Wellfield TSXV-WFLD announced massive news after the IPO which made it skyrocket. Famed stock picker, Alexander Goldman’s, much anticipated follow-up technical analysis below.

Analysis

Breakout for Golden Star Enterprises Ltd. (OTC-GSPT)?

Golden Star Enterprises LTD is a publicly traded holding and acquisition company. (OTC:GSPT) is a tech incubator that acquires startups and takes them to the next level.

Their extensive experience in this space and our tech industry connections, create massive opportunities for traders.

“Most of our subscribers are familiar with me, but for those that are new to Small Cap Exclusive’s detailed, featured, Break Out Alerts, my name is Alexander Goldman. I’ve been a trader for over 20 years and I’m pretty, pretty, pretty good at picking massive winners.”

“Most of our subscribers are familiar with me, but for those that are new to Small Cap Exclusive’s detailed, featured, Break Out Alerts, my name is Alexander Goldman. I’ve been a trader for over 20 years and I’m pretty, pretty, pretty good at picking massive winners.”

The Company’s flagship company is Enigmai, an Israeli tech company that specializes in the Workforce Management space. I’m very excited about the results of 2021 and over the moon in 2022. You have an opportunity to get in on the ground floor, where, in my opinion, it is a steal!

The top 4 reasons Golden Star Enterprises (OTC: GSPT) is primed for a massive breakout!

#1 Enigmai’s Market Potential

#2 GSPT has great NEWS

#3 Golden Star Enterprises (OTC: GSPT) Chart Looks Amazing!

#4 GSPT has publicly revealed an amazing strategy for 2022!

Before we go over the top 4 reasons, let’s get acquainted with Golden Star Enterprises.

Company Name: Golden Star Enterprises

Ticker: GSPT

Exchange: OTC

Website: www.goldenstarenterprisesltd.com

Company Summary:

Golden Star Enterprises LTD is a publicly traded holding and acquisition company (OTC:GSPT) is a tech incubator that acquires startups and their latest acquisition of Enigmai, an Israeli tech company, is looking very promising.

Enigmai specializes in the Workforce Management space, as its new subsidiary. Enigmai was established in 2009 and developed a comprehensive workforce management system that enables large organizations to better manage their employees’ schedules and save money by providing a state-of-the-art management tool.

The Workforce Management (WFM) system is critical to any organization that manages employees’ shifts. It is even more critical since many people work remotely, with employees distributed between various locations including their home office. Enigma’s offering is holistic as it offers an end-to-end solution that integrates with existing systems used by BPOs, Business Process Outsourcing otherwise known as a call center.

[thrive_leads id=’10008′]

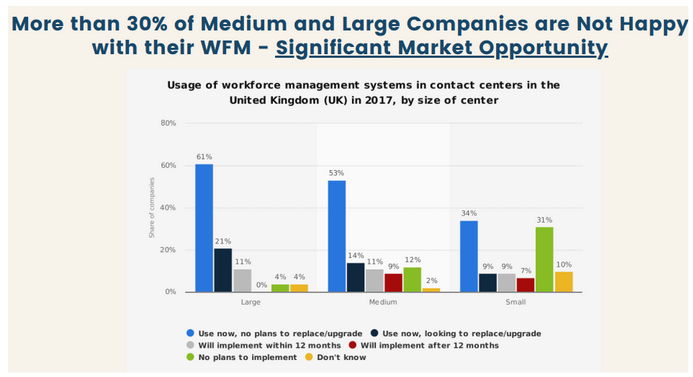

#1 Enigmai’s Market Potential

I am intimately knowledgeable about the true market potential for this software, because I worked for five years as a consultant to Contact Centers both for customer service and sales. The lack of dependable software to forecast labor initiatives is a real problem. There is a vacuum in the marketplace that Enigmai could tap into.

There are 60,850 contact centers (with over 10 seats) in North America with 3.3 million agent positions the North American Contact center industry is valued at $28 Billion per annum. Also, 30% of that ($8.4 billion) represents outsourced activity.

Almost one in ten Contact Centers are still using either pen and paper or whiteboards to schedule staff.

33% of the call centers are generating revenue less than 500 Million Dollars.In fact, five of the largest call centers in the US employs 40,000-47,000 employees! That is an incredible opportunity! Citation HERE

If Golden Star could just capture 10% of the market that is $2.8 BILLION in revenue which would place a conservative valuation, 5X, at $10 Billion. Even if they capture 1% of the market, thats a 1 BILLION dollar valuation!

#2 GSPT has great NEWS

Nov. 10, 2021 HERE

Announced that its wholly-owned subsidiary, Enigmai Ltd, has signed a Letter Of Intent (LOI) with National Organized Workers Union to pilot its Enigmai Business Suite (EBS) workforce management system (WFM) in hospitals.

That is a huge announcement, imagine when the revenue possibly starts pouring in and they release the financials in Q1?

Jan. 06, 2022 HERE

Updated shareholders with a summary of the fiscal year 2021 activities and plans for the coming year. 2021 was a transition year for Golden Star. That means, this could be a ground floor opportunity!

During the year, the Company focused on operations of its newly acquired Israel-based subsidiary, Enigmai Ltd., and investments in upgrades to its WorkForce Management (WFM) software product. Here are some of the activity highlights from fiscal 2021:

- Enigmai signed three-year contracts with its existing clients

- Enigmai was featured in a webinar in Israel, resulting in dozens of new client leads

- GSPT established an advisory board and nominated its first two advisory board members

- Enigmai commenced the upgrade of its WFM products’ user interface

- Enigmai signed a pilot program for its WFM with the city of Tel-Aviv

- Enigmai signed a contract with AuroraView, a US Based, customer-oriented software development and consulting company that offers products, solutions to take over software product support in Israel and North America

- Enigmai participated in a major trade conference in Israel, resulting in many additional client leads

- Enigmai signed a Letter of Intent to pilot its WFM software at some of Canada’s largest hospitals

- The Company retained PCAOB audit firm, Pinnacle Accountancy Group (DBA Heaton & Associates) to audit fiscal 2020 and 2021 operations in order to move a step closer to becoming a fully reporting issuer with the Securities and Exchange Commission, and potentially upgrade our listing to OTCmarkets: QB

Sept. 14, 2021 HERE

Announced that its wholly-owned subsidiary, Enigmai, has signed an agreement with AuroraView, a US Based, customer-oriented software development and consulting company that offers products, solutions, and value-added services.

I’m always looking for start up incubators that are pre-revenue but showing agreements that will produce revenue in the future. So, you don’t have to chase news and get in before the morning gap ups on news.

#3 Golden Star Enterprises (OTC: GSPT) Chart Looks Amazing!

