Medivolve Inc. (OTC-COPRF, NEO-MEDV) is possibly ready for a big move, traders place this on your watchlist immediately!

Here are SIX reasons why Medivolve is just warming up!

- The chart is potentially very promising.

- The Testing Network is established and nation-wide.

- Covid is here to stay!

- Recent press releases are incredible!

- Medivolve (COPRF/MEDV) is poised to be a major disrupter of medical services due to their low CPA (Cost Per Acquisition).

- A leader is a dealer in hope and the leadership team embodies hope for traders!

Company Name: Medivolve, Inc.

Ticker: (OTC-COPRF, NEO-MEDV)

52 Week High: $.67

Current Trading Price: $.32

Market Trend: Bullish

Company Summary: Medivolve, Inc. has a substantial collection of leased sites for COVID-19 testing, offering convenient access to rapid antibody and antigen tests; these tests take 8-10 minutes to administer, provide results in less than 24 hours and cost under $100 along with standard PCR tests. The company is expanding into tele-health and tele-diagnostics which they intend to capture a significant market share through their impressive CPA model for obtaining new clients, where they can disrupt the medical service industry with hundreds of convenient walk up locations rather than the traditional come and wait in a Covid-19 saturated doctors lobby for your hour late appointment.

The chart is potentially very promising!

February 04, 2021

In order to maximize operational efficiency, Collection Sites is conducting a state by state expansion where possible. The new sites are currently located on the properties of Simon’s Property Group, an investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company as well as Sandor Development Group. Additional sites are expected to be open in Texas, Florida, and Georgia within the coming weeks.

November 11th – Collection Sites Announces Agreement to Offer COVID-19 Testing Services and Protocols for The Elf On The Shelf’s Magical Holiday Journey

November 17th – QuestCap Announces Planned Name Change to Medivolve Along With Transition to Single Purpose Medical Company

December 1 – Collection Sites Expands Convenient COVID-19 Testing Across America with 25 Additional Testing Sites

January 5th 2021 – Medivolve (COPRF/MEDV) announces a C$5M bought deal private placement led by Canaccord Genuity.

Medivolve entered into an agreement with Canaccord Genuity Corp., on behalf of a syndicate of underwriters (collectively the “Underwriters”), pursuant to which the Underwriters have agreed to purchase on a bought deal private placement basis, 20,000,000 units of the Company (“Units”) at a price of C$0.25 per Unit (the “Issue Price”), for aggregate gross proceeds of C$5,000,000

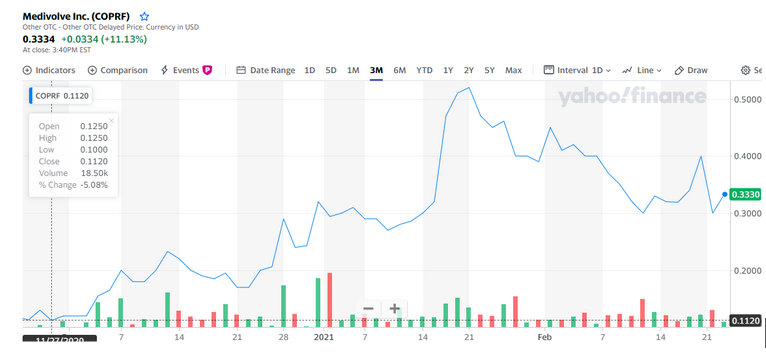

The press releases over the last three months have garnered serious attention by Wall Street, take a look at this CHART.

The chart above is potentially very promising with some serious consolidation taking place over the last month. Out of the first 34 volume bars on this chart 24 are green, closing positive for the day, which represents 71% positive days. Hence, the stock reacted with an ascending, bullish, chart line.

The run started on 11/27/2020 at a price per share of $.125 and due to those “buying” days it reached a high of $.60 on 1/20/21 which represents a 380% gain over the specified period.

Now let’s look at the consolidation that took place after the amazing run of 380% gains, there were 22 volume bars after the run to $.60 with 13 representing a sell off day, 60%, hence the traders who were happy with their gains from the run exited their positions. This is consolidation, which creates a prime environment for another massive possible price increase due to the lack of sellers creating downward pressure.

