Put LITE on your Watchlist NOW

3 Critical Events Have Made SpotLite360 the Darling of the Canadian Securities Exchange!

Here are the 3 critical events that could forever change supply chain technology!

- The chart is on fire!

- In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

- The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Company Name: SpotLite360

Ticker: CSE-LITE

Company Summary: SpotLite360 is a SaaS-based, enterprise software company leveraging IoT technologies, blockchain, & machine learning to deliver supply chain solutions which result in improved tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture.

What do they do?

In lay terms, they develop software that improves tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture. SpotLite360’s software allows companies to have a real-time view of inventory all over the world with a click of a mouse! Imagine if this software or software like it, was mandatory? The pandemic would have been way different, we would have had toilet paper, LOL!

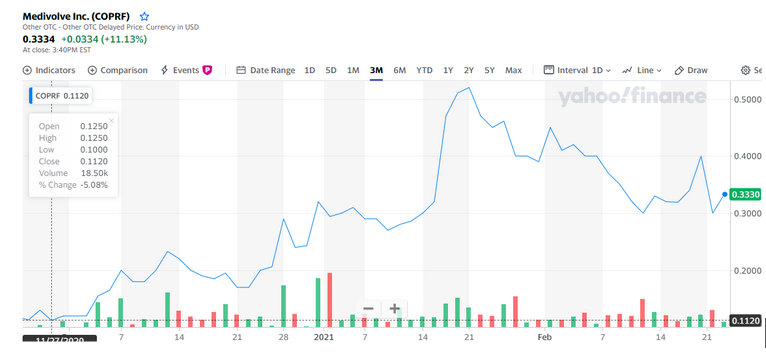

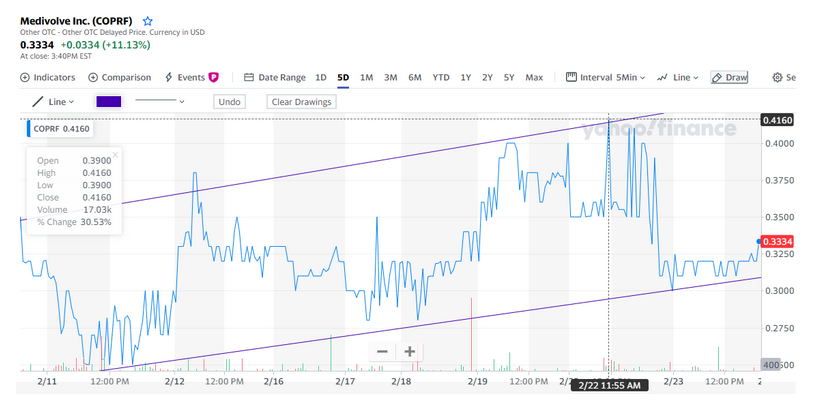

#1. The trading for LITE is in an aggressive bullish trend with possibly no end in sight, producing 100% gains in a month!

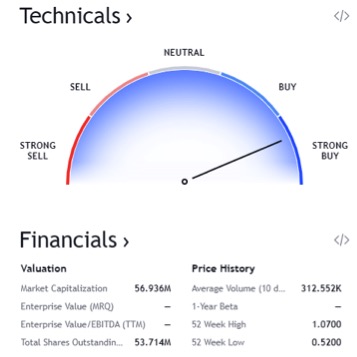

As you can see in this chart found above, this stock is absolutely trending extremely bullish. All indicators are positive and likely to continue in this upward trend line. In regards to the technicals, it is a STRONG BUY! 7

#2. In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

Take a look at this quote by an industry giant in the supply chain management:

Mike Crum, a professor and chair of supply chain management in Iowa State University’s Ivy College of Business was asked, Why is the government an important part of the supply chain?

“The government, through investments, financial incentives, regulations, and policies, greatly [affects] supply chain performance.” 3

It is clear, the writing is on the wall, whether you like it or not big brother is coming with mandates! The libertarians will be sounding the alarm that the police state is being ushered in, the Dems will be cheering the victory and the consumer will be tickled pink when essential goods will be available during the next crisis. As a trader, you have a rare opportunity to profit from big brother’s mandates.

In Big Pharma’s case it’s not if the government will mandate better supply chain technology, it’s when because we have the date!

In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.”

