Chicago Bridge & Iron Company N.V. (NYSE: CBI) – McDermott International Inc. (NYSE: MDR) Merger Given Green light By Shareholders

Is Karyopharm Therapeutics Inc. (NASDAQ: KPTI) A Breakout Stock After Positive Myeloma Trial Results?

Aurora Cannabis Inc. (OTCMKTS: ACBFF) Turns To Acquisitions And Partnerships To Accelerate Growth

Aurora Cannabis Inc. (OTCMKTS: ACBFF) Turns To Acquisitions And Partnerships To Accelerate Growth

Aurora Cannabis Inc. (OTCMKTS: ACBFF) has not had the best of starts to a new year. Its stock has been under immense selling pressure, a move that has seen its tank from the $12.30 handle to current trading levels. However, the steep pullback cannot in any way be attributed to deteriorating underperformance.

The industry has been under pressure for the better part of the year. However, things are starting to look up, presenting a unique opportunity to buy stocks with high growth potential.

Aurora Cannabis should be an exciting pick for investors looking to gain some exposure in the fast emerging marketplace. The stock appears to have found support at the $6 a share handle, from where it is trying to make a comeback as investor confidence in the space starts to tick higher.

Aurora Cannabis is one of the big players in Canada’s legal cannabis business. The company produces and distributes medical marijuana products in Canada. Its products line consists of dried cannabis and cannabis oil.

Recent Developments

Aurora Acquisition Drive

After starting with one flagship project in the name of Aurora Sky, Aurora Cannabis has sought to expand its empire in pursuit of growth opportunities in the sector. Acquisitions and partnerships have come into play, further strengthening the company’s competitive edge in the industry.

Early this year, the company formed a joint venture with Danish tomato and pepper producer Alfred Pedersen & Son for the sale of Cannabis. Pursuant to the agreement, Aurora Nordic facility should come to life, capable of producing 120,000 kilograms a year. The joint venture paves the way for the company to target customers in Europe, in countries that have legalized medicinal cannabis.

Aurora Cannabis has also broadened its product portfolio with the acquisition of Saskatchewan-based CanniMed. The acquisition adds about 19,000 kilograms of fully-funded capacity into Aurora Coffers.

Sales Opportunities

The company is also pursuing sales opportunities in addition to strengthening its production capacity. The signing of a final agreement with Société des Alcools du Québec should low the company to supply a minimum of 5,000 kg of cannabis per annum to Quebec adult consumer market, once it comes online.

“With two facilities, as well as a supply agreement with the Green Organic Dutchman, we have a strong local presence, which we believe will contribute to increased visibility in this important market. We look forward to establishing the Aurora Standard as the benchmark for quality and customer service in Canada’s second most populous province,” stated Terry Booth, CEO.

Acquisitions and partnerships all but position Aurora Cannabis in a strategic position, in pursuit of revenue opportunities in the fast-growing cannabis industry. The stock is thus expected to continue climbing as investors take note of the emerging opportunities for growth.

More Articles:

https://finance.yahoo.com/news/aurora-cannabis-completes-agreement-soci-110000909.html?guccounter=1

https://finance.yahoo.com/news/aurora-cannabis-apos-expansion-plans-122100729.html

Nfusz Inc. (OTCMKTS: FUSZ) Signs Strategic Partnerships In Pursuit Of Revenues

iAnthus Capital Holdings Inc. (OTCMKTS – ITHUF) An Emerging Cannabis Play After 615% Revenue Growth

iAnthus Capital Holdings Inc. (OTCMKTS: ITHUF) An Emerging Cannabis Play After 615% Revenue Growth

iAnthus Capital Holdings Inc. (OTCMKTS: ITHUF) stock look set to climb higher after the company reported impressive fourth quarter financial results. A 615% increase in revenue in the quarter underscores the rate at which the company is growing.

After falling from highs of $5.08 to the $2.3 handle, the stock has bounced back in what appears to be a continuation of the long-term uptrend. The stock needs to rise and close above the $3.80 handle, to reaffirm confidence about the continuation of the uptrend. On the downside, the stock faces immediate support at the $3 handle, below which it could drop to the $2.40 mark.

IAnthus Capital owns and operates best in class licensed cannabis cultivation, and dispensary facilities in the U.S. The company also seeks to provide investors with exposure to the U.S regulated cannabis industry.

