Medivolve Signs Agreement to Acquire 100% of Modern Rx LCC, a Las Vegas based Pharmacy

Read original article here.

As part of its telehealth strategy, Medivolve has acquired a pharmacy to better serve Collection Sites telehealth patients as the program launches. Further, Medivolve will host an investor webinar Tuesday, March 23rd at 1 pm ET

TORONTO, March 16, 2021 (GLOBE NEWSWIRE) — Medivolve Inc. (“Medivolve”) (NEO:MEDV; OTC:COPRF; FRA:4NC) is pleased to announce the signing of a binding Letter of Intent (LOI) to acquire a 100% equity interest in Modern Rx LLC, a Las Vegas based pharmacy from shareholders of Modern. This pharmacy is expected to serve as an important component of Medivolve’s telehealth strategy, where Collection Sites telehealth patients will be able to have their presecription filled directly through the pharmacy’s operating license.

“As Medivolve developed its telehealth strategy, we saw the need for the ability to fill patients prescriptions directly. As such, management sought out an operating pharmacy that would imemdiatley allow Collection Sites to offer valuable telehealth services to patients when the program launches,” commented Medivolve CEO Doug Sommerville. “The Modern Rx company provides Medivolve with the necessary licensing and infrastructure at a price that is accretive for shareholders. As Medivolve’s telehealth program launches, we anticipate the additional services offered through Modern Rx, and its network of pharmacy relationships nationally, will be an integral component of the telehealth solution.”

About the Transaction

Medivolve will acquire a 100% equity interest in Modern from the shareholders of the company. As consideration for the acquisition of a 100% equity interest in Modern, Medivolve shall pay to the Modern shareholders: (i) cash consideration of US$100,000; and (ii) one (1) million common shares of Medivolve. The completion of the transaction to acquire 100% of Modern Rx LLC is subject to customary closing conditions, including due diligence to the satisfaction of Medivolve, the parties entering a definitive agreement and NEO Stock Exchange approval. No finder fees are payable in connection with, and no change of control of Medivolve will result from, the transaction.

Upcoming Corporate Webinar

Medivolve is pleased to announce it is hosting a Corporate Update webinar, on Tuesday, March 23rd at 1 pm ET that will provide investors with an update on the Company’s recent business developments.

Registration Link: https://us02web.zoom.us/webinar/register/WN_tmyDKJWYQTGoviFFM1zq7Q

Specifically, the webinar will feature Medivolve CEO Doug Sommerville and Dr. Glenn Copeland to elaborate on Collection Sites telehealth strategy. Dr. Glenn Copeland is a medical advisor to Medivolve and CEO of Glenco Medical, a Medivolve partner company. With Dr. Copeland’s guidance, Medivolve and Collection Sites are developing telehealth plans that include remote patient monitoring and virtual care, among other offerings. Collection Sites intends on leveraging its network of sites and large customer database to market these new services and launch a series of mobile clinics.

About the Collection Sites

The pop-up labs will be managed by Las Vegas based company Collection Sites, LLC and powered by Alcala Testing and Analysis Services, a CLIA-licensed laboratory based in San Diego, California. Appointments and payments will be handled through an online portal www.testbeforeyougo.com.

The key to flattening the curve is to increase testing.

The testing centers will offer convenient access to rapid antibody and antigen (pending availability) tests – which take 8-10 minutes to administer and provide results within 24 hours. The sites also offer regular RT-PCR. All tests can be administered with insurance coverage options. The tests results can be communicated via text or email and can be accompanied with a certificate of good health via a HIPAA-compliant smartphone application.

For more information about the pop-up lab, the available sites and services visit www.testbeforeyougo.com.

About Medivolve Inc.

Medivolve Inc. (NEO:MEDV; OTC:COPRF; FRA:4NC) seeks out disruptive technologies, ground-breaking innovations, and exclusive partnerships to help combat COVID-19 and generate remarkable risk-adjusted returns for investors. Specifically, Medivolve offers investors a diversified investment in the COVID-19 medical space across three areas; prevention, detection, and treatment.

Medivolve has a team of renowned global medical and business advisors that have developed a proprietary business strategy to capitalize on high-margin opportunities in the COVID-19 space. This panel includes prominent immunologist Dr. Lawrence Steinman and Dr. Glenn Copeland, who has 45 years of experience in orthopaedic treatment, foot and ankle care, and sports medicine.

