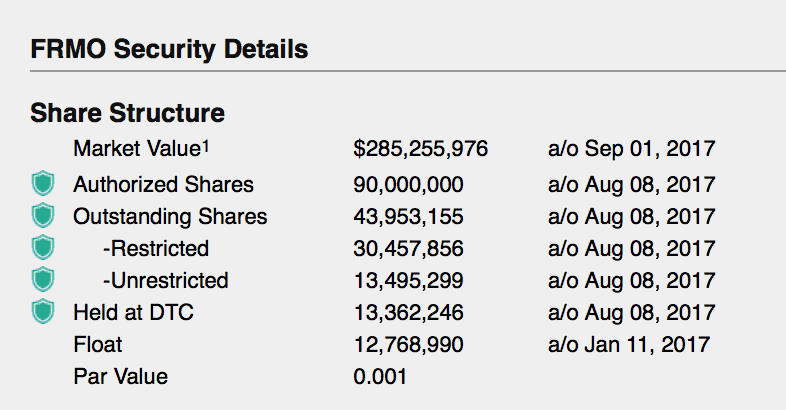

FRMO Corp has OVER 40% Gains in Just 3 Days, BUT WHY?

FRMO (OTCMKTS:FRMO) FRMO Corp has solid gains on massive Volume in just 3 days, but why?

We are going to attempt to explain why share prices have gone from $4.30 on 8/30/17 to over $6.49 on Friday 9/1/17

Recent History

FRMO has traded between $ and $4.50 for the last few months with moderate volume and no spikes or drops. On August 28 volume hit a 3 month high but FRMO closed red. On the 29th of August FRMO Corp released its Fiscal Results for 2017

FRMO’s 2017 book value as of May 31, 2017 was $114.2 million ($2.60 per share on a fully diluted basis), including $10.9 million of non-controlling interests. The figure from the prior fiscal year-end as of May 31, 2016 was $102.0 million ($2.33 per share) including $3.7 million of non-controlling interests. Current assets, comprised primarily of cash and equivalents and investments available for sale, amounted to $71.3 million as of May 31, 2017, and $62.8 million as of May 31, 2016. Total liabilities were $13.1 million as of May 31, 2017, compared to $12.9 million as of May 31, 2016, the majority of each being deferred taxes.

FRMO’s 2017 net income (loss) for the fiscal year ended May 31, 2017 was $3,493,948 ($0.08 per share basic and diluted), compared to a loss of $(780,011) ($(0.02) per share basic and diluted) for the 2016 fiscal year. Income from operations for the 2017 fiscal year ended May 31, 2017 was $6,915,986, compared to $993,913 for the prior year. Comprehensive income (loss) attributable to the Company for the same periods was $4,335,956 up from a loss of $(7,020,898). The latter figure included unrealized investment losses.

Business Description

Unable to find much in for a business description:

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

Company website Again not much to it….

My Opinion

There is just not much to talk about with this company but the chart looks amazing. I will continue to watch but would be very cautious about purchasing.

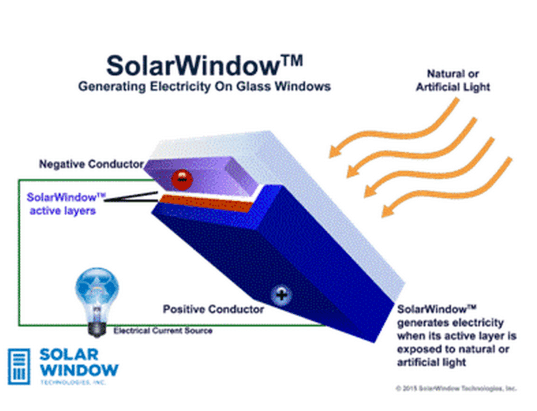

WNDW SolarWindow Technologies starts production of its Solar Windows (OTCMKTS:WNDW)

WNDW SolarWindow Technologies Stock Spikes After News of Production Moving Forward (OTCMKTS:WNDW)

[caption id="attachment_7890" align="alignleft" width="445"] March 14, 2014 shoot for New Energy Technologies. Scott Hammond[/caption]

March 14, 2014 shoot for New Energy Technologies. Scott Hammond[/caption]

Share of WNDW (OTCMKTS:WNDW) SolarWindows Technologies have seen 25% spike over last few trading sessions, from $3.60 to $4.80. On 8/29/17 WNDW released news that the company will go into production of its Electricity-Generating Glass with an award winning fabricator, Los Angeles-based Triview Glass Industries, LLC.