Recent Developments

Stellar fourth quarter financial results is the latest catalyst sending shares of iAnthus Capital up the chart. The company generated revenues of $2.4 million in the quarter, representing a 615% increase. Net loss in the quarter came in at (-$13.7 million. IAnthus Capital attributes the growth to a rise in costs because of expansion into additional states.

Invested capital in the quarter totaled $23.7 million bringing the total capital invested to date at $98.7 million. During the quarter, the company closed a C$12 million short-form prospectus offering.

“The past year has brought major developments for iAnthus, including acquisitions in the major east coast markets of Florida and New York , the continued build-out of a world-class operations team led by Carlos Perea (Chief Operating Officer), and the establishment of iAnthus as one of the U.S. cannabis industry’s most well-known and well-funded companies,” said CEO, Hadley Ford.

Pilgrim Rock Acquisition

Separately, iAnthus Capital has completed the acquisition of the remaining 20% stake in Pilgrim Rock. The acquisition will provide the company with access to Mayflower an affiliate of Pilgrim Rock that has received provisional licenses to registered marijuana dispensaries in Massachusetts.

According to Randy Maslow, president of iAnthus, focus now shifts towards positioning Mayflower as a leading cultivator, processor, and operator of dispensary operator in Massachusetts. The subsidiary has a 36,000 cultivation facility in Holliston that is fully operational.

In addition, iAnthus wholly owned subsidiary, Grow Healthy Holdings has commenced delivery of cannabis products to patients in Florida. The company has also signed a lease for a dispensary in Orlando Florida.

More articles:

https://finance.yahoo.com/news/ianthus-subsidiary-growhealthy-begins-delivery-110000744.html

https://finance.yahoo.com/news/ianthus-completes-full-acquisition-pilgrim-110000411.html

https://finance.yahoo.com/news/ianthus-reports-fourth-quarter-fiscal-223600323.html?guccounter=1

Is General Cannabis Corp. (OTCMKTS – CANN) A Bounce Back Play On Positive 2018 Outlook?

Is General Cannabis Corp (OTCMKTS: CANN) A Bounce Back Play On Positive 2018 Outlook?

Shares of General Cannabis Corp (OTCMKTS: CANN) are showing signs of trading higher as investors react to impressive full year financial results and a positive outlook for 2018. According to the Chief Executive Officer, Michael Feinsod, the company has never been in a better position to take advantage of its strong infrastructure, in a bid to focus on growth.

Price Action

Over the past one month, the stock has rallied by more than 60% after coming under pressure early in the year. Given that it is currently trading at the $4.34 handle, the stock needs to rise and close above the $6 a share level, for it to attract investors who until now have been on the fence.

A rise followed by a close above the $6 a share level should open the door for the stock to spike to the $10 a share mark. On the downside, the stock faces immediate support at the $4 a share mark below which it remains susceptible to declines to the $2 a share mark.

General Cannabis casts itself as a comprehensive national resource for high quality service providers in the legal cannabis space. The company is also engaged in the business of cultivating producing and sale of cannabis products.

Why is the Stock Spiking?

The stock has bottomed out after coming under pressure early in the year after the management stated 2017 was a transformative year. According to the Chief executive officer, the balance sheet is stronger than ever, on the company generating impressive revenues last year.

General Cannabis has already paid down a substantial amount of its debt and raised new equity, expected to finance development plans in 2018. The company exited 2017 with a net loss of (-$8.2) million an improvement from ante loss of (-$10.2) million reported in 2016

“Our business expanded during the year, which positions us for continued national expansion. We will continue to hire talented executives to support our growth. General Cannabis has never been in a better position to take advantage of our strong infrastructure and continue to focus on growth through acquisitions,” said Michael Feinsod Executive Chairman of the board.

2018 Outlook

The management expects Security Segment revenues to increase as expansion in California gains traction. The company is also planning to explore additional service offerings. Marketing segment should also post significant growth as General Cannabis pursues national distributors and retailers for its apparel lines.

General Cannabis is also planning it carry out acquisitions in 2018 in a bid to accelerate growth.

International Cobalt (OTCMKTS – COBAF) Acquires Two Additional Projects

Click here to view the original article.

VANCOUVER, British Columbia, April 17, 2018 (GLOBE NEWSWIRE) — International Cobalt Corp. (CSE:CO) (the “Company” or “International Cobalt”) is pleased to announce that its wholly owned subsidiary, American Cobalt Corp. (“American Cobalt”) has entered into two option agreements (the “Option Agreements”) with Supreme Metals Corp. to acquire up to an 80% interest in two cobalt projects which are comprised of the Foster Marshall Project and the Mount Thom Project (collectively known as the “FM Projects”).