Medivolve’s primary focus is to provide convenient and assessable medical services for testing of the COVID-19 virus to help combat the pandemic. This is achieved largely through two acquisitions: 100% of Collection Sites, LLC and 28% of Colombian Sanaty IPS. Collection Sites is setting up a series of COVID-19 testing sites across the United States with appointments and payments will be handled through the online portal www.testbeforeyougo.com. Sanaty is setting up a series of full-service medical clinics offering a complete COVID-19 testing solution.

For additional information, please contact:

Doug Sommerville, CEO [email protected]

For investing inquiries please contact: [email protected]

For US media enquires please contact: Veronica Welch [email protected]

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the expansion of COVID-19 testing sites; the proposed roll-out of testing sites; projected timelines for testing results; projected revenues from the testing; the pursuit by Medivolve of investment opportunities; and the merits or potential returns of any such investments. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAS REVIEWED OR ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Medivolve Inc. (OTC-COPRF, NEO-MEDV) is Possibly Ready for a Big Move

Medivolve Inc. (OTC-COPRF, NEO-MEDV) is possibly ready for a big move, traders place this on your watchlist immediately!

Here are SIX reasons why Medivolve is just warming up!

- The chart is potentially very promising.

- The Testing Network is established and nation-wide.

- Covid is here to stay!

- Recent press releases are incredible!

- Medivolve (COPRF/MEDV) is poised to be a major disrupter of medical services due to their low CPA (Cost Per Acquisition).

- A leader is a dealer in hope and the leadership team embodies hope for traders!

Company Name: Medivolve, Inc.

Ticker: (OTC-COPRF, NEO-MEDV)

52 Week High: $.67

Current Trading Price: $.32

Market Trend: Bullish

Company Summary: Medivolve, Inc. has a substantial collection of leased sites for COVID-19 testing, offering convenient access to rapid antibody and antigen tests; these tests take 8-10 minutes to administer, provide results in less than 24 hours and cost under $100 along with standard PCR tests. The company is expanding into tele-health and tele-diagnostics which they intend to capture a significant market share through their impressive CPA model for obtaining new clients, where they can disrupt the medical service industry with hundreds of convenient walk up locations rather than the traditional come and wait in a Covid-19 saturated doctors lobby for your hour late appointment.

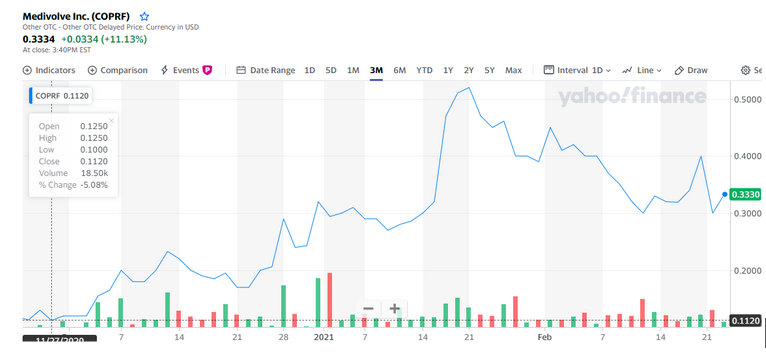

The chart is potentially very promising!

February 04, 2021

In order to maximize operational efficiency, Collection Sites is conducting a state by state expansion where possible. The new sites are currently located on the properties of Simon’s Property Group, an investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company as well as Sandor Development Group. Additional sites are expected to be open in Texas, Florida, and Georgia within the coming weeks.

November 11th – Collection Sites Announces Agreement to Offer COVID-19 Testing Services and Protocols for The Elf On The Shelf’s Magical Holiday Journey

November 17th – QuestCap Announces Planned Name Change to Medivolve Along With Transition to Single Purpose Medical Company

December 1 – Collection Sites Expands Convenient COVID-19 Testing Across America with 25 Additional Testing Sites

January 5th 2021 – Medivolve (COPRF/MEDV) announces a C$5M bought deal private placement led by Canaccord Genuity.

Medivolve entered into an agreement with Canaccord Genuity Corp., on behalf of a syndicate of underwriters (collectively the “Underwriters”), pursuant to which the Underwriters have agreed to purchase on a bought deal private placement basis, 20,000,000 units of the Company (“Units”) at a price of C$0.25 per Unit (the “Issue Price”), for aggregate gross proceeds of C$5,000,000

The press releases over the last three months have garnered serious attention by Wall Street, take a look at this CHART.

The chart above is potentially very promising with some serious consolidation taking place over the last month. Out of the first 34 volume bars on this chart 24 are green, closing positive for the day, which represents 71% positive days. Hence, the stock reacted with an ascending, bullish, chart line.