“The prospect of generating electricity on commercial buildings, which consume nearly 40% of all electricity generated in the US, is made possible when transparent SolarWindow™ electricity-generating liquid coatings are applied to glass surfaces.

As the company’s select regional fabricator in North America, Triview Glass will work to fabricate specific SolarWindow™ electricity-generating glass products at commercial scale by integrating SolarWindow™ technologies into its manufacturing processes.

Commercial buildings are ideal customers for electricity-generating windows, which could reduce electricity demand by 30%-50% and provide a one-year financial payback, according to independently-validated engineering modeling for a 50-story building. ”

Full News Released on 8/29/17 : Click Here

RECENT HISORY

ON 8/29/17 Price per share of WNDW started trading around $3.69 and with massive volume the stock hit a high of $4.04. The following day WNDW opened at $4.07 and hit a high of $4.69. On 8/31/17 the price started to consolidate and came back off the highs, hitting a low of $4.05 before hitting support and closing the day around $4.25.

Volume has slowed a bit over the last few sessions but the WNDW pps has continued to show solid support and solid moves upward.

“We’ve long awaited the opportunity to integrate SolarWindow™ technologies into commercial scale production, and I believe that our agreement with Triview puts us well on that path,” explained SolarWindow President and CEO, Mr. John A. Conklin.

Business Description

SolarWindow Technologies, Inc., publicly traded under the symbol WNDW, is focused on the research, development and eventual commercialization of the first-of-its-kind see-through SolarWindow technology, capable of generating electricity on glass windows and flexible plastics.

https://www.otcmarkets.com/stock/WNDW/profile

Technology

SolarWindow™ achieves payback within one year, according to first-ever independently validated financial modeling results.

To produce the equivalent amount of energy with conventional solar systems would require at least 5-11 years for payback and at least 10-12 acres of valuable urban land.

Unlike the many acres of expensive downtown real estate required for solar array fields, SolarWindow™ systems can be installed on the readily-available vast window glass surfaces on tall towers and skyscrapers.

SolarWindow™ can be applied to all four sides of tall towers, generating electricity using natural, shaded, and even artificial light. Conventional solar simply does not work in shaded areas or perform under artificial light.

The result? SolarWindow™ can outperform today’s solar by as much as 50-fold when installed on a 50 story building, according to independently validated power production calculations.

Find more at the company website here : www.solarwindow.com

Our Opinion

We like everything about WNDW and its electricity-generating window technology. We believe that WNDW is a safe play and the future will bring many happy investors.

CRYO American CryoStem Corp Continues, but is it time to SELL?

OTC:CRYO (American CryoStem Corporation), based in Eatontown, NJ, with partner laboratories in the U.S., Japan and China, is a firm engaged in developing, bringing to market, standardizing and licensing technologies, materials and services geared at adipose tissue (aka body fat) regenerative and personalized medicine. In this capacity, CRYO is focused on research, analysis, transfer, storage, sterilization, viability and other services in the over-arching adipose tissues field. They also claim to have a strategic portfolio of intellectual property (IP) which they say will support their pipeline of stem cell and applications and biologic products. CRYO was founded in 2008.

OTC:CRYO (American CryoStem Corporation), based in Eatontown, NJ, with partner laboratories in the U.S., Japan and China, is a firm engaged in developing, bringing to market, standardizing and licensing technologies, materials and services geared at adipose tissue (aka body fat) regenerative and personalized medicine. In this capacity, CRYO is focused on research, analysis, transfer, storage, sterilization, viability and other services in the over-arching adipose tissues field. They also claim to have a strategic portfolio of intellectual property (IP) which they say will support their pipeline of stem cell and applications and biologic products. CRYO was founded in 2008.

