Namaste Technologies (OTCQB – NXTTF): Namaste Stock Tumbles 80% From Highs. Time To Buy?

The explosion of the cannabis industry in Canada has led to the emergence of many new businesses surrounding the industry and one of them is online retail for cannabis products. It is, without a doubt, a novel idea and one that would eventually pay off, because of the rising demand of cannabis product and accessories. One of the major names in the cannabis online retail space is Toronto based Namaste Technologies Inc. (TSXV:N) (OTCQB:NXTTF) and considering the line of business the company is in, one would expect them to do well. However, there are some burning issues with the company that could prove to be the undoing of Namaste Technologies in the long run.

Corporate Fraud

Back in 2018, Namaste Technologies seemed to be the next big thing in the cannabis retail space after it recorded staggering growth of 300% in August and generated revenues to the tune of $1.65 million. All the revenues came from its interests in a range of website in Canada. Following in the tradition of major cannabis companies eventually heading to Nasdaq for raising more capital, Namaste Stock did the same but that is when the company’s hidden skeletons came to the fore.

[thrive_leads id=’8276′]

Citron Research published a report in which it stated that the upper echelons of the company’s management were involved in large scale fraud. Namaste responded with legal proceedings against its CEO, who was eventually fired and made widespread changes at the board level. However, the company has had a disastrous run in 2019 and is yet to file its earnings report for the February quarter.

Updates Missing

Amidst the general meltdown in the company’s standing, Namaste Technologies has also been grossly negligent of providing updates on its corporate situation for quite some time. Other than the update regarding the addition of a board member and then his installation as the chief of the audit committee, no big updates have been forthcoming.

The search for a new CEO is likely still going on but there is no clarity on the matter and an interim CEO is still doing the job. Last but not the least, without further clarity on its earnings and the appointment of a new CEO, it is highly unlikely that the company is going to be looked upon favourably by Wall Street.

Namaste stock has tumbled over 80% from its from its all time high of $3.05.

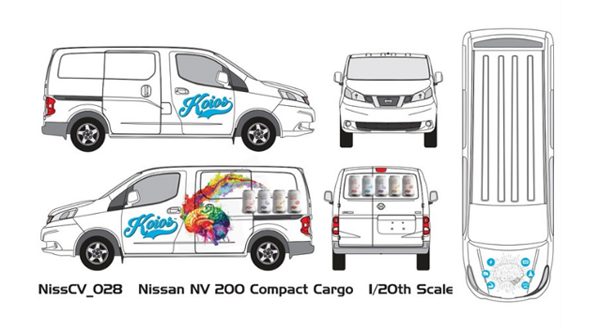

Protected: Koios Beverage Corp. (OTC:KBEVF – CSE:KBEV) Ramps Up Production to Meet Increased Retail Demand

There is no excerpt because this is a protected post.

Transcanna Holdings (TCAN:CNX) Stock Jumps 675% This year, What’s The Buzz?

Shares of Transcanna Holdings Inc (TCAN:CNX) (TCNAF:OTC) are one of the biggest cannabis stock gainers this year on the Canadian Exchange. The stock is up a huge 675% since the start of this year. Transcanna‘s stock is up another 2% to $7.59 CAD in today session after hitting a new high 52-week high of $7.70.

According to the outfit Grand View Research, the global cannabis industry is projected to be value at a staggering $146.6 billion by 2025. More importantly, the compounded annual growth rate is projected to be 34.6%. When that happens, companies which provide logistical support to the industry is also going to grow and TransCanna Holdings Inc such a company.

[thrive_leads id=’8276′]

The Canadian company is engaged in distribution and transportation services that are meant for a range of industries. However, its main focus seems to be in Cannabis and it has now emerged that the company has successfully generated a handsome sum of money through a private placement.

New Cannabis Facility

TransCanna targets to build a portfolio of premium brands to capitalize on growing cannabis market. The company plans on acquiring 15 premium brands, manufacture them in a state-of-the-art 196,000 sq. ft. facility that covers everything from the nursery to extraction, and distribute them to a network of dispensaries via an internal sales team. The facility will allow the TransCanna to have a full service operation starting from nursery to extraction and then to distribution. The acquisition of this facility certainly gives the company a firm footing for its future growth and could prove to be a smart investment.

