Company Snapshot:

Company Name: Canoo Inc.

Ticker: GOEV

Exchange: NASDAQ

Website: www.canoo.com

Industry:

Company Summary:

Canoo’s mission is to bring EVs to Everyone. The company has developed breakthrough electric vehicles that are reinventing the automotive landscape with bold innovations in design, pioneering technologies, and a unique business model that spans the full lifecycle of the vehicle. Distinguished by its experienced team from leading technology and automotive companies – Canoo has designed a modular electric platform purpose-built to deliver maximum vehicle interior space that is customizable across all owners in the vehicle lifecycle to support a wide range of vehicle applications for consumers and businesses. Canoo has offices in California and Texas.

Canoo’s charts look incredible:

The 1 day chart above reveals resistance at $12.50 PPS, so make sure it’s clear of it before entering a position Friday.

As you can see from the 6 month chart above, we have hit a 6 month high with 100% gains in 14 weeks, so nice and steady!

UPDATE: Investors invested in GOEV, that’s putting your money where your mouth is!

NASDAQ reports “Over the last year, we can see that the biggest insider purchase was by insider Daniel Hennessy for US$5.0m worth of shares, at about US$10.00 per share.”

Why is it up 100% over the last 14 weeks?

This company is REAL and making serious moves!

In Arkansas Business, they state, “Electric automaker Canoo Inc. announced late Monday that it will move its headquarters to northwest Arkansas, pledging to employ more than 500 people in Benton and Washington counties.”

There is another EV manufacturer you may have heard of, Tesla, current share price of $1,116 per share!

So you have a EV manufacturer making good on manufacturing plants and the possibility that it could be 10% of Tesla and BOOM , $111 per share price up $100+/- from today’s price! That is wealth and there is attention being paid with this gem.

Summary

We like this stock! Fundamentals are good and technicals are solid as well. $5M of shares purchased at $10 is also really good because it is undervalued at $12 so there is lots of room for a nice long term play,

Happy trading!

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies. Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A. Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink. Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media. Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

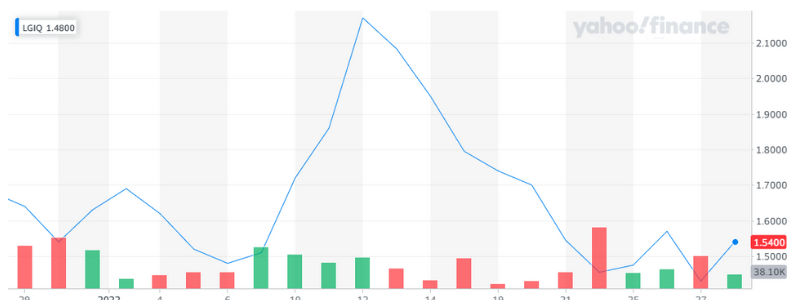

Look at this chart, it looks like it could b

Look at this chart, it looks like it could b