There’s been a spike in recent activity on CRYO and we’ll look at the short- and long-term implications as well as try to figure out what’s actually behind the sudden upward trendline.

In 2016 CRYO appointed a Nobel Prize nominee and stem cell expert Vincent C. Giampapa, M.D. to its medical and scientific advisory board. Mr. Giampapa was nominated for the prize for his stem cell work in epigenetics, or the study of human cell function with the goal of aging better. More recently CRYO filed for patent protection for its premier growth medium, ACSelerate MAX™, in Europe, China, Hong Kong, Japan, Mexico, Thailand, Israel, Russia, India, Australia/New Zealand, Brazil, Canada, and Saudi Arabia. This product is a growth medium for stem cells. They also announced the plan to continue to expand the licensing model that the developed for ACSelerateMAX™ and apply it to their entire family of 14 growth and differentiation mediums as well as its transportation and cryopreservation mediums many of which are patented and others in the patent process internationally.

So long story short, this company is in the business of stem cell treatments and therapies. What does that mean and how does it compare to their peers? Well, they just released their 2017 Q3 earnings report and from what we can see, most indicators fare pretty well for the future. In summary, revenues are up slightly, YOY revenue growth is about 173%, earnings are positive for the first time in several cycles as is net margin.

So long story short, this company is in the business of stem cell treatments and therapies. What does that mean and how does it compare to their peers? Well, they just released their 2017 Q3 earnings report and from what we can see, most indicators fare pretty well for the future. In summary, revenues are up slightly, YOY revenue growth is about 173%, earnings are positive for the first time in several cycles as is net margin.

Their peers include Brainstorm Cell Therapeutics, Inc. (BCLI), Verastem, Inc. (VSTM), Arrowhead Pharmaceuticals, Inc. (ARWR), Fate Therapeutics, Inc. (FATE) and Caladrius Biosciences, Inc. (CLBS) and all have reported for the same Q3 period. All told, CRYO appears to be in good shape compared to its peers (all information is available to the public) and is holding onto its market share. It doesn’t look like CRYO has sacrificed working capital for gross margins, which also improved, and indicates balance sheet solidity and good decision making by corporate governance.

So, where does it stand and where is it going? For much of the last year it has hovered between a low of $0.20 and $0.54 in June of 2017. At that point it began a takeoff and in August fluctuated between $0.53 and $0.75 before spiking to $1.10 twice in the past 2-week period through a 75% increase in trading volume. As of now, it rests at $1.00. We truly think that anything is possible with this one and most indicators are positive for the short and mid-term value of this stock. It appears to be slightly undervalued and the market has noticed. A year ago they retained an investor relations partner and that may be paying off in more than one ways.

Keep an eye on this one. Even though it’s near its all-time high, we think that bodes even better for the future.

ESPR Esperion Therapeutics, Inc. Consolidation (NASDAQ:ESPR)

(NASDAQ:ESPR) Esperion Therapeutics Inc

(NASDAQ:ESPR) Esperion Therapeutics, Inc. peaked out and closed at $48.90, way up from about $10 where it sat last August, but way below its all-time high of $107.51 in spring 2015. Still, ESPR has been on a good run since about January, but especially since June, probably based on positive news coming out on various stages of ongoing clinical trials. ESPR is a pharmaceutical company based in Ann Arbor, MI and dedicated pretty much exclusively to developing non-statin LDL cholesterol drugs with safer profiles and fewer side effects than the statins currently on the market.

THE COMPANY

ESPR Esperion Therapeutics Inc. has an interesting history, having been acquired by Phizer in 2004 for $1.3Bn in order to get sole possession of an experimental statin called ETC-216 and prevent their competitors from obtaining it. Esperion was founded by Dr. Roger Newton, the man responsible for co-discovering the Lipitor molecule, a statin drug and the most prescribed medication in the history of pharmaceuticals. Phizer eventually killed off the research and ESPR was re-acquired by Dr. Newton after he raised the capital to buy the rights to the name and to their other experimental compound, ETC-1002, which is also a novel cholesterol treatment based on the biological properties of bempedoic acid, which is converted to ETC-1002-CoA in the human liver and, through a sequence of reactions, results in the liver’s removal of LDL-C from the blood.