The run started on 11/27/2020 at a price per share of $.125 and due to those “buying” days it reached a high of $.60 on 1/20/21 which represents a 380% gain over the specified period.

Now let’s look at the consolidation that took place after the amazing run of 380% gains, there were 22 volume bars after the run to $.60 with 13 representing a sell off day, 60%, hence the traders who were happy with their gains from the run exited their positions. This is consolidation, which creates a prime environment for another massive possible price increase due to the lack of sellers creating downward pressure.

In short, many people bought the COPRF/MEDV on the two month run to $.50-$.60 then sellers started to exit their positions creating downward pressure resulting in the share price falling from the high of $.60 down to $.33. Moreover, $.33 still represents a 164% gain from the November price of $.125 which reveals this stock could be primed for another move holding a much higher main trend line than November!

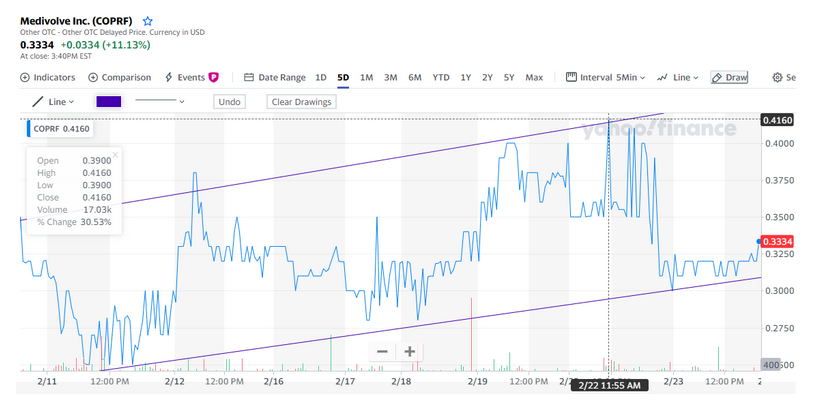

This channel is poised for a possible major breakout!

Let’s review the 5 day chart and one can see the channel-line, top line, and the main trend, bottom line, is a perfect set up for a possible strong run. What does that mean? A bullish channel traditionally signals technical traders to watch or buy a stock based on the ascending main trend line and the corresponding channel-line.

The Testing Network is established and nation-wide!

Medivolve has signed with a major multi-billion dollar premium mall operator to set up these Collection Sites COVID-19 testing centers to offer convenient access to rapid antibody and antigen tests – which take 8-10 minutes to administer and provide results in less than 24 hours. The sites also offer regular RT-PCR. The testing centres are powered by Alcala Testing and Analysis Services, a CLIA-licensed laboratory based in San Diego, California.

All tests can be administered with insurance coverage options. The tests results can be communicated via text or email and can be accompanied with a certificate of good health via a HIPAA-compliant smartphone application.

Medivolve (COPRF/MEDV) issues Huge News in regards to strategic partners, who will be next?

Covid is here to stay!

Feb 3rd, just a few weeks ago, had the third largest amount of cases of Covid-19 in the United States.

Think about this, they made $7.1M in just January and that was just a few months of the company being in business! What will Q2 look like?

During the month of January, the Company realized the sale of 73,973 COVID-19 tests at an average sale price of $96 per test across it’s expanding network. Approximately 52% of the sales were cash pay, with the balance as insurance sales. The Company continued to see the strongest demand for antigen tests, followed by antibody and then PCR.

So, the question is, how long will Covid testing be a viable source of income?

The answer: Covid is unfortunately here to stay!

Let’s look at the latest numbers: Are we going up? Are we holding the average? Or going down?

Almost 71,000 new cases of COVID-19 were reported in the United States on February 22, 2021.

If those numbers hold true, there will be 2,130,000 new cases (71,000 X 30 days) that have to be tested to be confirmed. Let’s look at the last 13 months to see if the Feb 22 numbers are going up, holding the average or going down.

Between January 20, 2020 and February 22, 2021 there have been almost 28 million confirmed cases of COVID-19 which means that the monthly average is 2,153,000 (28 million / 13 months) which is almost exactly at the projected average derived from the Feb 22 numbers, which means we are 100% still in the grips of this deadly virus.

Recent press releases are incredible!

February 4, 2021

Sales of 73,973 Tests at $96 , that is over $7M in just January!

During the month of January, the Company realized the sale of 73,973 COVID-19 tests at an average sale price of $96 per test across it’s expanding network. Approximately 52% of the sales were cash pay, with the balance as insurance sales. The Company continued to see the strongest demand for antigen tests, followed by antibody and then PCR.

