Guess Who Picked Fieldpoint Petroleum Corp (NYSEMKT:FPP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Fieldpoint Petroleum Corp (NYSEMKT:FPP) reported that Herman Michael D has picked up 663,423 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Herman Michael D to a total of 663,423 representing a 6.22% stake in the company.

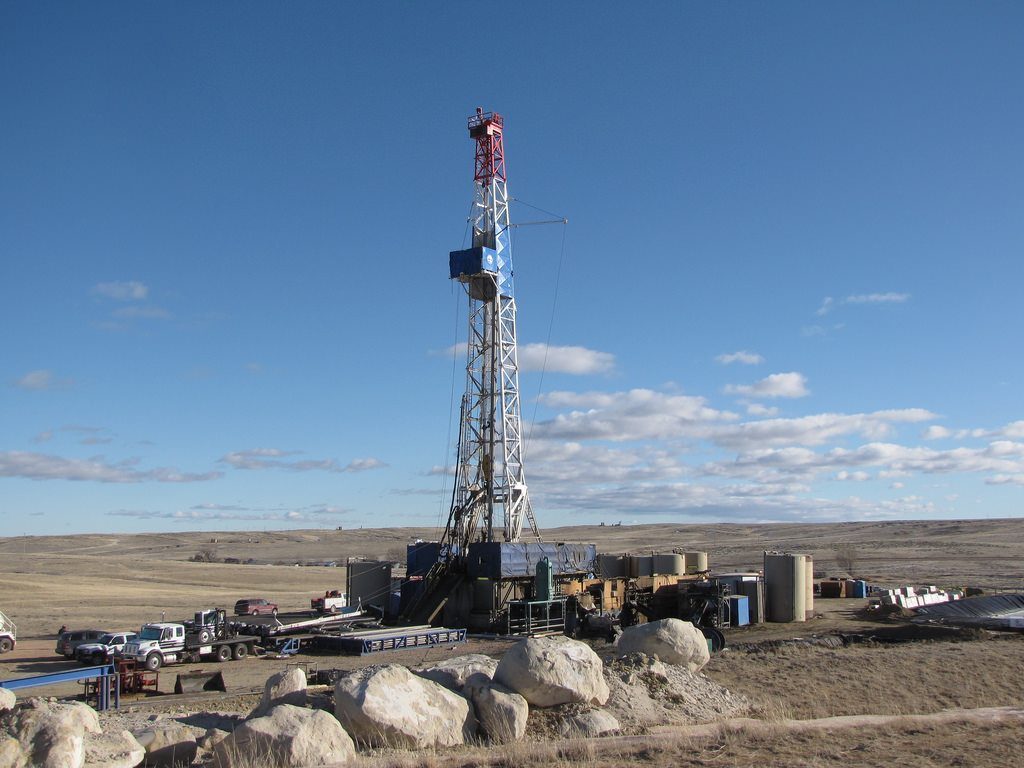

For those not familiar with the company, FieldPoint Petroleum Corporation is engaged in the acquisition, operation and development of oil and natural gas properties, which are located in Louisiana, New Mexico, Oklahoma, South Central Texas and Wyoming. The Company’s principal oil and natural gas properties include Block A-49, Spraberry Trend, Giddings Field and Serbin Field in Texas; Flying M Field, Sulimar Field, North Bilbrey Field, Lusk Field and Loving North Morrow Field in New Mexico; Apache Field, Chickasha Field and West Allen Field in Oklahoma; Longwood Field in Louisiana, and Big Muddy Field in Wyoming. The Company has varying ownership interest in approximately 470 gross wells (over 113.26 net) located in approximately five states. The Company operates over 20 of approximately 470 wells, and other wells are operated by independent operators under contracts.

A glance at Fieldpoint Petroleum Corp (NYSEMKT:FPP)’s key stats reveals a current market capitalization of 5.37 Million based on 10.67 Million shares outstanding and a price at last close of $0.515 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2014-12-03, Bryant picked up 2,000 at a purchase price of $2.60. This brings their total holding to 34,000 as of the date of the filing.

On the sell side, the most recent transaction saw Carnes unload 6,401 shares at a sale price of $0.49. This brings their total holding to 2,333,200.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Fieldpoint Petroleum Corp (NYSEMKT:FPP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Sito Mobile Ltd. (NASDAQ:SITO) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Sito Mobile Ltd. (NASDAQ:SITO) reported that Baksa Stephen D has picked up 1,006,060 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Baksa Stephen D to a total of 1,006,060 representing a 4.9% stake in the company.

For those not familiar with the company, SITO Mobile, Ltd. operates a mobile location-based advertising platform serving businesses, advertisers and brands. The Company’s offerings include SITO Location-Based Advertising and SITO Mobile Messaging. SITO Location-Based Advertising delivers display advertisements and videos on behalf of advertisers, including various features, such as Geo-fencing, Verified walk-in, Behavioral Targeting, and Analytics and Optimization. Geo-fencing targets customers within a certain radius of location and uses technology to push coupons, advertisements and promotions to mobile applications. Verified Walk-in tracks foot-traffic to locations and which advertisements drive action. Behavioral Targeting tracks past behaviors over 30 to 90 day increments allowing for real-time campaign management. Analytics and Optimization is a culling and building measurement system. SITO Mobile Messaging is a platform for building and controlling programs, including messaging and customer incentive programs.