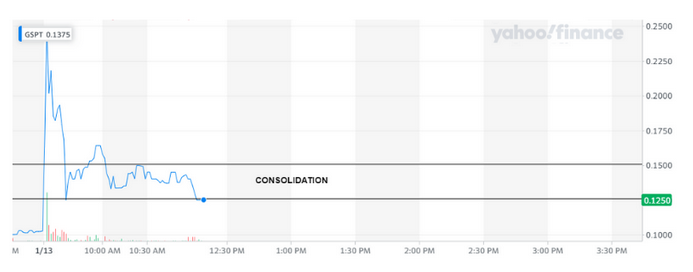

GSPT 5 Day Chart

Golden Star Enterprises 1 Day Chart

GSPT Technical Analysis:

Bottom play alert, can you say that again. More importantly, you can see a clear reversal of the bearish trend in the 5 day chart. Reversal #1 and #2 is clear as day. This is exciting.

The 1 day chart clearly shows after the trend reversal a pullback as early investors liquidate the amazing 150% gains! If you look at the 1 year chart you will see, time and time again, opportunities for 100%+ winners.

The stock is consolidating after the 150% run and is primed for a possible run. Put it on your watchlist today because GSPT might be ready to breakout to further highs soon.

#4 GSPT has publicly revealed an amazing strategy for 2022! HERE

We expect fiscal 2022 to bring the following additional accomplishments:

- Enigmai will complete the development of the upgraded front-end client for its WFM for initial installation with existing clients

- Enigmai will commence the WFM software pilot program with several hospitals in Canada

- Conclude 2021 and 2020 audit of our financial results, and complete a registration statement to become a fully reporting issuer with the SEC

- Commence development of the mobile application for Enigmai’s WFM software system

- Commence marketing and sales activities in North America

Let’s recap why GSPT could be, THE massive breakout of 2022!

#1 Enigmai’s Market Potential

#2 GSPT has great NEWS

#3 Golden Star Enterprises (OTC: GSPT) Chart Looks Amazing!

#4 GSPT has publicly revealed an amazing strategy for 2022!

It is a rare opportunity in this world to have this kind of investment opportunity. This company is operating in a tech sector that is exploding, has favorable news, the chart is keen for a massive move possibly and the 2022 outlook is fundamentally solid.

Happy Trading and remember, never try to catch a falling knife!

[thrive_leads id=’10008′]

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, GSPT. Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on January 18, 2021 to publicly disseminate information about (GSPT) via website and email. We have been compensated $5,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

Netlist NLST is ready to take off?

Netlist NLST is ready to take off is a loaded question and it depends on a few factors. However, before we get into the details of whether it can be profitable in 2022, let’s take a look at a quick overview to get you familiar.

Company Name: Netlist, Inc.

Ticker: NLST

Exchange: OTC

Website: www.netlist.com

Netlist NLST company summary:

Netlist provides high-performance solid state drives and modular memory solutions to enterprise customers in diverse industries. The Company’s NVMe™ SSDs in various capacities and form factors and the line of custom and specialty memory products bring industry-leading performance to server and storage appliance customers and cloud service providers.

Netlist licenses its portfolio of intellectual property including patents, in server memory, hybrid memory and storage class memory, to companies that implement Netlist’s technology.

Netlist NLST in the news:

In October 2021 the Court issued summary judgment in favor of Netlist and against Samsung for material breach of various obligations under the Joint Development and License Agreement (JDLA), which the parties executed in November 2015.

In the summary judgment Order, the Court also held that Netlist properly terminated the JDLA, a remedy which leaves Samsung without a license to Netlist’s patents. That ruling, however, limited the damages phase of the case to issues of direct damages. The case now moves to the post-trial phase over the next couple of months.

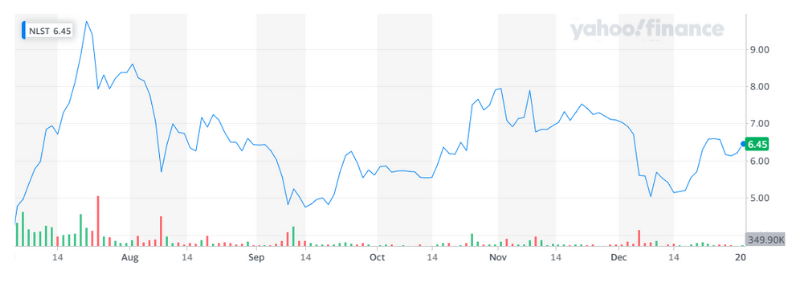

Netlist, Inc. 1 Month Chart

Netlist, Inc. 5 Day Chart

Netlist, Inc. NLST Technical Analysis

I like NLST if it can break $6.60 and maintain a consolidation pattern above that PPS.

It has reversed it’s bearish trend but it could be a head fake it has difficulty at the $6.60 PPS. Trade with stop losses.

IPO Alert: Crypto Darkhorse Wellfield (TSXV-WFLD) Goes Public

Company Snapshot

Company Name: WellfieldTicker: WFLD.VExchange: TSXVWebsite: https://wellfield.io/ (Crypto Experts, highly recommend, too granular for a typical investor)Investor Deck: Here (Crypto Experts, highly recommend, too granular for a typical investor)Industry: Blockchain – Decentralized FinanceCompany Summary:Wellfield Technologies develops hardcore technology and easy to use applications that give blockchain the power to unlock the future of finance. WFLD creates decentralized, open, transparent, inclusive, and cost-effective financial products and services. Wellfield brings decentralized finance (DeFi) to traditional finance.

Top FOUR Reasons Why WFLD could become a Juggernaut with Massive Upside!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

[thrive_leads id=’9849′]

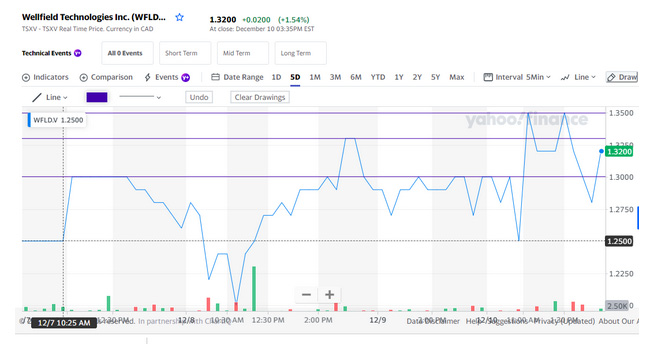

Before jumping into the main talking points, let’s look at the chart & a bird’s eye review on Wellfield.

CHART LOOKS GOOD!

Technical Summary:

Wellfield had an intraday swing from $1.20 to $1.33 representing a 10% gain! Furthermore, WFLD finished the day BULLISH! As you see the three lines, the first line is on 12/7 price action at $1.30 and then the second line is a NEW HIGH! The third line is, you guessed it, a new high! This chart is shaping up marvelously.