Private Placement

A private placement is often the best way to raise money for a publicly traded company, if it wants to raise fresh capital but does not want to go through the public markets. More often than not, this route is chosen by companies which want to raise capital through institutional investors. The company announced its private placement initiative was launched some time ago but it came to a close in the early days of April and TransCanna managed to raise a handsome $16 million.

The company issued 8,000,000 common shares of the company to the investors at $2.00 and in addition to that each investor was provided with a warrant along with each share. The advantage of the arrangement is that the investor in question would be able to buy a share in TransCanna for $3 until 2022 for each warrant that he owns. For an institutional investor, it is an excellent deal.

Looking Ahead

Following the capital raise, the company is going to spend half of it as an advance on a sprawling cannabis facility. It had made an announcement about the facility earlier this year. In addition to that, TransCanna will also need to use the money for purchasing high end manufacturing equipment and for all other sundry expenses.

Moleculin Biotech (NASDAQ: MBRX) Stock Goes Through a Rollercoaster

Moleculin Biotech (NASDAQ:MBRX), which is involved in the manufacturing of a range of cancer drugs meant for particularly damaging tumours, went through a bit of a rollercoaster at the beginning of the week. The company has produced a variety of drugs which are meant for the clinical stages of conditions like brain tumours, pancreatic cancer and others. On Monday, the stock reached new heights after the company announced a major breakthrough for the treatment of lung cancer, but on the very next day, it nosedived following a direct equity offering.

The Rise

On Monday, the Houston, Texas based pharmaceutical company released a press release in which it announced that it had made a significant discovery as regards to a drug related to treatment of lung cancer. Needless to say, such an announcement created a flutter in the markets and investors soon piled in as the stock soared by as much as 180% in Monday’s intraday session to reach three-year high of $3.15. By the end of the session, the stock finally closed at 2.98, up 169%. For any pharmaceutical company which is engaged in this particular line of drugs, the announcement was of huge significance and the broader market thought so as well, as the stock went on an almighty rally.

[thrive_leads id=’8276′]

The Fall

However, the rally did not last long as the next day Moleculin Biotech announced a direct equity offering to institutional investors in order to raise money for research and development, clinical trials, corporate necessities and other sundry expenses. The company offered 9,375,000 units of its common stock at $1.60 to the institutional investors and raised a total of $15 million through this manoeuvre.

The offering is an attractive one for institutions. In addition to the stock, the institution will also get one half of a warrant that would allow it to buy a share for $1.75. The warrant is valid for 5 years and the offering is going to close on the 25th of April. Such an offering did not seem to amuse the market much and the stock tanked 51% after having gone up by about 170% the previous day.

Shares of MBRX are down another 18% to $1.42 in Thursday’s session.

Appliance Recycling Centers of America (ARCI) Stock Hits Multi-Year High On Big News

When a listed company makes a major breakthrough that could take it into a new level altogether, then there is every chance of a major rally in the shares of the company in question. That is exactly what happened with Appliance Recycling Centers of America, Inc. (ARCI), when one of its subsidiaries announced such a breakthrough news and the company’s stock reached a new 4-year high today.

Stock Jumps Big

IoT or Internet of Things connectivity is a form of technology that allows physical objects to be connected to an internet network and in a path breaking development, Appliance Recycling Centers of America, Inc. (ARCI) ‘s subsidiary GeoTraq announced that it now had that capability. It is regarded as a thing for the future and following the announcement, the stock rallied as much as 80% at it reached $8.50 in Thursday’s session. The stock made a multi-year high of $9.56 earlier in the session today and needless to say, it is quite evident that this particular development has piqued investors immensely.

[thrive_leads id=’8276′]

The possibilities opened up by such a capability are believed to be immense and if the world does in fact get connected through IoT, then ARCI will be in a pole position to take advantage. Considering the fact that it now access to this connectivity, it will now be possible for ARCI to track devices far more easily. It will also be possible to communicate with the connected devices.