Pursuant to the Option Agreements, American Cobalt will have the option to earn an initial sixty percent (60%) interest in any of the FM Projects by making an initial payment of $87,500 and by funding exploration to reach an NI 43-101 compliant resource estimate within sixty (60) months of signing of the Option Agreements. American Cobalt will have the right to earn a further twenty percent (20%) interest and any of the FM Projects by completing a Preliminary Economic Assessment (PEA) within twenty-four (24) months of completing the initial resource estimate. Each of the FM Projects is subject to a 1.5% NSR in favor of a third party.

The Company will also pay a finder’s fee to an arm’s length party in connection with the acquisition of the FM Projects.

ABOUT THE FOSTER MARSHALL PROJECT

The Foster Marshall Project is located in the historic mining area of Cobalt, Ontario and is approximately 25 kilometres north of the former producing Langis Mine project in the Larder Lake Mining Division. The area covers approximately 256 hectares (633 acres) and is comprised of seven mineral claims.

Historical assays on surface grade up to 4.5% Cobalt and drill hole intercepts of 30 centimetres grading 87 oz/ton silver with several intercepts containing copper, lead and zinc.

ABOUT THE MOUNT THOM PROJECT

The Mount Thom Project is located 22 kilometres east of Truro in Nova Scotia, Canada, over a historic copper deposit that was discovered in the early 1970’s by Imperial Oil. It is comprised of 39 mineral claims over five neighbouring licenses and covers approximately 1,560 acres. The project is also close to the TransCanada Highway #104 and power lines, making the area highly accessible.

Even though assays of at the time of Imperial Oil’s work reported up to 1.66% copper over 15.5 feet (4.7m), IOCG deposits and associated cobalt mineralization were unknown at the time. Subsequently, high concentrations of cobalt assaying up to 0.57% cobalt were reported in mineralized outcrop and rubble crop from trenches (source Nova Scotia assessment report AR2005-005). The deposit is now recognized as having affinities to IOCG-style deposits and is considered highly prospective for cobalt mineralization.

ABOUT THE COBALT MARKET

Cobalt prices recently reached a 10 year high of $42.75 US per pound and have shown a steady increase since the mid-point of 2015. Cobalt is an important component of many of the lithium-ion batteries used in a wide range of applications from cell phones to electric vehicles (EV) and the home energy storage market. Driven primarily by the EV market demand for cobalt is expected to remain strong and growing for the near future. Currently over 60% of the global supply of cobalt is sourced from mines operating in the Democratic Republic of the Congo (DRC). Political instability in the DRC coupled with social-economic issues surrounding mining in the country including reports of child labour have led many tech companies to seek supplies of the metal from more stable jurisdictions.

ABOUT INTERNATIONAL COBALT CORP

International Cobalt Corp. (CSE:CO) is a Canadian based mineral exploration and development business focusing on the burgeoning cobalt sector. The rapidly growing large battery industry, a major consumer of cobalt, makes cobalt an appealing sector of focus. The Company seeks to add shareholder value by sourcing and developing projects in safe, progressive jurisdictions adhering to strict environmental and social standards.

The technical information in this news release has been reviewed by Neil McCallum, P.Geol., of Dahrouge Geological Consulting Ltd., a Qualified Person as defined by National Instrument 43-101.

On behalf of:

INTERNATIONAL COBALT CORP.

“Timothy Johnson”

Timothy Johnson, President

This release includes certain statements that may be deemed to be “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements in this release, other than statements of historical facts, that address future production, reserve potential, exploration and development activities and events or developments that the Company expects, are forward‑looking statements. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploration and development successes, continued availability of capital and financing, and general economic, market or business conditions. Please see our public filings at www.sedar.com for further information.