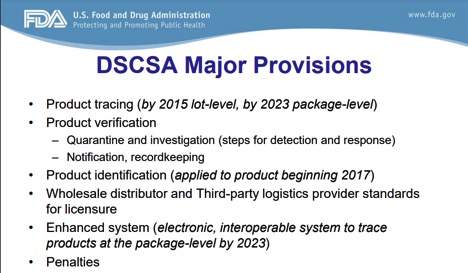

Take a look at this excerpt from the FDA website!

The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States. 2

Big brother is mandating that pharma companies must follow federal guidelines in regards to certain drugs, this is the reason why:

- More than $1 billion in drug thefts annually

- $236 billion in counterfeit drugs causing harm to the populace

- 25% of vaccines damaged in transit, another result of Covid

- 20% temperature sensitive drugs perish.

These mandates are looming, they are right around the corner and trillion dollar mega-companies will be scrambling to be compliant and SpotLite360 will be knocking on their door with possibly the best solution in the market with decades of experience!

Don’t believe me, this is an excerpt taken from the FDA website.

This will enhance FDA’s ability to help protect consumers from exposure to drugs that may be counterfeit, stolen, contaminated, or otherwise harmful. The system will also improve detection and removal of potentially dangerous drugs from the drug supply chain to protect U.S. consumers.2

The above screen shot was taken from the FDA website.

If the big Pharma mandate by the federal government gets you excited, there are two mandates that will greatly impact SpotLite360! Take a look at this!

#3. The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Take a look at the following excerpt from the FDA’s website,

“The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States.” 2

On July 13, 2020, the FDA released the Blueprint for the New Era of Smarter Food Safety. The blueprint outlines the FDA’s vision to enhance traceability, improve predictive analytics, respond more rapidly to outbreaks, address new business models, reduce contamination of food, and foster the development of stronger food safety cultures. Although the FSMA 204 rulemaking is limited to only certain foods, the blueprint identifies it as a foundational first step on the path to promoting tech-enabled end-to-end traceability for all foods. The proposed rule, when finalized, would establish a standardized approach to traceability recordkeeping, paving the way for industry to adopt, harmonize, and leverage more digital traceability systems in the future.

From the FDA’s website, “A modern, coordinated approach to traceability that can be used and understood throughout all stages of the food supply chain will go further to reduce foodborne illness, build consumer trust, and avoid overly-broad recalls.” 5

The federal government is pushing for these laws to ensure safety for its constituents and to respond to the majority who are interested in where their food comes from.

56% of shoppers want to know where their food comes from. 6

Our world, whether we like it or not, is headed towards: organic, lactose free, grass fed, grown in the USA, Kobe, farm raised, cruelty free and so on and so on. As the demand for thoses nomenclatures grow, the demand for the proof of those labels increases too.

56% of shoppers want to know where their food comes from. SpotLite360 (CSE-LITE) specializes in supply chain management via a SaaS platform that can meet the demands of those 56% that are demanding certificate of origin.

FDA is establishing these rules to tackle to avoid these problems:

- Lack of visibility allows opportunities for product tampering and theft

- 68% of consumers will pay more for products that are produced ethically and responsibly

- As much as 60% of all food produced is wasted and never makes it to the consumer ($1 trillion)

- Food-borne pathogens costs consumers $55.5 billion per year

- Food fraud costs the industry $40 billion annually

SpotLite360 is catering to three verticals: agriculture, big pharma and healthcare. Of the three, two have or will have mandates to utilize the technology that SpotLite360 has developed. SpotLite360 will be funding its efforts to penetrate and control as much of the market share via a public offering. We are incredibly excited to share this information with you and highly encourage you to place SpotLite360 on your watchlist TODAY.

As A Quick Recap, the THREE Top Reasons to Put (CSE-LITE) on Your Watchlist Today!

- The chart is on fire!

- FDA announced that they are making it mandatory to identify and trace certain prescription drugs as they are distributed throughout the U.S., that could be worth TRILLION$!

- The FDA has proposed new traceability rules in regards to agriculture, people care about the efficacy of organic food!

3. https://www.futurity.org/supply-chain-us-government-2535692/

4. https://mitsloan.mit.edu/ideas-made-to-matter/post-pandemic-supply-chains-retool-a-new-abnormal

5. https://www.fda.gov/food/new-era-smarter-food-safety/tracking-and-tracing-food

6. https://www.spotlite360.com/investors

7. https://www.tradingview.com/symbols/CSE-LITE/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, SpotLite360. Small Cap Exclusive has been hired by SpotLite360 for a period beginning on July 10, 2021 for 3 months to publicly disseminate information about SpotLite360 via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.