NMRD Stock: Why is Nemaura Medical (NASDAQ: NMRD) A Top Stock To Watch in February?

Over the past week, the Nemaura Medical Inc (NASDAQ: NMRD) stock has been in the middle of a solid rally and recorded gains of 56% to emerging as one of the stock to watch. As it happens, the NMRD stock hit its highest level since mid-October last year.

Nemaura Medical Inc

Company Name: Nemaura Medical Inc

Ticker: NMRD

Exchange: NASDAQ

Website: https://nemauramedical.com

Nemaura Medical Inc Summary:

Nemaura Medical Inc. is a medical technology company developing and commercialising non-invasive wearable diagnostic devices. The Company is currently also commercialising sugarBEAT® and proBEAT™. sugarBEAT®, a CE mark approved Class IIb medical device, as a non-invasive and flexible continuous glucose monitor (CGM) providing actionable insights derived from real time glucose measurements and daily glucose trend data, which may help people with diabetes and prediabetes to better manage, reverse, and prevent the onset of diabetes.

There are certain specific triggers that led to the remarkable rally in the NMRD stock.

#1 Medical’s Program Shows Weight Loss In 100% Of Participants

One of those came about earlier in the week on January 24 when the company announced the initial results from the patient studies that had been conducted with the National Health Service (NHS) of the United Kingdom for Miboko, its metabolic health program.

The results were positive as the patients recorded an average weight loss of 3.7 pounds and all the patients experienced some degree of weight improvement.

This news had a major positive impact on NMRD stock and is one of the top stock to watch.

#2 Commences Pilot Program of Miboko with the NHS

While that was quite clearly a significant development it should be noted that the announcement with regards to the study for Miboko in collaboration with the NHS had been announced back on November 29, 2022.

Mikobo is the first product in its category to have a non-invasive glucose sensor in a lifestyle app. It not includes information with regard to drinking and good intake but also provides analytics and educational content. At the end of the analysis, the app provides the user with a metabolic score based on diet and other important factors.

#3 Solid Industry Growth

Nemaura is entering the Continuous Glucose Monitoring Market with the product and it is a market that is expanding rapidly. The market was worth as much as $6.13 billion back in 2021 and by 2030 it is expected to command a valuation of $16.33 billion, which reflects a CAGR of 17.33%.

So, considering the latest news and big jump, NMRD stock is one of the other top stock to watch for the month of February.

A2Z Smart Technologies (NASDAQ:AZ) Is The Stock to Watch Following Multiple News

At this point in time, investors are hotly on the trail of A2Z Smart Technologies Corp (NASDAQ:AZ) and that becomes apparent when one looks into the price action in the stock and is the notable stock to watch. Over the course of the past week alone, AZ stock has clocked gains of 43% and that took the gains over the past month to as much as 92%.

Why Such a Big Jump?

AZ stock has been witnessing continuous buying after announcing multiple news. Firstly, the stock reached a key partnership with Lenovo Group Limited. Secondly, the company announced a launch of a new Smart Cart model.

A2Z Smart Technologies Corp

Company Name: A2Z Smart Technologies Corp

Ticker: AZ

Exchange: NASDAQ

Website: https://a2zas.com/

A2Z Smart Technologies Corp Summary:

A2Z Smart Technologies Corp. creates innovative solutions for complex challenges. A2Z’s flagship product is an advanced proven-in-use mobile self-checkout shopping cart.

With its user-friendly smart algorithm, touch screen, and computer-vision system, Cust2Mate streamlines the retail shopping experience by scanning purchased products and enabling in-cart payment so that customers can simply “pick & go”, and bypass long cashier checkout lines. This results in a more efficient shopping experience for customers, less unused shelf-space and manpower requirements, and advanced command and control capabilities for store managers.

As AZ stock has soared over the past month, let’s analyze the key catalysts:-

#1 Big Partnership With Lenovo Group

Last Friday, the company announced that its subsidiary has partnered with Lenovo Group Limited. As per the joint venture, A2Z Smart Technologies will use Lenovo solutions in its revolutionary Cust2mate Smart Cart solution and Lenovo will actively sell and promote the solution through its extensive worldwide channels.

Hila Kraus, Head of Sales stated, “The Cust2Mate platform with embedded Lenovo OEM solution is designed to serve shoppers from the moment they enter the store until they leave-without any friction, lines, or delays.”

