Agritech Worldwide Inc. (OTCMKTS:FBER) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Agritech Worldwide Inc. (OTCMKTS:FBER) reported that Kahn Jonathan Efrem has picked up 10,320,889 of common stock as of 2017-04-18.

The acquisition brings the aggregate amount owned by Kahn Jonathan Efrem to a total of 10,320,889 representing a 6.6% stake in the company.

For those not familiar with the company, Agritech Worldwide, Inc., formerly Z Trim Holdings, Inc., is an agricultural technology company. The Company owns existing, and seeks to develop new, products and processes that convert generally available agricultural by-products into multi-functional all-natural ingredients that can be used in food manufacturing and other industries. Its products cater to food and nutritional beverage industry, including fat-free, low-fat, reduced-fat and full-fat, across meats, baked goods, dairy and non-dairy products, snacks, beverages, dressings, sauces and dips. Its industrial products division focuses on the manufacture, marketing and sales of products designed specifically for industrial applications, including oil drilling fluids, petroleum coke, charcoal briquettes, hydraulic fracturing, and paper and wood adhesives. Its product portfolio of multifunctional food ingredients includes Corn Z Trim (both genetically modified organism (GMO) and non-GMO) and Oat Z-Trim.

A glance at Agritech Worldwide Inc. (OTCMKTS:FBER)’s key stats reveals a current market capitalization of 1.80 Million based on 154.98 Million shares outstanding and a price at last close of $0.00850 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2013-11-29, Garfinkle picked up 30,000 at a purchase price of $0.60. This brings their total holding to 777,448 as of the date of the filing.

On the sell side, the most recent transaction saw Kahn unload 400,000 shares at a sale price of $0.01. This brings their total holding to 7,383,663.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Agritech Worldwide Inc. (OTCMKTS:FBER) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Morgan Stanley Picked Bristow Group Inc. (NYSE:BRS) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Bristow Group Inc. (NYSE:BRS) reported that Morgan Stanley has picked up 1,786,447 of common stock as of 2017-04-18.

The acquisition brings the aggregate amount owned by Morgan Stanley to a total of 1,786,447 representing a 5.0% stake in the company.

For those not familiar with the company, Bristow Group Inc. is an industrial aviation services provider and helicopter service provider to the offshore energy industry. The Industrial Aviation Services segment’s operations are conducted primarily through four regions: Europe Caspian, Africa, Americas and Asia Pacific. The Europe Caspian region consists of all its operations and affiliates in Europe and Central Asia, including Norway, the United Kingdom and Turkmenistan. The Africa region consists of all its operations and affiliates on the African continent, including Nigeria, Tanzania and Egypt. The Americas region consists of all its operations and affiliates in North America and South America, including Brazil, Canada, Trinidad and the United States Gulf of Mexico. The Asia Pacific region consists of all its operations and affiliates in Australia and Southeast Asia, including Malaysia and Sakhalin. Additionally, it operates a training unit, Bristow Academy.

A glance at Bristow Group Inc. (NYSE:BRS)’s key stats reveals a current market capitalization of 489.95 Million based on 35.10 Million shares outstanding and a price at last close of $14.00 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-02-10, Baliff picked up 1,400 at a purchase price of $17.69. This brings their total holding to 52,398 as of the date of the filing.

On the sell side, the most recent transaction saw Baliff unload 8,874 shares at a sale price of $68.06. This brings their total holding to 8,819.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Bristow Group Inc. (NYSE:BRS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Picked Americas Carmart Inc. (NASDAQ:CRMT) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Americas Carmart Inc. (NASDAQ:CRMT) reported that Magnolia Capital Fund, Lp. has picked up 797,955 of common stock as of 2017-04-18.

The acquisition brings the aggregate amount owned by Magnolia Capital Fund, Lp. to a total of 797,955 representing a 10.2% stake in the company.

For those not familiar with the company, America’s Car-Mart, Inc. is an automotive retailer focused on the integrated auto sales and finance segment of the used car market. The Company conducts its operations through its two operating subsidiaries, America’s Car Mart, Inc. (Car-Mart of Arkansas) and Colonial Auto Finance, Inc. (Colonial) (Collectively, Car-Mart of Arkansas and Colonial are referred to as Car-Mart). It primarily sells older model used vehicles and provides financing for all of its customers. As of April 30, 2016, the Company operated 143 dealerships located primarily in small cities throughout the South-Central United States. Dealerships are operated on a decentralized basis. Each dealership is responsible for buying (with the assistance of a corporate office buyer) and selling vehicles, making credit decisions, and servicing and collecting the installment contracts it originates. Dealerships also maintain their own records and make daily deposits. The Company has both regular and satellite dealerships.

A glance at Americas Carmart Inc. (NASDAQ:CRMT)’s key stats reveals a current market capitalization of 296.42 Million based on 7.80 Million shares outstanding and a price at last close of $37.00 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-17, Magnolia picked up 18,313 at a purchase price of $35.85. This brings their total holding to 797,955 as of the date of the filing.

