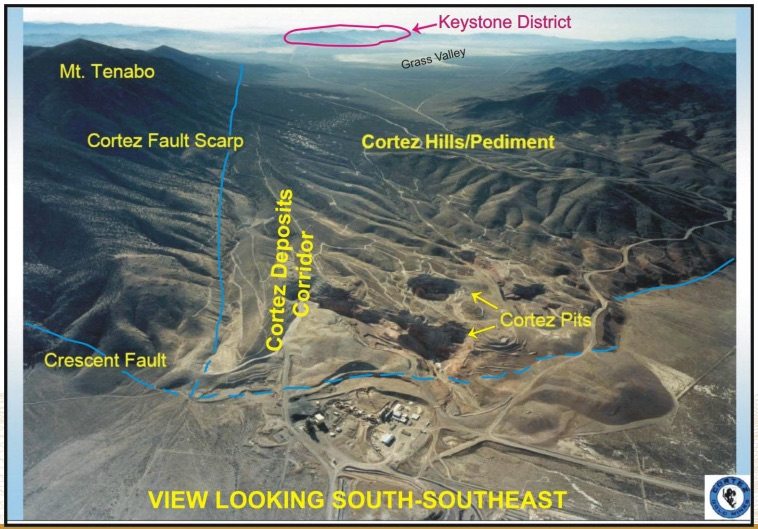

One of the companies to have been in the news in recent weeks is Northern Dynasty Minerals Ltd (NAK) and much of that is due to its Alaska Pebble Mine project. That has resulted in a considerable rally in its stock as well.

Major News

Over the course of the past month, the stock has rallied strongly and delivered gains of as much as 80%. However, it should be noted that the stock has experienced considerable ups and downs ever since the United States Army Corps of Engineers rejected Northern Dynasty’s response with regards to environmental issues related to the above-mentioned project.

However, the rally in the recent days came about after Northern Dynasty announced that it lodge a request for appeal (RFA) with regards to the decision. In this regard, investors need to note that the rejections from the U.S. Army Corps of Engineers had almost been a death blow for the project in question.

That being said, the company’s CEO stated that the new RFA lodged by Northern Dynasty apparently contains strong arguments that suggest that the rejection from the Army Corps of Engineers may have been against the law. Hence, it is no surprise that the recent development has resulted in considerable excitement among investors with regard to the Northern Dynasty stock.

The RFA was actually sent by the company back on January 19 but the details of the same emerged around a week later. The RFA has argued that the concerns that have been raised with regards to the project could have been resolved if the company had been provided an opportunity to address them.

In addition to that, Northern Dynasty also asserted that in addition to not getting the opportunity to address the issues, the company was not even provided any explanation regarding the reasons behind such an action. Investors have sent the stock higher in the hope that the project might be resurrected. It remains to be seen how the stock performs this week.

Start your own Due Diligence with the following links