A glance at Sito Mobile Ltd. (NASDAQ:SITO)’s key stats reveals a current market capitalization of 39.60 Million based on 20.59 Million shares outstanding and a price at last close of $2.06 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-08, Singer picked up 20,000 at a purchase price of $1.87. This brings their total holding to 2,100,718 as of the date of the filing.

On the sell side, the most recent transaction saw Braun unload 2,000 shares at a sale price of $5.03. This brings their total holding to 1,994,580.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Sito Mobile Ltd. (NASDAQ:SITO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Capital World Investors is Buying Transdigm Group Inc. (NYSE:TDG) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Transdigm Group Inc. (NYSE:TDG) reported that Capital World Investors has picked up 5,526,700 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Capital World Investors to a total of 5,526,700 representing a 10.4% stake in the company.

For those not familiar with the company, TransDigm Group Incorporated is a designer, producer and supplier of engineered aircraft components for use on commercial and military aircraft in service. The Company operates through three segments: Power & Control, Airframe and Non-aviation. The Power & Control segment includes operations that primarily develop, produce and market systems and components that provide power to or control power of the aircraft utilizing electronic, fluid, power and mechanical motion control technologies. The Airframe segment includes operations that primarily develop and market systems and components that are used in non-power airframe applications utilizing airframe and cabin structure technologies. The Non-aviation segment includes operations that primarily develop, produce and market products for non-aviation markets. Its product offerings include mechanical/electro-mechanical actuators and controls, engineered latching and locking devices, and seat belts and safety restraints.

A glance at Transdigm Group Inc. (NYSE:TDG)’s key stats reveals a current market capitalization of 12.21 Billion based on 52.84 Million shares outstanding and a price at last close of $228.71 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-14, Small picked up 2,121 at a purchase price of $234.27. This brings their total holding to 327,681 as of the date of the filing.

On the sell side, the most recent transaction saw Reiss unload 1,205 shares at a sale price of $253.79. This brings their total holding to 3,600.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Transdigm Group Inc. (NYSE:TDG) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Capital World Investors Picked Up Humana Inc. (NYSE:HUM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Humana Inc. (NYSE:HUM) reported that Capital World Investors has picked up 14,602,995 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Capital World Investors to a total of 14,602,995 representing a 10.1% stake in the company.

For those not familiar with the company, Humana Inc. is a health and well-being company. The Company’s segments include Retail, Group, Healthcare Services and Other Businesses. The Retail segment consists of Medicare benefits, as well as individual commercial fully insured medical and specialty health insurance benefits, including dental, vision, and other supplemental health and financial protection products. The Group segment consists of employer group commercial fully insured medical and specialty health insurance benefits, including dental, vision, and other supplemental health and voluntary insurance benefits, as well as administrative services only (ASO) products. The Healthcare Services segment includes services offered to its health plan members, as well as to third parties, including pharmacy solutions, provider services, home-based services and clinical programs, as well as services and capabilities to manage population health. The Other Businesses segment includes its closed-block long-term care insurance policies.

A glance at Humana Inc. (NYSE:HUM)’s key stats reveals a current market capitalization of 30.14 Billion based on 144.28 Million shares outstanding and a price at last close of $210.75 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2011-07-29, Damelio picked up 526 at a purchase price of $79.83. This brings their total holding to 20,634 as of the date of the filing.

On the sell side, the most recent transaction saw Bilney unload 4,348 shares at a sale price of $213.80. This brings their total holding to 13,578.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Humana Inc. (NYSE:HUM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Alteryx Inc. (NYSE:AYX) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Alteryx Inc. (NYSE:AYX) reported that Capital World Investors has picked up 1,235,325 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Capital World Investors to a total of 1,235,325 representing a 13.7% stake in the company.

For those not familiar with the company, Alteryx, Inc. is a United States-based provider of self-service data analytics software. The Company offers various products, such as Alteryx Designer, Alteryx Server and Alteryx Analytics Gallery. Alteryx Designer is a repeatable workflow for self-service data analytics. Alteryx Designer allows data analysts by combining data preparation, data blending, and analytics-predictive, statistical and spatial-using the same user interface. Alteryx Server is a scalable platform to deploy and share analytics. Alteryx Server accelerates time to analytical insight, and allows analysts and business users across organization to make data-driven decisions. Alteryx Analytics Gallery is an analytics cloud platform to recognize that business decision makers expect their business applications to be as engaging as the applications they use at home. Its solutions include analytic, departmental and industry. Its analytic solutions connect business analysts and decision makers to data.