ESPR has pushed bempedoic acid in 18 completed Phase 1 and Phase 2 clinical studies and it is currently being evaluated in four other Phase 3 LDL efficacy and safety studies, along with one cardiovascular outcomes trial. Their pipeline consists solely of Bempedoic Acid (once daily pill) and a combination of Bempedoic Acid and Ezetimibe (once daily pill) which itself just began Phase 3 trials.

ESPR stock price has fluctuated greatly in the past 52-week period with a range of $9.40 to $57.38 and earlier in August they announced an underwritten offering of 3,100,000 shares to the public at $49.00 per with the goal of continuing to finance the previously mentioned clinical trials for the two drugs in their pipeline. There’s lots of detailed technical information out there on these trials, but suffice it to say that if any one or a combination of them are unqualified successes, they could be looking at blockbuster status on par with or even bigger than Lipitor and of course a huge uptick in value. Results are somewhat far off, however, with expected announcements after the completion of the studies in Q2 and Q3 2018 and various bridging studies yet to begin. Of note, ESPR’s R&D budget for the first six months of 2017 was $74.1M compared to $19.5M for the same period in 2016.

We think this makes ESPR an intriguing investment. With the FDA having approved an abbreviated regulatory pathway to the bempedoic acid/ezetimibe combination, and a looming New Drug Application anticipated after the studies are concluded in 2018, this stock may take a slight dive in the next few weeks, but rally significantly toward its $107.51 all-time high by the end of 2018.

Whats Next For LBUY (OTC:LBUY) Leafbuyer Technologies Inc. Looking Forward

(OTC:LBUY) Leafbuyer Technologies, Inc. has seen a recent spike in volume which is currently at 363,464 and nearing 3x its previous average. LBUY is a Colorado firm that provides an online database for the U.S. legal and medical cannabis markets. Founded in 2012, their users are able to locate dispensaries by state/city, read reviews of dispensaries, and in some cases find coupons to save money on cannabis purchases.

In addition to their longer upward trend over the past 52 week period, there have been several recent developments that likely contributed to this spike in trading over the past week. In May their stock was granted DTC eligibility, which is a must for any stock’s future growth potential. Most large U.S. broker-dealers and banks are DTC participants – they hold and deposit securities at DTC. Additionally LBUY has made several announcements in the past few months that have garnered them positive publicity. These include the development and launch of a mobile app that mostly mirrors the functionality of the LBUY website, and which is available in the Apple Store and Google Play Store.

In June they added a career-finder portal to their suite of services which makes use of their existing database search tools and reportedly lists hundreds of careers and jobs in the cannabis industry. In May LBUY announced a forward split of 9.25 to 1 which itself led to a momentary spike, but nothing near the current value of $2.94, which even though it’s down from a 1-yr high of $3.61 is nearly 4x the $1 level where it sat for most of 2016 and 2017. This came just before a big announcement that they will be expanding their regional footprint to markets in Washington, Oregon, California, Arizona, Nevada and Michigan. Most recently on August 22, LBUY issued a press release touting a renewed partnership with the Cannabist, a mainstream and highly regarded (pun intended) marijuana news website subsidiary of The Denver Post. This is meaningful because of the reach of and respect for the Cannabist and especially because there is now a LBUY “Deals Widget” on every page of the Cannabist’s website.

So what does all this mean? We think that the current price may represent a good value and that recent trading levels could indicate a sharp spike in price; but if not the combination of factors discussed before will at least ensure a steady rise toward the $5 range. Whether you’re basing your investment decision on the larger trend toward decriminalization/legalization or on LBUY’s ability to reach its intended market or the strength of its brand and relative lack of competition – or all three – LBUY hasn’t looked more promising than it does now in quite some time.