The Technology

The technology is supposed to give ARCI a definite in the market in which it operates. With IoT connectivity, the company will be able to monitor devices with far more easily and also reduce the cycle time considerably, which should lead to savings for ARCI. According to experts, the coverage of IoT through mobile devices is going to be at 93% by the middle of 2019.

The subsidiary GeoTraq is still in the process of testing new modules and it is believed that at some point in the summer of 2019, the company is going to apply for certification from the regulatory authorities. GeoTraq will also participate at a global IoT event in the second week on May and the tech will get far more exposure.

Wildflower Brands’ Stock Gains Momentum On Positive News

Shares of Wildflower Brands Inc. (SUN:CNX) (WLDFF:OTC) are on fire so far this year with a gain of over 40% during the same period on the Canadian Exchange. In fact, the stock has soared over 30% since March 11, 2019 .

Wildflower Brands, which is involved in creating, distribution and designing a range of cannabis branded products, entered into a private placement deal earlier this month that could raise up to $15 million for the company. However, that is not all. The company, which also distributes its products to retailers in the cannabis space across the United States, has also embarked upon an ambitious expansion into the European Union. Needless to say, these are great tidings for the cannabis company that went public only five years ago in 2014.

[thrive_leads id=’8276′]

Expansion into the European Union

On April 16th, Wildflower signed an agreement that will take the brand into the European Union and needless to say, it is a market that remains on the radar of most cannabis companies. The company signed an agreement with another firm known as Two Towers to take its signature brand named Wildflower Wellness CBD+ into Poland.

The partnership between the two companies is highly strategic. Two Towers, which is one of the best known prescription medical distribution company in Poland is a subsidiary of Omega Rex, which runs a number of pharmacies in the capital city of Warsaw. According to market research firms, the CBD market in Europe is expected to explode in the next few years and it is believed that it could grow by a staggering 400% by the year 2023. In such a situation, many firms in the European Union are looking for partnerships with established brand which operate in the CBD space.

The Private Placement

A private placement is often used by a company when it wants to sell some of its stock to private investors but not through the public markets and over the years, it has become a very popular method of raising capital. Wildflower went for a private placement as well instead of going to the capital markets and has issued a total of 20,000,000 subscription receipts at 75 cents apiece.

The whole process is supposed to close on 23rd of May this year and the company expects to raise up to $15 million through this placement. The money raised will directly go into fortifying the company’s supply chain, distribution infrastructure and for boosting manufacturing capabilities.

What do you think of Wildflower’s Stock?

Koios Beverage Corp (OTC:KBEVF) continues to Impress. Are you paying attention yet?

Today we are bringing you a play that has proven itself in recent weeks, making gains of over 132% in just a single day of trading back in late February off some excellent news (more on this in a bit).

It’s a play that’s making major moves in the nootropic and now under their subsidiary, Cannavated Beverage Corp, are also making headway into the CBD infused beverage space.

KOIOS has delivered BIG news with Big Companies in just the last few weeks

Trading right at $0.34, KBEVF develops and distributes nature-based products that boost brain function, enhance health, and improve productivity. Its core vision is to help a billion people worldwide live more productively through the development of nootropics, which are supplements that improve cognitive abilities. It also is expected to start to provide CBD-infused beverages through its subsidiary company, Cannavated Beverage Corp.

A couple of weeks ago, KBEVF launched itself onto our radar after making an announcement that caused share price to sky rocket. On February 27, they announced that they had caught the White Whale. The company announced that it has signed a vendor agreement with Walmart Inc, the world’s largest retailer, and is expected to supply 1,094 locations across the US.

Share price went crazy, hitting highs of $0.72 on the day and held near those highs as the market closed. When all was said and done, share price had made triple digit gains of over 130%.

Since then, KBEVF has pulled back to $0.40, which is still above it’s 200 day MA of $0.29 AND it’s 50 day MA of $0.31. Holding above these pivot points can be quality indicators of strength.