A glance at Alteryx Inc. (NYSE:AYX)’s key stats reveals a current market capitalization of 943.38 Million based on 9.00 Million shares outstanding and a price at last close of $16.69 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-29, Iconiq picked up 296,382 at a purchase price of $14.00. This brings their total holding to 296,382 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Alteryx Inc. (NYSE:AYX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Modsys International Ltd. (NASDAQ:MDSY) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Modsys International Ltd. (NASDAQ:MDSY) reported that Columbia Pacific Opportunity Fund, L.p. has picked up 9,191,156 of common stock as of 2017-04-10.

The acquisition brings the aggregate amount owned by Columbia Pacific Opportunity Fund, L.p. to a total of 9,191,156 representing a 42.80% stake in the company.

For those not familiar with the company, ModSys International Ltd., formerly BluePhoenix Solutions Ltd., develops and markets enterprise legacy migration solutions, and provides tools and professional services to international markets. The Company operates through information technology (IT) modernization solutions segment. The Company’s technologies and services allow businesses to migrate from their legacy mainframe and distributed IT infrastructures to modern environments and programming languages. In addition to the technology tools, the Company provides professional services for project management of migrations, understanding and mapping of the applications, testing, remediation, and ongoing monitoring and management of the environments. The Company performs conversions of legacy databases, such as Integrated Database Management System (IDMS), Adaptable Data Base System (ADABAS), Virtual Storage Access Method (VSAM), Oracle and database 2 (DB2) environments.

A glance at Modsys International Ltd. (NASDAQ:MDSY)’s key stats reveals a current market capitalization of 15.56 Million based on 19.09 Million shares outstanding and a price at last close of $0.820 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-04, Columbia picked up 1,091,442 at a purchase price of $0.01. This brings their total holding to 8,993,089 as of the date of the filing.

On the sell side, the most recent transaction saw Lake unload 159,356 shares at a sale price of $1.04. This brings their total holding to 1,818,973.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Modsys International Ltd. (NASDAQ:MDSY) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Scripps Eaton M is Buying E.w. Scripps Co (NYSE:SSP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), E.w. Scripps Co (NYSE:SSP) reported that Scripps Eaton M has picked up 11,783,927 of common stock as of 2017-04-07.

The acquisition brings the aggregate amount owned by Scripps Eaton M to a total of 11,783,927 representing a 14.5% stake in the company.

For those not familiar with the company, The E. W. Scripps Company is a media enterprise with interests in television and radio broadcasting, as well as local and national digital media brands. The Company’s segments include television, radio, digital, and syndication and other. As of December 31, 2016, the Television segment included approximately 15 American Broadcasting Company (ABC) affiliates, five National Broadcasting Company (NBC) affiliates, two FOX affiliates, two Columbia Broadcasting System (CBS) affiliates and four non big-four affiliated stations. As of December 31, 2016, the radio segment owned 34 radio stations in eight markets. As of December 31, 2016, it operated 28 frequency modulation (FM) stations and six Amplitude Modulation (AM) stations. The digital segment includes the digital operations of its local television and radio businesses. Its Syndication and other segment primarily includes the syndication of news features and comics and other features for the newspaper industry.

A glance at E.w. Scripps Co (NYSE:SSP)’s key stats reveals a current market capitalization of 1.95 Billion based on 70.04 Million shares outstanding and a price at last close of $23.48 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-08-11, Scripps picked up 112,000 at a purchase price of $19.95. This brings their total holding to 766,954 as of the date of the filing.

On the sell side, the most recent transaction saw Scripps unload 3,727 shares at a sale price of $23.48. This brings their total holding to 6,934.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on E.w. Scripps Co (NYSE:SSP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

GAMCO Investors Picked Up Chemtura Corp (NYSE:CHMT) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Chemtura Corp (NYSE:CHMT) reported that GAMCO Investors has picked up 2,313,761 of common stock as of 2017-04-07.

The acquisition brings the aggregate amount owned by GAMCO Investors to a total of 2,313,761 representing a 3.66% stake in the company.

For those not familiar with the company, Chemtura Corporation is a chemical company. The Company is engaged in developing, manufacturing and marketing of engineered industrial specialty chemicals. The Company’s products are sold to industrial manufacturing customers for use as additives, ingredients or intermediates. The Company’s segments are Industrial Performance Products and Industrial Engineered Products. The Industrial Performance Products segment manufactures and markets lubricant additive components, synthetic lubricant base-stocks, synthetic finished fluids, calcium sulfonate specialty greases and phosphate and polyester based fluids, and is also engaged in the development and production of hot cast elastomer pre-polymers. The Industrial Engineered Products segment develops and manufactures bromine and bromine-based products and organometallic compounds. The Company operates in a range of industries, including automotive, building and construction, electronics, lubricants, packaging and transportation.

A glance at Chemtura Corp (NYSE:CHMT)’s key stats reveals a current market capitalization of 2.11 Billion based on 63.20 Million shares outstanding and a price at last close of $33.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2012-11-27, Dover picked up 8,700 at a purchase price of $20.04. This brings their total holding to 23,266 as of the date of the filing.

On the sell side, the most recent transaction saw Medley unload 6,778 shares at a sale price of $33.17. This brings their total holding to 35,335.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Chemtura Corp (NYSE:CHMT) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.