These Analysts Insist Wirecard AG (FRA:WDI) Remains Considerably Undervalued

Wirecard AG (FRA:WDI) (OTCMKTS:WRCDF) (OTCMKTS:WCAGY) took a real hit last year when the company found itself on the wrong end of an unwarranted short attack. Despite being one of the biggest payments processors in the world, large portions of the market chose to take the word of an unknown research organization as more reliable than that of the analysts following the stock and wiped off more than 30% of Wirecard’s market capitalization between January 2016 and March the same year.

As is to be expected, with the accusations proving baseless, Wirecard has appreciated considerably across the 12 months subsequent to its March 2016 lows. Despite this appreciation, however, analysts still expect Wirecard’s share price to rise throughout the second quarter of 2017 and beyond.

Here is a look at where these analysts think this growth is coming from and what price target each has on the company right now.

Before we get started on the price targets, and for those not yet familiar with Wirecard, we’ll kick things off with a quick introduction to the company.

It is a German-based entity that – at last count – served more than 170,000 clients across the globe. These range from small individual retailers doing business online to large multinational corporations using Wirecard’s services as a full suite payment processing framework for their various operational activities. Outside of its technology offerings, Wirecard Provides consultation type services, with things like relationship management, risk control and expansion strategy guidance all underlying the existing relationships it shares with the clients on its books.

Just recently, and on the back of the company’s acquisition of the prepayment card operations of US banking giant Citigroup Inc (NYSE:C), Wirecard expanded into the US. In doing so, the company has taken a considerable step towards overtaking its primary competitor, and the leader in the space from a client count perspective, Worldpay Group PLC (LON:WPG). The move marks the company’s first foray into the North American market and sets the stage for industry leadership in the fast-growing payments processing sector.

Now let’s look at the expectations of various analysts.

For the purposes of this discussion, we’re going to focus on five institutional analyses. These are those of Hauck & Aufhäuser, Baader, Commerzbank, Berenberg and Godman Sachs.

First then, Hauck & Aufhäuser.

This firm put out its latest Wirecard report on April 10, 2017, subsequent to the company’s conference call. Based on the call in question, H&A kicked off the report with a reaffirmation of its opinion that Wirecard holds a leading market position for payment service and risk management solutions for merchants globally and followed up with the opinion that the growth potential for the company is not fully reflected in the then-current share price of €53.

The growth potential, according to H&A, is rooted primarily in the global shift towards more efficient payments processing. The firm highlighted the fact that currently only 6-7% of transactions are processed efficiently. Accordingly, Wirecard is positioned to take advantage of the inevitable push to increase this percentage figure. Wirecard put out guidance last month for 2017 revenues of between €382-400 million and H&A, in its report, reinforced the company’s ability to meet the high end of this guidance, if not outpace it altogether.

The price target the firm placed on Wirecard at the time of its report was €65. At the time of writing (this report) the company trades for €58, suggesting a 12% premium.

Next, Baader.

Baader’s latest report came on April 18, 2017. Most notably, as part of this report, Baader suggested that the company’s guidance for 2017 understated the company’s potential. A number of inputs fed into this suggestion, primarily that Wirecard’s 2016 financials showed no signs that organic EBITDA growth should slow in 2017 (organic EBITDA growth was 26% in 2015 and 27% in 2016; guidance for 2017 at mid-point: +24%) and that M&A costs should decrease during 2017, as compared to 2016.

Baader made a point of noting that the above-mentioned acquisition of the Citi operations was included in these estimates. Based on these assumptions, Baader estimates an outperformance on Wirecard’s 2017 guidance, suggesting EBITDA could reach €408 million (€8 million above the higher threshold of the €400 million guidance given by the company last month).

Based on its analysis, Baader has a €70 price target on Wirecard – a 20% gain on the company’s current price.

Moving on, Commerzbank.

The Commerzbank report highlights the fact that Wirecard remains one of its top secular growth plays. The research report pointed to a slight acceleration of organic revenue growth during the first quarter of the year contributing to as underpinning revenue of €276m. The company’s preliminary estimates for this number actually came out as €274 million, representing a circa 31% increase on the €210 million reported during the same period in 2016.

