UPDATE 2/4/25 at 12:50 est.

Quantum BioPharma (QNTM) Soars Following Positive Unbuzzd™ Trial Results: Stock Up Nearly 80%

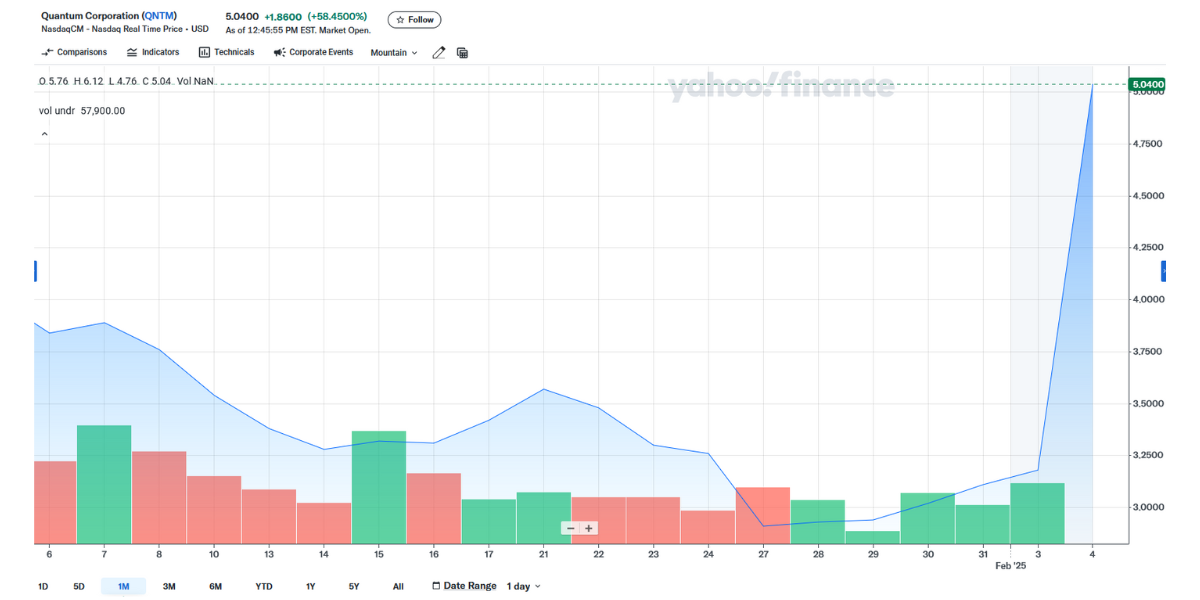

Quantum BioPharma (NASDAQ: QNTM) saw an explosive surge in its stock price after announcing positive results from its clinical trial of Unbuzzd™, a dietary supplement that accelerates alcohol metabolism and alleviates intoxication and hangover symptoms. Shares spiked 62.3% in early Tuesday trading, with a nearly 80% increase, reaching $5.71, according to Benzinga Pro. This surge is a direct result of the market’s enthusiastic response to the trial, which demonstrated statistically significant improvements in reducing blood alcohol concentration (BAC) and alleviating intoxication symptoms.

The clinical trial results revealed rapid improvements in alertness, reduction of alcohol impairment, and significant hangover relief. With no reported side effects, Unbuzzd™ is positioned as a revolutionary product for those seeking to mitigate the adverse effects of alcohol.

However, investors should remain cautious. Quantum BioPharma’s stock, with a market cap of approximately $6 million and only 1.83 million shares available for public trading, remains a speculative micro-cap investment. As a result, the stock is highly susceptible to volatility and large price fluctuations.

Despite the volatility, the strong market response to the Unbuzzd™ clinical trial results is fueling investor optimism, leading to significant stock gains. Investors should stay alert to potential market swings as Quantum BioPharma continues to capitalize on this breakthrough in alcohol metabolism and consumer health.

ORIGINAL ARTICLE Posted 2/3/25

Quantum BioPharma Ltd. (OTC: QNTM) is making waves in both the biopharmaceutical and financial sectors. With a court date set to classify Dr. Raza Bokhari as a vexatious litigant, the company is looking to put past legal distractions behind it and focus on its aggressive growth strategy. At the same time, QNTM has successfully dual-listed on Upstream, signaling an expansion into blockchain-powered trading. Adding even more fuel to its momentum, the company has diversified its treasury by purchasing $1 million in Bitcoin and other cryptocurrencies, positioning itself at the intersection of biotech and digital finance.