“We are thrilled by the strong sales performance in the month of January and are excited for future sales with the rapid growth of our network,” commented Collection Sites.

As we already examined above, the Covid numbers are holding to the 13 month average, so the $7.1M in revenue for Medivolve should be a solid projection for the near future. Possibly, as Americans grow tired of masks, quarantines and become lackadaisical in conjunction with warmer weather, get-togethers both public and private, we believe the covid cases will be on the rise as well.

February 18, 2021

Medivolve Announces Launch of Investor Awareness Campaign

As a trader, I absolutely love seeing emerging companies paying for awareness campaigns. If a company believes in it’s product/service and is willing to have skin in the marketing game, well, it is a very good sign. Medivolve has contracted with three of the most respected investor relations firms in the country: EMC Marketing Services, Winning Media Marketing Services & Amherst Baer Marketing Services.

These three firms are savants when it comes to creating awareness around some of the biggest investments in the last decade. Let’s get ready fellow investors, this could be a legendary ride! One of those war stories you tell on your front porch, all eyes on you, hanging on every word as you hear exclaimed, “get out of here, no way!” Let’s take a good look at the companies and monies spent over the duration.

EMC Marketing Services

Medivolve entered into an agreement for electronic media and webcast services, design, development and dissemination services with Emerging Markets Consulting LLC (EMC), with respect to EMC providing investor relation services to the company. Effective February 24, 2021, the EMC agreement has an initial term of 90 days, wherein the company will pay EMC a non-refundable fee of US$250,000.

Winning Media Marketing Services

Medivolve entered into an agreement for strategic digital media services, marketing and data analytics services with Winning Media LLC (WM). Effective February 8, 2021, the WM agreement has an initial term of 90 days, wherein the company will pay WM a non-refundable fee of $250,000.

Amherst Baer Marketing Services

Medivolve has retained Amherst Baer Consultancy Corp. (ABCC) of Langley, B.C., as investor relations consultant to prepare a marketing campaign for the company. ABCC will be paid $70,000 a month for a three-month contract.

Medivolve (COPRF/MEDV) is poised to be a major disrupter of medical services due to their low CPA of customers

Let’s take a look at the Tele-Health & Tele-Diagnostic Industry

In a press release dated February 22nd, 2021 Medivolve has “A large network of Collection Sites and intends on leveraging its network and large customer database to market these new services and launch a series of mobile clinics.”

What is Tele-Health?

The Health Resources Services Administration defines telehealth as the use of electronic information and telecommunications technologies to support long-distance clinical health care, patient and professional health-related education, public health and health administration. Technologies include videoconferencing, the internet, store-and-forward imaging, streaming media, and terrestrial and wireless communications. Link

What is the Tele-Health market size?

The telehealth market growth will increase by $95.72 billion during 2019-2024. Link

Why should Medivolve enter into this vertical?

First and foremost, they are mitigating the risk if Covid-19 is eradicated then they will have an established vertical to monetize with their current customer base. The announcement by Medivolve to enter into the TeleHealth sector makes a lot of sense due to their existing customer base, strategic partnerships and to develop an exit strategy when Covid numbers go down. Well done, well done!

CPA, not the accountant, Cost Per Acquisition, it’s the name of the game!

I remember an interview with ClickFunnels’ Russel Brunson and I will never forget it; he said, the name of the game is being able to pay a higher price for a client than your competition. So, if you can create a higher AOV (Average Order Value) then, you can pay more to acquire the client. If you are scaling and penetrating the market enough you can actually start eliminating weak competitors by cutting off their ability to acquire clients by increasing the CPA. It’s reminiscent of Genghis Khan’s legendary military tactic of disrupting the food supply and starving out your enemies. I’m not alluding to Medivolve engaging in such practices but with their massive customer database already acquired to repurpose that database to create new revenue streams would create a massive competitive advantage!

They don’t have to go pay per clicks, hire an agency or pay for a team of sales reps to ring doorbells, they already have a list of thousands of clients who prefer to conveniently walk up to a testing facility on their way to Target. I imagine the client after 8 minute experience said, I sure wish all medical experiences were like this! They will tap into this customer list and it should be even bigger than their current operations!

“A leader is a dealer in hope.” —Napoleon Bonaparte

You’re only as good as your people, let’s take a look.

Medivolve has a team of renowned global medical and business advisors that have developed a proprietary business strategy to capitalize on high-margin opportunities in the COVID-19 space. This panel includes prominent immunologist Dr. Lawrence Steinman and Dr. Glenn Copeland, who has 45 years of experience in orthopaedic treatment, foot and ankle care, and sports medicine.