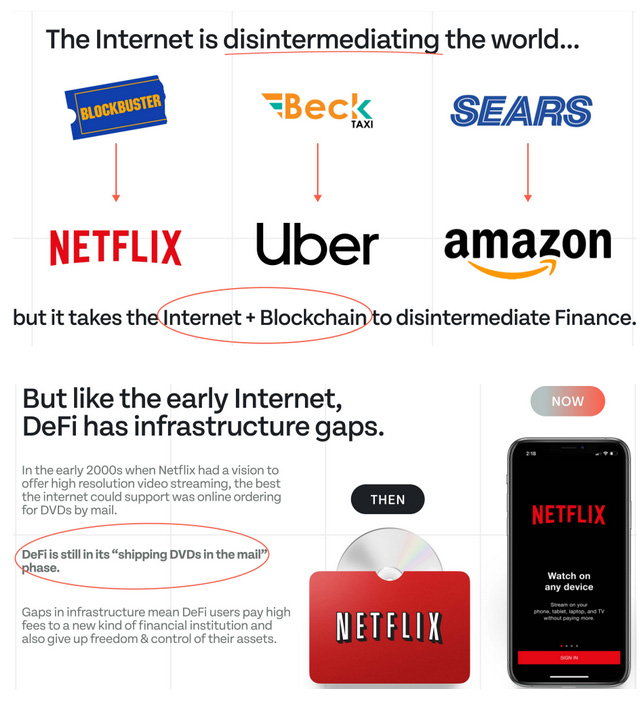

Bird’s Eye View of Wellfield:Before we take a look at Wellfield, let’s review the backbone, dare I say, the huge bet on a new disruptive global finance mechanism, blockchain. Most people, unless you’ve been living under a rock, have heard of blockchain or cryptocurrency, which trades on the blockchain.

Blockchain has the potential to disrupt global finance and change the way we do banking forever, but just like the internet in its early days, blockchain’s capacity and performance are currently limited and the applications built on it aren’t relevant to most people.

Wellfield has developed critical technology that increases blockchains potential and makes it relevant to our everyday financial lives, let’s take a look!

What the heck do they do?

This is difficult because it is the new frontier. Imagine, it is the 6th of August 1991 and someone is describing the internet, Google and smartphones; you would be lost! We will try to do our best to explain the true MASSIVE value of Wellfield. I’m going to follow the old adage, Keep It SImple Stupid, K.I.S.S.!

Wellfield does 2 things:

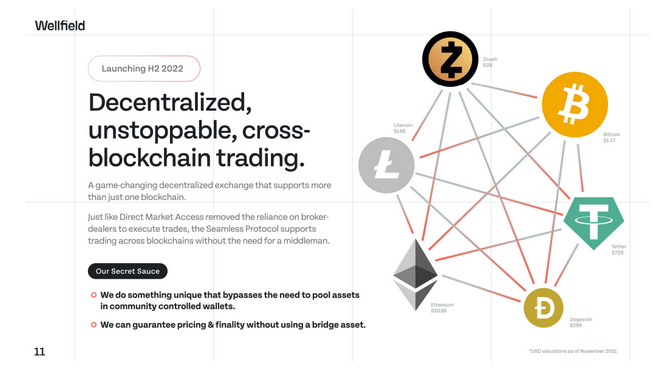

#1 Blockchain Applications (apps) – MoneyClip#2 Blockchain Protocols – Seamless

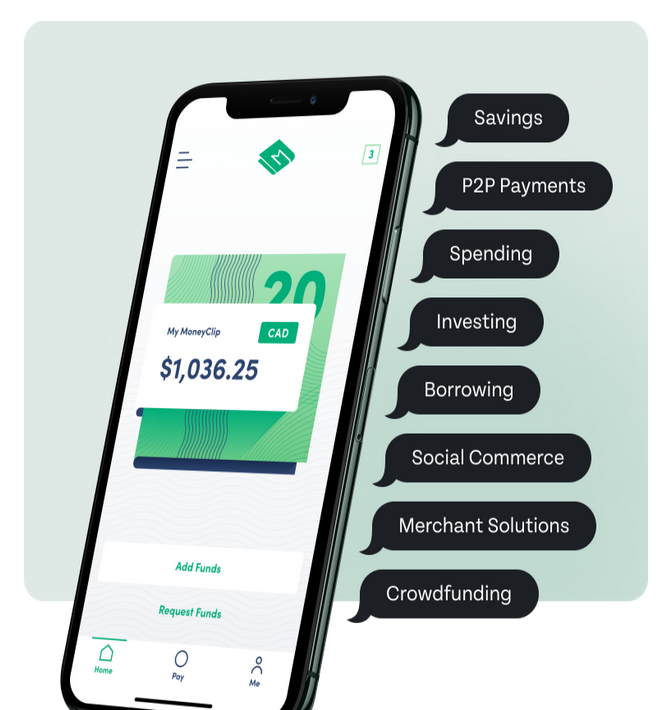

#1 Applications (apps) – MoneyClip

MoneyClip is truly the ultimate trading wallet, it links your bank to blockchain and gives you regulated access to the world’s best DeFi solutions.Above is the Wellfield jargon explanation to the power of their app. Although it is eloquent and chalked full of jargon, the real question is, what does all that mean?

We will do our best to explain their life-changing technology, but it is cutting edge technology that is over our head.

Here goes, nobody likes jumping from app to app, so we’re very excited about the all-in-one solution for savings, borrowing, merchant solutions, investing and so much more. It’s truly innovative even without the whole deregulation of crypto currency. So they go and develop this innovative application to operate on the blockchain so individuals and the government can’t be poking around in your business. It’s truly permissionless.

It’s kind of like, one app to rule them all. Sorry, for the Lord of the Rings reference, we couldn’t resist!

Their website is incredible, check it out here, maybe download it.

Top 3 reasons we love this App!#1 ControlThey promote “No hidden fees” or “recurring payments”, I don’t know about you but we’re big fans of that. #2 SimplicityYou can load digital cash on the go, make payments or send money from your phone, and easily request payments from individuals or groups. Earn high amounts on your balances without locking it into a GIC or buying an investment.#3 Privacy (our favorite)Well it’s not a conspiracy theory anymore, the governments around the world are tracking us. Moneyclip allows you to spend in person and online without leaving trails of personal data.

#2 Protocols (smart contracts) – Seamless

Wellfield touts that Seamless is “An ecosystem of protocols that removes the need for intermediaries.”

Well… Again, lots of sophisticated words by undoubtedly someone more intelligent than us, so we’re going to attempt to break down this cutting edge technology.

DeFi (Decentralized Finance) is not yet truly decentralized. Essentially, the whole mantra of crypto is built around decentralization. Meaning, we don’t want governments or five families to run the world banking system. So, crypto was born. Pretty cool in our opinion and many others agree with us, it’s the talk of the town!