With these bold moves, Quantum BioPharma is proving itself as an innovative force in the biopharma industry. But what really makes QNTM a potential breakout stock in 2025? Let’s break down the six key catalysts that could drive substantial upside for investors.

1. Major Legal Battle Could Clear the Path Forward

The ongoing litigation against Dr. Raza Bokhari is a critical moment for the company. If the court grants QNTM’s request to label him as a vexatious litigant, it could deter future legal entanglements and allow the company to focus entirely on its growth and innovation.

2. Dual Listing on Upstream Unlocks Global Investor Interest

Quantum BioPharma’s recent approval for dual listing on Upstream (a blockchain-powered securities exchange) enhances its visibility and accessibility to international investors. This move is expected to improve stock liquidity and attract fresh capital inflows.

3. Strong Financial Position with Cryptocurrency Diversification

In a bold strategic move, QNTM has diversified its treasury by purchasing $1,000,000 in Bitcoin and other cryptocurrencies. This not only signals confidence in digital assets but also positions the company for potential blockchain-based transactions and financing in the future.

4. Progress in Clinical Trials for Lucid-21-302 (Lucid-MS)

QNTM’s pipeline continues to advance, with its Safety Review Committee recommending the commencement of dosing for the second cohort in its Phase 1 Multiple Ascending Dose clinical trial for Lucid-21-302. This progress keeps the company on track to develop new treatments for neurodegenerative diseases.

5. Strategic Private Placement to Fuel Growth

Quantum BioPharma has secured a non-brokered private placement of convertible debenture units, raising up to $5 million in funding. This capital will help accelerate clinical trials, expand operations, and secure additional strategic partnerships.

6. Potential Windfall from $700M+ Lawsuit Against Major Banks

QNTM has an ongoing $700 million lawsuit against CIBC, RBC, and other financial institutions for alleged stock price manipulation. If successful, this legal battle could result in substantial financial gains for the company, further strengthening its position in the market.

Now lets take a deeper dive into QNTM

1. Expanding Drug Pipeline in Precision Medicine

Quantum BioPharma is aggressively advancing its flagship candidate, Lucid-21-302 (Lucid-MS), through Phase 1 clinical trials. This novel treatment, aimed at tackling multiple sclerosis (MS), has already passed a major milestone, with the Safety Review Committee recommending the commencement of dosing for the second cohort.

The MS treatment market is expected to reach $39 billion by 2030, fueled by growing diagnoses and demand for innovative therapies. If Lucid-21-302 continues to demonstrate safety and efficacy, QNTM could tap into a multi-billion-dollar opportunity, making it an attractive prospect for investors looking for exposure to high-growth biotech plays.

2. Strategic Treasury Diversification In a move that sets it apart from traditional biotech firms, QNTM has allocated $1 million into Bitcoin (BTC) and other cryptocurrencies. This decision serves multiple strategic purposes:

Attracting Institutional & Retail Crypto Investors: This strategic move broadens QNTM’s investor appeal, potentially increasing demand for its stock as more institutional players seek exposure to firms leveraging blockchain-based financial strategies.

Hedging Against Inflation & Currency Fluctuations: By holding decentralized assets, QNTM safeguards its treasury against fiat currency devaluation and macroeconomic uncertainties.

Expanding Financing & Transaction Capabilities: The integration of crypto into financial operations positions QNTM at the forefront of modern financial innovation, enabling transactions and funding mechanisms that appeal to a tech-savvy, globally diverse investor base.

3. Dual Listing on Upstream Expands Investor Access

QNTM’s recent approval for dual listing on Upstream, a next-generation trading platform, opens the door for international investors. This listing provides several advantages:

- Increased liquidity through access to a global audience

- Enhanced transparency and investor confidence via blockchain-based trading

- Potential exposure to digital asset-friendly investors, aligning with QNTM’s crypto initiatives

As more retail investors explore alternative markets, QNTM’s presence on Upstream could lead to higher trading volumes and price appreciation.