Key Catalysts

- The company is making big moves in multiple explosive industries:

- KBEVF is utilizing its subsidiary, cannavated Beverage Corp by becoming the first “nootropic” beverages enhanced with CBD cannabidiol molecules.

- The CBD market is expected to hit $22Billion by 2022 according to inc.com.

- The global field of nootropics is also growing rapidly and is expected to reach over $6Billion by 2024 according to globalnewswire.com.

- These are both brand spanking new industries that are rife with market availability. In other words, there are few, if any, big guys swiping up any market share in either industry.

- KBEVF has recently made moves off of good news.

- Excellent Recent News: As already stated, KBEVF announced that it has signed a vendor agreement with Walmart Inc, the world’s largest retailer, and is expected to supply 1,094 locations across the US. This isn’t their only big recent news as the company appears prepared to continue its aggressive expansion.

- Continue reading to get all of KBEVF’s recent news in the Recent News section of this Full Report.

[thrive_leads id=’8530′]

Key Performance Indicators

For our purposes, the key to KBEVF’s success is their anti-reliance on caffeine and their focus on ingredients that increase clarity and focus of the mind.

Taking two KOIOS beverages per day can create mental superiority and is less expensive than drinking Starbucks and much healthier than consuming energy drinks and pre-workouts.

Koios enhances focus, concentration, mental capacity, memory retention, cognitive function, alertness, brain capacity, and creates all day mental clarity and energy, without using large amounts of stimulants.

And the science is starting to ramp up fast. Just a few months ago, KBEVF started clinical trials in Denver to prove the testimonials right. “Enhances cognition.” Imagine seeing that on a can in Walmart!

Recent News

March 8, 2019: CBD Products Coming to a Store near You; CBD Companies Expand Reach – Koios Beverage Corp. is ensuring more than just proper distribution, having announced that the Company has increased its production capacity by partnering with Full Metal Canning, located in Longmont, CO, in addition to its current partnership with Golden Global Goods, the parent company of Rocky Mountain Soda.

Forming these partnerships came as a result of the Company securing purchase orders with two of the largest retailers in the world, thereby increasing its retail footprint by 4,000 locations since February 2019.

Continue Reading: https://finance.yahoo.com/news/cbd-products-coming-store-near-130000129.html

March 7, 2019: Koios Beverage Corp Announces New Canning Facility Partnership and Increased Production Capacity – KBEVF is pleased to announce that the Company has increased its production capacity by partnering with Full Metal Canning, located in Longmont, CO , in addition to its current partnership with Golden Global Goods, the parent company of Rocky Mountain Soda.

The partnerships with Full Metal Canning and Golden Global Goods will provide the Company with the available use of two canning lines in their local Colorado market. This not only allows Koios to produce twice the amount of product but it also provides for a much more rapid pace at which orders are fulfilled.

Continue Reading: https://finance.yahoo.com/news/koios-beverage-corp-announces-canning-120000899.html

February 27, 2019: Koios Beverage Corp secures purchase order with Walmart; to supply 1,094 locations across the US – KBEVF is pleased to announce it has signed a vendor agreement with Walmart Inc, the world’s largest retailer.

Walmart will soon be adding the Koios beverage line to its new functional beverage set. Initially, Koios products will be available in 1,094 Walmart locations across the United States . The retail giant will carry Pear Guava, Blood Orange and Peach Mango beverages. The products will also be available through Walmart’s online portal at www.walmart.com and will be available in stores April 1 st of 2019.

KBEVF CEO, Chris Miller had this to say about the deal: “Working with the world’s largest retailer is an honor. Walmart has begun carving out significant shelf space in select locations to build the next generation of better-for-you brands, and we are truly excited to be one of them. Making the world a healthier place is our mission and our relationship with Walmart will be a tremendous catalyst for reaching a mass audience for our brand.”

Continue Reading: https://finance.yahoo.com/news/koios-beverage-corp-secures-purchase-120000680.html

More About KBEVF

As stated, KBEFV develops and distributes nature-based products that boost brain function, enhance health, and improve productivity. Its core vision is to help a billion people worldwide live more productively through the development of nootropics, which are supplements that improve cognitive abilities.

