NFT Gaming Company (NASDAQ: NFTG) Pushing Boundaries in $300B+ Market

Imagine taking two of the hottest verticals for investors and smashing them together.

That is exactly what NFT Gaming Company NFTG has done by combining the power of the gaming industry with the endless opportunities in the NFT sector.

If you are not familiar with NFTs and the metaverse, it could be the most promising investment for astronomical growth in 2023.

Pay close attention to NFTG over the next month as we could see massive increase in average share price with this IPO.

Looking Glass Labs could be your answer for a breakout stock, The NFT Gaming Company we researched and believe with their excellent executive team and expertise they could be an answer to the noisy market. We are all awaiting the corporate leaders of this vertical to establish themselves and it is possible that NFTG is a front runner.

The NFT Gaming Company is a new public company in the red hot sector of NFTs and gaming and we couldn’t be more excited!

Our average gains at Small Cap Exclusive this year have been absolutely impressive with the average yield being 20%+, take a look at OUR LATEST ALERTS.

We’re excited, so let’s go over why I spent the last month researching NFTG stock. Then, we can go over the macros before we get into the specifics.

Company Name: The NFT Gaming Company

Ticker: NASDAQ: NFTG

Exchange: NASDAQ

Website: https://nftgco.webflow.io/

Company Summary:

NFTG is pushing the boundaries of the industry and disrupting traditional business models in the gaming sector. The NFT Gaming Company is creating a digital gaming platform that will feature both its own proprietary games and those developed and published by third-party game developers.

What is a NFT and why should you pay attention?

I’m going to give you two definitions, the first definition is filled with jargon and then I will do my best to explain the second one in lay terms.

Non-fungible tokens or NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency.

This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions.

Let’s try to break that down for us simple folk.

Non-fungible tokens are called NFTs for short and they are unique, like a digital Mona Lisa and completely different from the dollar. There was only one Mona Lisa made and it carries a very real monetary value.

On the contrary, as us Americans are finding out, when you own a fungible currency, like the dollar, you can print, print, print and continue printing which in turn debases the value.

Now, let’s look at the THREE catalysts that could send NFTG into orbit!

THREE Catalysts That Every Investor Needs To Know Before It’s Too Late:

#1 Gaming Is One Of the Hottest Sectors

#2 NFTs Are In It’s Infancy With a Strong Upside for Investors

#3 Competitors Have Already Seen Explosive Gains

#1 Gaming Is One Of the Hottest Sectors

NFTG’s goal is to develop, acquire, and manage traditional digital games while incorporating new, never-before-seen methods, such as the creation and minting of non-fungible tokens (NFTs) for in-game features like skins, characters, and experiences. The combining of blockchain based NFT technology with traditional gaming elements allows users for a personal, customizable experience, like never seen before in the gaming industry.

The NFTG gaming platform is known as the Gaxos platform. With the Gaxos platform, players will have the ability to move their characters and achievements between games as NFTs. This will allow users to have more control over their in-game assets and have more unique experiences.

Initially, the company plans to start by releasing their own straightforward and enjoyable proprietary games that allow gamers to easily mint their own affordable NFTs within the Gaxos platform. These NFTs will come with unique and exclusive features that can be utilized across the network of games on the NFTG platform.

Now, let’s go over the exciting idata surrounding the gaming sector!

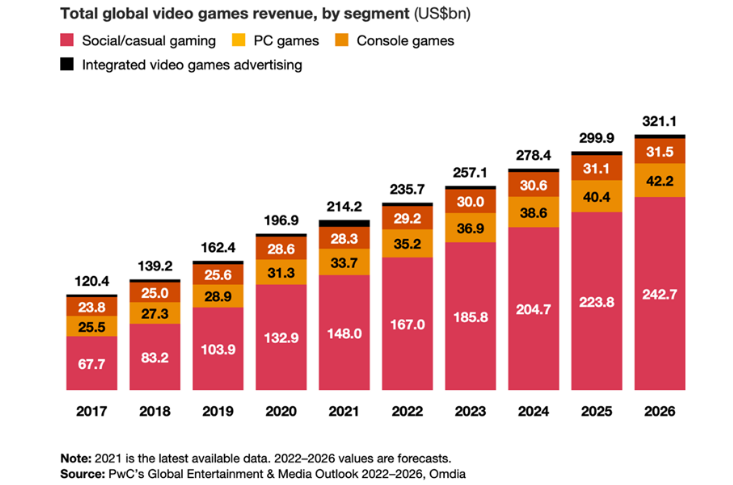

The market expansion is expected to make the global gaming industry worth $321 billion by 2026, according to PwC’s Global Entertainment and Media Outlook 2022-26.

The expansion is being driven by social and casual gaming after millions of people picked up their controllers to escape the boredom and isolation of COVID-19 lockdowns.

“People were looking for ways to both entertain themselves and maintain their social connections,” says Bartosz Skwarczek, co-founder and CEO of online gaming marketplace G2A.com. “Gaming has so often been painted with the wrong brush – stereotyped as being isolating and unsociable. However, the pandemic has shown this could not be further from the truth.”

Think about the above statement, “People were looking for ways to both entertain themselves and maintain their social connections,”

NFTG is combining the excitement of gaming and the addictive nature we have seen with social media platforms like Facebook now Meta.

#2 NFTs Are In It’s Infancy With a Strong Upside for Investors

This Is Just The Beginning for NFTs & NFTG, take a look at the growth projections below.

“Brooklyn, New York, Dec. 17, 2021 (GLOBE NEWSWIRE) — According to a new market research report published by Global Market Estimates, the Global Non-Fungible Tokens Market is projected to grow at a CAGR value of 185.0% from 2021 to 2026.” The full article is here.

Remember back in the day, when you received your Netflix videos in the mail? Look at where we are now! Just like Netflix had a booming start, so are the NFTs, but literally it is just the beginning.

Just back in 2020, the NFT market was $100 million, last year, 2021, $40 Billion!

#3 Competitors Have Already Seen Explosive Gains

While not strictly a gaming company, Zedge Inc. is a company that develops digital marketplaces and competitive games centered around user-generated content that allows individuals to express themselves.

Take a look at what their stock did shortly after their IPO

Investors are starving for the next Tesla, the next Meta and their attention has been focused on the Meta/NFT/Crypto verticals.

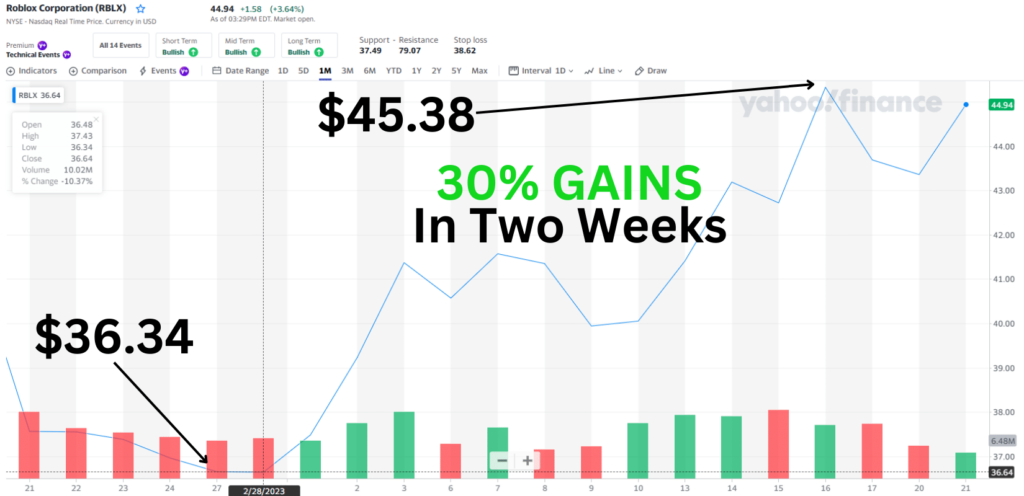

Take a look at Roblox, a multi-faceted application that provides users with a platform for playing a diverse range of games, creating their own games, and engaging with others through online chat features.

Roblox is The NFT Gaming Company biggest competitor and they integrate gaming, social media, and social commerce into a cohesive experience and brands itself as the “ultimate virtual universe”.

Take a look at their growth.

The reason we mention these stocks are because they had their post IPO runs presenting massive gains.

Now you have the opportunity to invest in a force to be reckoned with in this explosive industry combining the best of two dominant verticals for investing.