Wellfield states, “With Seamless protocols, we accelerate the evolution of the internet”t” of money.

We read this to mean, the internet was built as a decentralizing and empowering technology creating a world where information and power is decentralized and delivered to the common person. That has not been actualized, but Seamless will speed up that reality.

- Top THREE selling points of Seamless are:1. Blockchain-agnostic2. Open3. Permissionless

#1 TAKEAWAYBy working with any blockchain, Seamless securely provides liquidity to the entire DeFi ecosystem.

Let us not forget about:

Security will be a cornerstone of Seamless.

The control and performance at scale will be unparalleled.

Seamless will be a truly decentralized protocol designed for DeFi services. Furthermore, it will be deployed on Ethereum for the global crypto community, as well as for MoneyClip users.

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

#1 Crypto & The Metaverse is the future, valued today at $3 TRILLION

The cryptocurrency market is now worth more than $3 trillion, that is a lot of 00000s.

“The little more than a decade old market for digital assets has already roughly quadrupled from its 2020 year-end value, as investors have gotten more comfortable with established tokens such as Bitcoin and networks like Ethereum and Solana continue to upgrade and attract new functionality. Excitement about the possibilities of decentralized finance and non-fungible tokens is growing, and memecoins like Dogecoin and Shiba Inu continue to attract attention.” Here

In case you have been under a rock, LOOK AT BITCOIN!

Crypto currency is positioning itself as the new currency of the future! Wellfield is building with Seamless the ability to monetize the possible Crypto takeover and be in a position to dominate the market!

#2 IPOs can be massive for tech US IPOS have already totaled $171 billion

Wellfield has a suite of technology and the resources to be a serious player in the blockchain ecosystem. But right now they’re pre-revenue and relatively unknown, trading on the TSX-V. As the market becomes aware of the company, and if they pursue a cross border listing, Wellfield can be a highly unique opportunity for the public markets. When will the us IPO launch?

“With more than six months until the year ends, U.S. initial public offerings have already totaled $171 billion, eclipsing the 2020 record of $168 billion, according to data from Dealogic.” Here

Wellfield just had an IPO on the TSX, the Canadian exchange, and now the question becomes when is the USA next?

#3 Wellfield understands the essence of crypto, DEREGULATION!

“”What Facebook is doing with meta…is a ‘fake metaverse,’ unless they actually have a real description as to how we can truly own it,” said Yat Siu, chairman and co-founder of Animoca Brands, an investor in and builder of metaverse platforms, speaking on a panel at the Reuters Next conference.” Here

The essence of crypto is disintermediation, freedom and taking back control and power from the banks and tech companies, hence the “fake metaverse” that Mr. Siu chastises Facebook for creating a BIG problem. Wellfield is a purist in the realm of the ideology of Defi, they are the opposite of META.

This will bodes well for them as they scale up, simply put, the backbone of crypto is built upon deregulation and they embody it.

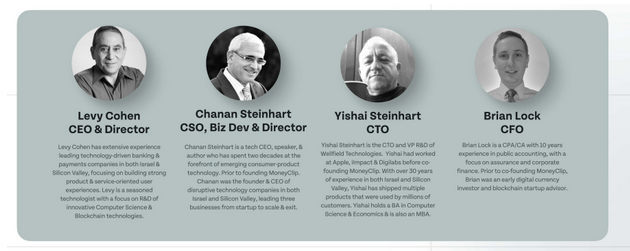

#4 Wellfield’s team is impressive

Wellfield’s Team is incredibly impressive with titans of silicon valley and finance.

“None of us is as smart as all of us.”

–Ken Blanchard

With that being said, take a look at the “us” in none of us is as smart as all of us!

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on WFLD (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, WFLD. Small Cap Exclusive has been hired by Civit Digital for a period beginning on December 17, 2021 to publicly disseminate information about (WFLD) via website and email. We have been compensated $37,870. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. WFLD is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

UPDATE:4 Reasons LGIQ Continues To Run Higher, Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

Here are 4 exciting reasons to stop what you are doing and read this short research article on Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

- Logiq’s News is explosive!

- They have an experienced leadership team

- The stock is Highly Undervalued

- The stock is ready for another possible big move!

Before we get into the those 4 exciting reasons to put LGIQ on your watchlist, let’s do a quick update on the news!

Jan. 27, 2022

Announced it has completed the transfer of its AppLogiq assets into Lovarra (OTC: LOVA), a fully reporting U.S. public company.

The transfer completes the previously announced separation of Logiq’s DataLogiq and AppLogiq businesses into two publicly traded companies. The AppLogiq assets include CreateApp™, an award-winning software-as-a-service (SaaS) platform that enables small and medium-sized businesses worldwide to easily create and deploy a native mobile app for their business. AppLogiq also includes platforms for mobile payments and delivery services designed for emerging markets, as well as licenses of its technologies to industry partners.

Jan 13, 2022

Preannounced Q4 revenues of $12.3 million, coming in well above our November estimate of $8.8 million. Although company did not give the breakdown between AppLogiq and DataLogiq, we believe both businesses had a strong quarter. For one, we know that DataLogiq had great results in providing Medicare sales leads and is even working to expand the sales leads business, investigating adding call center capabilities. In addition, the company announced it had achieved gross margins in excess of 34% for the quarter. These results show year over year revenue growth of 87% and a doubling of gross margin dollars.

For the year Logiq will report revenues of approximately $36.5 million a decline of 3.7% and a double of its gross margin to approximately 30.6% versus 16.8% in 2020. As a result we are raising 2021 numbers as well as 2022. For 2022 we are increasing to $44 million in sales while keeping the loss the same. We will revisit estimates when the financials for the spin out are released.

Nov. 08, 2021

Has been invited to present at the ROTH 10th Annual Technology Event being held virtually on November 17-18.

Logiq president, Brent Suen, scheduled to present and participate in one-on-one meetings with institutional analysts and investors at the conference.

Management will discuss the company’s recently announced plan to separate AppLogiq™ and DataLogiq™ into two publicly traded companies to capitalize on their respective growth opportunities in the rapidly evolving global e-commerce and fintech landscape.

Preannounced Q4 revenues of $12.3 million, Now, That Is Incredible News!

Company Name: Logiq

Ticker: {NEO: LGIQ} (OTCQX: LGIQ)

Company Summary: Let’s start with the fancy jargon, “Logiq is a global provider of marketing solutions for Ecommerce, m-commerce (mobile commerce), and fintech solutions.”

Now let us break down in layman terms what all of that mumbo jumbo really means.

Logiq is BIG, really big, in fact they are reaching into the WORLD market. They are in ASIA, In North America and everywhere in between.

They offer solutions to small and medium sized companies who are trying to sell you something online. For example, all those advertisements following you around Facebook, Instagram and even news articles, that is Logiq and their competitors.