The company’s flagship product, Koios, is a GMP-certified dietary supplement. Made from natural ingredients and backed by science, Koios is designed to improve focus, memory, mental drive, clarity and energy. The company produces Koios in the following formulations:

- Powder supplements containing nootropics as well as caffeine and lion’s mane and chaga mushrooms;

- Vegan-friendly capsules;

- Canned beverages containing nootropics along with MCT oil to burn fat and increase metabolism.

Not to be mistaken with prescription-only drugs which are at times used for similar effects, nootropics are over-the-counter dietary supplements; some of which, like Koios, contain ingredients that are currently used in the treatment of patients with Alzheimer’s disease.

According to media reports, there is believed to be significant and growing use of nootropics among high-achieving students and professionals. The UK’s leading Guardian newspaper found that nootropics are commonly used in Silicon Valley by computer industry professionals who want to “hack” their minds and maximize their productivity without any possible negative effects on the brain.

Koios was born out of the personal struggles of its founder and CEO, Chris Miller, who has ADHD. Speaking of his struggles at this time, Miller says, “Coffee and energy drinks were no longer helping me. Eventually, I was drinking so much caffeine that I was beginning to notice negative and troubling health effects.” He adds, “I believed there had to be a better way. Better technology that the earth was providing that I could implement and not only boost my daily performance but take care of my brain and body long-term.”

After years of experiments and with the help of leading scientists, he developed Koios, named after the Greek Titan who represented rational intelligence.

Koios contains the following ingredients, among others:

- Vitamin B12:Crucial for the function of the nervous system and the synthesis of DNA, B12 also helps in the creation of red blood cells.

- Vitamin B6:This vitamin is crucial for brain development among children and brain function in adults. B6 is also important in the production of key hormones: serotonin, which regulates mood, norepinephrine, which helps us handle stress, and dopamine.

- Huperzine A: Developed from the Chinese club moss plant, huperzine A is used on Alzheimer’s patients to boost their memories. It is also used to raise energy levels and alertness and is the subject of medical trials to test its efficacy when combined with other drugs.

- Bacopa: Also known as brahmi, bacopa is an Indian herb used in Ayurvedic medicine to improve concentration and memory. Modern science has recognized its effectiveness, and it is used to treat symptoms caused by Alzheimer’s disease, ADHD and anxiety.

- Ciwujia: Sports scientists have been interested in this herb since they heard of how mountain climbers in Tibet use it to boost their performance at high altitudes. Peer-reviewed research has shown that Ciwujia has clear positive effects on endurance.

The company’s products can be found online at https://www.mentaltitan.com and in stores, both across the United States and internationally, via a continuously growing distribution network that includes Walmart.

Make sure to do your own due diligence on KBEVF and, as always, stay tuned for more news and updates.

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on KBEV (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Koios Beverage Corp. Small Cap Exclusive has been hired by Koios Beverage Corp. for a period beginning on May 1, 2018 to publicly disseminate information about (KBEV) via website and email. We have been compensated $558,000. We will update any changes to our compensation. We own zero shares of (KBEV).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. Koios Beverage Corp.. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.

Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Agora Holdings Inc. Subsidiary, eSilkroad Network Limited, Retains Kitsoft to Improve Functionality of eSilknet Platform

View original article here.

TORONTO, ON, Dec. 03, 2018 (GLOBE NEWSWIRE) — via NEWMEDIAWIRE — Agora Holdings Inc. (OTC PINK: AGHI) (the “Company”) today announced that its 51% owned subsidiary, eSilkroad Network Limited (“ESRL”), has engaged limited liability company, Kitsoft, with offices in Kiev, Ukraine to enhance the eSilknet platform including functionality and next level prototype creation of B2B pages to support the social network component of its platform referred to as “eSilknet”.