Doug Sommerville is a veteran leader in the North American medical, pharmaceutical and technology industries. Prior to joining Medivolve, Mr. Sommerville held the role of Head of Country for Canada for Teva Canada, a subsidiary of Teva Pharmaceutical Industries Ltd. (“Teva”), the world’s leading provider of generic medicines. In this role, Mr. Sommerville was responsible for Teva’s third largest global subsidiary, with sales in excess of $1.3 billion. Douglas led all aspects of the company’s commercial, distribution, demand planning and customer operations – aligning and coordinating all company functions, production, supply chain, regulatory and global support functions. Douglas was also the Chairman of the Canadian Generic Pharmaceutical Association up until his retirement from Teva Canada in 2018.

Previous to his tenure at Teva Canada, Mr. Sommerville was Global Vice President, Infusion Systems with Baxter Healthcare International (“Baxter”), one of the world’s largest medical, pharmaceutical and technology companies. In his role, Douglas was responsible for the company’s infusion pumping devices and intravenous administration sets worldwide, as well as pain management and ambulatory infusion devices, working with Baxter’s product development, regional sales and marketing teams globally.

Lawrence Steinman, MD is Professor of Neurology, Neurological Sciences and Pediatrics at Stanford University and Chair of the Stanford Program in Immunology from 2001 to 2011. His research focuses on antigen specific tolerance in autoimmune disease and in gene therapy for degenerative neurologic diseases. He has elucidated what provokes relapses and remissions in multiple sclerosis (MS). He is taking forward a pivotal clinical trial with antigen specific tolerization therapy for type 1 diabetes. He serves as attending neurologist at Stanford’s Lucille Packard Children’s Hospital.

Steinman was senior author on the 1992 Nature article that led to the drug Tysabri, approved for MS and Crohn’s disease. Tysabri has been taken by over 200,000 individuals with MS.

Dr. Glenn Copeland possesses over 45 years of experience in both orthopaedic treatment and sports medicine, Dr. Glenn Copeland is one of North America’s most prominent foot and ankle specialists.

He has established unique and authoritative treatments specializing in both surgical and non-surgical procedures of the foot and ankle.

Dr. Copeland has founded and directed several highly successful medical companies including Footmaxx Inc., which converted orthopaedic evaluation of the lower extremity from moulding technology to pressure and motion mapping. Dr. Copeland was successful in opening over 1,880 clinics globally.

Between 2002 and 2008, Dr. Copeland was selected to be the founder, chairman, and CEO of Cleveland Clinic Canada. Cleveland Clinic is universally regarded as one of the top three medical institutions in the world.

He was recruited in 2008 by Mount Sinai Hospital in Toronto to establish the Rehab and Wellbeing Centre and Sports Medicine Centre, which continues to thrive, seeing over 10,000 patient visits each year.

These are 5 very good reasons why Medivolve should be on your watchlist.

- The Testing Network is established active and nation-wide massive and growing with hundreds of additional sites.

- Covid is here to stay!

- Recent press releases are incredible!

- Medivolve (COPRF/MEDV) is poised to be a major disruptor of medical services due to their low CPA (Cost Per Acquisition)

- A leader is a dealer in hope and the leadership team embodies hope for us traders!

Happy Trading and remember my adage, “Never try to catch a falling knife!”

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Medivolve, Inc. Small Cap Exclusive has been hired by Medivolve, Inc. for a period beginning on March 3, 2021 to publicly disseminate information about (COPRF) via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

SOLO Shares Jump 19% end of day today. Still a Buy?

SOLO Shares jump 19% end of day. Is it still a buy?

Shares of SOLO or Electra Meccanica jumped on Thursday by more than 19% and closed at $9.48pps, after an article was released of Improved Sales Visibility by SeekingAlpha.

Shares of SOLO or Electra Meccanica jumped on Thursday by more than 19% and closed at $9.48pps, after an article was released of Improved Sales Visibility by SeekingAlpha.

Shares of SOLO were already up more than 20% in January as the Electric car market has been on major run since Biden took office.

Electrameccanica Vehicles Corp., a development-stage company, develops, manufactures, and sells electric vehicles in Canada. The company operates in two segments, Electric Vehicles and Custom Build Vehicles. Its flagship product is the SOLO, a single seat vehicle. The company is also developing Super SOLO, a sports car model; and Tofino, an all-electric two-seater roadster. It also develops and manufactures custom built vehicles. The company sells its vehicles online through electrameccanica.com Website, as well as through six retail stores. Electrameccanica Vehicles Corp. was founded in 2015 and is headquartered in Vancouver, Canada.

