Grove Inc GRVI stock price is up 28% in the last 3 months and it appears that it is just the start.

I will go over my perspective in detail in the this article, but don’t take my word for it!

Pull up the chart right now and I think you will agree.

So make sure you continue reading because it is pretty common that I deliver 100%++ gainers to our subscribers!

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & Awareness Campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system.

I have found some critical components to success for GRVI that I will share below, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for CA:XBC is, a 4 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

Grove Inc. Company Information

Company Name: Grove Inc.

Ticker: GRVI

Exchange: NASDAQ

Website: https://groveinc.io/

Grove Inc. Company Summary:

We started as a group of hemp enthusiasts, eager to spread the positive benefits associated with the use of CBD and hemp-based products. But our mission has always been to be innovators in wellness.

Our R&D team works tirelessly to provide people with brands they can trust, putting the customer first during every step of the process. From our stringent testing of each product to our competitive pricing, we believe in plant-based wellness for all and have curated our product line to benefit the needs of each individual person.

GRVI stock price is due to News?

Mar 31, 2022

Announced the initial launch of a billboard campaign in 3 major cities throughout the nation aimed at driving submission traffic and awareness for Upexi, the company’s Amazon Brand Aggregator.

The out of home advertising campaign will launch in early April in Boston, Dallas, and Los Angeles, aiming to garner over 40 million impressions across the next several months.

February 15, 2022

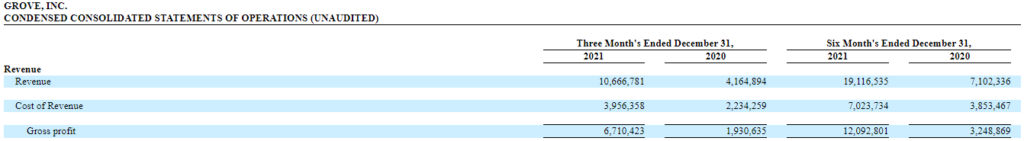

Announced financial results for the second quarter period ended December 31, 2021.

Year to Date Financial Highlights

- Revenues rose to $19.1 million from $7.1 million, a 167% increase.

- $0.04 basic earnings per share compared to loss of $0.06.

- $2.9 million in adjusted EBITDA.

- 103,750 shares of Grove common stock repurchased with cash flow from operations.

Trending Stock GRVI 5 Day Chart

GRVI Stock Price HOT Stock Grade:

The official heat level for GRVI is, a 🔥🔥🔥🔥 4 out of 4 . My reasons are substantial, take a look below.

GRVI Trading Volume

The volume, is trading at an increase of 162% over the average which indicates a higher demand in the stock. 162% over average is very significant, but not the only KPI to look at when evaluating a small cap stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

GRVI Technicals

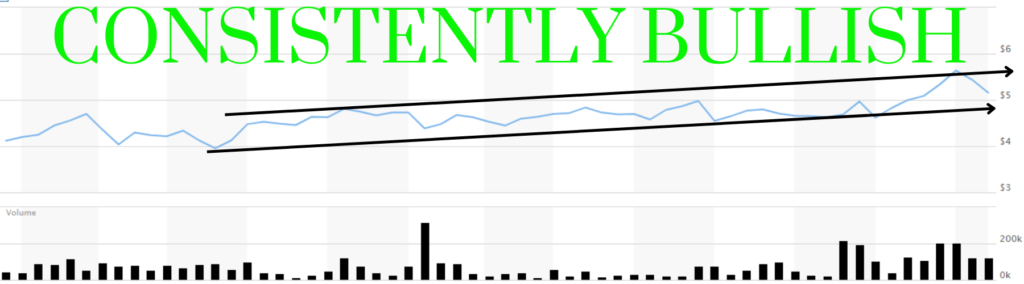

The technical analysis “chart reading”, it is bullish and has been that way all year with a steady ascending channel. When reviewing the news it is not difficult to understand why this stock is such a value.

Look at the 3 Month Chart for GRVI!

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

GRVI News Cycle

The news, there is significant news, for example the “launch of a billboard campaign in 3 major cities throughout the nation aimed at driving submission traffic and awareness for Upexi, the company’s Amazon Brand Aggregator.”

This news coupled with “Revenues rose to $19.1 million from $7.1 million, a 167% increase.”

All of the incredible news lately is playing a part in the spikes in volume and I believe the PPS price per share is in a trailing pattern and it will follow soon. If you think the technicals, news and volume looks good, it gets BETTER! Look at the financials on this Cinderella story!

GRVI Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, they are profitable, buying back shares and revenue is up over 160%!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

GRVI Awareness, GRVI stock price is related to it!

Marketing efforts “Awareness Campaigns”, I have found significant marketing efforts around the investor awareness of this company. Hence the 4 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives! Do you believe GRVI stock price could go up?

To receive one more 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]

Alexander Goldman’s Disclaimer

I am not a certified financial consultant and have no license to give financial advice. The information found in this article is purely my opinion. Do not take my opinion as trading advice.

Small Cap Exclusive’s Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”.

This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and PPS of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they invest in the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, MIGI. Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on April 7th, 2022 to publicly disseminate information about (MIGI) via website and email. We have been compensated $4,450 USD. We will update any changes to our compensation. Read FULL DISCLAIMER