Timothy JohnsonT: 604-687-2038F: 604-687-3141

Photos accompanying this announcement are available at

http://resource.globenewswire.com/Resource/Download/e8e95a2e-5904-41ae-b526-7a124fb6a59e

http://resource.globenewswire.com/Resource/Download/20b139cf-e38a-4820-952f-03ccb4091b2d

http://resource.globenewswire.com/Resource/Download/b9a84c48-d5a4-4d70-8d25-28bcd0deb10b

http://resource.globenewswire.com/Resource/Download/0e0dd4ed-7f97-4350-a5cc-6f8a9257918b

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on COBAF (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, International Cobalt. Small Cap Exclusive has been hired by a third party, Sunrise Media, LLC ., for a period beginning on March 15, 2018 to publicly disseminate information about (COBAF) via website and email. We have been compensated $50,000. We will update any changes to our compensation. We own zero shares of (COBAF).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. International Cobalt is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

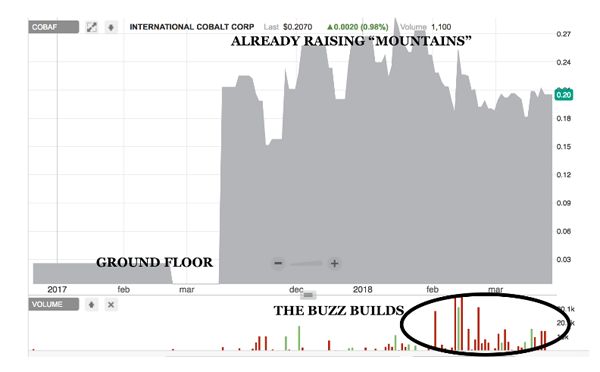

COBAF Positioned to Break Past the Crowd of Lithium Plays (OTCMKTS – COBAF)

Put COBAF at the top of your WATCHLIST!

You will be thanking us later. Getting a position at these prices could your golden ticket.

Remember the first investment story you read about the coming lithium boom? For me, it was more than five years ago. Some lithium mining stocks have done well over that timeframe. For others, the age of electric cars and smart phones has been more fizzle than spark.

Don’t misunderstand, we love the RIGHT lithium stock at the right time. But with close to 200 copycats hoping Elon Musk will notice them and buy their brine for Tesla batteries, there’s a lot of “me too” action crowding that pool.

Especially because all the gadgets and cars that run on lithium need ANOTHER key natural resource in order to boost their battery power. And where the race to exploit lithium deposits has gone a long way toward filling that supply/demand gap, this other mineral fell behind.

We’re talking about COBALT (OTCMKTS – COBAF). You “only” need about 35 pounds of this once-obscure rock to light up a 75 kWh Tesla. Apple only needs 10 grams per iPhone, about a third of an ounce. But with 1.2 BILLION of those little phones in circulation and Elon Musk ramping up those “giga factories,” the miners haven’t kept up.

Throw in new technology that uses more cobalt than ever . . . plus shadows on the global trade situation . . . and people who invest in cobalt now could be where the first wave of lithium bulls were a few months ago: staring at TRIPLE digit performance!

Sometime when you’re feeling like there’s nothing left in the market but the “FANG,” load up the Albermarle 5-year chart, ALB. They’re the biggest lithium producer around. Then turn to a cobalt stock that’s tiny right now, International Cobalt (OTC:COBAF).

Unless you’ve got a time machine and can go back to 2013, which one’s on the ground floor? The $10 billion behemoth trading above $90 or the $35 million start-up currently priced at pocket change?

But before you answer, remember: down here in the start-up zone, every $1 isn’t just another little bump in the long-term trend. It’s a multiplier, unlocking truly massive return potential for those with the insight to come to the cobalt party BEFORE the me-too money crowds the table.

Can COBAF reach the lofty heights ALB now travels? Let’s set cobalt’s future against lithium’s recent past . . . and then you can probably come up with your own answer.

Cobalt used to be an obscure element (like lithium was 10 years ago), more famous for making a pretty blue when powdered or a higher-temperature steel in trace amounts. Thanks to the emergence of new power storage systems, both elements are now irreplaceable components of phone batteries, laptops, home power systems and yes, electric cars.

HALF of all cobalt that gets consumed right now goes into batteries. That wasn’t true before the high-tech world switched to lithium-cobalt power systems, which means that since the iPhone revolution started and Tesla made its first car demand here has at least DOUBLED.

That’s why smart players are already rolling up as many cobalt prospects as they can. Just a few weeks ago First Cobalt paid $115 million to buy out US Cobalt. That’s a good number to keep in mind as cobalt consolidation heats up. For one thing, the bid came in 65% above market price, so the deal premiums are already getting huge as the fever kicks in.

And I did the math: historical work on US Cobalt’s primary project showed 1.2 million tons of high-grade cobalt ore grading at maybe 0.6% per ton. That’s roughly 7,500 tons of cobalt in that dirt . . . First Cobalt paid $15,000 per ton, so that’s a benchmark to keep in the back of your mind.

