Here’s Who Picked Up Rent-A-Center Inc. (NASDAQ:RCII) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Rent-A-Center Inc. (NASDAQ:RCII) reported that Engaged Capital has picked up 2,519,969 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Engaged Capital to a total of 2,519,969 representing approximately 4.7% stake in the company.

For those not familiar with the company, Rent-A-Center, Inc. is a rent-to-own operator in North America. The Company provides an opportunity to obtain ownership of products, such as consumer electronics, appliances, computers (including tablets), smartphones and furniture (including accessories), under rental purchase agreements. The Company operates in four segments: Core U.S., Acceptance Now, Mexico, and Franchising. As of December 31, 2016, the Company operated over 2,463 Company-owned stores in the United States, Canada and Puerto Rico. The Company’s Mexico segment consists of the Company-owned rent-to-own stores in Mexico. As of December 31, 2016, the Company operated 130 stores in this segment. Its Franchising segment engages in the sale of rental merchandise to its franchisees. As of December 31, 2016, the Company’s Franchising segment franchised 229 stores in 31 states operating under the Rent-A-Center (152 stores), ColorTyme (39 stores) and RimTyme (38 stores) names.

A glance at Rent-A-Center Inc. (NASDAQ:RCII)’s key stats reveals a current market capitalization of 566.51 Million based on 53.09 Million shares outstanding and a price at last close of $10.64 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-23, Engaged picked up 40,000 at a purchase price of $8.82. This brings their total holding to 3,390,148 as of the date of the filing.

On the sell side, the most recent transaction saw Gade unload 9,000 shares at a sale price of $27.39. This brings their total holding to 2,400.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Rent-A-Center Inc. (NASDAQ:RCII) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up EPR Properties (NYSE:EPR) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), EPR Properties (NYSE:EPR) reported that Cnl Lifestyle Properties Inc. has picked up 8,851,264 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Cnl Lifestyle Properties Inc. to a total of 8,851,264 representing approximately 12.0% stake in the company.

For those not familiar with the company, EPR Properties is a specialty real estate investment trust. The Company’s investment portfolio includes primarily entertainment, education and recreation properties. The Company’s segments include Entertainment, Education, Recreation and Other. The Entertainment segment consists of investments in megaplex theatres, entertainment retail centers, family entertainment centers and other retail parcels. The Education segment consists of investments in public charter schools, early education centers and K-12 private schools. The Recreation segment consists of investments in ski areas, waterparks, golf entertainment complexes and other recreation. The Other segment consists primarily of land under ground lease, property under development and land held for development. As of December 31, 2016, the Company’s owned real estate portfolio of megaplex theatres consisted of approximately 10.6 million square feet.

A glance at EPR Properties (NYSE:EPR)’s key stats reveals a current market capitalization of 4.88 Billion based on 64.11 Million shares outstanding and a price at last close of $76.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-17, Brown picked up 1,907 at a purchase price of $67.64. This brings their total holding to 1,907 as of the date of the filing.

On the sell side, the most recent transaction saw Peterson unload 13,645 shares at a sale price of $74.61. This brings their total holding to 34,108.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on EPR Properties (NYSE:EPR) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Devry Education Group Inc. (NYSE:DV) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), L Brands Inc. (NYSE:LB) reported that International Value Advisers has picked up 3,357,491 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by International Value Advisers to a total of 3,357,491 representing a 5.3% stake in the company.

For those not familiar with the company, DeVry Education Group Inc. (DeVry Group) is a global provider of educational services. DeVry Group’s focuses on empowering its students to achieve their educational and career goals. DeVry Group’s institutions offer a range of programs in healthcare, technology, business, accounting, finance, and law. The Company operates in three segments: Medical and Healthcare; International and Professional Education, and Business, Technology, and Management. Medical and Healthcare includes DeVry Medical International (DMI), Chamberlain College of Nursing (Chamberlain) and Carrington College (Carrington). International and Professional Education consists of DeVry Brasil and Becker Professional Education (Becker). Business, Technology, and Management consist of DeVry University. As of June 30, 2016, DMI operated three institutions: American University of the Caribbean School of Medicine (AUC), Ross University School of Medicine (RUSM) and Ross University School of Veterinary Medicine (RUSVM).

A glance at Devry Education Group Inc. (NYSE:DV)’s key stats reveals a current market capitalization of 2.13 Billion based on 62.88 Million shares outstanding and a price at last close of $34.35 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-02-06, Wardell picked up 3,100 at a purchase price of $33.26. This brings their total holding to 114,598 as of the date of the filing.