#2 Launches Next Generation V2.8 Light Smart Cart

AZ stock hit its 4-month high recently as a key contender for the stock to watch this year. One of the major catalysts behind the latest rally in the stock came about earlier this week when the company announced that it had launched its latest Smart Card model. The product in question is expected to further enhance the current range of offerings from A2Z Smart.

The company announced that the latest version of the model had been created after consulting with some of the major retail companies in the world from the Asian and European markets.

#3 It Will Display Its Smart Cart Line of Products at the NRF 2023 Big Retail Show In NYC

Moreover, earlier on in the month on January 12, the company made another announcement that had come as a positive trigger for the A2Z Smart stock. It announced that it was going to be one of the participants in the NRF Big Retail Show. The company announced at the time that it was going to display its Smart Cart Line at the event.

Considering the recent multiple news, AZ stock should be on your radar as a stock to watch in 2023.

Will AgriFORCE Growing Systems Ltd (NASDAQ:AGRI) Patent News Trigger Further Rally?

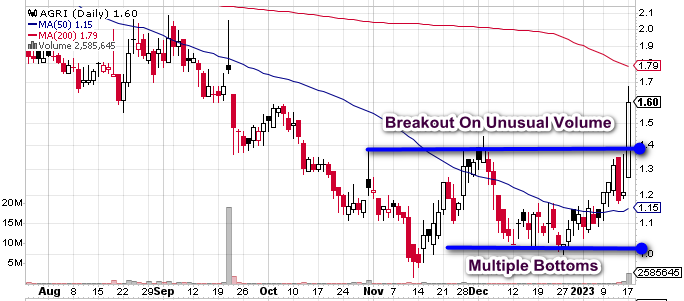

AgriFORCE Growing Systems Ltd (NASDAQ:AGRI) stock is flying with a price-volume breakout!!

It was hardly a surprise that the AgriFORCE Growing Systems Ltd (NASDAQ:AGRI) stock went on a major really yesterday and ended up hitting a four-month high following a jump of 29% and closed at a 4-month high. Considering the magnitude of the gains, investors are expected to be in hot pursuit over the course of the coming days.

Why Such a Big Rally?

The news that triggered the rally in the stock was the award of the patent for its proprietary method for the natural processing and modification of gains by the United States Patent and Trademark Office.

AgriFORCE Growing Systems Company Summary

Company Name: AgriFORCE Growing Systems Ltd.

Ticker: AGRI

Exchange: NASDAQ

Website: https://agriforcegs.com/

AgriFORCE Growing Systems Company Summary:

AgriFORCE Growing Systems Ltd. (NASDAQ: AGRI; AGRIW) is an agtech company focused on building an integrated agtech platform that combines the best technology, intellectual property, and knowledge to solve an urgent problem – providing the best solutions to help drive sustainable crops and nutritious food for people around the world.

The AgriFORCE vision is to be a global leader in delivering plant-based foods and products through an advanced and sustainable agtech platform that makes a positive change in the world—from seed to table. Additional information about AgriFORCE is available at: www.agriforcegs.com.

#1 – AgriFORCE Granted Patent Related to its Proprietary Methods for Processing Nutritious Foods Under the UN(THINK)™ Foods Brand

The company is highly innovative and is engaged in the advancement of agricultural technology which could promote sustainable agriculture as well as crop processing operations.

By way of this particular process, it would be possible to turn grains of rice, pulses, and other seeds into fiber-rich, high-protein, and low-starch baking flour products. It is clear to see that it is a patent that could lead to a revolution in the fast-growing nutritious foods space.

It ought to be noted that the unique process had been acquired by AgriFORCE through the acquisition of Manna International Group back in May last year. The acquisition was part of the company’s overall aggressive acquisition strategy and it seems it may have paid off handsomely following the award of the patent.

#2 – AGRI stock Trades Above 20-Day and 50-Day EMA

Tuesday’s big rally has pushed the stock above key moving averages – signaling a short-term momentum trade. The stock is now trading well above the 20-Day and 50-Day EMA of $1.20 and $1.15 respectively.

Moreover, the stock closed at a 4-month high triggering a multi-month price-volume breakout.