Let’s Recap the THREE Catalysts That Every Investor Needs To Know Before It’s Too Late:

#1 Gaming Is One Of the Hottest Sectors

#2 NFTs Are In It’s Infancy With a Strong Upside for Investors

#3 Competitors Have Already Seen Explosive Gains

Disclaimer

Small Cap Exclusive owned by King Tide Media has been hired by Awareness Consulting for a period beginning on March 20th, 2023 to publicly disseminate information about (NFTG) via website and email. We have been compensated up to $10,000 USD to profile NFTG. Full Disclaimer

Full DISCLAIMER LITS

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $160,000 from Alchemist Mining Inc. for profiling (CSE:AMS). We own ZERO shares in AMS.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Avalon GloboCare Corp. (NASDAQ:ALBT) Ready for Another 40% Move?

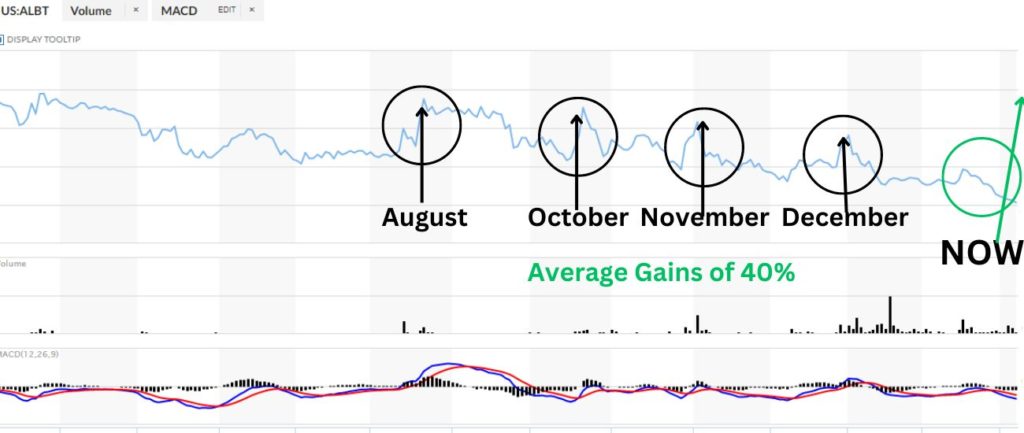

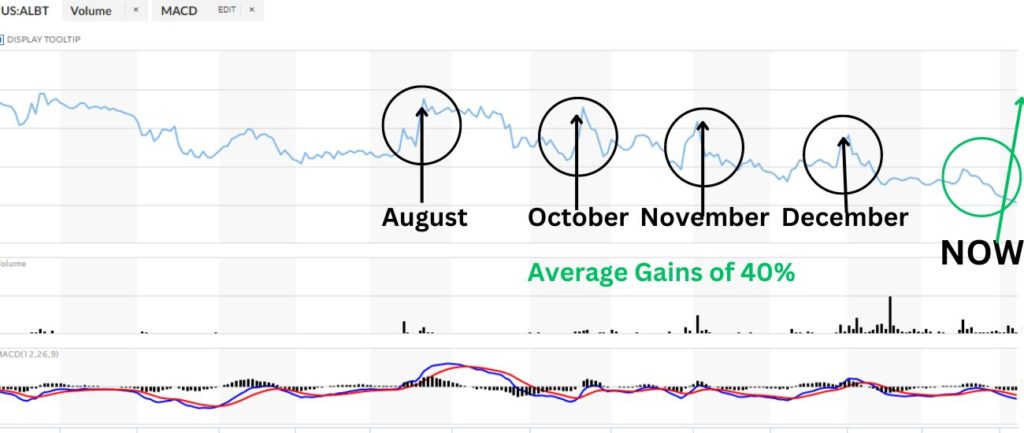

Alert, Alert, Alert: Avalaon GloboCare Corp. (ALBT) every 1-2 months has exploded from lows to average 40% gains for savvy traders, and we have been tracking it!

ALBT has been one of the most dependable trades of the last 6 months and our Small Cap tracker has alerted our team that ALBT could be ready for another 40%, 60% or even 100% move!

As a trader, I remember my missed trades more than my winners!

Make sure you don’t regret this alert, pull up ALBT and start your research for Monday trading.

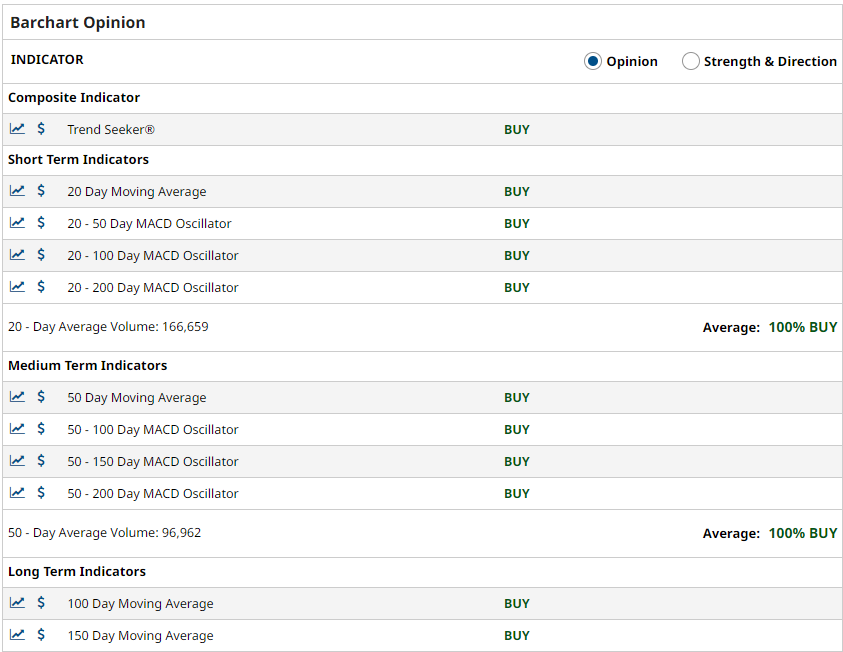

What did our algorithm detect, look at this chart below!

Over the last 6 months there has been 4 major moves offering anywhere from 28% gains to 55%, in a bearish market!

This is the longest period of time, since August, and our tracker has just went GREEN.

Let’s review the basics before I jump in the 3 catalysts that could make ALBT the best trade of 2023.

Avalon GloboCare Company Summary

Company Name: Avalon GloboCare Corp.

Ticker: ALBT

Exchange: NASDAQ

Website: www.avalon-globocare.com

Avalon GloboCare Company Summary:

Avalon GloboCare Corp. (NASDAQ: ALBT) is a clinical-stage biotechnology company dedicated to developing and delivering innovative, transformative cellular therapeutics, precision diagnostics, and clinical laboratory services.

Avalon also provides strategic advisory and outsourcing services to facilitate and enhance its clients’ growth and development, as well as competitiveness in healthcare and CellTech industry markets.

Through its subsidiary structure with unique integration of verticals from innovative R&D to automated bioproduction and accelerated clinical development, Avalon is establishing a leading role in the fields of cellular immunotherapy (including CAR-T/NK), exosome technology (ACTEX™), and regenerative therapeutics.

Let’s turn our attention to the top 3 catalysts that could send ALBT skyrocketing for a 5th time in 6 months!

Top 3 Catalysts:

#1 Under Valued and Under The Radar

#2 The Press Is Incredible

#3 A Major Breakthrough with Their Fusion Gene Map Technology

#1 Under Valued and Under The Radar

Can you imagine that this kind of news is going unoticed? ALBT filed 16 patent applications, co-invented with key strategic partners, including a top-5 U.S. university, a leading education and research center in Europe, as well as a premier multi-national developer of cellular therapies in the field of oncology, and this issuance further enhances our position as a leader in immuno-oncology and cellular medicines.”

That is headline news and we pride ourselves here at Small Cap Exclusive to bring you the diamonds in the rough. That is why we have numerous 1,000%+++ alerts every year, for over 6 years!

Read the full press release below, it is truly captivating!