On the sell side, the most recent transaction saw Paul unload 1,835 shares at a sale price of $32.56. This brings their total holding to 24,499.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Devry Education Group Inc. (NYSE:DV) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Hersch Dennis S. is Buying L Brands Inc. (NYSE:LB) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), L Brands Inc. (NYSE:LB) reported that Hersch Dennis S. has picked up 19,199,710 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Hersch Dennis S. to a total of 19,199,710 representing a 6.7% stake in the company.

For those not familiar with the company, L Brands, Inc. operates specialty retail business. The Company is focused on women’s intimate and other apparel, personal care, beauty and home fragrance categories. Its segments include Victoria’s Secret, Bath & Body Works, and Victoria’s Secret and Bath & Body Works International. It sells its merchandise through company-owned specialty retail stores in the United States, Canada, the United Kingdom and Greater China, which are mall-based; through Websites, and through international franchise, license and wholesale partners. It operates in the retail brands, which include Victoria’s Secret, PINK, Bath & Body Works and La Senza. La Senza is a specialty retailer of women’s intimate apparel. It sells its La Senza products at over 120 La Senza stores in Canada. Henri Bendel sells handbags, jewelry and other accessory products through New York and 28 other stores. Mast Global is a merchandise sourcing and production function serving the Company and its international partners.

A glance at L Brands Inc. (NYSE:LB)’s key stats reveals a current market capitalization of 13.52 Billion based on 284.81 Million shares outstanding and a price at last close of $47.82 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-06-24, Tessler picked up 3,500 at a purchase price of $67.92. This brings their total holding to 3,500 as of the date of the filing.

On the sell side, the most recent transaction saw Mcguigan unload 23,687 shares at a sale price of $76.37. This brings their total holding to 29,735.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on L Brands Inc. (NYSE:LB) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Periam Ltd. Picked Up Enernoc Inc. (NASDAQ:ENOC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Enernoc Inc. (NASDAQ:ENOC) reported that Periam Ltd. has picked up 1,525,120 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Periam Ltd. to a total of 1,525,120 representing a 5.0% stake in the company.

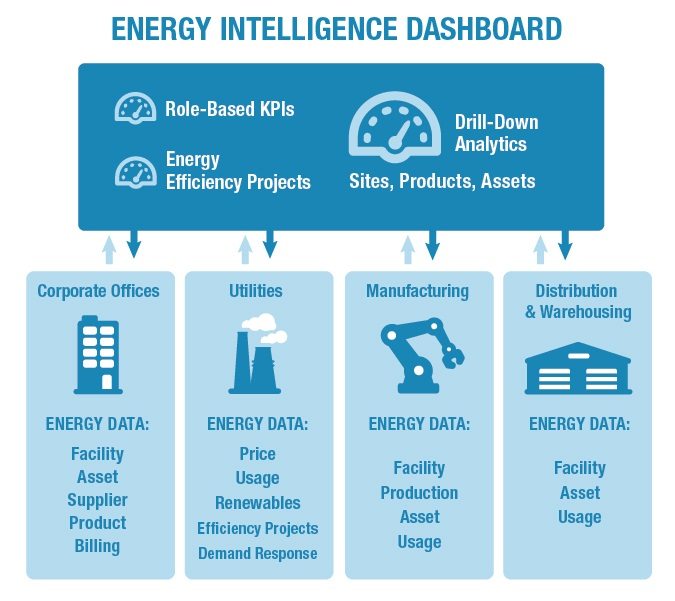

For those not familiar with the company, EnerNOC, Inc. is a provider of energy intelligence software (EIS) and demand response solutions. The Company’s EIS provides enterprise solutions, utility solutions and energy procurement solutions. The Company’s EIS offers enterprise customers with a Software-as-a-Service (SaaS) solutions with various areas of functionalities, including energy cost visualization, budgets, forecasts and accruals; project tracking, and demand management. Its EIS provides its utility customers with a SaaS-based customer engagement platform, which collects and processes data and enables its utility customers to provide personalized communication and recommendations to their customers. Its EIS includes an energy procurement platform that helps its enterprise and utility customers. Its procurement platform offers its enterprise and utility customers with features, such as energy contracts management. Its technology includes over two components: its EIS platform and Network Operations Center (NOC).

A glance at Enernoc Inc. (NASDAQ:ENOC)’s key stats reveals a current market capitalization of 160.04 Million based on 30.43 Million shares outstanding and a price at last close of $5.40 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-17, Healy picked up 8,170 at a purchase price of $7.36. This brings their total holding to 1,353,907 as of the date of the filing.