Just as with the other analysts covering this stock, Commerzbank pointed to industry expansion in the payments processing space (and the drive for efficiency therein) as fundamental to Wirecard’s growth potential going forward. This was a common thread throughout the majority of the company’s analyst coverage.

Looking at a price target, Commerzbank has Wirebank at €65. The company was trading for €53 at the time of the target’s placement, implying a 22% performance to its then-price and a 12% premium to current pricing.

Next, Berenberg.

This is one of the more conservative reports on our list, yet it still presents a significant upside potential to the company’s current share price. Berenberg highlights the Citi acquisition as being key to Wirecard’s growth potential, with this suggestion primarily rooted in its impact on shareholder opinion. Specifically, Berenberg notes that the acquisition has proven to investors that Wirecard’s relationship with the US authorities is not as poor as some believed and that this paves the way for further expansion in North America going forward. It goes without saying that North America is a key market in the electronic payments space and, as such, any indication that Wirecard is overcoming hurdles to expansion within this market is almost certain to support and strengthen bullish sentiment.

We noted that Berenberg has a conservative opinion when compared to some of the above reports, but this conservatism refers to its price target only. Berenberg believes that Wirecard can outperform on its guidance of €400 million for 2017, with €404 million listed as a most likely scenario and €421 million as blue-sky.

Finally, Goldman Sachs.

Goldman Sachs is one of the only reports on this list to highlight the potential for growth in Asia (on the back of a spate of recent acquisitions in the region) as fundamental to its forward thesis on the stock.

Further, Goldman notes that Wirecard should benefit from an increase in the scale of its operations over time, stating that this will lead to a proportional increase in the company’s transaction volume per merchant.

Looking at the firm’s price target, Goldman falls in line with both Commerzbank and H&A in its placing of a twelve-month target of €65 on Wirecard. That’s a 23% premium to Wirecard’s price at the time of Goldman’s report publication, and as noted above, represents a 12% premium to the company’s current price.

WSTRF Shareholder Update News

TORONTO and NUCLA, Colo., Aug. 21, 2017 (GLOBE NEWSWIRE) — Western Uranium Corporation (CSE:WUC) (OTCQX:WSTRF) (“Western” or the “Company”) is pleased to provide an update to shareholders and the market.

WSTRF Western is investigating re-starting its vanadium-rich mines as the result of the higher vanadium price, currently $9.50 per pound. The 2017 forecast global production of vanadium is about 80,000 tonnes compared to the forecast consumption of 88,000 tonnes, implying a supply deficit of approximately 8,000 tonnes in the global vanadium market. As vanadium inventories have been depleted, global steel mills are competing against the growing vanadium redox battery (VRB) industry for consistent vanadium supplies. The VRB market could represent another 7,000 to 30,000 tonnes of vanadium demand per annum over the next ten years.

The reason for the decrease in supply and increase in price of vanadium is the Chinese government forcing some factories and iron ore mines to curtail operations to reduce air pollution. Vanadium is a unique commodity market, as China is both the largest producer and consumer of vanadium. China accounts for about 45% of the world’s vanadium production while Russia and South Africa account for approximately another 30% of global vanadium production.

WSTRF has begun discussions on the economics of building a vanadium and ferro-vanadium processing plant. Ferro-vanadium is a higher value product than vanadium pentoxide, enhancing margins for the Company and shareholders.

Finally, discussions have begun with potential vanadium offtake partners both domestically and internationally.

The aforementioned discussions are early stage and the Company will update the market when further news can be released.

Further, WSTRF Western also announces it has received a bonus payment of $120,000 from signing an oil and gas lease on one of its properties in a hydrocarbon rich region. If oil and/or gas is found, the Company will receive a significant royalty percentage which will be reinvested in the Company’s core vanadium and uranium mining operations. The oil and gas leasing agreement allows the Company to retain full property rights to vanadium, uranium, and other mineral resources.