FREEHOLD, N.J., Jan. 17, 2023 (GLOBE NEWSWIRE) — Avalon GloboCare Corp. (“Avalon” or the “Company”) (NASDAQ: ALBT), a leading global developer of innovative cell-based technologies and therapeutics and laboratory testing provider, today announced that the United States Patent and Trademark Office (USPTO) has issued U.S. Patent No. 11,555,060, titled “QTY Fc Fusion Water Soluble Receptor Proteins.” The issued claims cover the composition of matter and methodology for multiple novel QTY-code modified cytokine and chemokine protein receptor molecules. The patent was jointly filed with Dr. Shuguang Zhang of the Massachusetts Institute of Technology (MIT).

“We are pleased to be granted this key patent by the USPTO which expands our intellectual property portfolio,” stated David Jin, M.D., Ph.D., President and Chief Executive Officer of Avalon GloboCare. “We have jointly filed 16 patent applications, co-invented with key strategic partners, including a top-5 U.S. university, a leading education and research center in Europe, as well as a premier multi-national developer of cellular therapies in the field of oncology, and this issuance further enhances our position as a leader in immuno-oncology and cellular medicines.”

“The QTY code protein design platform, which was developed together with Professor Shuguang Zhang’s laboratory at MIT, can turn water-insoluble proteins that normally reside within cellular membranes—and that can be difficult to work within the laboratory—into water-soluble proteins that can be potentially used in many clinical applications. The resulting soluble, antibody-like cytokine/chemokine decoy receptors derived using the QTY protein design, have many potential applications including mitigation of the ‘cytokine storm’ associated with CV-19 and cellular immunotherapy delivery, as well as broadening the range of therapeutic targets addressable by CAR T-cell therapies,” concluded Dr. Jin.

#2 The Press Is Incredible

Feb. 13, 2023

Avalon GloboCare Announces Closing of Strategic Investment in Laboratory Services MSO, a Leading Clinical Diagnostics and Reference Laboratory Company

Feb. 2, 2023

Avalon GloboCare Partnerships, Completed Capital Raise, And Robust IP Portfolio Expose An Attractive Value Proposition

Jan. 31, 2023

With Multiple Shots On Revenue-Generating Goals, Avalon GloboCare Positions For A Breakout 2023

#3 A Major Breakthrough with Their Fusion Gene Map Technology

Enabling the Development and Commercialization of Companion Diagnostics and Novel Therapeutic Targets for Leukemia Patients

FREEHOLD, N.J., Jan. 03, 2023 (GLOBE NEWSWIRE) — Avalon GloboCare Corp. (“Avalon” or the “Company”) (NASDAQ: ALBT), a leading global developer of innovative cell-based technologies and therapeutics and laboratory testing provider, today announced that it has deployed a breakthrough fusion gene map technology to be used for the goal of developing companion diagnostic kits and devices to enhance personalized clinical management of leukemia patients.

In collaboration with the Lu Daopei Institute of Hematology, a fusion gene map database from over 1,000 patients with leukemia was established and the results were previously published in the Blood Cancer Journal. Fusion genes are important genetic abnormalities in leukemia. Using advanced gene sequencing technology, called “Whole Transcriptome Sequencing” (WTS), multiple previously unknown fusion genes were identified which may potentially establish novel diagnostic and therapeutic targets.

“Fusion genes are crucial in the diagnosis and treatment of leukemia. All well-known fusion genes are founder variations and constitute critical causative factors and can serve as important indicators of disease diagnosis,” stated David Jin, M.D., Ph.D., President and Chief Executive Officer of Avalon GloboCare. “Avalon is applying the bioinformatics from the fusion gene map with the goal of accelerating the development and commercialization of companion diagnostic kits and devices to enhance personalized clinical management of leukemia patients. The first diagnostic prototype is expected to enter clinical study and regulatory filing stage during Q3 of 2023. The fusion gene map technology also provides an unprecedented opp. to identify and validate fusion gene products as potential novel therapeutic targets. Additionally, this gives us an opp. to expand Avalon’s R&D pipeline and intellectual property portfolio.”

ALBT Summary:

Top 3 Catalysts:

#1 Under Valued and Under The Radar

#2 The Press Is Incredible

#3 A Major Breakthrough with Their Fusion Gene Map Technology

Remember, ALBT has been so consistent, you could set your watch to the movement!

Averaging 40% gains for our traders and you can see from the chart below, it could be ready again!

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $6,000 from Life Water Media for profiling ALBT. We own ZERO shares in ALBT.

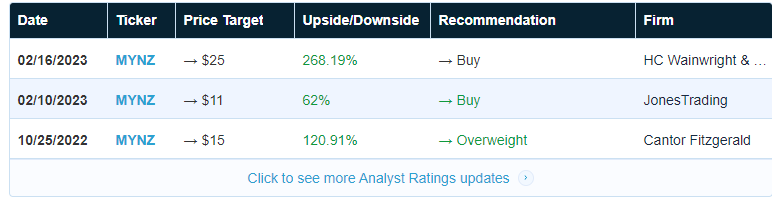

Mainz Biomed MYNZ Receives a $25 Price Target (Possible Gains Of 272% From Current Prices)

H.C. Wainwright Price Target Here

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential. Our research reports have uncovered some of the largest breakout stock alerts year after year.

We stand by our alerts, our 2023 alert tracker providing transparency. Click Here

Small Cap Exclusive’s much anticipated research report on Mainz Biomed is found below.

4 Catalysts That Could Send Mainz Biomed B.V. (NASDAQ: MYNZ) Soaring Past Wainwright’s $25 Price Target

#1 H.C. Wainwright Announces MYNZ is Undervalued with a Price Target of $25

#2 Technicals Reveal a Major Bounce Play Opportunity

#3 Mainz Biomed Is Generating Revenue

#4 Philanthropic Investing feels good

Before we go over the top 4 reasons, let’s get acquainted with Mainz Biomed.

Company Name: Mainz BioMed

Ticker: MYNZ

Exchange: NASDAQ

Website: https://mainzbiomed.com/investors/

Mainz Biomed Company Summary

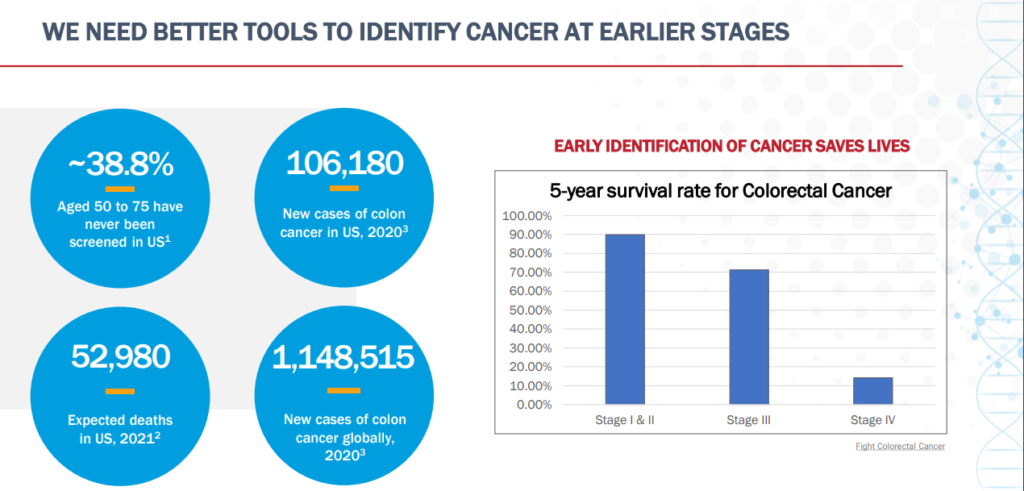

Mainz Biomed develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product is ColoAlert, an accurate, non-invasive, and easy-to-use early detection diagnostic test for colorectal cancer.

ColoAlert is currently marketed across Europe with an FDA clinical study and submission process intended to be launched in the first half of 2022 for U.S. regulatory approval.

Urgent: Pattern Detected

Small Cap Exclusive’s research department has uncovered a pattern with their news cycle.

Most investors react to a press release, however our largest breakout stock alerts have an over arching story hidden in the news cycle.

However, if you read between the lines, the press releases act as a road map to the future.

Found below is the important press releases signaling to savvy investors a future where Mainz Biomed could soar past $25.

Seeking Alpha’s research report echoes this sentiment with the quote below:

“The current data suggest that the approvals should occur. As such, I expect the share price to jump significantly.”

Our research department has provided the condensed press releases below that are pointing to the “big announcement” where massive price increases could take place in hours yielding a fortune for early investors.

We have highlighted the “road map” below where we found hidden in the press releases a foreshadowing of “the big announcement”.

