Zynga ZNGA purchased for $12B by Take-Two Interactive. ZNGA gaps up 46% with heavy trading volume this morning. Let’s take a closer look at Zynga.

Zynga Inc. ZNGA Company Summary

Company Name: Zynga Inc.

Ticker: ZNGA

Exchange: NASDAQ

Website: www.zynga.com

[thrive_leads id=’9825′]

Zynga Inc. ZNGA Company Summary

Zynga ZNGA is a global leader in interactive entertainment with a mission to connect the world through games.

Therefore with it’s massive global reach in more than 175 countries and regions, Zynga has a diverse portfolio of popular game franchises that have been downloaded more than four billion times. Just on mobile including CSR Racing™, Empires & Puzzles™, FarmVille™, Golf Rival, Hair Challenge™, Harry Potter: Puzzles & Spells™, High Heels!, Dragons!™, Merge Magic!™, Toon Blast™, Toy Blast™, Words With Friends™ and Zynga Poker™.

With Chartboost, a leading mobile advertising and monetization platform, Zynga is an industry-leading next-generation platform with the ability to optimize programmatic advertising and yields at scale.

Founded in 2007, Zynga is headquartered in California with locations in North America, Europe and Asia.

Why did ZNGA go up over 40% overnight?

Jan. 10th 2021

Take-Two to acquire all the outstanding shares of Zynga for a total value of $9.861 per share – $3.50 in cash and $6.361 in shares of Take-Two common stock, implying an enterprise value of $12.7 billion.

Transaction represents a 64% premium to Zynga’s closing share price on January 7, 2022.

Establishes Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

Unifies highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

Creates one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

Consequently, Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

Take-Two TTWO Company Summary

Company Name: Take-Two Interactive Software, Inc.

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Zynga Inc. ZNGA Company Summary

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher, and marketer of interactive entertainment for consumers around the globe.

We develop and publish products principally through Rockstar Games, 2K, Private Division, and T2 Mobile Games.

Take-Two TTWO products are designed for console systems, personal computers, and mobile, including smartphones and tablets.

Also, they deliver through physical retail, digital download, online platforms, and cloud streaming services. Take-Two TTWO common stock trades on NASDAQ under the symbol TTWO.

ZNGA 3 Month Chart

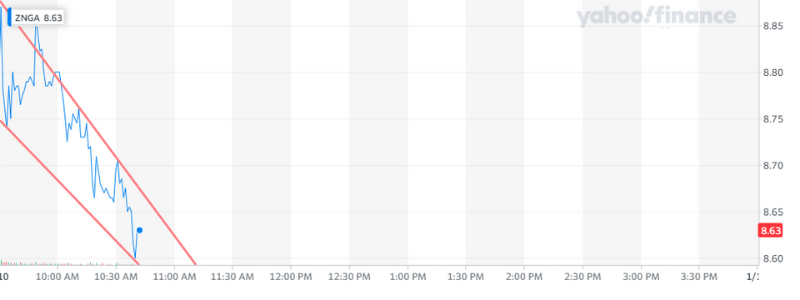

Zynga ZNGA 1 Day Chart

ZNGA Technical Analysis

After the announcement that Take-Two TTWO was acquiring Zynga Inc. ZNGA the stock gapped up with heavy trading volume by over 40%! Meanwhile TTWO suffers in PPS with a massive sell off.

ZNGA is shockingly consolidating after the massive run with a slight pullback. This is a good sign. Therefore, I would like to see it break $8.70 then $8.76 before I would take a position because normally there will be a massive sell off after a huge gap up like this.

[thrive_leads id=’9825′]