Why was (LITS:CNSX)(LITSF:OTC US) Up 32% in August? You won’t believe the reason!

We did it again, we have uncovered a stock that is up almost 60% even in a bearish market!

(CSE:AMS) Alchemist Mining is the parent company to Lithos Technology, building a sustainable solution for lithium production.

The lithium market is projected to grow from USD 21 billion in 2021 to USD 83BN billion in 2035, according to Benchmark Mineral Intelligence.

As you may imagine, not all mines have the same production potential. This is why Benchmark Mineral Intelligence (BMI) made its calculations based on annual production averages for each of the necessary mines lithium-ion cell manufacturing requires.

According to the company, a lithium mine delivers an average of 45,000 metric tons per year. At that production level, the world would demand 74 new mines by 2035, for a total production of 3,3 million metric tons.

That will complement our current production capacity for the 4 million metric tons of lithium EVs will need by 2035.

As you will see in the technology section of this report, Lithos may have the right technology to capture 20% of market share by 2035.

If they did, they would have $16 Billion in revenue with a current float of $33,360,000 would place the price per share at $479.

That is a rough estimate but you get the idea, tons of upside.

If you think that is enough to get excited, look at what the Biden administration announced last year.

June 2022

WASHINGTON, D.C.— President Biden today issued presidential determinations providing the U.S. Department of Energy (DOE) with the authority to utilize the Defense Production Act (DPA) to accelerate domestic production of five key energy technologies:

Critical Materials Defined by the Energy Act of 2020

The Presidential Determination references five minerals associated with large capacity, rechargeable batteries

(lithium, nickel, cobalt, graphite, and manganese); these minerals, among others, have been designated “critical

minerals” by the U.S. Geological Survey (USGS).40

DOE’s Continued Commitment to Bolstering a Domestic Clean Energy Supply Chain

In February, DOE launched the new Office of Manufacturing and Energy Supply Chains to secure energy supply chains needed to modernize America’s energy infrastructure and support the full transition to clean energy Defense Production Act HERE

Here is a great article on the amazing market advantages to North American energy corporations when the government enacts such legislation.

It is a big deal, let’s recap the “perfect storm” that is brewing for (CSE:AMS):

#1 The lithium market is expected to grow by almost $80BN in the next decade!

#2 Rough calculations would place (CSE:AMS) at $400 PPS+/-?

#3 Defense Production Act (DPA) to accelerate domestic production of lithium

So, why is AMS up almost 60%? I think it is pretty obvious.

Let’s cover the mundane first, then get to the information that every trader needs to see.

Company Name: Alchemist Mining Inc.

Ticker: AMS

Exchange: CSE Canadian Stock Exchange

Website: https://www.lithostechnology.com/

Alchemist Mining Company Summary

Alchemist’s subsidiary LiTHOS is developing the trusted standard for environmentally efficient and economically sustainable brine-lithium resource development.

Now that we got the particulars out of the way, let’s go over something very exciting for investors.

We have uncovered 3 catalysts that could send AMS on the Bullish run of the year.

More importantly, we will then unveil the long awaited “reason” why AMS is getting major attention lately.

Without further ado,

The Top 3 Catalysts that Could Send AMS on the Bullish Run of 2023:

#1. The Chart Is Perfect, Literally Perfect!

#2. IPOs Offer A Significant Upside Potential

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

#1. The Chart Is Perfect, Literally Perfect!

Our research team at Small Cap Exclusive is good, really good! They have uncovered some of the most explosive trades in the last ten years.

Take a look at what we have done lately HERE.

Tens of Thousands of traders trust SCE, the reason why, we uncover the best investment opportunities before the general population are aware.

Creating a unique situation of positioning before the volume spikes.

(CSE:AMS) is yet another diamond in the rough with incredible upside potential, take a look at the chart below!

Keep in mind, the market has been a blood bath lately, why is this stock up so much?

Wait until the conclusion, it’s important to have a foundational research established to understand the significance.

The chart above is a clear example of a bullish chart with technicals indicating bullish patterns both in the short term and long term.

There are two bullish moves, one in early February and one in the beginning of March.

Moreover, there are two consolidation patterns from Feb 8th till March 2nd.

The next consolidation has just started to begin.

Once a double confirmed breakout takes place, we will see another move upwards.

Traditionally, this is when savvy investors execute a position during the consolidation before the next move.

So start your research now.