#3- Growth Through Acquisition – Delphy Group’s Acquisition In Focus

Last month on December 28 the company announced that it had got shareholder approval for the acquisition of Delphy Group, which is expected to help AgriFORCE in offering its products in the global market easily.

The acquisition is expected to be closed at some point in the coming weeks. The company has also stated that throughout the course of 2023, it expects to witness certain developments which could further accelerate its growth. AgriFORCE remains committed to its aggressive merger and acquisition strategy.

The company said that ” We will continue to drive our M&A strategy to further strengthen our AgTech 2.0 platform.”

#4 Impressive Outlook

The company is projected to bring the first products under UN(THINK) Foods to market. In particular, with the B2B and direct-to-consumer launch of Awakened Flour, and hope to create a new standard for sprouted flours.

Following this, the company plan to launch our Power Flour which will bring superior nutrition with no compromise to consumers. Additionally, they have several other consumer products in the pipeline, for which we intend to provide additional details in 2023.

Moreover, AgriFORCE will start advancing the expansion of Delphy into North America as well as continue to build our Delphy Digital platform and suite of services.

The company noted ” As we look ahead, we believe we have secured the foundational pieces to transform our business in the near term. We believe 2023 will be a pivotal year in the company’s history and that we have laid the foundation in 2022 to achieve major achievements and successes in the coming year.”

LM Funding America Inc (NASDAQ:LMFA) Stock Jumps 30% in a Month: Here is Why

There are now plenty of options for investors when it comes to innovative finance companies and one of those is LM Funding America Inc (NASDAQ:LMFA). It is a specialty finance company that is fundamentally dependent on innovative technology and in recent days, its stock has also performed quite strongly.

The stock was in focus among investors on Monday and managed to clock gains of 13% amidst heavy interest. As a matter of fact, the gains made by the stock yesterday took its gains for the past month to as much as 31%. The company, which is looking to move into the crypto space, made a key announcement yesterday and investors ought to take a closer look at it.

Yesterday, the company announced the pricing in relation to an underwritten public offering it will conduct. In that particular offering, the company will be offering a total of 6,315,780 shares of the LM Funding America common stock and in addition to that, warrants to pick up an additional 6,315,780 shares are also going to be offered.

The offering is going to be made in the form of a unit consisting of one share of the common stock and one warrant. The units in question are going to be offered for the price of $4.75 each. It goes without saying that it was a major announcement from the company and one that seems to have come as a source of optimism among many investors.

In this context, it is perhaps also necessary to point out that the warrants could be exercised immediately at a price of $5 a share of the LM Funding America common stock. The warrants are going to expire five years from the day of issuance.

Although the common shares and warrants are being combined into one unit, they could be separated immediately after the purchase is completed. The offering is expected to be closed today as long as the usual closing conditions are met. It is going to be interesting to see if the stock remains on the radars of investors today. It could be a good idea to keep an eye on LM Funding America today.

Sphere 3D Corp (NASDAQ:ANY) Stock Forms Bullish Trend: Jumps 380% YTD

Bitcoin-related stocks have had a pretty good time in recent days and one of those is the Sphere 3D Corp (NASDAQ:ANY) stock. Over the course of the past week, the stock has come into sharp focus among investors, and during the period, it managed to clock gains of as much as 16%.

It goes without saying that such gains are likely to bring the stock into focus this week and hence, investors could do well to take a closer look at Sphere 3D. The positive trigger for the stock actually came last week after the company announced that it signed a critical new agreement with Gryphon Digital Mining. As per the terms of the agreement, Gryphon is going to be responsible for supplying Sphere 3D with 230 MW worth of carbon-neutral Bitcoin mining hosting power.

The capacity is going to be managed by Sphere 3D’s hosting partner Core Scientific. In this context, it should be noted that the hosting agreement that was bagged by Core Scientific is the biggest it has had in its history.

More importantly, it is another step towards Gryphon and Sphere 3D becoming the biggest carbon-neutral Bitcoin miners in the world. Considering the fact that Bitcoin has come in for heavy criticism due to the sort of power that is consumed for mining the cryptocurrency, it is a step that might have come as a source of great optimism for many investors.

The Chief Executive Officer of Sphere, Peter Tassiopoulos stated that both Sphere, as well as Gryphon, are committed to professionalizing the cryptocurrency industry. He went on to state that both the companies were highly excited at the prospect of working with a big-ticket company like Core Scientific in the venture. Sphere 3D is primarily a company that is involved with data visualization and management solutions.

