Gold investors have been waiting a long time for a shot at another Malartic and we believe we just struck gold with Northern Superior Resources (TSX-V: SUP) (OTCQX: NSUPF)!

Malartic was a big gold discovery in the province of Quebec which became a mine and the company owning it ended up being acquired for total considerations of C$3.9 billion! Of course, not all mining developers are as rewarding, but when a company is successful in that sector, the reward for investors can be astonishing.

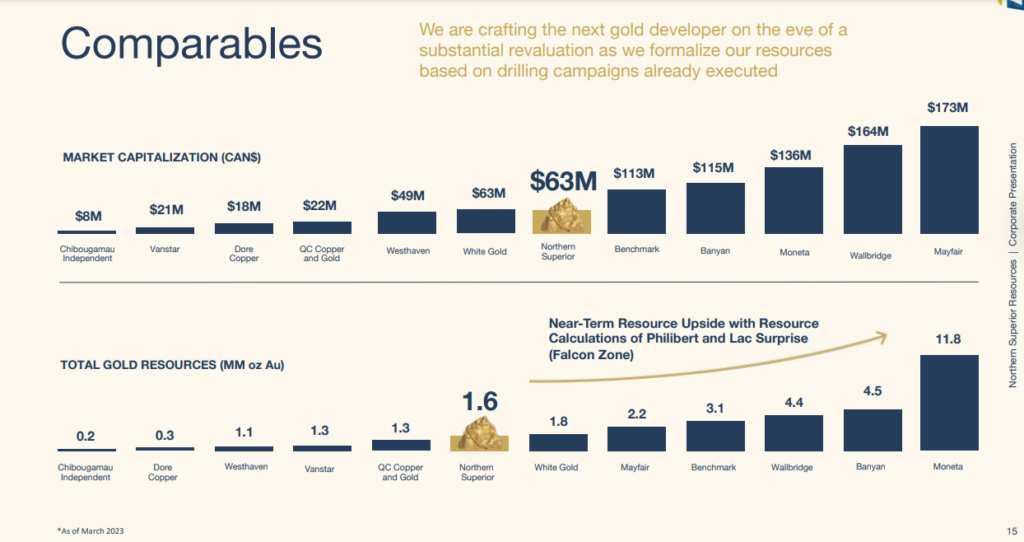

For those investors who missed out on the 1000%++ returns that we have seen repeatedly in that industry, sit back and keep reading because we believe (TSX-V:SUP) (OTCQX: NSUPF) could be just as interesting and its value is currently only C$60M.

What do you get when you combine one of the largest consolidated gold discoveries in Quebec’s rich history and a rapidly rising gold price driven by global economy in a tailspin, possibly, even stronger gains?

Before we get into the 3 catalysts that could make Northern Superior Resources one of the best gold plays of 2023, let’s go over the basics…

This company owns several deposits near each other and has been making headlines with its impressive drill results from the Philibert gold property in Quebec, where it has delineated of gold near surface over a 3-kilometre strike length.

Those deposits, including Philibert, are located in the rapidly emerging Chibougamau gold camp, which hosts the world-class Nelligan deposit. Nelligan was the “Discovery of the year[1]” in 2019. Many believe that the area, The Chibougamau Gold Camp, has the potential to be the next Malartic, as ounces grow and reach a level similar to one of the largest operating gold mines in Canada.

But that’s not all. Northern Superior also has a stellar executive team that has decades of experience in discovering and developing gold projects in Canada and abroad. The team includes Mr. Victor Cantore, Executive Chairman, a seasoned executive whose most recent win has been to take Amex Exploration from C$0.07 to more than C$3.50 per share in less than 2 years. This team is seriously invested. All in all, the insiders own more than 30% of the company and recently took down almost 20% of the $5M equity financing.

And if that’s not enough to convince you to take a look at Northern Superior, consider this: Northern Superior is well-positioned to benefit from the rising gold prices driven by stagflation. Stagflation is a scenario where inflation rises while economic growth slows down, creating a perfect storm for gold demand. As more investors seek a safe haven from currency devaluation and market volatility, central banks around the world keep buying and gold prices are already soaring to new heights.

BREAKING NEWS

TORONTO, ON / ACCESSWIRE / June 6, 2023 / Northern Superior Resources Inc. (“Northern Superior” or the “Company”) (TSXV:SUP) (OTCQX:NSUPF) is pleased to report the final assay results for nine holes completed on the Falcon Gold Zone (“FGZ“) on its large (20km x 15km) 100% owned Lac Surprise property, located within the Chibougamau gold camp, Québec.