These strategic positioning decisions are being evaluated relative to cash flow generation potential. Western is seeking to capitalize on the vanadium and royalty opportunities to generate meaningful cash flow by optimizing and advancing the asset package, in spite of the current low uranium price environment. These actions would have the added benefit of advancing uranium operations in preparation for when the cycle turns and the market recognizes the imminent global uranium supply deficit.

About Western Uranium Corporation

Western Uranium Corporation is a Colorado based uranium and vanadium conventional mining company focused on low cost near-term production of uranium and vanadium in the western United States and development and application of ablation mining technology.

KAYS Marijuana Company Kaya Holdings (OTCMKTS:KAYS) Announces Property Purchase Agreement

(OTCMKTS:KAYS) Marijuana Company Kaya Holdings 10-Q Details Increase in Institutional Financing Agreement to $6.3M, Targets Property Purchase for Cannabis Production Facility

Aug 22, 2017

OTC Disclosure & News Service

–

FORT LAUDERDALE, Fla., Aug. 22, 2017 (GLOBE NEWSWIRE) — Kaya Holdings, Inc. (OTCQB:KAYS), filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 yesterday afternoon. This confirmed KAYS’ continued growth and detailed an agreement for an increase in funding with the Cayman Venture Capital Fund. This will be used for KAY’s purchase of property to build a Cannabis Production Facility in central Oregon.

“KAYS is pleased to confirm the filing of our 10Q for the period ending June 30, 2017. We are very excited by the growth components that we have developed over the quarter. As we look forward to completing a targeted property purchase, on which we plan to relocate our grow and establish a state-of-the-art medical and recreational cannabis manufacturing facility,” stated Kaya Holdings CEO Craig Frank. “Additionally, we secured additional financing to support the launch of Kaya Shack™ delivery services.”

“Difficulty in transitioning our Portland store from an OHA to an OLCC license resulted in a decline in sales for Q2, year over year, of approximately $50,000. However our cash and other assets have increased by nearly $1mm for the same period. As of June our monthly numbers are on pace to exceed last year’s average monthly revenues by 20%, on an annualized basis. We now have 3 OLCC Licensed Kaya Shack™ marijuana retail outlets, with the 4th location expected to open in Q-3”, continued Frank. “With our growth plan in place, including introducing home delivery service and relocating and expanding our grow and production facility, the Company is taking steps to broaden its market and increase revenues, while lowering costs through more in-house production.”

The Company expects to release full details of the property purchase within the next 2 weeks.

About Kaya Holdings, Inc. (OTCMKTS:KAYS)

Kaya Holdings, Inc. (OTCQB:KAYS) owns and operates Kaya Shack™ legal marijuana dispensaries in Oregon as well as grow and manufacturing operations, which produce, distribute and/or sell premium legal cannabis products under the Company’s own brands, including flower, concentrates, and cannabis-infused baked goods and candies. KAYS is the first publicly-traded U.S. company to own and operate legal marijuana dispensaries and a vertically integrated legal cannabis grow and manufacturing operation.

Important Disclosure

KAYS is planning execution of its stated business objectives in accordance with current understanding of State and Local Laws and Federal Enforcement Policies and Priorities as it relates to Marijuana (as outlined in the Justice Department’s Cole Memo dated August 29, 2013). Also a plan to proceed cautiously with respect to legal and compliance issues. Potential investors and shareholders are cautioned that the Company will obtain advice of counsel prior to actualizing any portion of its business plan. This (including but not limited to license applications for the cultivation, distribution or sale of marijuana products, engaging in said activities or acquiring existing cannabis production/sales operations). Advice of counsel with regard to specific activities of KAYS, Federal, State or Local legal action or changes in Federal Government Policy and/or State and Local Laws may adversely affect business operations and shareholder value.

Forward-Looking Statements

This press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe,” “estimate,” “project,” “expect” or similar expressions. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, acceptance of KAYS’ current and future products and services in the marketplace.

For more information please review our periodic and current filings available at www.sec.gov, call 561-210-5784 or visit www.kayaholdings.com or sign up to receive updates.