M-commerce (mobile commerce) is a fancy term for an app (application) on your phone (mobile) that gives the user the ability to make a small business website on their phone! Yes you can make a full website on your phone in the waiting room of your doctor’s office. Pretty cool!

Fintech Solutions, the “Fin” in Fintech stands for financial. The “tech” in Fintech stands for technology. So, they offer solutions in the financial sector via technology.

Logiq has all the right building blocks for an explosive play! TAKE A LOOK NOW!

There are 4 Key Units Driving Logiq’s Impressive Financial Numbers!

Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ), operates four key units:

1. DataLogiq – Here comes the Jargon, “is designed for ad generation and Ecommerce marketing solution” Ok, ad generation is found below, it is found on sports illustrated and is an ad

This ad is following me around because my dog is a jack A$# that doesnt listen and I’ve been searching for services and products so I don’t murder him. So the advertisement found above, understands that I have a jerk for a dog and will continue to show me things to buy.

E-commerce, means any attempt to buy and sell goods or services (commerce) online (e). Any platform that is found online, including websites (native) & Facebook (social media) that has an advertisement on it, is considered an e-commerce platform.

DataLogiq is a technology that allows small to medium size businesses to gain access to data (statistics) to help decide what platform (facebook) to run advertisements on to capture conversions (a purchase).

2. AppLogiq – which is a platform-as-a-service (PaaS) solution for SMBs to deploy native mobile apps for their businesses that come complete with mobile payments.

Wowzers, that is a lot of fancy words! PaaS platform as a service is fancy talk for an app (platform) as a service, self explanatory, the app offers a service.

Example, if you know a millennial, they have photo editing applications on their phone, so they can look completely different on instagram, LOL. The app (platform), offers a service (photo editing).

The service that AppLogiq offers is the ability to build a website on your phone with the AppLogiq app. It comes complete with the ability to accept payment right from your very own small business website built with your smartphone.

3. Fixel – delivers AI-driven engagement segmentation by analyzing user interactions on a company’s website, fixel learns consumer behavior and then delivers the data the company needs to create valuable audiences.

Let me break that down for you, when a person goes to a website they use a tracking pixel, similar to a jealous husband that puts a GPS tracker in his wife’s car.

The company, like the jealous husband, can follow your patterns of buying things. This information is then run through artificial intelligence to create audiences (larger groups) based on the data.

Best example, the more you use Netflix, the more the (AI) can predict what you will WANT to watch next. Yes it can sound creepy but it is also very convenient.

So they can market to more people just like that user. Hence, more data, more efficiency and more buyers.

4. Pay&GoLogiq – this unit handles credit and payment points, payments using QR codes, and powers the company’s AtoZ Go food delivery service.

This one is written in almost common language. Here is a little more clarification, all ecommerce stores need to process payments via credit card on their website, Logiq offers that solution.

FOUR Exciting reasons to stop what you are doing and read this short research article on Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ)

The News is explosive!

Oct. 12, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include Semcasting’s advanced consumer and B2B title targeting capabilities.

Commonly referred to as data onboarding, Semcasting’s solution will allow LDM clients to easily take their offline customer data, including in-store receipts or home addresses, and translate it into targetable data for online marketing.

Sept. 23, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include geofencing-based targeting.

Unlike traditional geotargeting that restricts digital ads to audiences in a particular zip code, city, state, or country, geofencing is a custom-defined area that can outline the boundaries around a particular store, mall, or other physical venues. The technology enables geofencing by using the latitude and longitude coordinates of a consumer digital device, such as a connected TV, smartphone, tablet or PC, to determine their location.

Sept. 13, 2021 Logiq creates a partnership that creates an avenue to bring digital wallet and payment services to 50 million Indonesians. Mobiquity Pay, one of the world’s largest digital wallets from Comviva, will now power Logiq’s (NEO-LGIQ) (OTCQX-LGIQ) PayLogic digital wallet in the country.

On June 21 2021, Logiq (NEO-LGIQ) (OTCQX-LGIQ) announced the closing of its IPO offering of 1,976,434 units of securities in Canada at C$3.00 for gross proceeds of C$5.9 million and began trading in Canada on the NEO exchange to expand its reach up north.

The Asia-Pacific region is one of the fastest growing in the world and Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is focusing efforts there as a result of the huge opportunities it presents for the company. On July 21, 2021, the company expanded its Logiq (NEO-LGIQ) (OTCQX-LGIQ) digital marketing platform to include direct-media buying across the APAC region.

Experienced Leadership

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

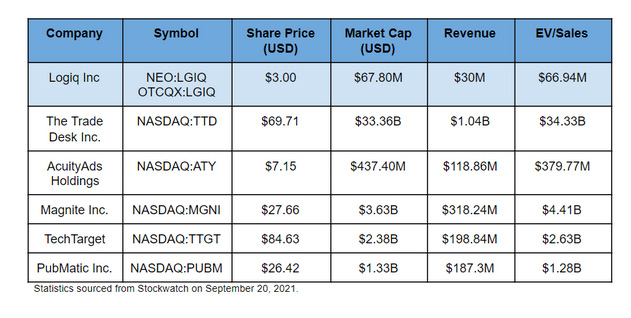

The stock is Highly Undervalued!

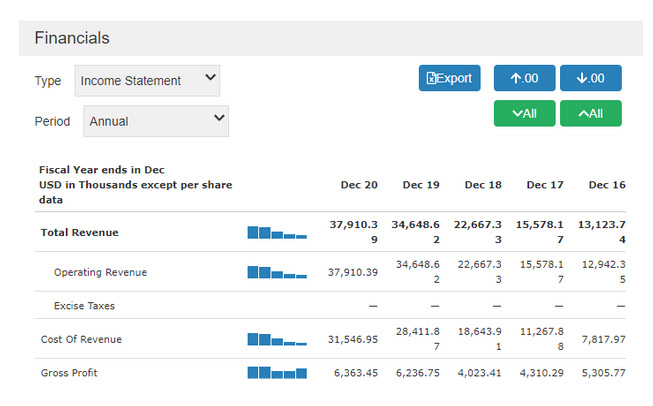

You get a better idea of how impressive the consistent, continued growth is by looking at the growth in the chart below over the last 5 years!

Growing at a CAGR (Compound Annual Growth Rate) of 31% from 2016 to 2020, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is growing fast. Company leaders are now expecting 31% gross margins and revenues between $34-38 million by the end of 2021.

As you can see from the prices above, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) has a lot of room to grow when it comes to price – and with word now starting to get out about this previously under-the-radar company that growth could come quickly.