We start with the announcement of March 2022 with the pivotal clinical trial design for ColoAlert concluding with the press release below, where they will begin commercialization throughout Europe. All press releases are located here.

Key Press Releases, When Will Be The “Big Announcement?”

Savvy investors have known for decades that corporations are sending messages to the trading public via press releases, can you detect the underlying message with their news cycle?

February 21, 2023

Transaction entails executing option agreements to purchase IP portfolio associated with current ColoAlert product and the novel gene expression (mRNA) biomarkers being evaluated in ColoFuture/eAARLY DETECT Studies

Announced today the execution of its option from Uni Targeting Research AS to acquire all of the previously licensed scientific intellectual property (“IP”) for its flagship product ColoAlert, a highly efficacious, and easy-to-use detection test for colorectal cancer (“CRC”) being commercialized across Europe.

Simultaneously, the Company also exercised its exclusive option with SOCPRA Sciences Sante et Humaines S.E.C. (“SOCPRA”), to outright purchase IP, including a pending patent, associated with a portfolio of novel gene expression (mRNA) biomarkers that have demonstrated ability to detect CRC lesions, including advanced adenomas (“AA”), a type of pre-cancerous polyp often attributed to this deadly disease.

Key Takeaway: Commercialized across Europe.

Mainz Biomed’s

Announced another deal to expand the marketing reach of its flagship ColoAlert diagnostic. This one is with Germany-based Labor Staber, a leading diagnostics services lab with over 800 employees, including almost 100 medical specialists, biologists, chemists, and other academics from various disciplines. Under the terms of the deal, ColoAlert, a highly efficacious and easy-to-use at-home screening test for colorectal cancer (CRC), will be marketed through Labor Staber’s extensive network of physicians and laboratories.

3/14/23

MYNZ share price weakness presents an opportunity to trade ahead of potential near-term catalysts. Shares dropped on Monday, possibly in sympathy with the Silicon Valley Bank fiasco. However, while MYNZ does list a Berkeley, California connection on its byline, this company is primarily based in Germany. Thus, financial exposure, if any, is more of a distraction than an MYNZ-specific event. Moreover, its significance is outweighed by the planned data releases expected over the next 90 days.

Remember, all deposits have been guaranteed by the U.S. Government and made available Monday morning. Hence, investors shouldn’t expect disruption to cash flow, which is the lifeblood of biotech. In other words, everything at MYNZ has stayed the same. And with contagion the likely cause of its share price decline, paying attention to MYNZ’s fundamentals and potential catalysts in the crosshairs exposes an opportunity worth seizing.

February 15, 2023

Continued roll-out in Europe with onboarding of new lab partners

Announced today the establishment of commercial partnerships for ColoAlert with Marylebone Laboratory (Marylebone Lab LTD) and Instituto de Microecologia, two leading independent laboratories covering England and Spain.

ColoAlert, Mainz Biomed’s flagship product, a highly efficacious and easy-to-use, at-home detection test for colorectal cancer (CRC), is currently being commercialized across Europe and in select international markets via a differentiated business model of partnering with third-party laboratories for test kit processing versus the traditional methodology of operating a single facility.

Key Takeaway: Covering England & Spain.

January 18, 2023

Patient Access Initiative Addresses €1 Billion Annual Market in Germany

Announced today the launch of a corporate health program in Germany for ColoAlert, its highly efficacious and easy-to-use screening test for colorectal cancer (CRC) being commercialized across Europe and in select international territories. As a start, ColoAlert has been integrated into BGM (“betriebliches Gesundheitsmanagement”), a corporate health network providing services to employees at forty-eight of the fifty largest companies in Germany[1].

Key Takeaway: Germany

November 15, 2022

MAINZ BIOMED ANNOUNCES U.S. EXTENSION OF COLOFUTURE STUDY TO EVALUATE INTEGRATION OF NOVEL MRNA BIOMARKERS INTO COLOALERT

Announced today the initiation of eAArly DETECT, its U.S. extension of ColoFuture, the Company’s European feasibility study evaluating the integration of a portfolio of novel gene expression (mRNA) biomarkers into ColoAlert, Mainz’s highly efficacious, and easy-to-use detection test for colorectal cancer (CRC) being commercialized across Europe and in select international territories. ColoFuture/eAArly DETECT are multi-center studies assessing the potential of these biomarkers to identify advanced adenomas, a type of pre-cancerous polyp often attributed to CRC.

Key Takeaway: USA

August 16, 2022

ColoAlert to be marketed through Dante’s extensive database and sold via its region-specific, ecommerce websites

Announced today the formal commencement of ColoAlert’s consumer commercial program in Italy and the United Arab Emirates (UAE). ColoAlert is Mainz’s flagship product, a highly efficacious and easy to use, at-home detection test for colorectal cancer (CRC) currently being commercialized across Europe and select international markets.

Key Takeaway: Consumer commercial program in Italy and the United Arab Emirates

March 31, 2022

MAINZ BIOMED COMPLETES SUCCESSFUL PRE-SUBMISSION PROCESS WITH THE U.S. FDA FOR COLOALERT’S PIVOTAL CLINICAL TRIAL

announced today that it has received supportive feedback from the U.S. Food & Drug Administration (FDA) on the Company’s pre-submission package profiling the potential pivotal clinical trial design for ColoAlert, its highly efficacious, and easy-to-use detection test for colorectal cancer (CRC). As Mainz prepares to launch ColoAlert’s pivotal clinical trial, the Company is also pleased to announce the formal commencement of its reimbursement process for ColoAlert by scheduling an initial meeting with The Centers for Medicare and Medicaid Services (CMS) in April 2022.

Key Takeaway: pivotal clinical trial design for ColoAlert

December 7, 2021

At-home Colorectal Cancer Diagnostic Test Now Available Online in Germany

Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test. German residents unable to obtain timely CRC screening via in-person physician visits, will be able to order ColoAlert directly to their home and receive highly accurate results within a maximum of nine working days.

Key Takeaway: Cancer Diagnostic Test Available Online In Germany

DECEMBER 14th, 2021

Mainz to co-brand ColoAlert with GANZIMMUN Diagnostics, one of the largest stool analysis labs in Germany with their 5,500 labs.

Mainz Biomed announced a partnership with leading diagnostics laboratory GANZIMMUN Diagnostics AG (GD), one of Europe’s leading laboratories for preventive and complementary medicine, for the commercialization in Germany of ColoAlert, Mainz’s unique, highly efficacious, and easy-to-use detection test for colorectal cancer.

Key Takeaway: 5,500 labs in Germany

Before we reveal “the big announcement” we are all waiting for MYNZ to release let’s review the methodical international network they are creating in the press releases above.

All the while Wall Street is dead asleep. That is exactly what Small Cap Exclusive has built it’s reputation on, the deep dive research delivered direct to our subscribers inbox before volume comes pouring in.

Early investing is where Warren Buffet created his wealth and we take pride in helping retail traders have the same edge as Berkshire.

Let’s review our catalysts now before we go over what we believe is “the big announcement” that will catapult MYNZ to record breaking gains.

The 4 Catalysts That Could Send Mainz Biomed B.V. (NASDAQ: MYNZ) To Wainwright’s $25 Price Target

#1 Undervalued Presenting Massive Upside Potential

#2 Technicals Reveal a Major Bounce Play Opportunity

#3 Mainz Biomed Is Generating Revenue

#4 Philanthropic Investing feels good

#1 Undervalued Presenting Massive Upside Potential

Lets start of with the upside potential, H.C. Wainwright has issued a price target of $25 HERE

From the current PPS that is a 270% gain! Savvy traders, Pay attention!

Mainz Biomed has a Market Cap of $121 Million but when you look at other companies that are in the space, you can see the value in this diamond in the rough.

We are very excited to see this kind of potential priced at such a low PPS and with a very small float at 12 Million shares outstanding.

Furthermore, Mainz plans on starting the FDA process shortly after their public listing. Recent FDA guidance recommends colorectal cancer screening for everyone over the age of 45, which translates to a market potential of over 52 million tests per year. 1

Can you imagine what will happen to the price per share of MYNZ when they get approved? Let’s look at one of their competitors to see what actually did happen!