4. Growing Industry Tailwinds Favo4. Growing Industry Tailwinds Favor Biopharma Innovation

The global biopharmaceutical market is undergoing a seismic shift, projected to surge from $600 billion in 2022 to $1.2 trillion by 2030. This unprecedented growth is fueled by multiple factors that create a fertile environment for companies like Quantum BioPharma Ltd. (OTC: QNTM) to thrive:

- Rising Prevalence of Chronic Diseases – With an aging global population and increasing incidences of neurodegenerative disorders, autoimmune diseases, and cancer, the demand for innovative biopharmaceutical solutions has never been higher. Treatments that address these pressing medical needs are poised for widespread adoption and significant revenue potential.

- Government-Backed Drug Innovation – Public sector investment continues to drive drug discovery and development. The National Cancer Institute alone allocates $1.5 billion annually toward research, and broader government initiatives—such as the NIH’s $45 billion annual budget—provide sustained funding for biotech advancements. This influx of capital accelerates clinical trials, regulatory approvals, and market adoption.

- Precision Medicine & Targeted Therapies – The shift toward personalized medicine is revolutionizing patient care, allowing treatments to be tailored to individual genetic profiles. This trend is driving biotech firms to innovate more effective, high-margin therapies with reduced side effects, making companies at the forefront of this movement attractive to both institutional and retail investors.

With its cutting-edge research and proprietary drug candidates, including Lucid-MS, QNTM is well-positioned to capitalize on these powerful industry tailwinds. Investors seeking exposure to the booming biotech sector should closely monitor companies like QNTM, which stand at the intersection of innovation and massive market demand.

5. Stronger Legal Standing Following Court Battles

Quantum BioPharma Ltd. (OTC: QNTM) is at a pivotal moment in its legal strategy, with two major court cases that could significantly impact its financial standing and market perception.

- January 24, 2025 – A Defining Court Date

QNTM’s legal battle against Dr. Raza Bokhari is set for a crucial hearing on January 24, where the company seeks to have him declared a vexatious litigant. If successful, this ruling would put an end to disruptive legal actions that have burdened the company with unnecessary legal costs and distractions. More importantly, eliminating this legal overhang could restore investor confidence, allowing management to fully focus on drug development, strategic expansion, and shareholder value creation. - $700 Million Lawsuit Against Major Financial Institutions

In a separate high-stakes legal action, QNTM is pursuing a $700 million lawsuit against CIBC, RBC, and other major financial institutions, alleging stock price manipulation through illegal spoofing tactics—a practice where traders place large orders they don’t intend to execute, distorting market prices.Should QNTM secure a favorable judgment or settlement, the financial ramifications could be game-changing. A multi-hundred-million-dollar award would not only fortify the company’s balance sheet but also provide a substantial capital infusion for accelerating clinical trials, expanding R&D, and pursuing strategic acquisitions. Additionally, the legal victory could serve as a catalyst for a significant stock price re-rating, as investors revalue QNTM’s financial position and growth potential.

By proactively defending its business from legal threats while aggressively pursuing justice against alleged market manipulation, QNTM is strengthening its corporate standing, reducing risk, and positioning itself for long-term financial gains.

6. Favorable Technical Indicators and Analyst Outlook

QNTM has been attracting attention from market analysts who see strong technical signals for a breakout. Recent bullish patterns on the stock chart, combined with growing interest from institutional investors, suggest potential upside in the near term.

With key catalysts lined up for 2025—including clinical advancements, legal victories, and financial innovation—analysts are eyeing QNTM as one of the most compelling small-cap biotech stocks to watch.

Final Takeaway: A Stock Poised for Explosive Growth

Quantum BioPharma Ltd. (OTC: QNTM) is positioning itself as a leader in precision medicine while simultaneously embracing cutting-edge financial strategies. With a rapidly advancing clinical pipeline, strategic crypto investments, a dual listing, and legal clarity on the horizon, QNTM is shaping up to be one of the most intriguing investment opportunities of 2025.

Add QNTM to your watchlist today and stay ahead of the next big biotech breakout!

CONDENSED DISCLAIMER Small Cap Exclusive is owned and operated by King Tide Media, LLC, a US-based corporation. We have been compensated up to $150,000 from Quantum BioPharma Ltd. for profiling (OTC: QNTM) starting 2/3/25 for one month. We own ZERO shares in (OTC: QNTM).