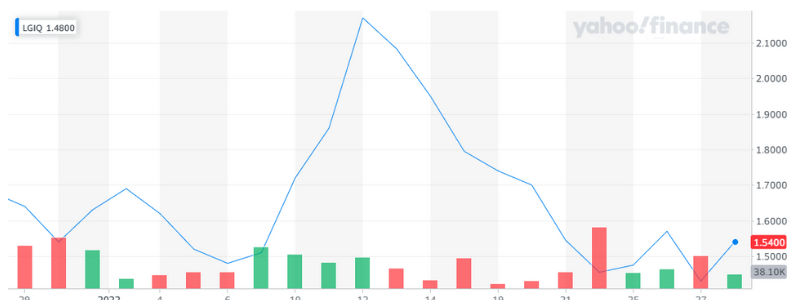

The stock is ready for another possible BIG MOVE!

As you can see below this stock has the ability to make some serious moves. In less than four trading days this stock went from $1.45 to over $2.17 yielding 50% gains. More importantly, the stock created a very stable and methodical climb to a whopping 50% GAINS in FOUR trading days! If you had $10,000 invested in about 4 days you could have made $5,000!!!

As one can see from the 1 month chart below, the stock has consolidated and is ready for a possible large run AGAIN.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Logiq should be on your watchlist because of the massive opportunity it has in a very accessible market because:

- The News is explosive

2. Experienced Leadership

3. The stock is Highly Undervalued

4. The stock is possibly ready for another big move!

Happy Trading and remember, never try to catch a falling knife!

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, LGIQ. Small Cap Exclusive has been hired by Civit Digital for a period beginning on October 29, 2021 and by Emerging Markets Consulting for a period beginning October 29, 2021 to publicly disseminate information about (LGIQ) via website and email. We have been compensated $35,000 USD by Civit Digital and $27,500 USD by Emerging Markets Consulting. We will update any changes to our compensation.

Read full disclaimer here.

All Eyes on FACT (OTC-FCTI) – The Only Company Fighting This $6 Billion Fraud Market Just Went Public

The Devil is in the details and this IPO is a Tech Company that examines a multibillion-dollar industry on the microscopic level! What does this company actually do? F.A.C.T, (OTC-FCTI) is the ONLY PORTABLE SOLUTION ON THE MARKET that uses technology to create a “Digital Fingerprints” from the Physical Artwork for Verification and Condition Reporting. Why is this technology so exciting for investors? The art fraud market is estimated by the FBI to be a $6B industry! FACT has positioned itself, with the above mentioned technology, to possibly be the dominant force in the art fraud prevention vertical, which is again a $6B industry. Who are their competitors? The first two questions ask, what do they do and how big is the market. The final question is, who will they be competing with to possibly gain control of this $6B a year industry? Their competition is “art experts” who verify paintings with the naked eye! This process is archaic and ripe with fraud and FACT has made it their mission to solve this dilemma via cutting-edge technology.

6 Reasons why F.A.C.T,(OTC-FCTI) Forensic Art Certification Technology is the IPO to watch and that is a FACT!

1. Numbers don’t lie, and the potential profit is possibly explosive!

I literally did about 20 minutes of research and my jaw hit the floor! It is rare to find a market that is worth so much internationally so antiquated in technology! Furthermore, to find the same industry boasting $6B in annual sales is when the hairs on the back of my neck stood up at attention like a WW2 soldier. Take a look at this quote from Statista.com, “This increase is also shown in the volume of global art sales which reached approximately 40 million transactions in 2018” LINK I rubbed my eyes and thought, 40 million transactions?!?! If FACT was just to capture 10% of the market share, which is possibly silly when you consider how far superior their technology in comparison to their competition, that’s $6B! So, if they capture 10% of a 40,000,000 transactions would equal 4,000,000 transactions! What could the revenue look like for (OTC-FCTI) if they were able to capture 10%? Here is a local “art expert” that reviews the piece with his/her naked eye and charges $150, with no technology! LINK 4,000,000 authenticating transactions X $150 = $600,000,000! Annually Their competition is a local “art expert” who evaluates the art with their naked eye and then authenticates the art with a piece of paper called a COA. That is it! Imagine if there was a machine that uses a computer algorithm to verify authenticity down to a size smaller than a grain of sand?!?! Well there is and we are excited. Is that worth $150, $300 or $600?!?! Will they penetrate 10%, 15% or 20% of the market? Let’s be honest, even in the worst case scenario, that is $600 Million US Dollars annually!

2. FACT has developed/redesignated a technology that is truly pioneering in the art authentication industry.

F.A.C.T, (OTC: FCTI), Secured Device is the ONLY PORTABLE SOLUTION ON THE MARKET that uses technology to create a “Digital Fingerprints” from the Physical Artwork for Verification and Condition Reporting. They have adapted the same forensic ballistics technology used by global law enforcement agencies to the art world! An “interferometer’ – a high tech machine – captures a scan of the painting down to 1/50th the size of a human hair. Right down to the pressure on an artist’s brush stroke! Current scans are compared to previous scans by a high tech computer generated algorithm to make sure that it is the same painting! This creates a Tangible Links between the Owner, Artwork and Database Record through Identification of a “Digital Fingerprint” from the Scans. LINK (Investor Deck on the website). I apologize for typing in caps above but that is an especially important concept that the average investor needs to play close attention. The current industry standard is “art experts” certifying with their naked eye that it’s the original, with their naked eye, with the possibility of Millions of dollars on the line. This archaic method lends itself to fraud because technology has outpaced the human eye. The art fraud market is estimated by the FBI to be a $6B industry! In fact, an expert in the field, 9Mousai founder, Richard Hammond, offers some advice: “A certificate of authenticity is essential when buying and selling art to prove legitimacy,” he reveals. “The certificate must be signed by the artists or a representative or it isn’t worth the paper it’s printed on, and there are fakes around, so beware.” LINK Let me repeat, there are fakes around, not anymore. FACT will literally revolutionize the art authenticating landscape forever. Investors are you excited? Everyone is excited for this IPO, except for art criminals, they are petrified!

3. Its groundbreaking technology is positioned in a $6B industry with no market leaders!

What other $10B+ industry has no clear-cut industry titan that dominates it, none that I can think of. This technology will become the gold standard of the art verification world and that world is worth $6B! No other verification system uses technology and the actual painting! For comparison purposes, the online dating industry is a $3 billion dollar a year industry! LINK Let’s take a minute to digest that research. In the example above, if FACT can capture 15% of the market at a $600 service fee, they will produce revenue in excess of $3 BILLION! However, there is no Ok Cupid in the space! No Bumble! No Tinder! Just a vacuum of opportunity with no competitors! A bunch of Ma and Pa stores before the advent of Walmart.

4. It’s an IPO with groundbreaking technology in a $6B industry with no market leader. Yes I repeated myself, because you should pay attention!

It’s an IPO, ground floor opportunity in a brand-new technology in a multibillion-dollar industry. I could do the easy lay up here and compare it to all the crazy IPOS which had 300%, 800%, and 1,200% gains but that is just too easy! As savvy investors we have heard all those war stories and for me that would feel like I lost a little bit of my soul by going somewhere so transparent. So, I will keep this point short and sweet and remind you for a third time, it’s an IPO with groundbreaking technology in a $6B industry with no market leader!