In short, many people bought the COPRF/MEDV on the two month run to $.50-$.60 then sellers started to exit their positions creating downward pressure resulting in the share price falling from the high of $.60 down to $.33. Moreover, $.33 still represents a 164% gain from the November price of $.125 which reveals this stock could be primed for another move holding a much higher main trend line than November!

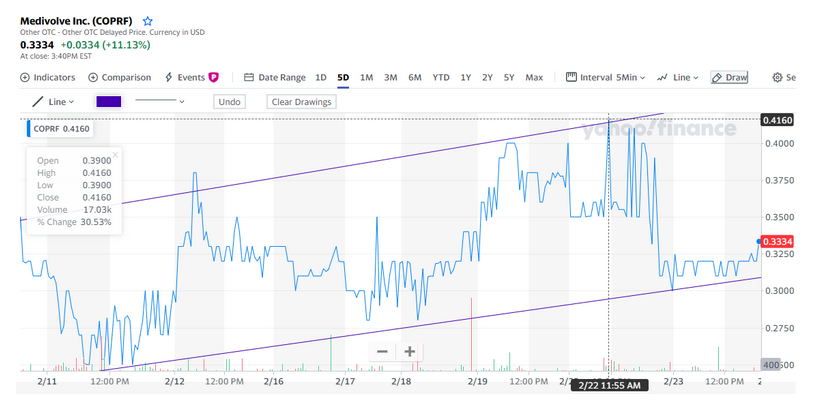

This channel is poised for a possible major breakout!

Let’s review the 5 day chart and one can see the channel-line, top line, and the main trend, bottom line, is a perfect set up for a possible strong run. What does that mean? A bullish channel traditionally signals technical traders to watch or buy a stock based on the ascending main trend line and the corresponding channel-line.

The Testing Network is established and nation-wide!

Medivolve has signed with a major multi-billion dollar premium mall operator to set up these Collection Sites COVID-19 testing centers to offer convenient access to rapid antibody and antigen tests – which take 8-10 minutes to administer and provide results in less than 24 hours. The sites also offer regular RT-PCR. The testing centres are powered by Alcala Testing and Analysis Services, a CLIA-licensed laboratory based in San Diego, California.

All tests can be administered with insurance coverage options. The tests results can be communicated via text or email and can be accompanied with a certificate of good health via a HIPAA-compliant smartphone application.

Medivolve (COPRF/MEDV) issues Huge News in regards to strategic partners, who will be next?

Covid is here to stay!

Feb 3rd, just a few weeks ago, had the third largest amount of cases of Covid-19 in the United States.

Think about this, they made $7.1M in just January and that was just a few months of the company being in business! What will Q2 look like?

During the month of January, the Company realized the sale of 73,973 COVID-19 tests at an average sale price of $96 per test across it’s expanding network. Approximately 52% of the sales were cash pay, with the balance as insurance sales. The Company continued to see the strongest demand for antigen tests, followed by antibody and then PCR.

So, the question is, how long will Covid testing be a viable source of income?

The answer: Covid is unfortunately here to stay!

Let’s look at the latest numbers: Are we going up? Are we holding the average? Or going down?

Almost 71,000 new cases of COVID-19 were reported in the United States on February 22, 2021.

If those numbers hold true, there will be 2,130,000 new cases (71,000 X 30 days) that have to be tested to be confirmed. Let’s look at the last 13 months to see if the Feb 22 numbers are going up, holding the average or going down.

Between January 20, 2020 and February 22, 2021 there have been almost 28 million confirmed cases of COVID-19 which means that the monthly average is 2,153,000 (28 million / 13 months) which is almost exactly at the projected average derived from the Feb 22 numbers, which means we are 100% still in the grips of this deadly virus.

Recent press releases are incredible!

February 4, 2021

Sales of 73,973 Tests at $96 , that is over $7M in just January!

During the month of January, the Company realized the sale of 73,973 COVID-19 tests at an average sale price of $96 per test across it’s expanding network. Approximately 52% of the sales were cash pay, with the balance as insurance sales. The Company continued to see the strongest demand for antigen tests, followed by antibody and then PCR.