NTN Buzztime Announces Meeting with Shareholders. Stock Falls Sharply for second day.

NTN Buzztime Announces Meeting with Shareholders. Stock Falls for second day.

Buzztime has been moving uphill since September, and in last 45 days had some significant jumps. In mid September NTN was trading around $1.60pps and by end of January had hit highs above $5.20pps

Buzztime has been moving uphill since September, and in last 45 days had some significant jumps. In mid September NTN was trading around $1.60pps and by end of January had hit highs above $5.20pps

That all ended in the last 2 days. Buzztime NTN fell on Wednesday this week by 20% intraday, from $6.38 to $4.82.

Just 2 hours after the market closed they released press and what was already a bad day got a bit worse.

By Market open today NTN shares started trading at $4.55 and have stayed under $5 most of the day.

NTN News -NTN Buzztime Announces Date of Special Meeting of Stockholders to Vote on Proposed Merger and Asset Sale

Midwest Energy Emissions Corp (MEEC) Continues MEGA Run

Midwest Energy Emissions Corp (MEEC) Continues to Hit New Highs: Now What?

It is often noticed that investors tend to focus on stocks that have displayed steady gains over a reasonable period of time and over the years such a strategy has generally proven to be correct. The Midwest Energy Emissions Corp (OTCMKTS:MEEC) stock could well be in that category considering the fact that it has recorded significant gains over the past two months.

What to Watch

During that period, the Midwest Energy stock has recorded gains of as much as 230% and it could be a good time for investors to perhaps take a closer look at the company’s business. Earlier in January, the company made an announcement with regards to a deal it struck with reached with national utility.

The company announced that according to the provisions of the deal, the national utility entity is going to be getting the non-exclusive license to use Midwest Energy’s patents. The patents are related to the process of Sorbent Enhancement Additive that is meant for removing mercury from coal-based power plants.

The national utility in question owns coal-based power plants. In light of the signing of the deal Midwest Energy has also dismissed the claims it brought against the national utility for having infringed its patents.

The Chief Executive Officer and President of Midwest Energy, Richard MacPherson, spoke about the development as well. He stated that the company is now moving ahead quickly with regards to signing new agreements and correcting the errors of the past. The new strategy from the company has also been rewarded by markets and that is apparent from the remarkable rally enjoyed by the stock over the past weeks.

Back in November last year, the company announced its financial results for the third quarter. The revenues in that quarter stood at $2.8 million, which was lower than the $3.8 million generated in the year-ago period. The drop in revenues was primarily due to the drop in coal-based power generation.

Hidden Gem FCTI Builds investor interest

Do your own Due Diligence Links Below

Rainmaker (RAKR) Making Big Moves on Big News

Rainmaker Making Big Moves on Big News (OTC-RAKR) Another run for Rainmaker Shareholders. Will Rainmaker will have the fuel in its engines after a broad based restructuring?

Rainmaker (OTC-RAKR). The name says it all. They make it rain in places where water is deadly scarce by generating water from thin air. Anywhere. RAKR so important to the international fresh water supply because Its technology can produce water in areas of the world where there are no options but international aid. This aid, delivered primarily through bottled water is incredibly expensive and makes these communities permanently dependent. Rainmaker technologies will make these communities independent, produce economic development of $5 dollar for every $1 spent and save countless lives. At the same time, the sheer enormity of the global water shortage ensures unlimited long term demand for Rainmaker as it delivers Water-as-a-Service efficiently in every corner of the globe.

What Is The Latest?

The latest efforts by Rainmaker Management to financially restructure its operations and produce three years worth of audited financials demonstrate a further and definitive commitment to up-list to become SEC reporting and ultimately up-list to the OTCQB. The Company has reduced 66% of its debt and obligations and its Executive has now converted all of its outstanding debt. The company is leaner and now in a position to access capital from institutions and all investors who were unable to invest on the OTC Pink. At the same time, nothing operationally will change. It’s remaining investment and management involvement in the now- private Dutch-Based Manufacturing company secures access products while providing full access to European and Netherlands based water-based grants that are in the 100s of millions currently. The Dutch entities previous success in securing such funding tells us that millions are on the horizon to improve efficiency, lower costs and expand operations. With capital comes mobility and building real time inventory to generate explosive growth in the next year and well beyond.

How Does It Work?