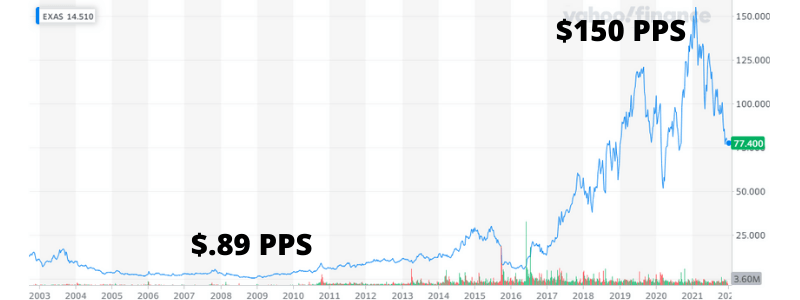

Take a look at Mainz Biomed’s competitor Exact Sciences Corporation NASDAQ

Today, the top non-invasive colorectal screening test technology is manufactured by Exact Sciences (NASDAQ:EXAS), which is a perfect success story that Mainz BioMed is currently seeking to recreate. EXAS is valued at $17 BILLION and trades at $60 PPS!

Could you imagine if MYNZ is trading at those PPS in the near future? That would be almost 1,000% gains, like turning $10,000 into $100,000.

We do apologize, we tend to get excited about companies that are showing massive potential in a philanthropic industry. Invest and possibly make money while saving lives, it’s the cornerstone of the capitalism that Adam Smith promoted.

Did you see the EXAS’ share price back in 08’ it fell to less than one dollar. Essentially, investors were basically saying Exact was worthless. But in June 2009, an announcement of a mutual collaboration and licensing agreement between Exact Sciences and the Mayo Clinic turned the company’s fortunes around.

Worth mentioning again, hint hint, “In June 2009, an announcement of a mutual collaboration and licensing agreement between Exact Sciences and the Mayo Clinic turned the company’s fortunes around.”

However, it was in 2014 when the FDA approved Cologuard for use as a non-invasive colorectal cancer screening test, and the test’s inclusion in multiple national guidelines that truly made the stock take off.

Hmm… Isn’t Mainz seeking FDA approval! See the correlation? I do and you should too.

For investors of EXAS who got in as recently as mid-2016 have already seen their investment grow nearly 20x in just over 5 years. Today it’s worth nearly $17 billion USD.

20x Returns, that $10,000 would be $200,000

Here is the kicker, Mainz Biomed’s ColoAlert is designed to be easier to administer than Exact Sciences ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy. This is truly cutting edge medical testing at a fraction of the PPS of Exact Science.

MYNZ other competitor is Genescopy a privately help company making some moves

The reason I mention Geneoscopy is because this story is relevant, take a look at the investment level, $100M++!

Geneoscopy Inc. is a life sciences company focused on the development of diagnostic tests for gastrointestinal health, announced November 17th the closing of a Series B financing, raising a total of $105 million through a combination of debt and equity.

The round is led by previous investors Lightchain Capital and NT Investments. Other investors in the round include Morningside Ventures, Labcorp, Cultivation Capital, BioGenerator Ventures, and Innovatus Capital Partners. HERE

That is an example of just how large this industry is and how much money is available to fund it. It’s cancer and it has affected almost everyone in one way or the other.

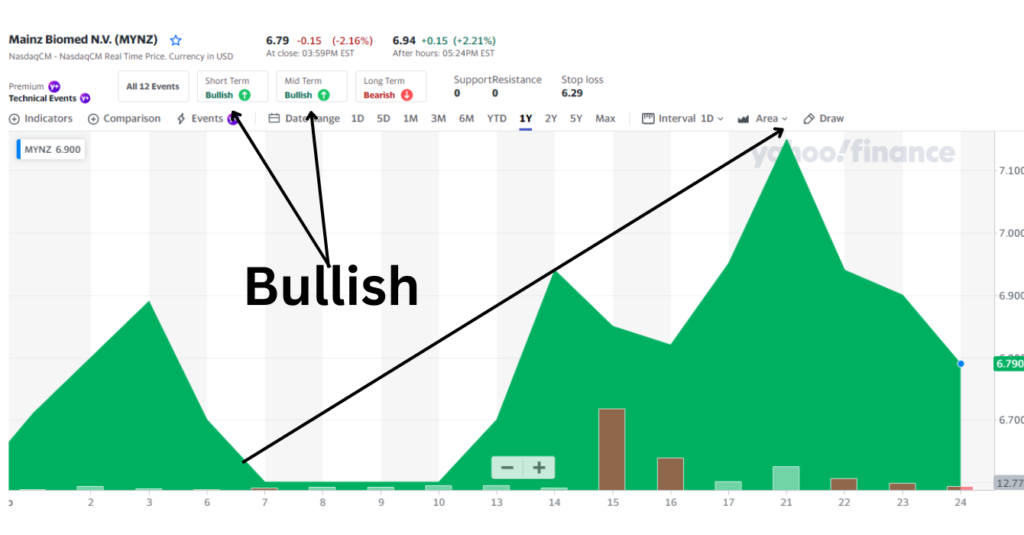

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing, for a bounce play!

Amidst the massive international stock market pull back, MYNZ PPS has been reduced by almost 50% and has created a clear consolidation pattern. See below

This is where Small Cap Exclusive shines! We issue research reports uncovering massive upside potential. There is a clear bottom in October of last year with a 30% run, then pulls back and consolidates again. We have seen this pattern over and over again and this stock should explode once the big announcement is made.

It is important to note, that MYNZ has created a stable base over the last 6 months reducing the downside risk, this is the exact point we issue research reports. Reduced risk with massive upside potential.

#3 Mainz Biomed B.V. Is Generating Revenue

ColoAlert has received CE accreditation and is approved for sale in Europe.1 European sales will provide near-term revenue potential, while they prepare for entry into the US market. Just last month, Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test.

This is significant, DTC (direct to consumer) test to see if you have cancer which will allow you to catch it early and have a 90% survival rate. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

ColoAlert is designed for profitability, rapid commercial uptake, and broad consumer acceptance. The fact that Mainz Biomed is generating revenue in Europe and will be entering the US market with FDA approval is a massive sign for things to come. Make sure you keep MYNZ on your watchlist because the potential is substantial.

#4 Philanthropic Investing – possibly turn an amazing profit while helping people

It is rare for investors to be able to possibly have a home run return on an investment while helping to alleviate senseless deaths with the 2nd most deadly form of cancer.Colorectal cancer is the 2nd most lethal cancer in the US, but also highly preventable; with early detection providing 5-year survival rates above 90%. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

90% survival rate if detected early, guess what, ColoAlert detects early stage colon cancer. There is a solution and it is ready to come to market in the USA with FDA approval.

Why is Mainz Biomed your cake and icing for investors?

-

- ColoAlert Holds Potential as a Blockbuster Early Detection Test for Colorectal Cancer. Far less senseless deaths in regards to colon cancer!

- Mainz BioMed protects its intellectual property through trade secrets to control all critical reagents, processes and formulations. Protecting intellectual property is important for market capitalization!

- Mainz Biomed MYNZ is developing proprietary genetic testing methods for pancreatic cancer. Once the distribution channel is developed, offering multiple products creates more than one revenue stream!

- Non-invasive test, which can be taken at home, with rapid response of 92% specificity and 85% sensitivity. Designed to be easier to administer than Exact Science’s ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy.

We have presented the necessary research and now we are ready to unveil what our research is pointing to, “the big announcement”.

On December 6, 2022 MYNZ announced approval from an independent Institutional Review Board (IRB) for the protocol ReconAAsense, the Company’s U.S. pivotal study to evaluate the clinical performance of its highly efficacious and easy-to-use detection test for colorectal cancer (CRC).

Mainz Biomed has been conducting this study for over a year, which will form the basis of the data package to be submitted for review by the U.S. Food and Drug Administration (FDA) to achieve marketing authorization.

ReconAAsense is a prospective clinical study that will include approximately 15,000 subjects from 150 sites across the United States. The study objectives include calculating sensitivity, specificity, positive predictive value (PPV) and negative predictive value (NPV) in average-risk subjects for CRC and advanced adenomas (AA).

We believe the studies will come back positive and will be released soon. Mainz Biomed has been methodically making strategic moves that act as a harbinger of things to come.

We are already diving deeper into this for our second research report on the impact on PPS when the announcement comes. To receive this exclusive report before our publication, sign up below.

Let’s recap why Mainz Biomed MYNZ could be, THE massive breakout of 2023!