“We are thrilled by the strong sales performance in the month of January and are excited for future sales with the rapid growth of our network,” commented Collection Sites.

As we already examined above, the Covid numbers are holding to the 13 month average, so the $7.1M in revenue for Medivolve should be a solid projection for the near future. Possibly, as Americans grow tired of masks, quarantines and become lackadaisical in conjunction with warmer weather, get-togethers both public and private, we believe the covid cases will be on the rise as well.

February 18, 2021

Medivolve Announces Launch of Investor Awareness Campaign

As a trader, I absolutely love seeing emerging companies paying for awareness campaigns. If a company believes in it’s product/service and is willing to have skin in the marketing game, well, it is a very good sign. Medivolve has contracted with three of the most respected investor relations firms in the country: EMC Marketing Services, Winning Media Marketing Services & Amherst Baer Marketing Services.

These three firms are savants when it comes to creating awareness around some of the biggest investments in the last decade. Let’s get ready fellow investors, this could be a legendary ride! One of those war stories you tell on your front porch, all eyes on you, hanging on every word as you hear exclaimed, “get out of here, no way!” Let’s take a good look at the companies and monies spent over the duration.

EMC Marketing Services

Medivolve entered into an agreement for electronic media and webcast services, design, development and dissemination services with Emerging Markets Consulting LLC (EMC), with respect to EMC providing investor relation services to the company. Effective February 24, 2021, the EMC agreement has an initial term of 90 days, wherein the company will pay EMC a non-refundable fee of US$250,000.

Winning Media Marketing Services

Medivolve entered into an agreement for strategic digital media services, marketing and data analytics services with Winning Media LLC (WM). Effective February 8, 2021, the WM agreement has an initial term of 90 days, wherein the company will pay WM a non-refundable fee of $250,000.

Amherst Baer Marketing Services

Medivolve has retained Amherst Baer Consultancy Corp. (ABCC) of Langley, B.C., as investor relations consultant to prepare a marketing campaign for the company. ABCC will be paid $70,000 a month for a three-month contract.

Medivolve (COPRF/MEDV) is poised to be a major disrupter of medical services due to their low CPA of customers

Let’s take a look at the Tele-Health & Tele-Diagnostic Industry

In a press release dated February 22nd, 2021 Medivolve has “A large network of Collection Sites and intends on leveraging its network and large customer database to market these new services and launch a series of mobile clinics.”

What is Tele-Health?

The Health Resources Services Administration defines telehealth as the use of electronic information and telecommunications technologies to support long-distance clinical health care, patient and professional health-related education, public health and health administration. Technologies include videoconferencing, the internet, store-and-forward imaging, streaming media, and terrestrial and wireless communications. Link

What is the Tele-Health market size?

The telehealth market growth will increase by $95.72 billion during 2019-2024. Link

Why should Medivolve enter into this vertical?

First and foremost, they are mitigating the risk if Covid-19 is eradicated then they will have an established vertical to monetize with their current customer base. The announcement by Medivolve to enter into the TeleHealth sector makes a lot of sense due to their existing customer base, strategic partnerships and to develop an exit strategy when Covid numbers go down. Well done, well done!

CPA, not the accountant, Cost Per Acquisition, it’s the name of the game!

I remember an interview with ClickFunnels’ Russel Brunson and I will never forget it; he said, the name of the game is being able to pay a higher price for a client than your competition. So, if you can create a higher AOV (Average Order Value) then, you can pay more to acquire the client. If you are scaling and penetrating the market enough you can actually start eliminating weak competitors by cutting off their ability to acquire clients by increasing the CPA. It’s reminiscent of Genghis Khan’s legendary military tactic of disrupting the food supply and starving out your enemies. I’m not alluding to Medivolve engaging in such practices but with their massive customer database already acquired to repurpose that database to create new revenue streams would create a massive competitive advantage!