On the sell side, the most recent transaction saw Henderson unload 10,000 shares at a sale price of $41.65. This brings their total holding to 76,984.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Americas Carmart Inc. (NASDAQ:CRMT) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Picked Up Hydrogenics Corp (NASDAQ:HYGS) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Hydrogenics Corp (NASDAQ:HYGS) reported that Commscope Holding Company, Inc. has picked up 984,974 of common stock as of 2017-04-18.

The acquisition brings the aggregate amount owned by Commscope Holding Company, Inc. to a total of 984,974 representing a 7.9% stake in the company.

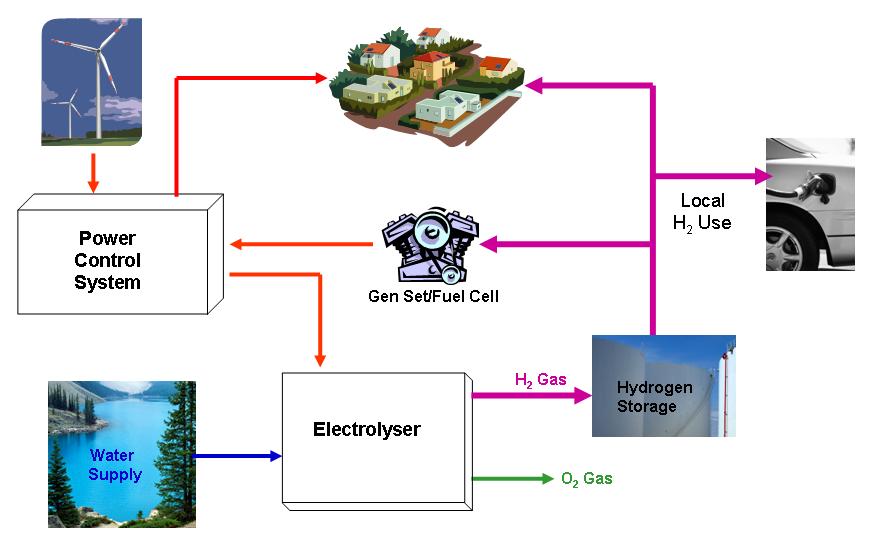

For those not familiar with the company, Hydrogenics Corp is a Canada-based firm, which designs and manufactures hydrogen generation products based on water electrolysis technology, and fuel cell products based on proton exchange membrane (PEM) technology. The Company’s segments are Onsite Generation and Power Systems. The OnSite Generation segment is based in Oevel, Belgium and develops products for industrial gas, hydrogen fueling and renewable energy storage markets. The Power business segment is based in Mississauga, Canada, with a satellite facility in Gladbeck, Germany. The Company’s products include HySTAT hydrogen generation equipment and HyPM fuel cell products. It has facilities in Mississauga, Ontario, Canada; Oevel-Westerlo, Belgium, and Gladbeck, Germany. It also has sales and service offices in Eastern Europe and North America. The Company has operations in Belgium, Canada and Germany with satellite offices in the United States and branch offices in Russia and Indonesia. Its products are sold around the world.

A glance at Hydrogenics Corp (NASDAQ:HYGS)’s key stats reveals a current market capitalization of 85.49 Million based on 12.54 Million shares outstanding and a price at last close of $6.95 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2011-06-30, Commscope picked up 611,247 at a purchase price of $4.09. This brings their total holding to 2,186,906 as of the date of the filing.

On the sell side, the most recent transaction saw Commscope unload 3,800 shares at a sale price of $10.14. This brings their total holding to 1,251,428.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Hydrogenics Corp (NASDAQ:HYGS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Ocera Therapeutics Inc. (NASDAQ:OCRX) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Ocera Therapeutics Inc. (NASDAQ:OCRX) reported that Perceptive Advisors has picked up 2,150,000 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Perceptive Advisors to a total of 2,150,000 representing approximately 9.11% stake in the company.

For those not familiar with the company, Ocera Therapeutics, Inc. is a clinical-stage biopharmaceutical company. The Company is focused on acute and chronic orphan liver diseases. The Company is focused on the development and commercialization of its clinical candidate, OCR-002, for the treatment of hepatic encephalopathy (HE). OCR-002 is a molecule, ornithine phenylacetate, which functions as an ammonia scavenger. It is conducting a randomized, placebo-controlled double blind Phase IIb clinical trial to evaluate the efficacy of intravenous administration of OCR-002 IV formulation in reducing the severity of HE symptoms among HE patients. The Company also conducted a Phase IIa investigator-sponsored trial of OCR-002 in Spain in patients with upper gastrointestinal bleeding associated with liver cirrhosis. It is developing an oral form of OCR-002 to provide continuity of care for HE patients, where the intravenous form is used for hospital-based acute care and the oral form for chronic maintenance care post discharge.

A glance at Ocera Therapeutics Inc. (NASDAQ:OCRX)’s key stats reveals a current market capitalization of 37.96 Million based on 23.60 Million shares outstanding and a price at last close of $1.45 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-28, Byrnes picked up 3,000 at a purchase price of $1.28. This brings their total holding to 13,000 as of the date of the filing.