Kitsoft has prepared 30 landing page prototypes for testing by business users of several countries including: China, Georgia, Croatia, Ukraine, South Africa, Turkey, Poland, Italy, and Sweden. December 2018 through January 31, 2019, we plan to conduct tests of the prototype pages with various business users from each of the target countries. The format for the test will be Unmoderated Remote Usability Testing (URUT), as well as focus groups. In total approximately 300 companies from around the world will take part in our testing process.

Test participants will receive a link to a special tool that designates their task as part of the testing. For example, testing protocols may include instruction such as: “You are on page A. Please find manufacturers of products from country B, with the nearest port being C.” The protocol used in our prior tests has confirmed the optimal way to accomplish each “test” task, and is referred to as Direct Success. We will monitor our participants’ activities in order to ensure they are able to find Direct Success using our improved prototype pages. Participants will also be able to accomplish the assigned task in other ways, referred to as Indirect Success, or to fail the task entirely, referred to as Quit or Bounce. Participants that have signed on for our testing protocol have agreed that eSilkroad Network shall have access to records of all participant clicks and general behavior statistics for each prototype page. Each participant has also agreed to provide specific feedback on prototype pages, concept and functionality.

The mechanics of testing for the planned focus groups are essentially the same, the only difference being that participants will receive an invite to a meeting, and moderators will observe the testing process and conduct an exit interview with each participant following the group.

President of Agora Holdings, Ruben Yakubov commented, “We could not be more pleased with the response to our invitations for participation in this testing protocol from international corporations. The level of interest in a trial of our current prototype from companies worldwide has been extremely encouraging. We look forward to sharing results of this process in 2019 once all test data has been analyzed.”

About Agora Holdings Inc.

Agora Holdings Inc., together with its subsidiary Geegle Media and affiliates, is presently an entertainment and media enterprise. Agora Holdings Inc. brings together media and technology, driving innovation to enhance online entertainment in five business segments: media networks, TV, studio entertainment, consumer products and interactive media. Agora is seeking to expand its portfolio to include dynamic and interactive web-based networking platforms for global implementation.

About Esilkroad Network Limited and subsidiaries

Esilkroad Network Limited and its subsidiary, eSilkroad of Ukraine, is a conceptual B2B platform that intends to make the interaction between businesses and non-profit organizations throughout the world faster, more effective, and less costly. eSilknet, the web-based platform under development by eSilkroad Network Limited will allow users to search for and communicate with business partners, search for and post proposals for investment and opportunity in developing projects globally, place advertisements for products and services, communicate securely on trade and project development and attract professional services for specific project-based needs. The concept of eSilknet is in line with the original concept of the “silkroad”, facilitating trade and commerce between countries, only a global scale. eSilkroad Network is currently negotiating the acquisition of complementary platform, “eSilktrade” which has been under development privately in Shanghai for several years. eSilkroad Network believes the combined expertise of its Ukraine based eSilkroad development team and the existing team at eSilktrade can integrate the live trade platform into its B2B site further enhancing value for its users. http://www.esilknet.com

About Kitsoft

Kitsoft is a Ukrainian limited liability company, which develops and implements digital technologies for state authorities and commercial organizations worldwide. Headquartered in Kiev, Ukraine, Kitsoft helps clients to arrange and automate internal process and to interact with consumers. The corporate mandate is to be a leader in the field of computer information technologies, providing innovative, customized solutions for our client-base.

Disclaimer — Forward-Looking Statements

This press release contains “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended and such forward looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties that could cause future results to differ materially from the forward-looking statements. You should consider these factors in evaluating the statements herein, and not rely on such statements. Forward-looking statements in this release are made as of the date hereof and Agora Holdings Inc. undertakes no obligation to update such statements.

Agora Holdings [email protected]: 1.844.625.8896

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on AGHI (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM STOCK TALK TODAY ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Stock Talk Today endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, stocktalktoday.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Agora Holdings, Inc. Small Cap Exclusive has been hired by AWARNESS CONSULTING NETWORK LLC, for a period beginning on November 14, 2018 to publicly disseminate information about (AGHI) via website and email. We have been compensated $23,000. We will update any changes to our compensation. We own zero shares of (AGHI).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. Agora Holdings, Inc. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.

Small Cap Exlusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.