5. Do I have your attention now? If I don’t, I will when you find out that they have multiple ways to monetize the hardware and software!

FINANCIAL INSTITUTIONS Art-secured lenders who accept art as loan collateral can verify whether that art is an original or a forgery. If a bank is loaning a couple of hundreds of thousands of dollars I’m sure that institution will have no problem paying for authentication to protect their investment. Last year over $24B in loans were secured by art! Or, even better yet, they make it mandatory, kind of like a Car FAX is mandatory today for used car purchases! AUCTION HOUSES Companies like Christie’s and Sotheby’s can verify the legitimacy of a piece before putting it up for sale. The top auction houses had over $24.2B in sales last year! Once one of the big auction houses makes it mandatory, every other auction house will probably follow suit! MUSEUMS & GALLERIES Art organizations can collect data to manage their portfolio and verify the legitimacy of their collections. Galleries had over $38.6B in sales last year! I would imagine that insurance companies will make this technology standard operating procedures before they will even insure a museum or gallery. ART INSURERS Fraud prevention departments can ensure the legitimacy of insured works to decrease unlawful payouts. Insurance is anywhere from 1% to 7% of the value of the painting. Again, similar to auction houses, once one major insurance provider makes it mandatory, the whole market will probably follow. ART TRANSPORTATION & STORAGE Companies can ensure transferred assets are legitimate and prove lack of quality loss upon delivery. Over 14MM pieces of art are moved annually! FACT also offers RFID chips to monitor the art as it is displayed or in transit! GPS tracking and block chain technology has arrived in the industry that started millennia ago in Europe. INDIVIDUAL COLLECTORS Art enthusiasts scan originals before lending them to museums and galleries to ensure they get the original back later. They can also track and manage their collections securely stored on blockchain! The best way to possibly protect your investment for generations to come, to authenticate the valuable art with the most sophisticated technology in the industry

6. FACT would just be a Tech Company if it wasn’t for these incredible assets, now they are a force to be reckoned with in the art verification industry!

The executive team is impressive! Patricia Trompeter, CFO & COO, brags pedigree hailing from the monster GE Capital! Ardavan brings an extremely critical component to the executive team, art industry expertise! He has decades of experience in the Forensic Art Certification industry. Michael Arbach, CIO, has written code that has Billion of dollars of transaction in the securities market, as in, trading stocks! Can I it gets any better? Yes, Jeff Felske, Co-Founder was an executive at Disney, if I had a microphone, I would drop it!

Patricia TrompeterCFO & COO Patricia spent 15+ years in the financial services industry with GE Capital. She held several positions in various divisions including CFO, Controller, Operations Leader, and M&A. After a short break to focus on philanthropic opportunities and family, Patricia founded Webbs Hill Partners. She holds a B.Sc. in Finance/Economics and Management Information Systems from Marquette University. Ardavan TajbakhshCo-Founder & CTO Ardavan holds a B.Sc. in Mathematics & Computer Science from Canada’s Capital University, where he was hired as a Senior Programmer Analyst after graduation. When he ended his career there, he was the Enterprise Architect for the University’s Enterprise Technology Infrastructure. He left this position to become the Solution Architect for ALIAS, before becoming the Vice- President and Chief Technology Officer at Pyramidal Technologies Ltd. He brings his decades of experience to the Forensic Art Certification Technology team. Jeff FelskeCo-Founder Jeff started his career as the national sales manager at Disney Canada. After developing his skills, he became the V.P. of sales for Lyons Group and In 1995, Jeff transitioned again becoming a V.P. and partner of GTS acquisitions. It was here that Jeff applied his unique skills and entrepreneurial passion, to open Target Marketing Group. He exclusively represented many A-list video game developers. Jeff then shifted his focus to funding and guiding the creation of ALIAS, which he now brings to F.A.C.T. Michael ArbachCIO Michael is a business-oriented software engineer with a proven 17 year track record building high performance solutions for top tier companies using emerging technologies. Code produced by Michael has processed billions of dollars in securities transactions. Today some of the largest banks and organizations in the U.S. rely on his software to power millions of users across various applications. He is an early blockchain enthusiast, developer, and investor. Michael holds degrees in Applied Mathematics and Computer Science. He is fluent in four languages and enjoys flying small airplanes. As a quick recap, these are the 6 reasons you want to place (OTC-FCTI) on your watchlist today!

- Numbers do not lie, 40 million art transactions in 2018!

- A.C.T Secured Device is the ONLY PORTABLE SOLUTION ON THE MARKET UTILIZING “Digital Fingerprints” oh and it is a $6B a year industry!

- What other $10B+ industry has no clear-cut industry titan that dominates it, not online dating apps which is a $3B a year industry. This technology will become the Gold Standard of the art verification world!

- It is an IPO, enough said!

- There are 6 ways to monetize this technology, I do not even think dating apps have that many revenue streams!

- The Executive team boasts GE Capital, Disney, and billions of transactions in the securities market!

Happy Trading, laptop drop!

Disclaimer :Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Owner of JBN partners purchased Shares of FCTI in September on the open market and does plan to sell those shares within the next 90 days. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, FACT, Inc. Small Cap Exclusive has been hired by FACT, Inc. for a period beginning on November 13, 2020 to publicly disseminate information about (TNCP) via website and email. We have been compensated $22,000. We will update any changes to our compensation.

Read full disclaimer here.

Medivolve Inc. (OTC-COPRF, NEO-MEDV) is Possibly Ready for a Big Move

Medivolve Inc. (OTC-COPRF, NEO-MEDV) is possibly ready for a big move, traders place this on your watchlist immediately!

Here are SIX reasons why Medivolve is just warming up!

- The chart is potentially very promising.

- The Testing Network is established and nation-wide.

- Covid is here to stay!

- Recent press releases are incredible!

- Medivolve (COPRF/MEDV) is poised to be a major disrupter of medical services due to their low CPA (Cost Per Acquisition).

- A leader is a dealer in hope and the leadership team embodies hope for traders!

Company Name: Medivolve, Inc.

Ticker: (OTC-COPRF, NEO-MEDV)

52 Week High: $.67

Current Trading Price: $.32

Market Trend: Bullish

Company Summary: Medivolve, Inc. has a substantial collection of leased sites for COVID-19 testing, offering convenient access to rapid antibody and antigen tests; these tests take 8-10 minutes to administer, provide results in less than 24 hours and cost under $100 along with standard PCR tests. The company is expanding into tele-health and tele-diagnostics which they intend to capture a significant market share through their impressive CPA model for obtaining new clients, where they can disrupt the medical service industry with hundreds of convenient walk up locations rather than the traditional come and wait in a Covid-19 saturated doctors lobby for your hour late appointment.