On the sell side, the most recent transaction saw Dixon unload 10,000 shares at a sale price of $12.51. This brings their total holding to 231,696.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Enernoc Inc. (NASDAQ:ENOC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Oci Partners Lp. (NYSE:OCIP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Oci Partners Lp. (NYSE:OCIP) reported that Oci N.v. has picked up 69,497,590 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Oci N.v. to a total of 69,497,590 representing a 79.9% stake in the company.

For those not familiar with the company, OCI Partners LP owns and operates an integrated methanol and ammonia production facility that is located on the Texas Gulf Coast near Beaumont. The Company has an annual methanol production capacity of approximately 912,500 metric tons and an annual ammonia production capacity of approximately 331,000 metric tons. It purchases natural gas from third parties and processes the natural gas into synthesis gas, which it then further processes in the production of methanol and ammonia. It stores and sells the processed methanol and ammonia to industrial and commercial customers for further processing or distribution. Its methanol production unit comprises Foster-Wheeler-designed twin steam methane reformers for synthesis gas production, over two Lurgi-designed parallel low-pressure, water-cooled reactors and approximately four distillation columns. The Haldor-Topsoe-designed ammonia synthesis loop at its facility processes hydrogen produced by methanol production process.

A glance at Oci Partners Lp (NYSE:OCIP)’s key stats reveals a current market capitalization of 744.39 Million based on 87.00 Million shares outstanding and a price at last close of $8.65 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-11-23, Sawiris picked up 370 at a purchase price of $5.65. This brings their total holding to 868,014 as of the date of the filing.

On the sell side, the most recent transaction saw Gregory unload 4,152 shares at a sale price of $5.35. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Oci Partners Lp. (NYSE:OCIP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Tesoro Logistics Lp (NYSE:TLLP) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Tesoro Logistics Lp (NYSE:TLLP) reported that Tesoro Corp /new/ has picked up 34,055,042 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Tesoro Corp /new/ to a total of 34,055,042 representing a 31.5% stake in the company.

For those not familiar with the company, Tesoro Logistics LP is a full-service logistics company operating in the western and mid-continent regions of the United States. The Company operates through three segments. Its Gathering segment consists of crude oil, natural gas and produced water gathering systems in the Bakken Region and Rockies Region. Its Processing segment consists of the Vermillion processing complex, the Uinta Basin processing complex, the Blacks Fork processing complex and the Emigrant Trail processing complex. Its Terminalling and Transportation segment consists of the Northwest Products Pipeline, which includes a regulated common carrier products, a regulated common carrier refined products pipeline system connecting Tesoro Corporation’s Kenai refinery to Anchorage, Alaska, and crude oil and refined products terminals and storage facilities in the western and midwestern United States; marine terminals in California; a petroleum coke handling and storage facility in Los Angeles, and other pipelines.

A glance at Tesoro Logistics Lp (NYSE:TLLP)’s key stats reveals a current market capitalization of 5.76 Billion based on 103.00 Million shares outstanding and a price at last close of $53.94 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-08-26, Sterin picked up 1,300 at a purchase price of $47.34. This brings their total holding to 3,814 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Tesoro Logistics Lp (NYSE:TLLP) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Soros Fund Management Picked Sigma Designs Inc. (NASDAQ:SIGM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Sigma Designs Inc. (NASDAQ:SIGM) reported that Soros Fund Management has picked up 4,068,819 of common stock as of 2017-04-14.

The acquisition brings the aggregate amount owned by Soros Fund Management to a total of 4,068,819 representing a 5.60% stake in the company.

For those not familiar with the company, Sigma Designs, Inc. is a provider of global integrated semiconductor solutions. The Company offers media platforms for use in the home entertainment and home control markets. The Company sells its products into markets, including smart television, media connectivity, set-top box and Internet of Things (IoT) devices. The Company’s media processor product line consists of a range of functionally similar platforms that are based on integrated chips, embedded software and hardware reference designs. The Company’s media connectivity product line consists of wired home networking controller chipsets that are designed to provide connectivity solutions between various home entertainment products and incoming video streams. The Company’s IoT devices product line consists of its wireless Z-Wave chips and modules. The Company is engaged in the license of its internally developed intellectual property. It also offers legacy products that are sold into prosumer and other industrial applications.

A glance at Sigma Designs Inc. (NASDAQ:SIGM)’s key stats reveals a current market capitalization of 211.77 Million based on 38.15 Million shares outstanding and a price at last close of $5.60 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-13, Soros picked up 133,857 at a purchase price of $5.64. This brings their total holding to 4,068,819 as of the date of the filing.

On the sell side, the most recent transaction saw Nader unload 976 shares at a sale price of $6.20. This brings their total holding to 58,345.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Sigma Designs Inc. (NASDAQ:SIGM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.