Through Rainmaker’s Air-to-Water and Water to Water applications, they harvest or purify water to World Health Organization Standards. Air-to-Water, through advanced technological processes, use the heat and humidity and air flow in the environment to generate substantial amounts of clean water. The Water-to-Water systems draw in seawater or poisonous water and uses an environmentally safe process to purify it to medical grade water. Both can be powered by renewable resources…directly in pursuit of ESG goals and principles.

Why is this Stock seeing tons of action in the market lately?

With every natural disaster comes a renewed acute recognition of the importance of clean water. These disasters typically happen in areas of the world which already suffer from economic disadvantage that have crumbling infrastructure. If these communities were simply prepared to meet water needs in these circumstances it would literally save trillions. Every international organization has its own goals and targets for water self-sufficiency. Every global corporation that uses water in a local environment has set targets for water neutrality. Investors everywhere are riding this wave and finding ways to invest in game changing technology. Solutions to these problems have to be technology based. There simply is no other option. Rainmaker is THE perfect way for investors to enter the market for the NEW GOLD.ESG investing grew to more than $30 trillion in 2018, and some estimates say it could reach $50 trillion over the next two decades.

The news is game changing!

Historically, the stock gains anywhere from 400%-2,000% when news is issued.

ESG means Big Bucks!

Rainmaker is based on ESG movement and was long before it became mainstream. ESG measures the societal and sustainability impact of every business activity. ESG investing grew to more than $30 trillion in 2018, and some estimates say it could reach $50 trillion over the next two decades. Investors are now looking to responsibly invest not just because it’s good for future generation but because it’s profitable with sanctions and executive orders that we saw last week.

Water is KING and RAKR can generate 20,000 litres of water per day from 1 Air to Water unit and 150,000 liters per day from one Water to Water unit.

Here are some quick stats (I like bullet points, so here goes)

Unsafe water is responsible for 1.2 million deaths each year.

6% of deaths in low-income countries are the result of unsafe water sources.

666 million people (9% of the world) do not have access to an improved water source.

1 billion (29% of the world) do not have access to safe drinking water.

October 8, 2020 –The partnership once fully deployed could reach USD $50 Million annually.

In a press release dated October 8th, 2020 Rainmaker Worldwide Inc. announced a Joint Venture with the Carlaw Group Ltd. This JV is to address the severe water crises across Africa while creating a new market to penetrate. Carlaw and partners have been operating mission critical infrastructure projects in Africa since 2006. This expertise will complement Rainmaker as it deploys its innovative Air-to-Water technology to bring water on-demand to communities lacking access to environmentally safe drinking water. The partnership will distribute this water through a proposed water distribution agreement within the mining and construction sectors as well as through a bottled water operation using Rainmaker’s hybrid energy Air-to-Water solutions.

In the Fall of 2019 RAKR exploded from a half of a penny to .27 accounting for a 2700%+ gain based on the lifesaving and profitable Water-as-a-Service (WaaS) technology. Investors have been interested in this ECG titan from day one and as you can see from the chart the stock is only gathering momentum. Since 2019 the shareholder base has grown by 4X to over 4000 as reported in its recently released audited financials.

To ring in 2020 with a bang it had another impressive run from around $.10 to $.50 producing a 400% move! To put this into example form, if someone invested $10,000 on January 1, 2020 they would have over $50,000 worth of RAKR for over almost the WHOLE YEAR, Now that is stable!

In the summer of 2020 it again, for a third time in a row, beat its previous high when it ran from $.15 to $.75. Another 400%+ move! Creating it’s all-time high! So if you purchased shares in RAKR in the first week of January 2020 you would have been in a massive profit position until now barring just two months. Based on the news of late and this tech giant’s history of running over 400% historically, I believe it could be getting ready to smash through that January 2020 $.10 barrier.

While there has been a temporary fall of in the first quarter of 2021. There are of course many global market factors that are accounting for this evolution. With the most recent news establishing the long term financial stability of Rainmaker I further believe it could be getting ready for another surge as projects such as Carlaw begin getting deployed.

Disclaimer :Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, www.smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Rainmaker Worldwide, Inc. Small Cap Exclusive has been hired by Rainmaker Worldwide, Inc. for a period beginning on February 1, 2021 to publicly disseminate information about (RAKR) via website and email. We have been compensated $25,000. We will update any changes to our compensation.

Read full disclaimer here.

Oculus VisionTech Inc (OTCMKTS-OVTZ) Stock Heats Up 250%

Oculus VisionTech Inc (OTCMKTS-OVTZ) Stock Heats Up: Soars 250% in 6-Week

Cybersecurity is an industry that has grown at a remarkable pace over the past few years and nowadays, investors actively looking for ways to get into that sector. Over the past few weeks, the Oculus VisionTech Inc (OTCMKTS-OVTZ) stock has emerged as one of the possible options owing to the sort of gains its stock has generated.