#1 MYNZ is Undervalued

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

#3 Mainz Biomed B.V. Is Generating Revenue

#4 Philanthropic Investing feels good

It is a rare opportunity in this world to have this kind of investment opportunity while also funding the act of saving lives. This is an easy fix, detect the 2nd most dangerous form of cancer early and you have a 90% survival rate. ColoAlert is the answer, we just need to stop what we are doing and place it on your watchlist, today!

Happy Trading and remember, never try to catch a falling knife!

Condensed Disclaimer

Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on February 24, 2023 to publicly disseminate information about (MYNZ) via website and email. We have been compensated $116,000 USD to profile MYNZ for one month. We will update any changes to our compensation. Full Disclaimer

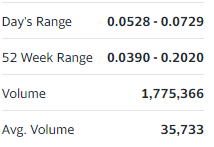

Therma Bright (TBRIF) Gains 29% Amidst Breaking News

Since Therma Bright TBRIF announced they secured the license for Digital Cough Technology, the stock has been on a steady climb up.

Here are the Top 3 catalysts that could send TBRIF up 200%++ in the next 3 months:

- Technologies are disruptive in a $21 billion market

- Multi-channel market penetration strategy

- Chart is bullish

History of Massive Runs

Where did we come up with 200%?

The 52 week high is $.21 and at the current prices that would represent 200% gains.

Check Out This Run

Date: October 24th 2022

PPS: $.039

PPS on 11/7: $.101

Gains: 159%

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential. Our research reports have uncovered some of the largest breakout stock alerts year after year.

We stand by our alerts, our 2023 alert tracker providing transparency. Click Here

Small Cap Exclusive’s much anticipated research report on Therma Bright is found below.

[clickfunnels_embed height=”320″ url=”https://chrisputnam1229.clickfunnels.com/optin1677276397943″ scroll=”yes”]

(OTC:TBRIF) Therma Bright has so many catalysts that could send it parabolic it was difficult to finalize the top 3 catalysts found above, so we will open this research report with the honorable mention!

Therma Bright’s Other Explosive Catalysts

- Recent news has has created massive increases in share volume in the US market.

- TSX, Canadian exchange, is also having the same changes in trends, volume and PPS.

- This is a classic momentum play, all the indicators are pointing to it.

- The chart looks like Warren Buffet grabbed chalk, went to the chalk board, turned to the class and said, “this is a bullish trend line, this is breakout pattern, this is a momentum play and a possible short squeeze catalyst.” all in one chart!

]Why is Therma Bright trading at 49X trading volume?

News below is a game changer:

Therma Bright announced that it has finalized and signed the exclusive worldwide licensing rights to market and sell AI4LYF’s Digital Cough Technology (DCT). DCT can accurately and almost instantaneously detect multiple respiratory diseases, including COVID-19, simply and efficiently through a smartphone app, anytime, anywhere.

Pay attention!

Therma Bright is methodically releasing incredible press releases possibly setting up a massive run similar to the last bullish move from $.039 to .1010 representing a 159% increase in share price.

Notice a trend in the news cycle below?

March 1st – Announced The Appointment of Dr. John Patton as Chairman, most notably he was the co-founder of Inhale/Nektar (NKTR) achieved a US $2.1bn valuation on NASDAQ. link

Feb 23 – TBRIF Reports on Progress of Inretio’s Novel Clot Removal Device for Stroke Treatment link

Feb 16 – Therma Bright Secures Exclusive License Agreement for AI4LYF’s Patent-Pending Digital Cough Technology (DCT) to Detect Respiratory Diseases Link

Jan 19 – Therma Bright to invest up to US$2.5M in developer of a groundbreaking ischemic stroke treatment Link

Dec 1, 2022 – TBRIF invests in novel treatment using inhaled statins to treat respiratory conditions Link

Let’s do a quick summary on TBRIF before we jump into the catalysts.

Therma Bright Company Summary

Company Name: Therma Bright, Inc.

Ticker: TBRIF

Exchange: OTC

Website: https://www.thermabright.com/

Therma Bright Company Summary:

Therma Bright, developer of the smart-enabled AcuVid™ COVID-19 Rapid Antigen Saliva Test, is a progressive medical diagnostic and device technology company focused on providing consumers and medical professionals with quality, innovative solutions that address some of today’s most important medical and healthcare challenges.

During the research process many investing principles that are a hallmark of a an explosive trade became clear in regards to Therma Bright.

However, we are going to focus on just three of the numerous unique investing propositions.

So, without further delay, here are the top 3 catalysts that could ignite parabolic growth with TBRIF.

Before we review #1 Catalyst, their technology suite, let’s review how the catalysts above could generate parabolic growth.

As mentioned above, Therma Bright trades on the OTC market which indicates the incredible upside potential if just one of their revolutionary products captures the market share warranted.

It gets better, they have strategically created two paths to revenue, institutional focus and direct to consumer.

More on that later, then to top it off the chart just broke through resistance and is appearing to be setting up for another massive run.

ADD UP ALL THE POSITIVES then add in that their technologies are innovative, have massive demand in the marketplace and are disruptive in a $21 billion market.

Digital Cough Technology (DCT)

Artificial intelligence, smart phones, algorithms, we live in an amazing time and Therma Bright very well could become a household name with their Digital Cough Technology.

In lay terms, imagine an application that has thousand of recorded coughs on a server. Next, those coughs are denoted and attributed to a certain illness or disease. Third step, develop a mobile app utilizing your microphone to record your cough. Finally, the application performs a search query to detect an illness or disease in the library of coughs.

Wow, just wow the times we live in! The icing on the cake is, you have an opportunity to take advantage of this amazing technology if you choose to invest in Therma Bright (OTC:TBRIF). Look at the amazing press on DCT below:

Press Announcing DCT Licensing

February 16th

Therma Bright announced that it has finalized and signed the exclusive worldwide licensing rights to market and sell AI4LYF’s Digital Cough Technology (DCT). DCT can accurately and almost instantaneously detect multiple respiratory diseases, including COVID-19, simply and efficiently through a smartphone app, anytime, anywhere. The exclusive license agreement also will allow Therma Bright to develop the DCT solution for other respiratory diseases, such as asthma, pneumonia, bronchiolitis, and chronic obstructive pulmonary disease.

Statins

Statins traditionally have been used to treat cholesterol but there has been significant studies in the efficacy in treating treat respiratory conditions, including asthma and chronic obstructive pulmonary disease (COPD), and acute lung inflammatory diseases, including those caused by COVID-19. Please review this study to gather a better insight in the incredible novel technology Therma Bright just acquired. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7836012/

In December Therma Bright announced that it has entered into an agreement to acquire an interest in a novel technology utilizing inhaled statins to treat respiratory conditions, including asthma and chronic obstructive pulmonary disease (COPD), and acute lung inflammatory diseases, including those caused by COVID-19.

Research from the University of California Davis School of Medicine on “inhaled statins” to treat the acute and chronic respiratory inflammatory mechanisms associated with asthma, COVID-19, and other respiratory conditions has yielded promising results, according to Therma.

Inretio

It keeps getting better, they announced a SPA (Share Purchase Agreement) with Inretio Ltd. (“Inretio”) for its innovative protective blood clot retriever technology.

Therma Bright has the right to invest up to USD $2,000,000 in cash and USD $500,000 in Therma Bright shares to earn up to 25% in Inretio Inc., subject to TSX Venture Exchange approval.

Inretio is developing a medical device called PREVA™ to treat ischemic stroke.

The PREVA™ clot retriever is a groundbreaking medical device that will change the way ischemic strokes are treated.

It is the first and only protective clot retriever that uses a distal basket. The device’s unique PREVA™ basket “ensnares” the clot, encapsulating it and protecting the brain from any sub-clots breaking off during the thrombectomy procedure.

This ensures the complete removal of the clot and its fragments, leading to more successful revascularization of the brain which can prevent further damage and complications. The PREVA™ clot retriever is a game-changing technology that has the potential to significantly improve outcomes of clot removal procedures for stroke patients.

Venowave

The Venowave is a circulation booster designed to improve circulation in the lower extremities.

The Venowave is a medical compression pump that is lightweight, compact, battery operated, designed to treat and alleviate the symptoms associated with poor circulation. When worn firmly on the calf, the Venowave produces a wave form motion forcing blood from the feet and legs back to the heart. This increase in blood flow draws oxygen to wound and ulcer sites, prevents blood pooling and clotting, and alleviates symptoms of Post Thrombotic Syndrome and other Chronic Venous Insufficiencies.