#2. IPOs Offer A Significant Upside Potential

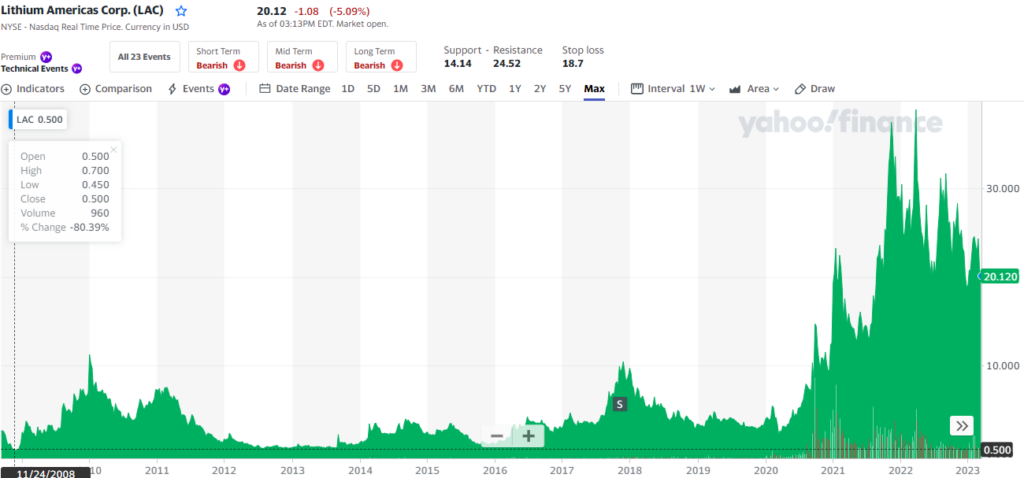

Lithium Americas Corp. (LAC)

In the lithium sector and has

On the IPO, on 11/24/2008 if you invested in LAC with $12,500 at $.50 on 3/28/2022 your 25,000 shares would be worth $1,000,000!

Lithium is the new oil and Alchemist is revolutionizing the lithium vertical.

In 2022 it was maxing out at $340, and in 2013 average investors had many opportunities to average out at $20, 1,600% growth!

The point of showing this example is that savvy investors have known for a while that energy is the new tech!

Lithium, which runs most battery operated items including vehicles is the investments making normal traders into millionaires with IPOs!

Why IPOs, you are getting in early before the parabolic growth.

Look at the chart above, the early investors are the winners!

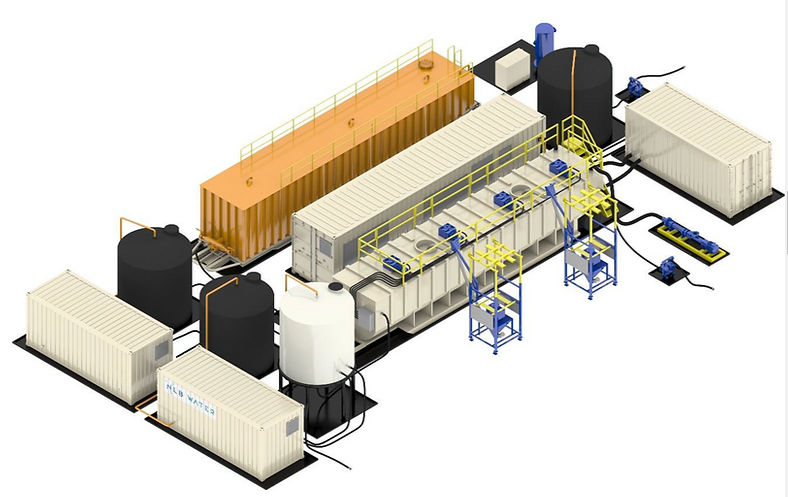

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

Let’s get nerdy for a minute and go over the VERY important process of lithium extract.

Currently, most of the world’s lithium reserves are found in continental brines – natural salt water deposits.

Currently 2/3 of the world production of lithium is extracted from brines, a practice that evaporates on average half a million litres of brine per ton of lithium carbonate. For an average mine that’s 40 billion litres of water per year. This is hardly sustainable.

Furthermore, the extraction is chemical intensive, extremely slow, and wastes up to 60% of the lithium resources in place while destroying the land.

However, efforts to increase production from brines have mostly stalled due to environmental and technical problems.

That is a big problem, Lithium brine resource owners need new technology to deliver new production quickly, efficiently, and sustainably.