Let’s do a quick summary on Northern Superior Resources (TSXV: SUP) :

Company Name: Northern Superior Resources

Ticker: (TSXV: SUP)

Exchange: TSX

Website: https://nsuperior.com

Northern Superior Resources Company Summary:

Northern Superior is a gold exploration company focused on the Chibougamau Gold Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau Est. Northern Superior also owns significant exploration assets in Northern Ontario highlighted by the district scale TPK Project. The Company has indicated its intention to spin off the TPK Project, which could provide immediate benefit for shareholders.

Without further ado, the 3 catalysts that could make Northern Superior Resources the gold play of 2023:

- #1 The next Canadian Malartic

- #2 The Executive Team

- #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to consider Northern Superior While it is on the ground floor of one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

#1 The next Canadian Malartic

Attention, investors! This is your chance to consider getting involved on the ground floor of a once-in-a-lifetime opportunity where central banks keep buying gold, combined with an oppertunity to getting a do-over on Malartic. Why is that significant? The company that owned Malartic was sold for C3.9 billion! Northern Superior Resources Inc. is a junior exploration company that is poised to possibly become the next Canadian Malartic. How will they do that? It is simple, they have consolidated the area and continue to rapidly increase the size of those deposits. By owning all of those nearby deposits, Northern Superior is rapidly reaching a critical geological level where the camp could become a single large mining operation. This matters as viable ounces are worth significantly more than unviable ounces, hence the consolidation strategy.

If you’re looking for a golden opportunity to invest in one of Canada’s largest and most exciting gold companies, look no further than Northern Superior Resources Inc. Northern Superior is consolidating the Chibougamau Gold Camp in Quebec, a region that has produced over 6 million ounces of gold historically. The company has discovered or acquired several impressive gold projects, including the Lac Surprise project, which is adjacent to IAMGOLD’s Nelligan project, which was the “Discovery of the Year” in 2019, and hosts a total of 5.5 million ounces[2] of gold.

Northern Superior Resources Inc. also has district scale exploration potential in Ontario, where it owns 100% of the TPK project, the largest till anomaly in North America, something that is sure to get the attention of any geologist. The TPK project has shown exceptional gold and diamond results, with drill intercepts of up to 25.9 grams of Gold per tonne over 13.5 meters and a boulder carrying 727 grams of Gold per tonne. The company recently obtained its drilling permit for this asset and has indicated its intention of spinning out this asset into a new company to accelerate its development. If TPK were to repeat historical exploration success, directly or indirectly, the shareholders of Northern Superior would greatly benefit.

Northern Superior Resources Inc. is led by a seasoned management team with decades of experience in the mining industry. Let’s take a closer look at their team.

Executive Team

Victor Cantore is the Executive Chairman of Northern Superior Resources with over 25 years of experience in the mining industry, having worked as an investment advisor, head of institutional trading and a corporate finance specialist. He has been instrumental in raising funds and negotiating deals for several mining companies, including Amex Exploration, where he serves as the President and CEO. It is worth mentioning again that he took Amex Exploration from C$0.07 to more than $3.50 in less than 2 years!

Cantore is passionate about creating value for shareholders and stakeholders, while adhering to the highest standards of environmental and social responsibility. He believes that Northern Superior Resources has the potential to become one of Canada’s premier gold producers. He is committed to advancing the projects to the next level.

Simon Marcotte is one of the most accomplished and visionary leaders in the Canadian mining industry. He has a proven track record of creating value for shareholders through his involvement in several successful exploration and development projects across various commodities. Marcotte has over 25 years of experience in the mining sector, starting his career as a Chartered Financial Analyst with CIBC World Markets, Sprott and Cormark Securities.

In 2018, Marcotte was instrumental in launching Arena Minerals Inc., a lithium exploration company with assets in Argentina. He facilitated strategic investments from Ganfeng, the world’s largest lithium producers, and also from Lithium Americas Corp. Most important to investors, he was instrumental in the price appreciation from $.05 – $.75! Arena was finally acquired by Lithium Americas Corp. in 2023.

In 2020, Marcotte founded Royal Fox Gold Inc., where he served as President and CEO until November 2022, when he orchestrated a merger with Northern Superior Resources and was appointed President and CEO of Northern Superior Resources thereafter.

Marcotte is also the founder of Black Swan Graphene Inc., a graphene manufacturing company based on a proprietary technology developed by Thomas Swan & Co. Ltd., a leading chemical company based in England. The shares of Black Swan Graphene just recently went up by 400%.

Michael Gentile is one of the most successful investors in the mining sector in Canada. He has built a fortune by identifying undervalued and overlooked opportunities in the natural resources industry; after his latest capital injection in the company, he now owns 16% of Northern Superior.

Michael, a former fund manager, has developed a reputation as a savvy and visionary investor who could spot opportunities that others missed. He invested in companies that had strong fundamentals, low valuation, high-quality assets, and growth potential. He also looked for companies that were undervalued by the market or had catalysts for appreciation.