Therma Bright has implemented a multi-channel market penetration strategy that doubles their opportunity at success and can double their revenue.

You might be asking right now, what is a multi-channel market penetration strategy? In lay terms, Therma Bright is institutionally focused while consumer driven, a rare double threat that is similar to a unicorn when referencing international commerce.

Let us explain this concept in greater detail, because it is important. You don’t buy Tylenol from McNeil Consumer Healthcare you purchase it from CVS, their distributor. Similarly, you don’t buy Nyquil from Proctor & Gamble, you pick it up Harris Teeter. Therma Bright is making a massive commitment to operate in both models, intuitional and dtc. For a brief description of both models, look below.

Institutional: Hospitals, pharmacies, HMOs and the VA to mention a few. The pros with this model is massive sales, streamline logistics, reduction in customer service, reduction in marketing, reduction in employees and reduced accounting expenses. The cons are, thinner margins and the tail wags the dog, meaning, if you lose a massive account that is 23% of your business, heads will roll and revenue comes crashing down.

Direct to Consumer: Otherwise known as DTC, is any company that penetrates a market with directly to the consumer rather than through a wholesale distributor, HMO as an example. The advantage with DTC is you have the ultimate control. You are fishing for yourself rather than depending on a sales agency essentially. Furthermore, your profit margins are higher as well. The cons are higher overhead and the pain of managing all the employees who oversee the customers you created through your direct marketing efforts. https://www.benepod.com/

Breakout Pattern Detected

The 3rd catalyst has so many facets, such as: breakout confirmation, Canadian volume skyrocketing, momentum and it’s consolidated and ready for it’s next move!

Breakout confirmation is clear as day in the chart below. There was resistance and consolidation from $.0425 to $.05, then boom, it catapulted through resistance reaching it’s 60 day high. More importantly, it has retraced, pulled back, and consolidating creating a bullish trend! The chart looks spectacular!

Canadian Volume – Therma Bright trades under the ticker (TSXV: THRM) on the TSX, mirroring the US market, volume is skyrocketing due to the news and the possible short squeeze. The short squeeze aspect of Therma Bright is the gasoline that the catalysts spark and then it may go parabolic, more on this later. If you look below, you will see the TSX chart with a similar bullish trend and volume spikes.

New Momentum – As seen in both charts above, volume has increased 4,900%, that is worth repeating, 4,900% increase in demand for this stock! Look at the screenshot below.

Worth noting, with all of this demand TBRIF still has almost 200% to get to their 52 week high and all signs point to the possibility of meeting and exceeding those numbers with the catalysts and the possible short squeeze that we will discuss shortly.

Consolidated under current prices – the last 70 days have been trading in a consolidation pattern creating a base then the move it made a few days creates a situation where there are modest gains and sustainable gains without creating a mass sell off. This action creates a bullish pattern and incredible stability in the trading activities.

In closing, look at these record breaking volume spikes, turn your attention to Therma Bright (OTC:TBRIF) right now, regret can be demoralizing and always remember, to the victor belongs the spoils.

[clickfunnels_embed height=”320″ url=”https://chrisputnam1229.clickfunnels.com/optin1677276397943″ scroll=”yes”]

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $60,000 from Therma Bright Inc. for profiling TBRIF. We own ZERO shares in TBRIF.

Massive IPO Stock Alert: Lucy Scientific (NASDAQ:LSDI) Announces It’s $7.5M IPO

Lucy Scientific manufactures therapeutic psychedelics and made a huge announcement, we will get to that soon.

The Global Psychedelics Market Is Expected To Reach almost $100 BN By 2029 Full Article

That is larger than the cannabis market segment, without a market leader.

Lucy Scientific has made some serious steps toward possibly dominating the market.

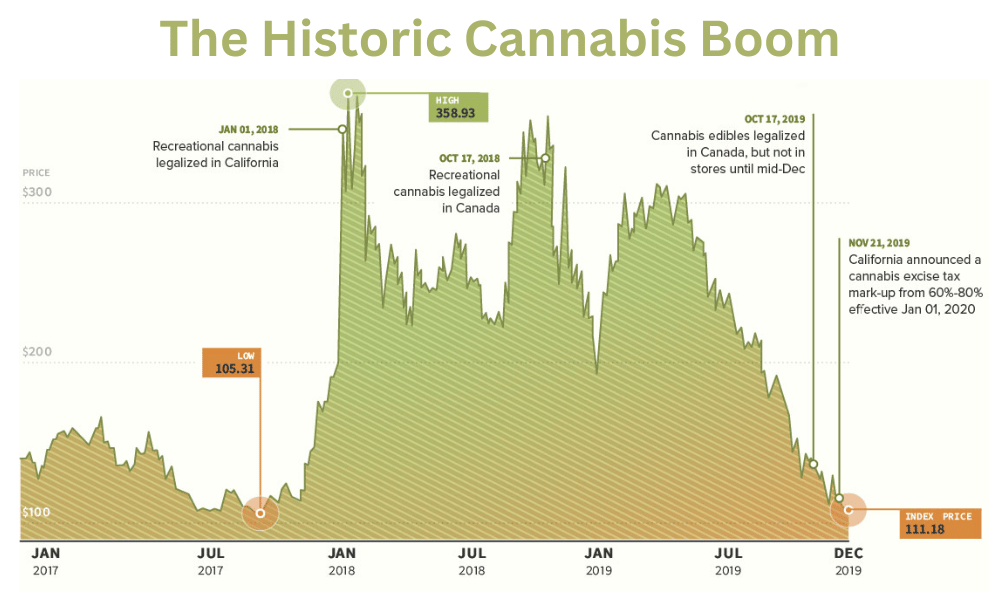

This is exciting investors, it is a second chance at the cannabis boom but bigger.

In case, you need a reminder of how crazy that ride was, the market grew by 250% in less than a year.

UPDATE:

Breaking News:

March 21, 2023 (GLOBE NEWSWIRE) — Lucy Scientific Discovery Inc. (“Lucy” or “The Company”) [NASDAQ:LSDI], an early-stage psychedelics manufacturing company, announced that it has entered into a definitive asset purchase agreement with Wesana Health Holdings Inc. (“Wesana”).

Lucy has agreed to acquire intellectual property and related assets for Wesana’s psilocybin and cannabidiol (CBD) combination investigational therapy, SANA-013, and Wesana’s supply of psilocybin which is sufficient to complete all near-term clinical studies. The aggregate consideration comprises 1,000,000 shares of common stock and $570,000 in cash. The shares will be subject to a lock-up agreement whereby half of the shares will be released 9 months from closing, and other half will be released 14 months from closing. The transaction is also subject to Wesana’s shareholder approval and is expected to close in Q2 2023.

Small Cap Exclusive has built a reputation of uncovering stocks with massive upside potential, concentrating on IPOs and we have uncovered some interesting data on LSDI.

Our research reports have uncovered some of the largest breakout stock alerts year after year.

LSDI may even be the best yet. So put us to the test and put it on your watchlist.

We stand by our alerts, our 2023 alert tracker provides transparency. Click HERE

Small Cap Exclusive’s much anticipated research report on Lucy Scientific (NASDAQ:LSDI) is found below.

Top 3 catalysts that could send LSDI up 127%++ in the next month:

#1 The Chart

#2 IPOs Offer A Significant Upside Potential

#3 The Market Could Be As Big As Coffee

Lucy’s Other Explosive Catalysts

- Recent news has has not been covered by major financial news outlets, creating a unique opportunity.

- Lucy Scientific Discovery Announces First Commercial Sale of Psilocybin. Press Release

- Files Amendment with Health Canada to Expand its List of Controlled Substances to Include Cocaine and Heroin Press Release

Why do we consider Lucy Scientific as a contender for the best stock of 2023?

Large announcements in the drug world is turning heads on Wall Street and it feels like 2017’s green boom with cannabis.

Wait until you see what we have uncovered!

Major Psychedelic Announcements:

2019: May 9th

Denver, Colorado became the first city in the United States to decriminalize the cultivation, possession and use of psilocybin mushrooms.

2019: June 5th

Oakland California decriminalized the cultivation, possession and use of plants or fungi containing psychedelic compounds including DMT, ibogaine, mescaline and psilocybin.

2019: September 4th

Johns Hopkins launched the Center for Psychedelic and Consciousness Research. The center’s director, Roland Griffiths, said that researchers will focus on how psychedelics affect behavior, mood, cognition, brain function, learning, memory, and biological markers of health.