Major News

In the past six weeks, the Oculus stock has generated gains of as much as 250%, and perhaps it is time for investors to take a closer look at the company. Oculus is a cybersecurity company that is focused on developing products that protect digital piracy of documents.

Breakout News on FCTI Click Here

It is primarily focused on the compliance and data governance markets. Back in November last year, the company announced the alpha release of its product named ‘Forget Me Yes’. The product in question is a data privacy compliance platform. It is a unique product and it is no surprise that it led to considerable buzz around the Oculus stock in the markets.

‘Forget Me Yes’ is a SaaS (software as a service) API platform. It is meant for compliance with regards to the right to be forgotten and the right of erasing of both individuals as well as organizations. The platform helps in structuring the data in compliance with the California Consumer Privacy Act.

However, that is not the only product that Oculus can boast of. The company has used its proprietary technology and built a system that helps in embedding digital watermarking for video on-demand clients. On the other hand, the company is also known for its cloud-powered system that helps in protecting documents through digital watermarking.

At a time when piracy is rampant, Oculus helps in providing protection to documents, images, and videos. The company is based out of Vancouver, Canada, and could be in the radars of investors over the coming days.

Fact Inc Adding Heavyweights to its Board of Directors OTC-FCTI

Fact Inc. just started trading under the ticker (OTC: FCTI), and has immediately made some major additions to its team, showing the public and its investors that it is focused on putting an end to art fraud.

Click here to read recent article on Fact Inc

- Today, February 2nd 2021 Fact Inc. (OTC: FCTI) Announced that internationally recognized curator and art expert, Jean-David Malat, has joined its Advisory Board.

Fact Inc Jean David Malat[/caption]

Fact Inc Jean David Malat[/caption]

“Mr. Malat is one of the world’s most respected and influential art dealers, described as ‘the best connected man in London’ by The Times, and ‘London’s most in demand guru’ by Metro Newspaper. For more than 15 years he has built a clientele of high-profile clients, including Kate Moss, Bono and Madonna. Born in Paris and now in the UK, Mr. Malat trained at Sotheby’s, established in 1744 and now the world’s largest, most trusted and dynamic marketplace for fine art, jewelry and collectables spanning 40 countries. During the early years of his career, Mr. Malat curated impressive collections with the collaboration of various world famous museums and foundations such as The Heydar Aliyev Center in Azerbaijan. In 2007, he redesigned the art-on-display for the opening of the Théâtre Mogador in Paris, and the following year achieved a significant career milestone, acquiring and selling two late-period Picasso paintings in the middle of the 2008 Recession.”

- On the 14th of January Fact Inc. (OTC:FCTI) Announced that former U.S. Assistant Secretary of Homeland Security Julie Myers Wood had joined its Board of Directors.

Fact Inc Julie Myers Wood[/caption]

Fact Inc Julie Myers Wood[/caption]

“Ms. Wood is an esteemed regulatory compliance and security expert with over 25 years of achievements in the public, private and political sectors. After graduating from Cornell Law School, Ms. Wood began her career as a lawyer at leading firm Mayer, Brown & Platt in Chicago. Her career has been focused on regulatory and enforcement issues through her various roles including defense counsel, government investigator, federal prosecutor, and compliance consultant.”

Fact Inc. Company Description

Fact, Inc. (OTC:FCTI) focuses on developing forensic technology for the art and collectibles market. The company is developing a front-end user interface, as well as modifying existing ballistics firmware for a comprehensive verification, tracking, and reporting system. Using white light interferometry, FACT takes a non-destructive 3D digital fingerprint of the art using approximately 100,000 unique images. It offers a suite of products that include authentication, condition reporting, GPS tracking, and provenance data, as well as collection management stored on blockchain accessible in real time to the consumer. The company’s software application is applicable to various channels in the fine art and collectible industry, including S secured lending, insurance, dealers, auction houses, and grading companies. The company was formerly known as Tiburon International Trading Corp. and changed its name to Fact, Inc. in November 2020. FACT, Inc. is headquartered in Toronto, Canada. As of October 5, 2020, Fact, Inc. operates as a subsidiary of Kryptos Art Technologies, Inc.

Disclaimer :Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, FACT, Inc. Small Cap Exclusive has been hired by FACT, Inc. for a period beginning on November 13, 2020 to publicly disseminate information about (FCTI) via website and email. We have been compensated $51,000. We will update any changes to our compensation.

Read full disclaimer here.