In a free market economy, the bigger the problem, the bigger the revenue.

AMS is positioning itself as an industry leader with cutting edge technology that could be disruptive!

What is the technology?

Based on a proven water treatment technology presently used to recycle produced fluids from oil & gas wells:

• Over 6 years of engineering and several million in hard investment

• To deliver a commercial, production robust field-proven modular brine processing unit.

• Current design capacity will convert 24,000 barrels of raw lithium enriched brine fluid per day into 2,512 mt of Lithium Hydroxide Monohydrate.

• Process has a US published patent. Company has an innovation pathway to deliver more patented intellectual property for shareholders.

The company has a pipeline of $5.5 million USD in pre-qualified State (Colorado Advanced Industries) and Federal (US Department of Energy) grant funding which will be awarded in late May

Company has an operational lithium processing facility commissioned in Denver, Colorado and is actively working with multiple major clients to benchmark its technology and deliver comparative results vs. other DLE technologies.

This technology has a potential to clean brines to purified irrigation water, while extracting lithium and other metals.

Above is the revolutionary technology that could transform the extraction of lithium.

The BIG problem: 500% MORE LITHIUM REQUIRED

Requirement by 2035, the western world needs 75 new mines each 45,000 ton mine requires:

- 2500 acres of land

- 10 billion gallons of water Per Year

- Produced 250,000 tons of CO2 Per Year

- up to 2 years to evaporate and deliver production.

Let’s recap the 3 Catalysts that Could Send AMS on the Bullish Run of 2023:

#1. The Chart Is Perfect, Literally Perfect!

#2. IPOs Offer A Significant Upside Potential

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

We have arrived at the much anticipated “reason” why AMS is getting major attention lately.

Research is indicating that the lithium sector could experience a historic boom due to five factors:

- Lithium has proven to be recession proof.

- Renewable energy thrives during a recession

- The lithium market is expected to grow by almost $80BN in the next decade!

- Rough calculations would place (CSE:AMS) at $400 PPS+/-?

- Defense Production Act (DPA) to accelerate domestic production of lithium

Lithium has proven to be recession proof.

Alex Gluyas of AFR states, “Lithium is proving to be largely immune from the volatility that has rocked commodity markets as prices soar in the face of a looming global recession, prompting Macquarie to deliver another round of upgrades for producers and developers of the battery metal.

Lithium prices have continued to hit record levels this year with spodumene, carbonate and hydroxide surging 243 per cent, 124 per cent and 152 per cent respectively.”

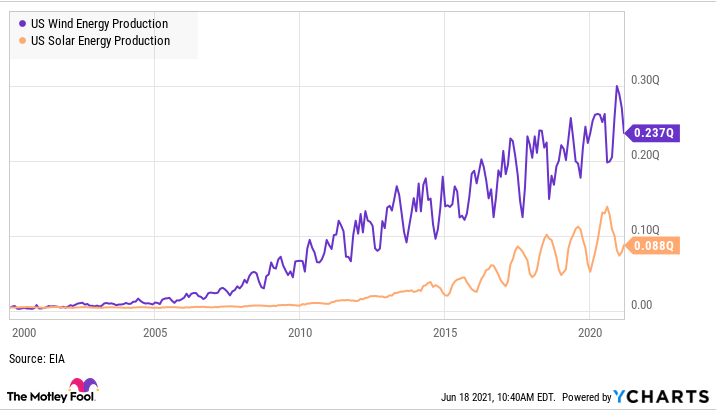

Renewable energy thrives during a recession

Motley Fool has an amazing report on the renewable energy sector thriving during recessions.

Recessions can be scary for investors because the market can crash and, for some businesses, demand can drop like a rock. But not all businesses are affected the same way during a recession.

In renewable energy, there are major tailwinds driving growth even through recessions. The cost of renewable energy is coming down, fossil fuel costs are rising long term, and there’s a political desire to increase renewable energy production. You can see below that recessions haven’t stopped the growth of wind and solar energy projection, two of the main sources of renewable energy over the last two decades — despite three recessions in that time. For investors renewable energy stocks have a lot going for them, even in a recession.

Small Cap Exclusive is preparing for significant press releases that could come very soon from Alchemist Mining (CSE:AMS).

If you want receive breaking news directly to your inbox we recommend signing up for updates on AMS below:

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $160,000 from Alchemist Mining Inc. for profiling (CSE:AMS). We own ZERO shares in AMS.