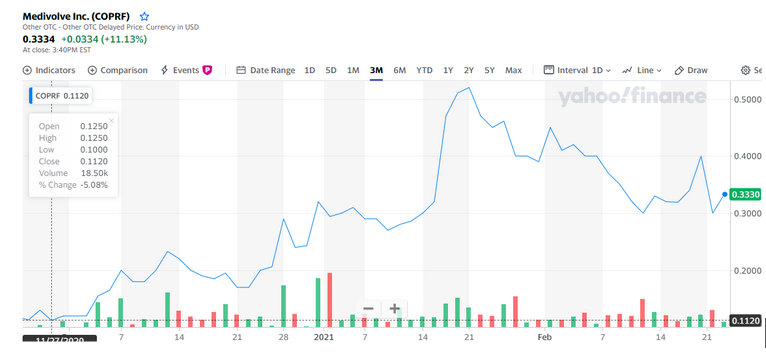

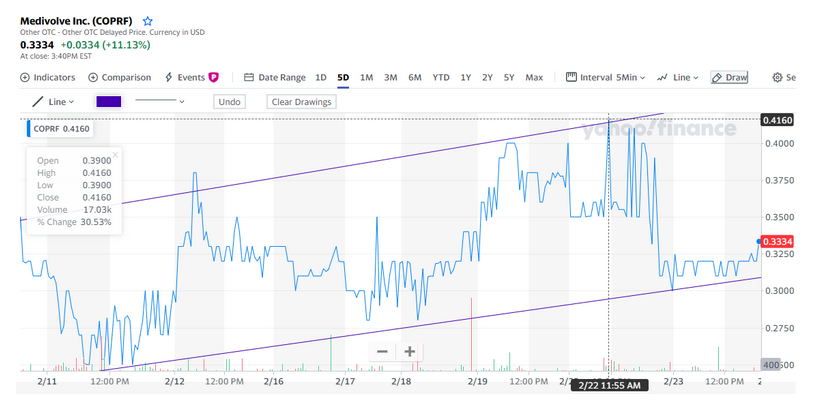

The chart is potentially very promising!

February 04, 2021

In order to maximize operational efficiency, Collection Sites is conducting a state by state expansion where possible. The new sites are currently located on the properties of Simon’s Property Group, an investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company as well as Sandor Development Group. Additional sites are expected to be open in Texas, Florida, and Georgia within the coming weeks.

November 11th – Collection Sites Announces Agreement to Offer COVID-19 Testing Services and Protocols for The Elf On The Shelf’s Magical Holiday Journey

November 17th – QuestCap Announces Planned Name Change to Medivolve Along With Transition to Single Purpose Medical Company

December 1 – Collection Sites Expands Convenient COVID-19 Testing Across America with 25 Additional Testing Sites

January 5th 2021 – Medivolve (COPRF/MEDV) announces a C$5M bought deal private placement led by Canaccord Genuity.

Medivolve entered into an agreement with Canaccord Genuity Corp., on behalf of a syndicate of underwriters (collectively the “Underwriters”), pursuant to which the Underwriters have agreed to purchase on a bought deal private placement basis, 20,000,000 units of the Company (“Units”) at a price of C$0.25 per Unit (the “Issue Price”), for aggregate gross proceeds of C$5,000,000

The press releases over the last three months have garnered serious attention by Wall Street, take a look at this CHART.

The chart above is potentially very promising with some serious consolidation taking place over the last month. Out of the first 34 volume bars on this chart 24 are green, closing positive for the day, which represents 71% positive days. Hence, the stock reacted with an ascending, bullish, chart line.

The run started on 11/27/2020 at a price per share of $.125 and due to those “buying” days it reached a high of $.60 on 1/20/21 which represents a 380% gain over the specified period.

Now let’s look at the consolidation that took place after the amazing run of 380% gains, there were 22 volume bars after the run to $.60 with 13 representing a sell off day, 60%, hence the traders who were happy with their gains from the run exited their positions. This is consolidation, which creates a prime environment for another massive possible price increase due to the lack of sellers creating downward pressure.

In short, many people bought the COPRF/MEDV on the two month run to $.50-$.60 then sellers started to exit their positions creating downward pressure resulting in the share price falling from the high of $.60 down to $.33. Moreover, $.33 still represents a 164% gain from the November price of $.125 which reveals this stock could be primed for another move holding a much higher main trend line than November!

This channel is poised for a possible major breakout!

Let’s review the 5 day chart and one can see the channel-line, top line, and the main trend, bottom line, is a perfect set up for a possible strong run. What does that mean? A bullish channel traditionally signals technical traders to watch or buy a stock based on the ascending main trend line and the corresponding channel-line.

The Testing Network is established and nation-wide!

Medivolve has signed with a major multi-billion dollar premium mall operator to set up these Collection Sites COVID-19 testing centers to offer convenient access to rapid antibody and antigen tests – which take 8-10 minutes to administer and provide results in less than 24 hours. The sites also offer regular RT-PCR. The testing centres are powered by Alcala Testing and Analysis Services, a CLIA-licensed laboratory based in San Diego, California.

All tests can be administered with insurance coverage options. The tests results can be communicated via text or email and can be accompanied with a certificate of good health via a HIPAA-compliant smartphone application.

Medivolve (COPRF/MEDV) issues Huge News in regards to strategic partners, who will be next?

Covid is here to stay!

Feb 3rd, just a few weeks ago, had the third largest amount of cases of Covid-19 in the United States.

Think about this, they made $7.1M in just January and that was just a few months of the company being in business! What will Q2 look like?

During the month of January, the Company realized the sale of 73,973 COVID-19 tests at an average sale price of $96 per test across it’s expanding network. Approximately 52% of the sales were cash pay, with the balance as insurance sales. The Company continued to see the strongest demand for antigen tests, followed by antibody and then PCR.

So, the question is, how long will Covid testing be a viable source of income?

The answer: Covid is unfortunately here to stay!

Let’s look at the latest numbers: Are we going up? Are we holding the average? Or going down?

Almost 71,000 new cases of COVID-19 were reported in the United States on February 22, 2021.

If those numbers hold true, there will be 2,130,000 new cases (71,000 X 30 days) that have to be tested to be confirmed. Let’s look at the last 13 months to see if the Feb 22 numbers are going up, holding the average or going down.

Between January 20, 2020 and February 22, 2021 there have been almost 28 million confirmed cases of COVID-19 which means that the monthly average is 2,153,000 (28 million / 13 months) which is almost exactly at the projected average derived from the Feb 22 numbers, which means we are 100% still in the grips of this deadly virus.

Recent press releases are incredible!

February 4, 2021

Sales of 73,973 Tests at $96 , that is over $7M in just January!