2019: November 22nd

The Food and Drug Administration granted Breakthrough Therapy designation to the Usona Institute for its psilocybin therapy for major depressive disorder. Usona’s phase 2 clinical trials will include 80 volunteers at seven sites around the U.S.

2020: October 22nd

In Vancouver, Canada Numinus Wellness Inc. harvested the first legal flush of psilocybin mushrooms by a public company under its Health Canada-issued Controlled Drugs and Substances Dealer’s License.

2021: October 18th

Johns Hopkins Medicine was awarded a $3.9 million grant by the National Institutes of Health (NIH) for clinical research on psilocybin-assisted psychotherapy to treat tobacco addiction.

Let’s take a closer look at Lucy LSDI.

2023: March 23

Announced today the launch of a new line of unscheduled psychoactive compounds that will be available for sale throughout the United States, and where permitted throughout the rest of the world.

The first line in the new family of brands contains Amanita Muscaria mushrooms, a psychoactive adaptogen. The product leverages the compounds of these mushrooms, and a proprietary blend of other natural functional ingredients, to create a transformative experience for consumers worldwide. This product line is named ‘Mindful by Lucy’.

Lucy Scientific Discovery Company Summary

Company Name: Lucy Scientific Discovery

Ticker: LSDI

Exchange: NASDAQ

Website: https://www.lucyscientific.com/

Lucy’s Company Summary:

Lucy Scientific Discovery Inc. [NASDAQ:LSDI] an early-stage psychedelics manufacturing company that is focused on becoming the premier research, development, and manufacturing organization for the emerging psychedelics-based medicines industry.

Lucy maintains a Controlled Drugs and Substances Dealer’s License under Part J of the Food and Drug Regulations promulgated under the Food and Drugs Act (Canada), more commonly known as a Dealer’s License, that was issued to Lucy by Health Canada’s Office of Controlled Substances.

This Dealer’s License authorizes the Company to develop, sell, deliver, and manufacture (through extraction or synthesis) certain pharmaceutical-grade active pharmaceutical ingredients, or APIs, used in controlled substances and their raw material precursors.

Before we review #1 Catalyst, their technology suite, let’s review how the catalysts above could generate parabolic growth.

As mentioned above, Lucy Scientific Discovery trades on the NASDAQ as an IPO, which indicates the incredible upside potential.

#1 The Chart

The chart has clearly broken out and is creating a bullish trend line. Start your research now before it is too late, just like the green boom.

#2 IPOs Offer A Significant Upside Potential

Facebook META acted the same way as most IPOs with hype. They get overbought, they pull back and then run like mad!

Lucy is following that same pattern and we believe it has created a bottom and has broken out clearly in the above image.

Look at what Motley Fool wrote about the massive opportunity FB provided, “The stock was offered at $38 per share via the IPO. Let’s assume you bought 132 shares for a total of $5,016 on May 18, 2012, and held all the way through to today. At today’s price of around $191 per share, those 132 shares would be worth $25,212, resulting in a market-beating five-bagger.”

Just like the cannabis boom, and Facebooks IPO, traders are being handed another possible monumental opportunity.

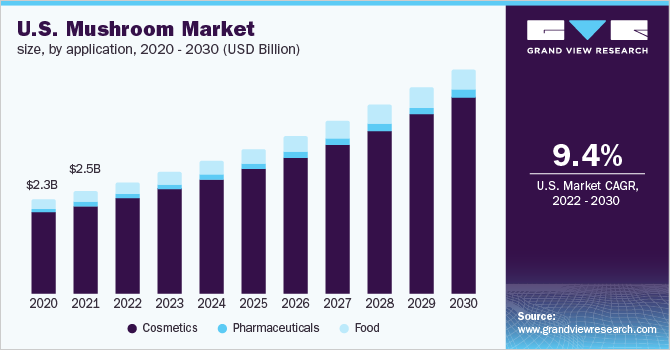

#3 The Market Could Be As Big As Coffee

The global mushroom market size was valued at USD 50.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2022 to 2030. The increasing vegan population demanding a protein-rich diet around the globe is expected to be a key driver for the market over the forecast period. Mushrooms are considered a superfood owing to their nutritional contents. Mushrooms are packed with four key nutrients namely selenium, vitamin D, glutathione, and ergothioneine. These nutrients help mitigate oxidative stress and prevent or decrease the risk of chronic conditions such as cancer, heart disease, and dementia. Moreover, it offers a strong natural umami flavor, allowing consumers to reduce salt proportion in mushroom meals by 30-40%, thereby benefitting health.

The U.S. was the second-largest producer accounting for approximately 375 million kg in the year 2019. The production in the country is declining since 2017 and has declined by 11% from 2017 to 2019. Whereas the demand from end-users is growing, which has resulted in an increase in the prices by 6% in 2017-18 and by 3% in 2018-19. The U.S. government is continuously increasing import duties, which is also contributing to the higher prices of mushrooms. Mushroom is one of the protein-rich vegan sources as it offers nearly 3.3 g of protein per 100 g of serving. Meat has been a key source of protein in the western diet; thus, the population adopting a vegan diet is anticipated to prefer protein-rich vegan products to fulfill their daily protein requirements.

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $350,000 from Lucy Scientific Discovery Inc. for profiling LSDI. We own ZERO shares in LSDI.

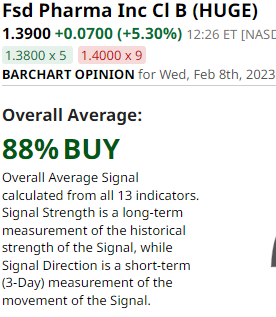

FSD Pharma Inc. (HUGE) Is Bullish On ALL 19 Technical Indicators

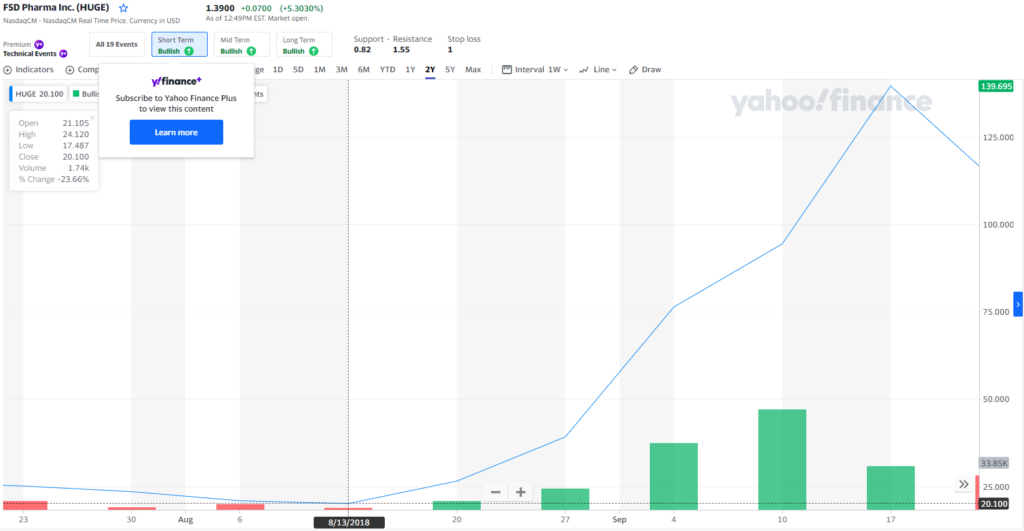

FSD Pharma Inc. HUGE stock could be heading to the moon, look at this chart below!

Top 3 Reasons To Turn Your Attention To (NASDAQ: HUGE) Right Away:

#1 All Technical Indicators & The Chart Are BULLISH

#2 Canada Greenlighted Phase 1 Trial for Multiple Sclerosis

#3 The Stock Has A History Of Big MOVES

FSD Pharma Growing Systems Company Summary

Company Name: FSD Pharma Inc.

Ticker: HUGE

Exchange: NASDAQ

Website: https://fsdpharma.com/

Company Summary: FSD Pharma, Inc. is a specialty biotech pharmaceutical research and development company. It focuses on developing over time a robust pipeline of FDA-approved synthetic compounds targeting the end cannabinoid system of the human body to treat certain diseases of the central nervous system and autoimmune disorders of the skin, GI tract, and the musculoskeletal system. The company was founded by Thomas Fairfull, Zeeshan Saeed and Anthony J. Durkacz on October 20, 1994 and is headquartered in Toronto, Canada.