There’s just not enough cobalt

Global supply has not kept up. Go back to 2010, the experts were already warning Congress that U.S. stockpiles had gotten so thin that they would only satisfy 1.7 DAYS of demand. Nobody listened! Since then, gurus think consumption has soared 75% in less than a decade . . . and the strategic government stockpile has shrunk 33%.

Long term, there’s plenty of cobalt in the ground. Recycling is coming. But it just isn’t ENOUGH to fill the demand gap. And in the meantime, new mines like what International Cobalt is exploring for are the sweet spot.

That’s especially true when you look at geography and politics. U.S. cobalt production was dead until 2014, when one mine finally stepped up to address 0.8% of annual demand. Not counting scrap, all our cobalt came from overseas.

The GOOD news is Canada now sells us almost as much cobalt as China does. The BAD news (unless you have cobalt or are invested in a company that is) is that U.S. production actually went DOWN recently, so the gap didn’t narrow.

And even though Canada is one of our oldest and dearest friends, it’s hard to say where the trade rules end up. The trade situation with China is cloudier than it’s been in decades. What’s a 25% tariff on Chinese cobalt going to do, if the White House treats it like other metals?

It’s going to hurt, the commodity kings at Glencore say. Elon Musk wants to source his cobalt from “clean” mines that don’t use child labor or wreck the environment. That rules out traditional producers in the Congo, where conditions get brutal. (VIDEO) Apple, similar story.

By the way, the great Elon Musk had a weird little freakout over cobalt in a recent quarterly conference call . . . fast-forward a year or two, we really need to think about cell production as being a constraint. Making sure that we have a secure supplies of lithium hydroxide, cobalt. There’s actually more amount of cobalt.

He’s talking about how Tesla is running out of secure supplies of cobalt because the company’s power cells use more of it than lithium. Notice how the investor relations guy cuts him off FAST after that. “Sorry everyone, we’re out of time” like he doesn’t want the supply constraint to scare shareholders.

But before it does, it’s a good bet that Tesla and everyone else is going to scramble for as much cobalt as they can. That might mean long-term supply contracts with mines that aren’t even open yet . . . mines like the one International Cobalt is exploring for up in friendly Idaho, right here in the USA. It might mean joint ventures, kicking in funding to make the mines happen.

Heck, I wouldn’t be shocked to see the great Elon go the Henry Ford route and buy the mines himself! In that scenario, investors are on the accelerated “exit” ramp!

But here’s the thing: Elon would mainly be interested in pure cobalt plays. That’s the mineral he covets. He doesn’t want copper . . . even though a lot of cobalt mining today is just a sideshow, a byproduct on copper. What’s he going to do, skim the cobalt and throw the copper away?

And while some cobalt comes off of nickel, that’s a secondary concern as well. Refining nickel ore is, and I quote, “horrendously” expensive. Waiting for a start-up company to take a primary nickel project to a viable economic level is basically bracing for massive investment in time and money. While the path can ultimately be satisfying, it just isn’t easy or quick.

Tesla doesn’t have that kind of time. Arguably they don’t even have that kind of cash to deploy, especially if there’s a relatively pure play available. That’s where International Cobalt shines. Pure play. Right here on the Idaho side of the international border. Dozens of what could be high-grade ore lodes.

I suspect we’ll be talking a lot about the geology as the company starts serious drilling. They’re just waiting for the permits. Right now, they’ve flown over the site and the visuals are worth pursuing . . . this airborne survey has given the company multiple targets to follow up on!

It’s a big claim, more than 1,700 acres. It’s surrounded by bigger players who might get motivated to take out a rival at a healthy premium. (No shame in that! Remember that $115 million US Cobalt buyout? Those assets are just south of International Cobalt’s Blackbird Creek acreage.)

Either way, right now it’s almost total upside. All the big boys on Wall Street know about this company right now is that there’s interesting rock here. They don’t know how much or where the future can go.

That’s the kind of opportunity that’s like getting into lithium five years early. It may not be gold, but it’s precious. Let’s go!

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on COBAF (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, International Cobalt. Small Cap Exclusive has been hired by a third party, Sunrise Media, LLC ., for a period beginning on March 15, 2018 to publicly disseminate information about (COBAF) via website and email. We have been compensated $50,000. We will update any changes to our compensation. We own zero shares of (COBAF).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. International Cobalt is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.