They don’t have to go pay per clicks, hire an agency or pay for a team of sales reps to ring doorbells, they already have a list of thousands of clients who prefer to conveniently walk up to a testing facility on their way to Target. I imagine the client after 8 minute experience said, I sure wish all medical experiences were like this! They will tap into this customer list and it should be even bigger than their current operations!

“A leader is a dealer in hope.” —Napoleon Bonaparte

You’re only as good as your people, let’s take a look.

Medivolve has a team of renowned global medical and business advisors that have developed a proprietary business strategy to capitalize on high-margin opportunities in the COVID-19 space. This panel includes prominent immunologist Dr. Lawrence Steinman and Dr. Glenn Copeland, who has 45 years of experience in orthopaedic treatment, foot and ankle care, and sports medicine.

Doug Sommerville is a veteran leader in the North American medical, pharmaceutical and technology industries. Prior to joining Medivolve, Mr. Sommerville held the role of Head of Country for Canada for Teva Canada, a subsidiary of Teva Pharmaceutical Industries Ltd. (“Teva”), the world’s leading provider of generic medicines. In this role, Mr. Sommerville was responsible for Teva’s third largest global subsidiary, with sales in excess of $1.3 billion. Douglas led all aspects of the company’s commercial, distribution, demand planning and customer operations – aligning and coordinating all company functions, production, supply chain, regulatory and global support functions. Douglas was also the Chairman of the Canadian Generic Pharmaceutical Association up until his retirement from Teva Canada in 2018.

Previous to his tenure at Teva Canada, Mr. Sommerville was Global Vice President, Infusion Systems with Baxter Healthcare International (“Baxter”), one of the world’s largest medical, pharmaceutical and technology companies. In his role, Douglas was responsible for the company’s infusion pumping devices and intravenous administration sets worldwide, as well as pain management and ambulatory infusion devices, working with Baxter’s product development, regional sales and marketing teams globally.

Lawrence Steinman, MD is Professor of Neurology, Neurological Sciences and Pediatrics at Stanford University and Chair of the Stanford Program in Immunology from 2001 to 2011. His research focuses on antigen specific tolerance in autoimmune disease and in gene therapy for degenerative neurologic diseases. He has elucidated what provokes relapses and remissions in multiple sclerosis (MS). He is taking forward a pivotal clinical trial with antigen specific tolerization therapy for type 1 diabetes. He serves as attending neurologist at Stanford’s Lucille Packard Children’s Hospital.

Steinman was senior author on the 1992 Nature article that led to the drug Tysabri, approved for MS and Crohn’s disease. Tysabri has been taken by over 200,000 individuals with MS.

Dr. Glenn Copeland possesses over 45 years of experience in both orthopaedic treatment and sports medicine, Dr. Glenn Copeland is one of North America’s most prominent foot and ankle specialists.

He has established unique and authoritative treatments specializing in both surgical and non-surgical procedures of the foot and ankle.

Dr. Copeland has founded and directed several highly successful medical companies including Footmaxx Inc., which converted orthopaedic evaluation of the lower extremity from moulding technology to pressure and motion mapping. Dr. Copeland was successful in opening over 1,880 clinics globally.

Between 2002 and 2008, Dr. Copeland was selected to be the founder, chairman, and CEO of Cleveland Clinic Canada. Cleveland Clinic is universally regarded as one of the top three medical institutions in the world.

He was recruited in 2008 by Mount Sinai Hospital in Toronto to establish the Rehab and Wellbeing Centre and Sports Medicine Centre, which continues to thrive, seeing over 10,000 patient visits each year.

These are 5 very good reasons why Medivolve should be on your watchlist.

- The Testing Network is established active and nation-wide massive and growing with hundreds of additional sites.

- Covid is here to stay!

- Recent press releases are incredible!

- Medivolve (COPRF/MEDV) is poised to be a major disruptor of medical services due to their low CPA (Cost Per Acquisition)

- A leader is a dealer in hope and the leadership team embodies hope for us traders!

Happy Trading and remember my adage, “Never try to catch a falling knife!”

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Medivolve, Inc. Small Cap Exclusive has been hired by Medivolve, Inc. for a period beginning on March 3, 2021 to publicly disseminate information about (COPRF) via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.