On the sell side, the most recent transaction saw Powell unload 11,969 shares at a sale price of $2.53. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Ocera Therapeutics Inc. (NASDAQ:OCRX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Ronin Capital, Llc is Buying Peregrine Pharmaceuticals Inc. (NASDAQ:PPHM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Peregrine Pharmaceuticals Inc. (NASDAQ:PPHM) reported that Ronin Capital, Llc. has picked up 95,059 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Ronin Capital, Llc. to a total of 95,059 representing approximately 5.8% stake in the company.

For those not familiar with the company, Peregrine Pharmaceuticals, Inc. (Peregrine) is a biopharmaceutical company. The Company operates through two segments: Peregrine, which is engaged in the research and development of monoclonal antibodies for the treatment of cancer, and Avid, which is engaged in providing contract manufacturing services for third party customers on a fee-for-service basis while also supporting its internal drug development efforts. Bavituximab is its lead immunotherapy candidate. Bavituximab is a monoclonal antibody that targets and binds to phosphatidylserine (PS), a immunosuppressive molecule that is usually located inside the membrane of healthy cells, but then flips and becomes exposed on the outside of cells in the tumor microenvironment, causing the tumor to evade immune detection. The Company’s subsidiary is Avid Bioservices, Inc. (Avid). Avid provides integrated current good manufacturing practices (cGMP) services from cell line development to commercial biomanufacturing.

A glance at Peregrine Pharmaceuticals Inc. (NASDAQ:PPHM)’s key stats reveals a current market capitalization of 158.77 Million based on 297.71 Million shares outstanding and a price at last close of 0.546 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2012-03-14, Swartz picked up 16,000 at a purchase price of $0.62. This brings their total holding to 126,000 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Peregrine Pharmaceuticals Inc. (NASDAQ:PPHM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Schuler Jack W Picked Up Biolase Inc. (NASDAQ:BIOL) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Biolase Inc. (NASDAQ:BIOL) reported that Schuler Jack W has picked up 20,728,060 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Schuler Jack W to a total of 20,728,060 representing approximately 28.71% stake in the company.

For those not familiar with the company, BIOLASE, Inc. (BIOLASE) is a medical device company that develops, manufactures, markets and sells laser systems in dentistry and medicine. The Company markets, sells, and distributes dental imaging equipment, including cone beam digital x-rays and computer-aided design (CAD)/computer-aided manufacturing (CAM) intra-oral scanners, in-office, chair-side milling machines and three-dimensional (3-D) printers. It offers two categories of laser system products: WaterLase (all-tissue) systems and Diode (soft tissue) systems. Its brand, WaterLase, uses a combination of water and laser energy to perform procedures performed using drills, scalpels, and other traditional dental instruments for cutting soft and hard tissue. It also offers its Diode laser systems to perform soft tissue, pain therapy, and cosmetic procedures, including teeth whitening. Its Waterlase and Diode systems use disposable laser tips of differing sizes and shapes depending on the procedures being performed.

A glance at Biolase Inc. (NASDAQ:BIOL)’s key stats reveals a current market capitalization of 93.50 Million based on 67.66 Million shares outstanding and a price at last close of $1.32 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-10-21, Schuler picked up 33,762 at a purchase price of $0.95. This brings their total holding to 4,213,429 as of the date of the filing.

On the sell side, the most recent transaction saw Mulder unload 5,000 shares at a sale price of $1.25. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Biolase Inc. (NASDAQ:BIOL) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

See Who Picked Nexpoint Residential Trust Inc. (NYSE:NXRT) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Nexpoint Residential Trust Inc. (NYSE:NXRT) reported that Highland Capital Management has picked up 2,038,778 of common stock as of 2017-04-17.

The acquisition brings the aggregate amount owned by Highland Capital Management to a total of 2,038,778 representing approximately 9.69% stake in the company.

For those not familiar with the company, NexPoint Residential Trust, Inc. is an externally managed real estate investment trust (REIT). The Company’s investment objectives are to maximize the cash flow and value of properties owned, acquire properties with cash flow growth potential, provide quarterly cash distributions and achieve long-term capital appreciation for its stockholders through targeted management and a value-add program. The Company is focused on multifamily investments primarily located in the Southeastern and Southwestern United States. All of the Company’s business operations are conducted through NexPoint Residential Trust Operating Partnership, L.P. (OP). The sole limited partner of the OP is the Company. Its subsidiary, NexPoint Residential Trust Operating Partnership GP, LLC, is the sole general partner of the OP. As of December 31, 2016, the Company owned 39 properties representing 12,965 units in eight states, including two Parked Assets. The Company’s advisor is NexPoint Real Estate Advisors, L.P.

A glance at Nexpoint Residential Trust Inc. (NYSE:NXRT)’s key stats reveals a current market capitalization of 525.04 Million based on 21.04 Million shares outstanding and a price at last close of $25.01 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-19, Constantino picked up 7,245 at a purchase price of $13.91. This brings their total holding to 19,420 as of the date of the filing.

On the sell side, the most recent transaction saw Mitts unload 200 shares at a sale price of $19.36. This brings their total holding to 1,125.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Nexpoint Residential Trust Inc. (NYSE:NXRT) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.