Some of his most notable investments include:

- K92: One of the most successful mining companies in recent years; Michael acquired a major stake in the company in 2017 between C$0.45 and C$1.00. K92 now trades around C$6.00 but reached more than C$10.00 last year!

- Arizona Metals: Michael first invested in Arizona Metals around C$0.18. A little more than a year later, the stock traded at more than C$6.00 per share.

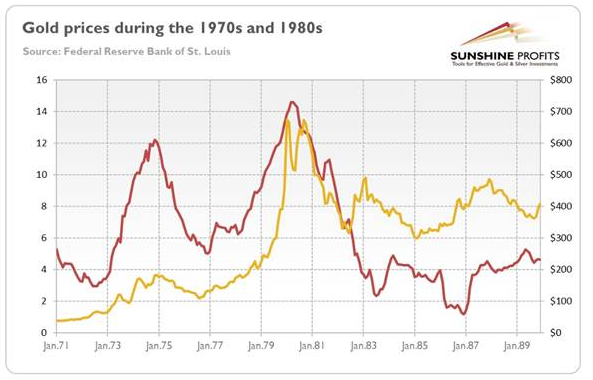

Stagflation’s Effect on Gold Prices

Gold investors have been waiting for this moment for almost 30 years, stagflation is upon us. The world is facing a serious economic dynamic. Stagflation, a situation where inflation is high and growth is slow, is absolute catnip for gold prices. Stagflation was once thought to be impossible by economists, but it happened in the 1970s, when an oil shock triggered a recession and soaring prices. This time, a step back in globalization, triggered by tension with China, and military activities in eastern Europe, are taking us down the same path.

What does this mean for investors? It means that they need to protect their wealth from the eroding effects of inflation. There is simply no better way to do that than by investing in gold, and this is why gold is already making new highs.

Gold has a long history of being a safe haven asset in times of turmoil. Gold preserves its purchasing power over time, unlike paper money that loses value as central banks print more of it. Gold also has a negative correlation with stocks and bonds, meaning that it tends to rise when they fall. Gold is therefore an ideal hedge against stagflation and market volatility.

But not all gold investments are created equal. Some are more risky and costly than others. That’s why we recommend taking a look at Northern Superior Resources, a company backed by a team with a proven track record of success.

Northern Superior Resources has a portfolio of high-quality projects in Canada, one of the most stable and mining-friendly jurisdictions in the world. The company has a strong management team with decades of experience in the industry. The company also has a low-cost structure and a healthy balance sheet, with no debt and ample cash.

In Closing – Northern Superior Resources Inc. has a diversified portfolio of gold in Ontario and Québec. The company’s value driver is its recent consolidation effort to put all of those deposits under one roof, opening the door to a single mining operation, and therefore increasing the value of those deposits. The flagship project, at least for the time being, is the Philibert Project, which has already seen more than 77,000 metres of drilling, a large part paid for by the Quebec Government, and is now about to publish a resource calculation. On its website, the Company is clear that it expects this resource publication to establish Philibert as a pillar in the Chibougamau camp. Philibert is only 9km away from Nelligan, so everyone will be quick to combine the size of those 2 deposits together and see the real value of this camp. The company also owns the Ti-pa-haa-kaa-ning (TPK) gold property, which has shown significant mineralization in several drill holes and the company indicated its intention to proceed to a spin out, which could also be an important catalyst for investors.

Northern Superior Resources Inc. is committed to creating value for its shareholders by advancing its projects to the next stage of development. The company has a strong financial position, having recently raised $5M with strong participation from insiders. The company also has a loyal shareholder base including several large institutional investors.

Don’t miss this opportunity to invest in one of the best gold exploration stories in the market. Northern Superior Resources offers you a chance to profit from the coming gold boom while protecting your wealth from stagflation.

Remember, just on of these catalysts could make SUP explode but there are three catalysts: #1 The Next Canadian Malartic #2 The Executive Team #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to take a look at one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

Act now before it’s too late.

Disclaimer

This Article contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Should one or more of these risks and uncertainties occur or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. This article is not intended to be a solicitation to buy or sell securities and readers are cautioned to consult their own financial advisors before doing so.

Small Cap Exclusive owned by King Tide Media has been hired by Northern Superior Resources Inc. for a period beginning on March 20th, 2023 to publicly disseminate information about (SUP) via website and email. We have been compensated up to $50,000 USD to profile SUP. Full Disclaimer

We think Cara Therapeutics (NASDAQ: CARA), a boutique “clinical stage” biotech/biopharma firm which develops novel compounds (including

We think Cara Therapeutics (NASDAQ: CARA), a boutique “clinical stage” biotech/biopharma firm which develops novel compounds (including