However, the latest move from the company seems to have come as a source of significant excitement among investors. After the gains made by the Sphere 3D stock in the past week, it is now going to be interesting to see if the stock can continue to add to its gains this week.

DatChat Inc (NASDAQ:DATS) Stock Makes An Interesting Move After The News

Messaging apps have only risen in popularity in recent times and investors who might be looking into fresh opportunities in this sector could consider taking a look at the DatChat Inc (NASDAQ:DATS) stock.

Although it is a small player in the privacy focussed messaging space at this point, it should be noted that DatChat went public earlier this year on August 12, and in recent days, the stock has been a strong performer. The DatChat stock has managed to deliver gains of as much as 43% over the course of the past week and it might be the right time for investors to take a closer look.

The company had been established back in 2014 and at this point in time, it only caters to 22572 users. That is a minuscule figure when it comes to messaging apps and nowhere near the numbers generated by its competitors.

While that may be the case, the company’s stock has performed strongly and has gone up fourfold since its IPO. The rally in the stock may have been strong but experts believe that those gains may not be actually sustainable. The company has not monetised its customers and hence, it is perhaps not surprising that since its launch in 2014 it has not generated any revenues at all.

As a matter of fact, many investors might in fact wonder about the reasons why the company actually went public considering the fact that in its last reported quarter DatChat suffered a loss of as much as $996,771.

However, the company has argued that it is in need of more capital in order to implement its plans and also to operate the whole thing smoothly. It has been suggested that DatChat is currently looking to add more features to its app and that is a major part of the current business plan that has been put in place. However, the current valuation of the company is pegged at a north of $250 million and experts believe that it is overvalued. Hence, it might be a good idea for investors to tread a bit carefully.

Good Gaming Inc (OTCMKTS:GMER) Stock Moves Near To 50 cents: A Bullish Sign?

In recent times, the Good Gaming Inc (OTCMKTS:GMER) stock has been in focus among plenty of investors and managed to record handsome gains at different points of time. On Friday, the stock made another massive move after Good Gaming announced that it signed another key partnership.

As investors piled on to the stock in a big way on Friday, the stock soared by as much as 65% and it is likely to stay in focus among investors this week as well. The company revealed that it struck up a partnership with the NFT (non-fungible token), blockchain technology, and cryptocurrency company Blockchain App Factory. As per the terms of the partnership, Blockchain App Factory is going to help the company with the development of the brand and the marketing efforts related to the game MicroBuddies.

Good gaming is going to launch this game at some point in the third quarter of 2021 and the news of the partnership seems to have come as a source of considerable excitement for investors. Considering the gains made by the stock following the announcement of the partnership, it could be a good idea to take a closer look at Blockchain App Factory.

The company is one of the pioneers in the blockchain business development sector and has been in business since as far back as 2017. In addition to that, it has worked with some of the biggest names across the world like Shell Oil Corporation and Econet Global among others. Investors could consider adding the Good Gaming stock to their watch lists at this point.

Global Tech Industries Inc (OTCMKTS:GTII) Stock Soars 25% in a Week: But Why?

Over the course of the past week, investors have taken a shine to the Global Tech Industries Inc (OTCMKTS:GTII) stock, and this morning the stock is in focus once again after the company made a key announcement. In the meantime, the Global Tech stock has managed to clock gains of as much as 25% over the course of the past week.

The Nevada corporation announced this morning that the Beyond Blockchain: Buy Crypto iOS app has been launched and people could now download the same from the Apple App Store. It is a major development for the company considering the fact that it is expected to bring more users to the crypto Beyond the Blockchain crypto platform.

In essence, the app is the mobile version of the BeyondBlockchain website and will now be available to iPhone users who prefer to trade through their phones. In this context, it is important to point out that those who are going to use the iOS app will also get the same sort of features and security that are available to those who trade through the website.

Traders are going to have around-the-clock access to not only their accounts but also the trading platform. Most of the popular cryptocurrencies like Chainlink, Ethereum and Bitcoin among others are going to be available. In addition to that, the traders are going to be able to trade through a range of fiat currencies and cryptocurrencies. It is a feature that is also available to those who trade through the website.