The robotic surgery industry has grown at a fairly impressive clip over the course of the past few years and nowadays investors are becoming increasingly interested in this particular sector. One of the companies that could be of interest to such investors is Asensus Surgical (NYSEAMERICAN:ASXC), which is currently one of the notable players in the sector thanks to its main product Senhance System.

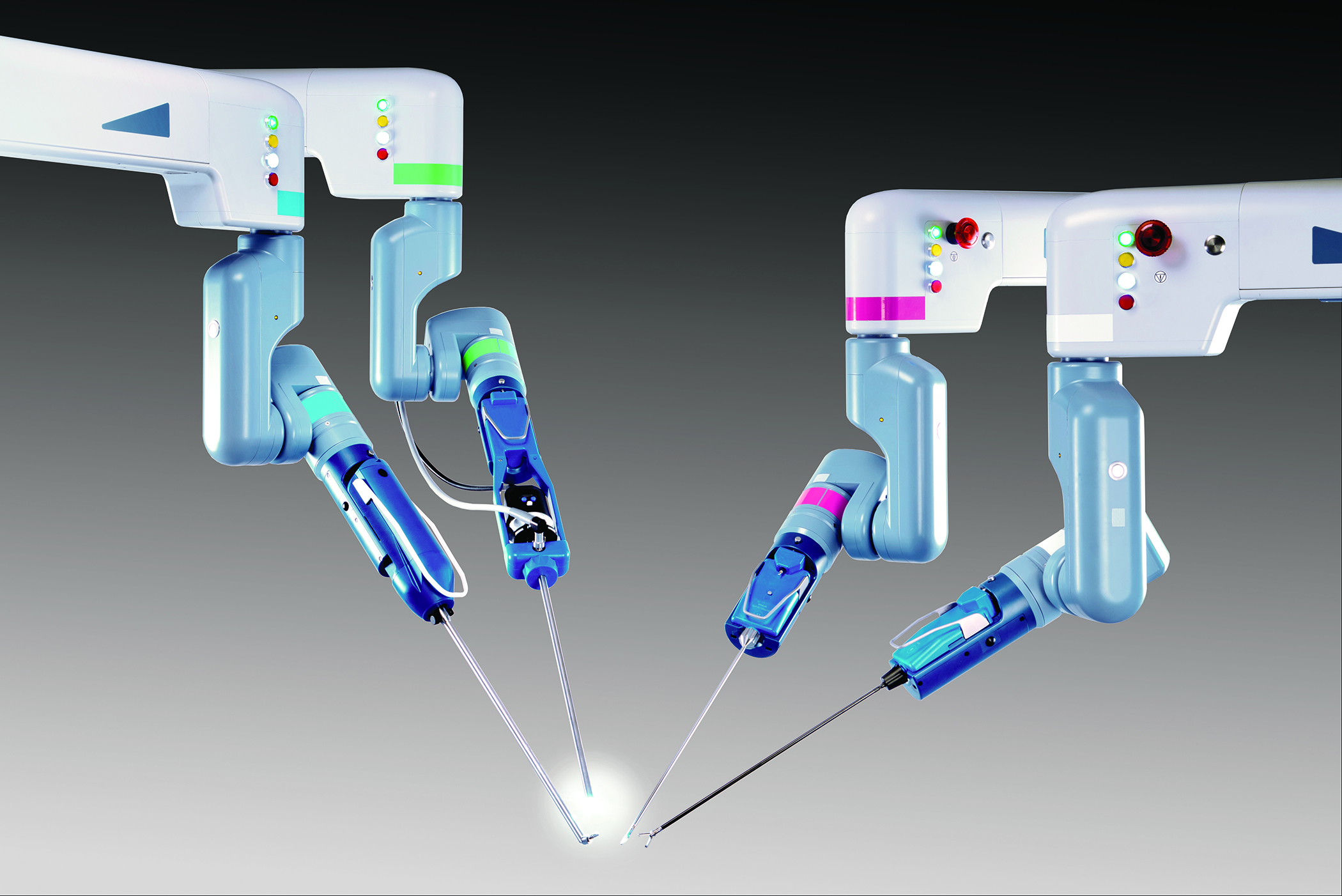

The product is meant for providing assistance during surgeries. However, if anyone is looking to analyze the Asensus stock then it is necessary to recognize that the situation may be a bit more complex. The most important thing to note that in addition to providing assistance for surgical procedures, Senhance System is also meant for cutting costs.

On the other hand, it is also necessary to remember that the Asensus stock had been caught up in the meme stock frenzy earlier this year and rallied hard as retail investors from Reddit piled on to the stock in a big way. As a matter of fact, the stock rallied by as much as 900% at the beginning of the year in a matter of few months.

However, such gains don’t last in general and it didn’t for the Asensus stock. The company’s product is ideal for laparoscopic surgeries since it is one type of surgery that has proven to be ideal for robotic solutions. Robotic surgery is expensive but Asensus has designed Senhance System in such a way that it can reduce costs by utilizing reusable standard instruments.